Tired of budgets that feel like a vague suggestion rather than a concrete plan? The zero-based budgeting method offers a powerful alternative: give every single dollar you earn a specific job. This isn’t about restriction; it’s about intentionality. By assigning all your income to expenses, savings, or debt repayment, you create a system where no money is left unaccounted for, ensuring your financial actions align perfectly with your goals. The formula is simple: Income - Expenses = Zero.

But how does this look in practice? Theory is one thing, but applying it to your unique financial situation is another. That’s where seeing real-world zero based budgeting examples becomes essential. This article moves beyond abstract concepts to provide clear, actionable templates for various life scenarios. We’ll break down exactly how different households can implement this strategy for maximum impact.

You will find detailed examples tailored for:

- Families managing household costs

- Individuals accelerating debt payoff

- Expats juggling multiple currencies

- Couples managing joint accounts and contributions

- Anyone building a dedicated travel or emergency fund

Each example includes sample numbers, strategic analysis of why certain allocations were made, and actionable takeaways you can apply immediately. We’ll also cover practical implementation tips, especially for those using manual entry tools like Econumo or self-hosted solutions, focusing on privacy and control. Forget generic advice; these are replicable financial blueprints designed to help you master your money, dollar by dollar. Let’s dive into the examples.

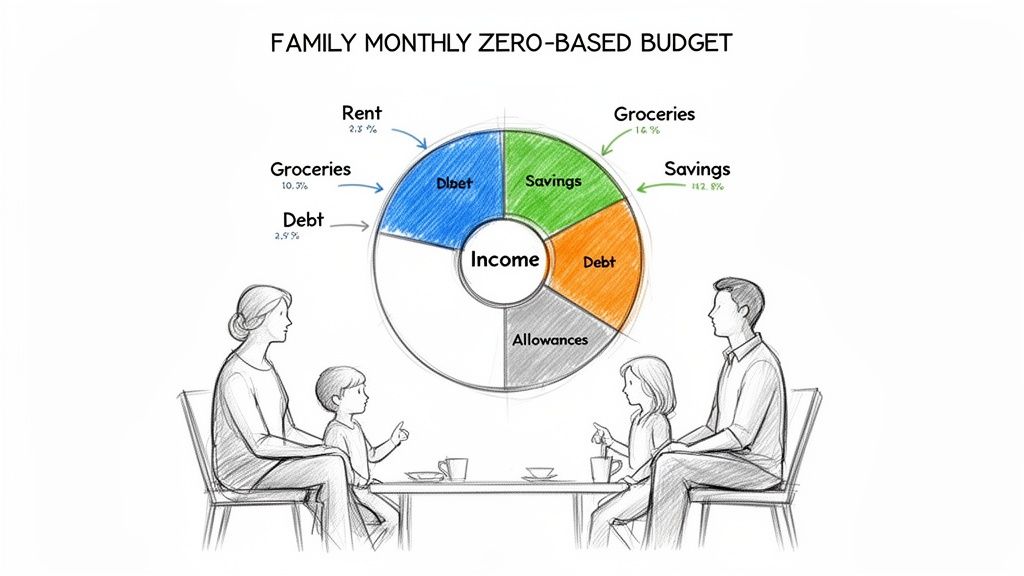

1. Family Monthly Zero-Based Budget Template #

The family monthly zero-based budget is a powerful framework for households with shared finances. The core principle is simple: every dollar of income is assigned a specific job before the month starts. This method ensures that total income minus total expenses equals zero, promoting intentional spending and preventing financial drift. It’s especially effective for couples and families who need to stay aligned on financial goals.

This approach, popularized by financial experts like Dave Ramsey and the YNAB community, forces partners to communicate about money. By planning together, you eliminate assumptions and build a unified financial front. For more guidance on setting up your initial plan, you can learn how to create a family budget that fits your specific needs.

Strategic Breakdown & Example #

A dual-income couple with a combined monthly income of $5,000 might allocate their funds this way. This is a classic example of zero-based budgeting in action:

- Income: $5,000

- Joint Fixed Expenses: $2,200 (Rent/Mortgage) + $800 (Utilities, Insurance) = $3,000

- Joint Variable Expenses: $600 (Groceries)

- Personal Allowances: $400 (Partner 1) + $400 (Partner 2) = $800

- Financial Goals: $600 (Debt Payoff) + $400 (Vacation Fund) = $1,000

In this scenario, $5,000 (Income) - $5,000 (Expenses + Savings) = $0. Every dollar is accounted for, covering necessities, personal freedom, and long-term goals.

Actionable Takeaways for Implementation #

To make this template work for your family, focus on collaboration and consistency.

- Schedule a Monthly ‘Money Meeting’: Before each month, sit down together to create the budget. This non-negotiable meeting ensures everyone is on the same page.

- Use a Shared Tool: In Econumo, you can use the multi-user feature to allow each partner to track their own spending within the shared budget. This promotes accountability and transparency.

- Build a Buffer: Assign 5-10% of your income to an “Unexpected Expenses” category. This prevents a small surprise, like a car repair, from derailing your entire budget.

- Review Weekly: A quick 15-minute check-in each week helps catch overspending early, allowing you to adjust before it becomes a major issue.

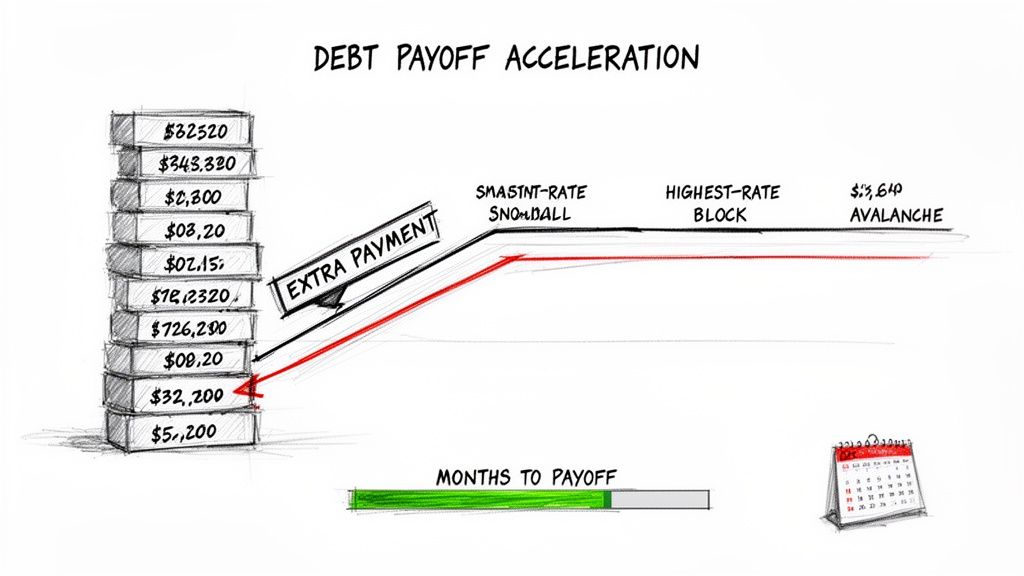

2. Debt Payoff Acceleration Zero-Based Budget #

The debt payoff acceleration model is a specialized zero-based budgeting approach designed for one primary goal: eliminating debt as quickly as possible. The strategy is straightforward: after covering essential living expenses and minimum debt payments, every remaining dollar of income is aggressively allocated to paying down debt. This focused method prevents “lifestyle creep” and channels all available financial energy toward becoming debt-free.

This intense focus is popularized by financial gurus like Dave Ramsey and Suze Orman and is a cornerstone of the FIRE (Financial Independence, Retire Early) community. It transforms your budget from a simple spending plan into a powerful tool for wealth-building by first eliminating the drag of high-interest debt. To dive deeper into specific payoff strategies, you can explore detailed guides on how to pay off debt faster.

Strategic Breakdown & Example #

Consider an individual with a monthly income of $4,000 and consumer debt (credit cards, personal loans) totaling $20,000. Here’s how they could structure their zero-based budget to accelerate payoff:

- Income: $4,000

- Essential Fixed Expenses: $1,500 (Rent) + $500 (Utilities, Insurance, Car Payment) = $2,000

- Essential Variable Expenses: $400 (Groceries) + $150 (Gas) = $550

- Minimum Debt Payments: $250 (Across all debts)

- Debt Payoff “Gazelle Intensity” Fund: $1,200 (Remaining surplus income)

In this plan, $4,000 (Income) - $4,000 (Expenses + Debt Payments) = $0. The key is the $1,200 allocated directly to the principal of a target debt, drastically shortening the payoff timeline and saving thousands in interest.

Actionable Takeaways for Implementation #

To successfully use this method without burning out, combine intensity with smart planning.

- Choose Your Method: Decide between the debt snowball (paying smallest balances first for psychological wins) or the debt avalanche (paying highest-interest debt first to save the most money). Stick to one to maintain focus.

- Automate Your Attack: In Econumo, set up a recurring automated transaction for your extra debt payment to go out on payday. This “pays yourself first” approach ensures the money is used as intended before you can spend it elsewhere.

- Build in a Small ‘Relief Valve’: Allocate a modest amount ($50-$100) to a “Fun Money” or “Personal Spending” category. This small allowance helps prevent budget fatigue and makes the intense plan more sustainable long-term.

- Visualize Your Progress: Create a dedicated tracker in a notebook or spreadsheet showing your debt balance decreasing each month. Visual progress is a powerful motivator to keep going when the journey feels long.

3. Expat/Multi-Currency Zero-Based Budget #

The expat/multi-currency zero-based budget is a sophisticated framework for individuals and families managing finances across different countries. This approach allocates every unit of income, regardless of currency, to a specific purpose. It forces you to account for exchange rate fluctuations, international transfer fees, and varying costs of living, making it an essential tool for global citizens.

This method, often discussed on forums like ExpatForum and NomadList, brings clarity to complex financial situations. By assigning a job to every dollar, euro, or pound, you gain control over your global financial footprint and ensure no money gets lost in translation. This is one of the most powerful zero-based budgeting examples for anyone with cross-border financial commitments.

Strategic Breakdown & Example #

Consider an American expat living in Berlin with a monthly income of €4,000. They have financial obligations in both Germany (EUR) and the United States (USD). Their zero-based budget must reconcile these two currencies.

- Income (EUR): €4,000

- Local Fixed Expenses (EUR): €1,200 (Rent) + €300 (Health Insurance, Utilities) = €1,500

- Local Variable Expenses (EUR): €400 (Groceries) + €200 (Transportation) + €300 (Entertainment) = €900

- International Obligations (USD): $500 (US Student Loan) + $200 (US Retirement Account) = $700

- Currency Conversion & Savings:

- To cover the $700 USD obligation, they need to convert approximately €650 (assuming a 1.08 EUR/USD rate).

- The remaining income is allocated: €600 (Local EUR Savings) + €350 (Travel Fund).

- Buffer: €100 (Currency Fluctuation Buffer)

The total allocation is €1,500 + €900 + €650 + €600 + €350 + €100 = €4,100. This leaves a small deficit, requiring a minor adjustment, such as reducing the travel fund to €250, to bring the total to exactly €4,000. This process highlights the importance of precise allocation.

Actionable Takeaways for Implementation #

Managing a multi-currency budget requires foresight and diligent tracking.

- Set Exchange Rate Assumptions: At the start of the month, decide on a realistic exchange rate to use for your budget. This creates a stable baseline for planning.

- Track International Transfer Fees: Create a separate category in your budget for wire transfer or currency exchange fees. This reveals the true cost of moving your money internationally. For those planning these transfers, understanding different options is key. You can find a helpful guide on how to exchange foreign currency to make informed decisions.

- Build a Fluctuation Buffer: Allocate 3-5% of your cross-border transfer amount to a “Currency Fluctuation” category. This protects your budget from unexpected and unfavorable rate shifts.

- Use a Multi-Currency Tool: Econumo allows you to manage accounts in different currencies within a single interface, making it easier to track your complete financial picture without constant manual conversions.

4. Privacy-Conscious Self-Hosted Zero-Based Budget #

The privacy-conscious zero-based budget is designed for individuals who want total control over their financial data. Instead of using cloud-based services, this approach utilizes self-hosted or local software, ensuring all your information remains private on your own server or computer. It applies the same core principle of assigning every dollar a job, but with an added layer of security and data ownership.

This method appeals to cybersecurity-conscious users and privacy advocates who prefer to manage their own systems. It combines the financial discipline of zero-based budgeting with complete autonomy over personal data. For those interested in this approach, you can explore the benefits of a self-hosted budget software to get started.

Strategic Breakdown & Example #

Consider a tech-savvy individual with a monthly income of $4,500 who prioritizes data privacy. They use a self-hosted instance of Econumo or a detailed local spreadsheet to implement their zero-based budget.

- Income: $4,500

- Fixed Expenses: $1,500 (Rent) + $500 (Utilities, Insurance, Subscriptions) = $2,000

- Variable Expenses: $400 (Groceries) + $200 (Transportation) + $300 (Dining/Entertainment) = $900

- Financial Goals: $800 (Investments) + $500 (Emergency Fund) = $1,300

- Tech/Privacy Fund: $300 (Software, Hardware, Backup Services) = $300

In this model, $4,500 (Income) - $4,500 (Expenses + Savings) = $0. Every dollar is meticulously planned, including funds dedicated to maintaining the private infrastructure itself.

Actionable Takeaways for Implementation #

To successfully run a self-hosted zero-based budget, prioritize system maintenance and consistent data entry.

- Schedule Weekly Manual Entry: Dedicate a specific time each week to manually input all transactions. This routine is crucial for keeping your self-hosted budget accurate and up-to-date.

- Establish a Robust Backup System: Create a regular schedule for backing up your budget data. Store these backups in an encrypted format in at least two separate, secure locations (e.g., a local external drive and a private cloud).

- Document Your Categories: Keep a separate document that defines each of your budget categories and rules. This ensures consistency over time, especially if you modify your budget structure.

- Test Your Recovery Process: Don’t just back up your data; periodically test your ability to restore it. This ensures that in case of a system failure, your financial records are safe and recoverable.

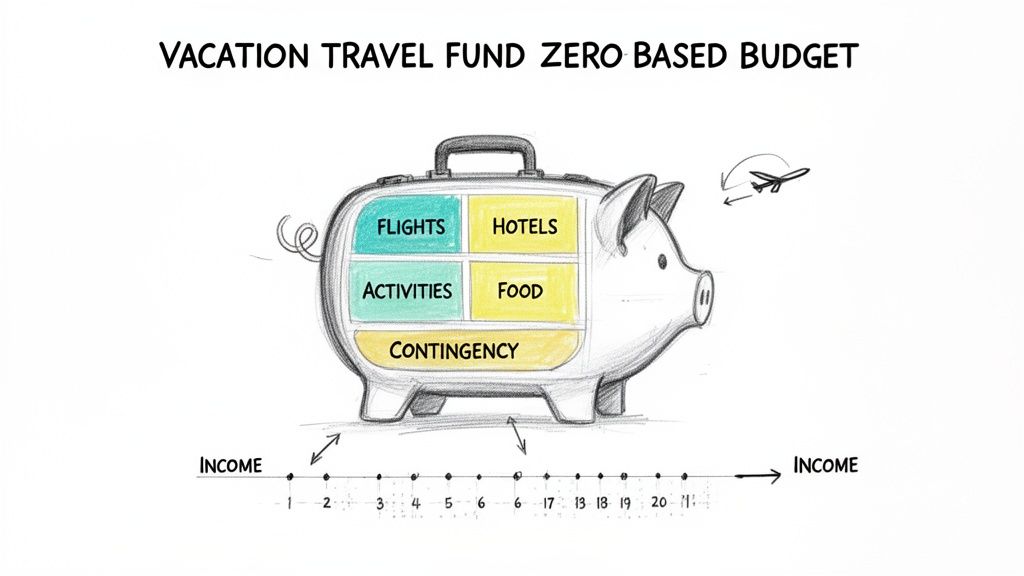

5. Vacation and Travel Fund Zero-Based Budget #

The vacation and travel fund zero-based budget is a specialized template designed to turn a dream trip into a financial reality. Instead of vaguely saving, this method assigns a specific portion of your monthly income to a dedicated travel goal. Every dollar earmarked for the vacation is given a job, covering everything from flights and hotels to activities and a contingency fund, ensuring you can enjoy your trip without financial stress.

This approach is highly popular among family travel bloggers and financial advisors who advocate for goal-oriented saving. By breaking down a large, intimidating goal into manageable monthly contributions, it makes ambitious travel accessible. For instance, when crafting your plan, practical resources like a complete budget guide for a 2-week trip to Japan can help you visualize and plan your expenses accurately.

Strategic Breakdown & Example #

A family of four plans a European vacation with a total estimated cost of $4,800. They decide to save for 12 months, making it a clear, actionable goal within their overall household budget.

- Total Vacation Goal: $4,800

- Monthly Savings Target: $400 ($4,800 / 12 months)

- Trip Category Breakdown:

- Flights: $2,000 (Saved at ~$167/month)

- Accommodations: $1,200 (Saved at $100/month)

- Activities & Tours: $800 (Saved at ~$67/month)

- Food & Local Transport: $400 (Saved at ~$33/month)

- Contingency (10%): $400 (Saved at ~$33/month)

Each month, the $400 is transferred to a dedicated savings account. The income allocated to this goal is subtracted from the main budget, ensuring Income - Expenses - Savings = $0. This is a perfect example of how zero-based budgeting examples can be adapted for specific, long-term goals.

Actionable Takeaways for Implementation #

To successfully fund your travel goals, focus on detailed planning and consistent tracking.

- Start Early: Begin your travel fund planning 8-12 months before your desired trip date to keep monthly contributions low and manageable.

- Research and Itemize: Break your trip down into granular categories. Research typical costs for your destination and build in a 15% contingency for unexpected expenses.

- Track Bookings vs. Projections: In Econumo, create a separate budget for your trip. As you book flights or hotels, log them as actual expenses and adjust your remaining savings goals accordingly.

- Use Multi-Currency Features: If traveling internationally, use Econumo’s multi-currency support to track expenses in the local currency, avoiding surprises from conversion rates.

6. Joint Account Household Contribution Zero-Based Budget #

This model is designed for partners who combine finances for shared responsibilities but want to maintain individual financial autonomy. It’s a zero-based budget that uses proportional contributions to a joint account, ensuring fairness when incomes are unequal. Each partner contributes a percentage of their income to cover shared household expenses, while the remainder is theirs to manage individually.

This approach, championed by modern financial advisors like Ramit Sethi and popular within the Financial Independence, Retire Early (FI/RE) community, promotes equity and transparency. It avoids the common conflict of a 50/50 split when one partner earns significantly more than the other, creating a system built on partnership rather than strict equality.

Strategic Breakdown & Example #

Consider a couple where Partner A earns a take-home pay of $6,000/month (60% of the total) and Partner B earns $4,000/month (40%). Their total household income is $10,000, and their shared expenses total $5,000.

- Total Joint Expenses: $5,000 (Mortgage, Utilities, Groceries, Insurance)

- Partner A Contribution (60%): $5,000 * 0.60 = $3,000

- Partner B Contribution (40%): $5,000 * 0.40 = $2,000

- Partner A Discretionary Income: $6,000 (Income) - $3,000 (Contribution) = $3,000

- Partner B Discretionary Income: $4,000 (Income) - $2,000 (Contribution) = $2,000

In this model, the joint account is zeroed out ($5,000 in contributions - $5,000 in expenses = $0). Each partner then uses a personal zero-based budget for their remaining discretionary income, allocating it to individual savings, investments, and personal spending.

Actionable Takeaways for Implementation #

To successfully implement this proportional contribution system, clear communication and setup are crucial.

- Define ‘Joint’ vs. ‘Individual’: Before you begin, create a definitive list of which expenses are shared (e.g., housing, shared car) and which are personal (e.g., individual hobbies, personal debt). This prevents future disagreements.

- Calculate Based on Net Income: Always base contribution percentages on take-home pay, not gross income. This provides a more accurate and fair reflection of each person’s actual financial capacity.

- Use a Shared and Separate System: In Econumo, you can use the multi-user feature for the joint budget. Each partner can then maintain a separate, private budget for their discretionary funds, offering both transparency and autonomy.

- Schedule Annual Reviews: Revisit your contribution percentages annually or anytime there is a significant change in income for either partner. This ensures the system remains fair and equitable over time.

7. Zero-Based Emergency Fund and Savings Protection Budget #

The zero-based emergency fund budget is a protective framework designed to prioritize financial resilience above all else. Its core principle is to treat building and protecting your emergency savings as a non-negotiable “bill” that must be paid first. Every dollar of income is assigned a job, but the very first job is to secure your financial safety net. This method is crucial for anyone wanting to break the cycle of debt caused by unexpected life events.

This approach is heavily influenced by financial literacy giants like Dave Ramsey, whose “Baby Step 1” is saving a starter emergency fund, and Suze Orman, who champions a strong financial security foundation. It systematically builds a buffer between you and financial disaster, ensuring that a car repair or medical bill doesn’t derail your long-term goals.

Strategic Breakdown & Example #

This budget model works in phases. Initially, it aggressively funds the emergency reserve. Once the fund is full, that allocation can be redirected to other goals. Let’s look at an individual earning $3,000 per month who is building their fund from scratch.

- Income: $3,000

- Financial Goal (Top Priority): $500 (Emergency Fund Accumulation)

- Fixed Expenses: $1,500 (Rent) + $400 (Utilities, Insurance) = $1,900

- Variable Expenses: $400 (Groceries) + $100 (Transportation) = $500

- Debt Repayment: $100 (Student Loan Minimum)

In this zero-based budgeting example, $3,000 (Income) - $3,000 (Expenses + Savings) = $0. The emergency fund is treated as the most important expense after housing and food, ensuring it grows consistently each month.

Actionable Takeaways for Implementation #

To make this protective budget work, discipline and clear definitions are key.

- Define ‘Emergency’: Before you start, write down what constitutes a true emergency (e.g., job loss, unexpected medical bills, critical home repair). This prevents you from dipping into the fund for a non-essential purchase.

- Automate the Transfer: Set up an automatic transfer from your checking to a separate high-yield savings account for the day you get paid. This “pay yourself first” strategy guarantees progress.

- Track Your Fund’s Growth: In Econumo, you can create a dedicated “Emergency Fund” savings goal. This allows you to visualize your progress toward your 3-6 month expense target without mixing it with your regular spending accounts.

- Replenish Immediately: If you use part of your emergency fund, your budget’s top priority immediately shifts back to replenishing it. Treat the used amount like a debt you owe to your future self.

8. Mindful Manual Entry Zero-Based Budget #

The mindful manual entry zero-based budget is an intentional approach that prioritizes financial awareness over automation. Instead of syncing bank accounts, every expense is recorded by hand, forcing you to consciously acknowledge where your money is going. This method combines the discipline of zero-based allocation with behavioral psychology to build healthier spending habits.

This hands-on technique, championed by financial therapists and the YNAB community, transforms budgeting from a passive review into an active, reflective practice. By manually entering each transaction, you create a moment of pause, allowing you to connect your spending decisions to your financial goals and emotional state. It’s one of the most powerful zero based budgeting examples for anyone looking to understand the “why” behind their spending.

Strategic Breakdown & Example #

Consider a single person with a monthly income of $3,500 who wants to curb impulse spending. Their zero-based plan allocates every dollar, but the magic happens during manual entry.

- Income: $3,500

- Fixed Expenses: $1,200 (Rent) + $400 (Utilities & Insurance) = $1,600

- Variable Expenses: $300 (Groceries) + $100 (Transportation) = $400

- Financial Goals: $800 (Student Loan Payoff) + $300 (Emergency Fund) = $1,100

- Discretionary Spending: $200 (Dining Out) + $200 (Hobbies/Fun) = $400

When this person enters “Coffee: $6 - stressed from work” or “Online Shopping: $45 - bored,” they build a data set of their spending triggers. The budget’s structure is simple, but the manual entry process provides profound insights. Over time, $3,500 (Income) - $3,500 (Expenses + Goals) = $0, and the user gains invaluable self-awareness.

Actionable Takeaways for Implementation #

To make manual entry a sustainable habit, integrate it into your routine and focus on reflection.

- Schedule a Daily ‘Money Minute’: Set a recurring time each day, like during your morning coffee or before bed, to enter the day’s transactions. Consistency is key.

- Use the Notes Field: In Econumo, leverage the note feature for each transaction. Jot down your mood, the context, or if the purchase was planned. This turns tracking into a financial journal.

- Start Small: If daily entry feels overwhelming, begin by tracking just one or two problem categories, like “dining out” or “shopping,” to build the habit without feeling swamped.

- Review Weekly for Patterns: Dedicate 20 minutes each Sunday to review your entries. Look for patterns, identify emotional spending triggers, and celebrate your planned, mindful purchases. This review is where true behavioral change happens.

Zero-Based Budgets: 8-Case Comparison #

| Template | Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes ⭐ / Impact 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Family Monthly Zero-Based Budget Template | Medium–High 🔄 — multi-earner coordination, monthly reviews | Moderate ⚡ — monthly time, multi-user tools, initial setup | High ⭐📊 — alignment, reduced conflicts, coordinated savings/debt plans | Couples & families with shared finances | Transparency and every-dollar allocation; supports multi-currency and shared goals |

| Debt Payoff Acceleration Zero-Based Budget | Medium 🔄 — debt-tracking and payoff strategy management | Low–Moderate ⚡ — extra payment capacity, payoff calculators, automation | High ⭐📊 — faster payoff, interest saved, improved credit utilization | Individuals/households focused on eliminating debt quickly | Clear measurable path to debt-free status; strong motivation via visible progress |

| Expat / Multi-Currency Zero-Based Budget | High 🔄 — currency conversions & cross-border reconciliation | High ⚡ — FX tools, multiple accounts, frequent rebalancing | High ⭐📊 — accurate cross-currency tracking, reduced FX surprises | Expats, frequent travelers, multi-currency earners | Handles real-time conversions, transfer fees, and repatriation planning |

| Privacy-Conscious Self-Hosted Zero-Based Budget | High 🔄 — self-hosting setup and ongoing maintenance | High ⚡ — technical skills, manual entry/backups, time investment | High ⭐📊 — complete data ownership, reduced third-party risk | Users prioritizing data privacy and control | Full ownership/customization, no cloud exposure or third-party analytics |

| Vacation & Travel Fund Zero-Based Budget | Low–Medium 🔄 — trip breakdowns and timeline allocations | Moderate ⚡ — destination research, monthly contributions, possible FX | High ⭐📊 — funded trips, fewer travel-related debts, clearer timelines | Families/couples saving for specific trips | Prevents debt-financed vacations; granular trip category tracking and contingency planning |

| Joint Account Household Contribution Zero-Based Budget | Medium 🔄 — proportional calculations and negotiation | Moderate ⚡ — fair-split calculators, communication time, multi-user | High ⭐📊 — perceived fairness, reduced money conflict, scalable contributions | Couples with unequal incomes or shared responsibilities | Equitable contribution model preserving individual autonomy and transparency |

| Emergency Fund & Savings Protection Zero-Based Budget | Low–Medium 🔄 — prioritized allocations and tiered targets | Moderate ⚡ — disciplined savings, separate accounts, automation | High ⭐📊 — stronger resilience, reduced reliance on borrowing | Those prioritizing financial security and resilience | Builds structured emergency reserves (1/3/6-month tiers); prevents debt from shocks |

| Mindful Manual Entry Zero-Based Budget | Medium–High 🔄 — consistent manual entry and reflection rituals | High ⚡ — daily/weekly time, note-taking, sustained discipline | High ⭐📊 — increased spending awareness, reduced impulse buys, behavior change | Individuals seeking mindful spending habits and privacy | Deep insight into triggers and habits; strong habit formation and privacy |

Your Turn: Build Your First Zero-Based Budget Today #

We’ve explored a wide range of zero based budgeting examples, from managing a family’s complex monthly spending to accelerating debt payoff and navigating multi-currency finances as an expat. Each template and strategic breakdown was designed to prove one central idea: zero-based budgeting isn’t a rigid, one-size-fits-all system. It’s a flexible framework you can adapt to any financial situation, no matter how unique.

You’ve seen how to assign every dollar a purpose, whether it’s for groceries, a vacation fund, or an aggressive savings goal. The power of this method lies in its intentionality. It forces you to confront your spending habits, prioritize your goals, and build a direct, actionable path toward financial control.

From Examples to Action: Your Key Takeaways #

As you move forward, keep these core principles at the forefront. They are the strategic threads that connect all the successful zero based budgeting examples we’ve covered.

- Intentionality is Everything: The goal isn’t to restrict spending; it’s to direct it. Giving every dollar a job transforms your budget from a list of limitations into a powerful tool for building the life you want.

- Flexibility is a Feature, Not a Flaw: Your budget will change. An unexpected car repair or a sudden income boost isn’t a failure; it’s an opportunity to adjust. A zero-based budget is a living document that should evolve with your life.

- Manual Tracking Creates Mindfulness: While automation has its place, the act of manually entering expenses, as highlighted in our privacy-focused examples, builds a deep, unshakable awareness of where your money is going. This connection is often the missing ingredient for lasting financial change.

- Your Categories Define Your Priorities: The categories you create and fund are a direct reflection of your values. Whether your focus is on a joint household, aggressive savings, or travel, your budget should tell the story of what truly matters to you.

Your Next Steps to Financial Clarity #

Feeling inspired is the first step, but taking action is what creates results. Don’t let the momentum stop here. Use the detailed templates and insights from this article to build your first zero-based budget, or refine the one you already have.

Start by choosing the example that most closely mirrors your own situation. Is it the joint account contribution model? The expat budget? Or the debt acceleration plan? Use it as your foundation. Remember, the numbers are just placeholders; the strategy is what counts.

The journey to mastering your finances is built one intentional decision at a time. The detailed zero based budgeting examples provided here are your roadmap. They offer proven strategies for gaining control, aligning your spending with your goals, and finally feeling empowered by your money instead of controlled by it. You have the tools and the knowledge. Now it’s time to put them to work.

Ready to stop just reading about budgeting and start doing it with clarity and control? The templates and strategies here are powerful, but the right tool makes implementation seamless. Econumo is a privacy-focused, self-hosted budgeting app built for manual tracking and complete financial ownership, making it the perfect partner for your zero-based budgeting journey. Take control of your finances with Econumo today.