Ever wondered what a secured bond means? The easiest way to think about it is to compare it to a home mortgage. When you get a mortgage, the house itself acts as collateral. If you can’t make the payments, the bank has a claim on your house. A secured bond works on the same principle for investors.

A company or government entity that issues a secured bond pledges a specific, valuable asset—think a factory, a fleet of aircraft, or a portfolio of real estate—as a safety net for the investor. This collateral is your assurance that if the issuer runs into financial trouble, there’s a tangible asset you have a claim to, helping you get your money back.

What a Secured Bond Means for Your Money #

At its heart, a secured bond is an investment built on a simple premise: trust, but have something solid to back it up. When you buy one, you’re essentially lending money. In exchange, the issuer promises to repay you with interest over a specific timeline.

It’s that “secured” part that makes all the difference. This detail provides a layer of protection that many other types of bonds and investments simply don’t have.

The Power of Collateral #

This collateral isn’t just a gentleman’s agreement; it’s a legally binding pledge written into the bond’s contract. If the issuer defaults—meaning they can’t make their payments—the secured bondholders are at the front of the line to get paid.

Those pledged assets are then sold off (or “liquidated”), and the money raised goes directly to paying back the investors. This priority status is a massive advantage, especially when the economy gets rocky.

Because of this structure, secured bonds offer investors significant downside protection. They are designed to preserve capital first and foremost, making them a cornerstone of more conservative portfolios.

And this isn’t just theoretical. History shows it works. During the 2008 financial crisis, for example, recovery rates for secured corporate debt were around 70-80%. That’s a world of difference from the 40% average investors recovered from unsecured debt.

Building a solid investment strategy means understanding these kinds of risk-management tools.

To boil it all down, here’s a quick look at the core features of a secured bond.

Secured Bonds at a Glance #

| Feature | Description |

|---|---|

| Collateral | Backed by specific assets (e.g., real estate, equipment) that can be sold if the issuer defaults. |

| Priority | Bondholders have first claim on the pledged assets during bankruptcy proceedings. |

| Risk Level | Generally considered lower risk compared to unsecured bonds due to the collateral backing. |

| Yield | Typically offer lower interest rates (yields) to reflect their lower risk profile. |

This table shows why secured bonds are often a go-to for investors who prioritize safety over chasing the highest possible returns.

How Collateral Creates a Safety Net for Investors #

When a company issues a secured bond, it’s not just making a promise—it’s signing a legally binding contract to put specific assets on the line. Think of it as the company giving you the keys to their car until they pay you back. This collateral is what gives secured bonds their power.

If the company runs into financial trouble and can’t make its payments, that collateral kicks in to protect your investment. This is where secured bondholders get a major advantage: seniority. It means you’re at the very front of the line to get paid back.

The pledged assets are sold off, and that cash goes straight to the secured bondholders. Only after you’ve been repaid does anyone else—like unsecured creditors or stockholders—get anything.

The Payout Process in Action #

Let’s make this real. Imagine a shipping company issues secured bonds to buy a new fleet of cargo ships, and those very ships are the collateral.

- The Default: The company hits rough seas financially and goes bankrupt, stopping its bond payments.

- Asset Liquidation: A trustee, who represents the bondholders, steps in and seizes the ships.

- Repayment: The ships are sold, and the money from that sale is used to pay back the secured bondholders first.

This priority claim is the core feature that makes secured bonds so appealing for investors who prioritize safety.

In short, collateral acts like an insurance policy on your investment. While no investment is truly risk-free, this tangible backing creates a clear and structured path to getting your money back if things go wrong—a defense mechanism that many other investments simply don’t have.

This is why secured bonds are often the bedrock of a stable investment portfolio. The presence of physical assets provides a concrete recovery value, making the whole investment feel far more predictable and secure. You can see similar principles at play when you consider financial tools backed by tangible assets, like your home equity.

Secured vs. Unsecured Bonds #

Not all bonds are created equal, and not all of them come with a built-in safety net. This is where the difference between secured and unsecured bonds becomes a crucial distinction for any investor, especially when you’re figuring out how much risk you’re comfortable with in your portfolio.

An unsecured bond, which you’ll often hear called a debenture, isn’t backed by any specific asset. Instead, it’s supported only by the company’s full faith, credit, and general reputation. Think of it like a personal loan to a friend based solely on their promise to pay you back—you’re trusting their word and their financial standing.

Because there’s no collateral to fall back on, investors take on more risk with unsecured bonds. To make that risk worthwhile, issuers almost always offer a higher interest rate, or yield, to attract buyers. For individual investors and families trying to build a balanced portfolio, this trade-off between higher potential returns and greater risk is a fundamental concept to grasp.

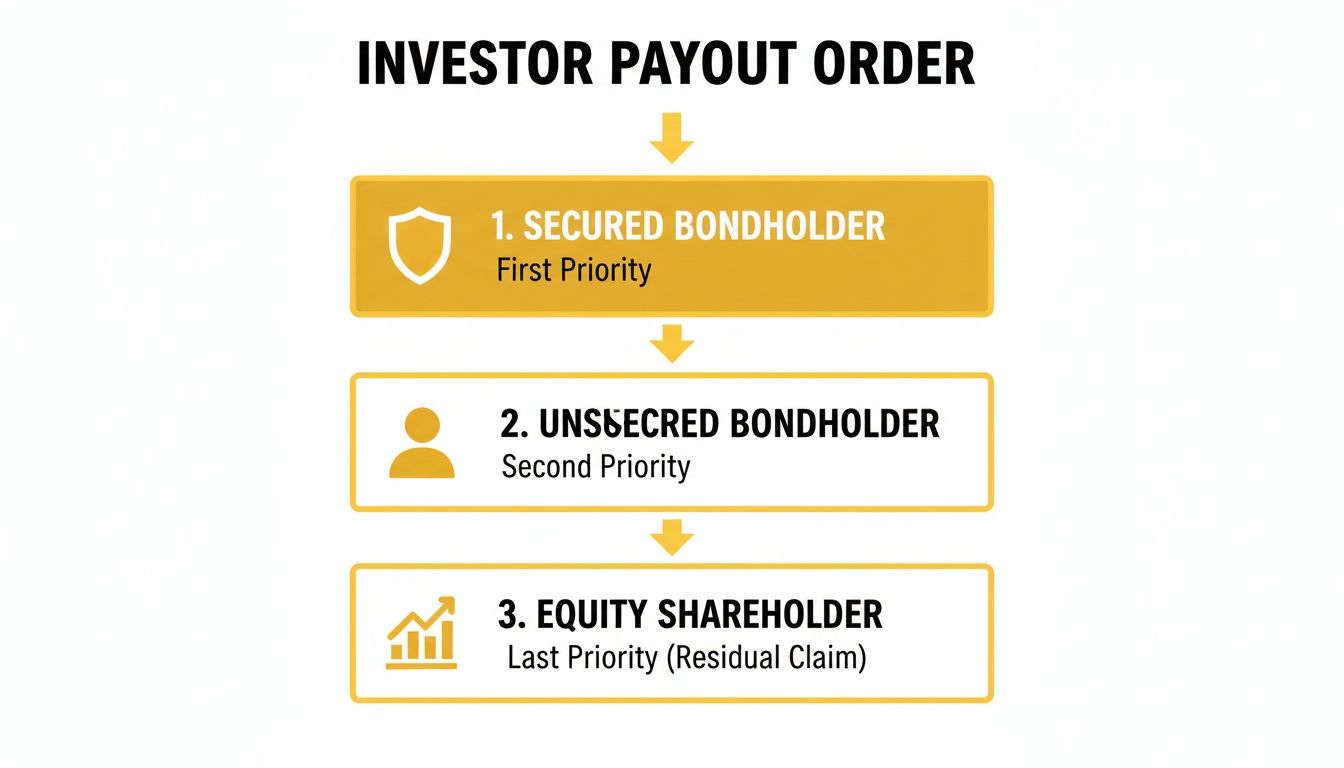

Understanding the Payout Pecking Order #

The real test of a bond’s security happens when a company runs into financial trouble and has to declare bankruptcy. This is where secured bondholders have a huge advantage. They have a priority claim on the specific assets pledged as collateral, meaning they are first in line to get their money back from the sale of those assets.

Unsecured bondholders, on the other hand, have to wait. They only get paid after all secured creditors have been made whole, and they’re paid from whatever general assets are left over—if any.

This chart clearly lays out the “pecking order” for who gets paid when a company liquidates.

As you can see, being at the top of the list gives secured bondholders the best chance of getting their original investment back. This priority is precisely what makes a secured bond “secure.”

To make this even clearer, let’s break down the main differences side-by-side.

Key Differences: Secured vs. Unsecured Bonds #

The table below gives you a quick snapshot of the core distinctions between these two types of bonds.

| Feature | Secured Bonds | Unsecured Bonds |

|---|---|---|

| Backing | Pledged physical or financial assets (collateral) | Issuer’s general creditworthiness and reputation |

| Risk Level | Lower, due to the collateral safety net | Higher, as there’s no specific asset to claim |

| Typical Yield | Lower, reflecting the reduced risk | Higher, to compensate investors for the extra risk |

| Bankruptcy Claim | First priority on the pledged collateral | Paid only after secured creditors are satisfied |

Ultimately, the presence of collateral is the dividing line. It’s the “security” in a secured bond and the main reason for its lower risk profile and, as a result, its typically lower yield compared to its unsecured counterparts.

Real-World Examples of Secured Bonds #

The best way to get a feel for what a secured bond means is to look at where they show up in the wild. These aren’t just abstract concepts from a finance textbook; they’re the engine behind major projects and purchases you see every day.

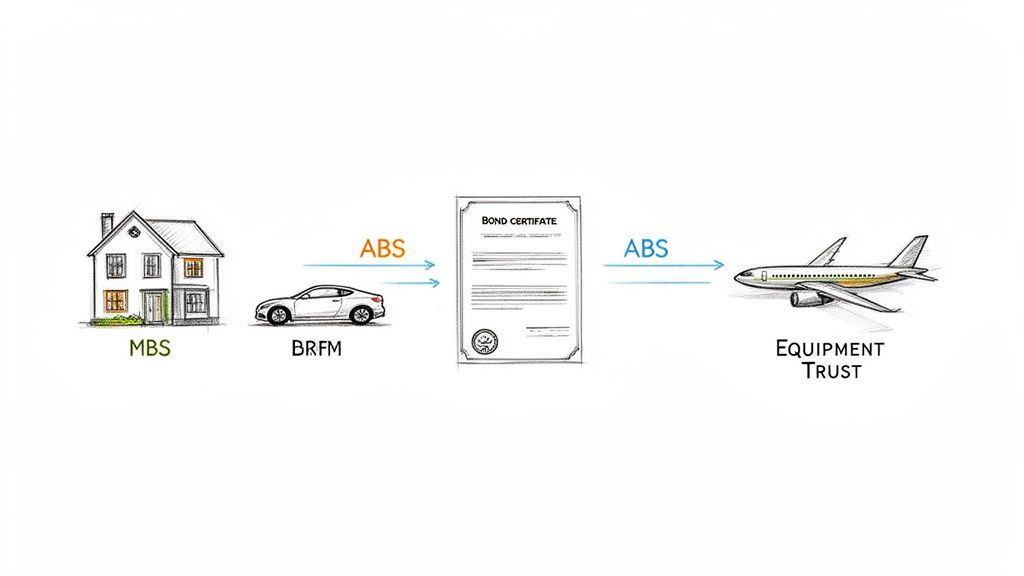

One of the most classic examples is the Mortgage-Backed Security (MBS). You’ve probably heard of them. Financial institutions take thousands of individual home mortgages and package them together into one big investment. In this case, the collateral is the actual real estate—all those houses and properties. If a bunch of homeowners stop paying their mortgages, the properties can be sold to make the investors whole again.

Then you have Asset-Backed Securities (ABS), which run on the exact same idea but use different kinds of collateral. Think of them as the versatile cousins of MBS.

- Auto Loans: Thousands of car loans are bundled, with the cars themselves acting as the collateral.

- Credit Card Payments: Your future credit card payments get packaged up and sold to investors.

- Student Loans: A big pool of student loan debt is used to back the bond.

Specialized Secured Bonds in Industry #

It’s not just about consumer debt. Big industries rely heavily on secured bonds to finance massive purchases. A great example is Equipment Trust Certificates (ETCs), which are a go-to for airlines.

When an airline needs to buy a new plane that costs hundreds of millions of dollars, it often issues an ETC. The plane itself is the collateral. Simple as that.

This structure is a win-win. It lets companies afford huge, necessary equipment, and it gives investors a tangible, high-value asset as a safety net if things go wrong.

This model is so powerful it’s even used to fund huge infrastructure projects. In Europe, a telecom company called FiberCop recently issued a €2.8 billion senior secured bond, making it the year’s largest high-yield deal. This just goes to show how essential secured bonds are for financing on a massive scale. If you’re curious, you can find more on how these major deals are structured in recent market analyses.

From helping a family buy a home to funding the jets we fly on, secured bonds are a fundamental part of our financial world. They provide a trusted mechanism for both the people who need money and the people who invest it.

What to Consider Before You Invest #

Just because a bond is “secured” doesn’t mean it’s an automatic green light for your portfolio. Yes, the collateral provides a fantastic safety net, but there are still a few key things you need to weigh before jumping in. Taking a moment to understand these factors will help you see if secured bonds are the right fit for your financial goals.

The biggest trade-off you’ll encounter is between risk and reward. Because secured bonds are safer, they almost always pay a lower interest rate, or yield, than their riskier unsecured cousins. In essence, you’re trading a bit of earning potential for a whole lot more stability and peace of mind.

This safety-first approach makes them a favorite for cautious investors. The global market shows just how much investors value this downside protection. For example, during the first half of a recent year, higher-rated bonds made up a massive US$76.2 billion, or 69%, of all US high-yield bond issues. You can dig deeper into this data on White & Case’s Debt Explorer.

Analyzing Credit Quality #

The collateral is important, but don’t forget to look at the financial health of the company or government issuing the bond. Always check the bond’s credit rating from major agencies like Moody’s or S&P Global. A top-tier rating (think AAA or AA) signals a very low risk of default, making it a much more dependable investment.

A lower rating, on the other hand, means the issuer’s finances are on shakier ground, which increases the odds of them running into trouble. Even with solid collateral, a default can become a messy and drawn-out affair. A financially sound issuer adds another crucial layer of security.

The core question to ask is: Does this investment’s stability align with my long-term goals? For those building a balanced retirement portfolio, the answer is often yes.

Finally, think about where these bonds fit into your overall investment strategy. They can be a fantastic way to anchor a portfolio that also holds more volatile, high-growth assets like stocks. If you’re figuring out how different accounts work together, you might find our guide on whether you can have an IRA and a 401(k) helpful.

Your Top Questions, Answered #

Even after getting the basics down, you probably still have a few questions floating around. Let’s tackle some of the most common ones that investors have about secured bonds.

Are Secured Bonds a Sure Thing? #

No investment is ever 100% risk-free, and that goes for secured bonds too. They are certainly much safer than their unsecured cousins, but a few risks remain.

For example, the value of the collateral itself could drop. And if market interest rates shoot up, your bond with its lower fixed rate becomes less attractive, causing its market value to fall. Still, because you’re first in line to get paid back in a worst-case scenario, they remain one of the most reliable pillars in the fixed-income world.

How Do I Actually Buy Secured Bonds? #

For most of us, buying individual secured bonds directly from a company isn’t very practical. It can be a complicated and expensive process.

The most straightforward route for individual investors is through bond mutual funds or exchange-traded funds (ETFs). These funds are essentially baskets containing a wide variety of secured bonds, which instantly diversifies your investment and spreads out the risk. You can buy shares in these funds just like stocks through any standard brokerage account.

Where Do Secured Bonds Fit in My Investment Plan? #

Think of secured bonds as the steady anchor in your portfolio. They provide a predictable income stream and don’t typically jump up and down in value like stocks do. This stability makes them perfect for balancing out the riskier, high-growth parts of your investment strategy.

For families using apps to manage their finances together, knowing how these bonds work is crucial for long-term planning. They offer the kind of stability needed for more conservative portfolios, a fact supported by market trends showing high-yield spreads are expected to tighten to 6.8% by mid-2025, the narrowest they’ve been since 2022. You can read more about high-yield market trends on White & Case.

At the end of the day, if you’re saving for big life goals like retirement or a college fund, the reliable returns and capital preservation that secured bonds offer are invaluable. They’re built for the long haul, giving you peace of mind.

This blend of safety and steady income is precisely why they are a cornerstone for so many smart, long-term investment portfolios.

Ready to take control of your family’s financial future? With Econumo, you can manage shared budgets, track spending, and work towards your goals together. Our privacy-focused app makes collaborative money management simple and stress-free. Try the live demo or join the waiting list today!