Let’s be honest, planning a trip should be exciting, not a source of low-grade financial dread. A solid travel budget is what separates a stress-free vacation from one spent worrying about your bank account. It’s your game plan for turning that dream trip into a reality without the financial hangover.

Why Old-School Budgeting Just Doesn’t Cut It Anymore #

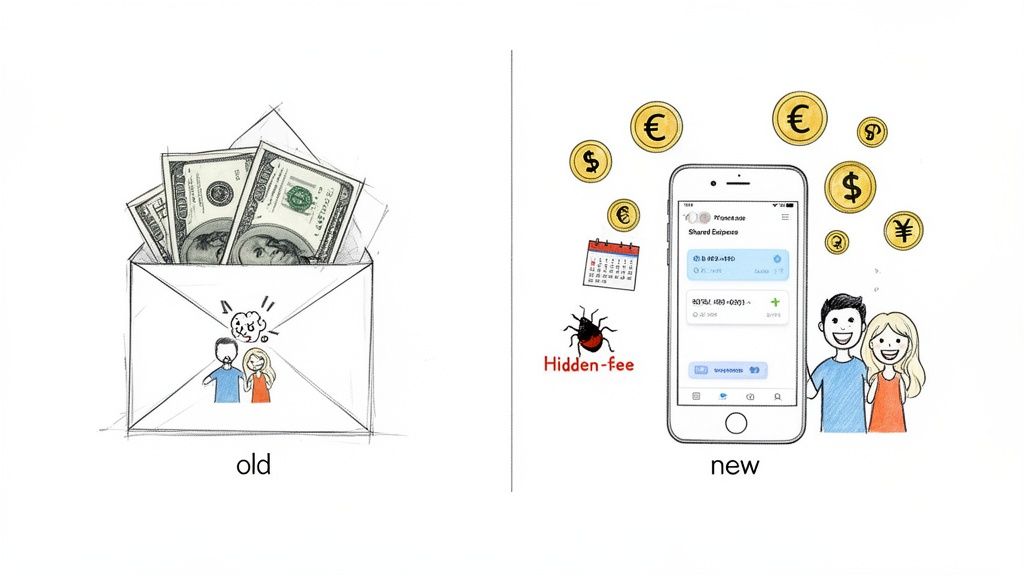

Remember the old “cash in an envelope” trick? It was great for its time, but for modern travel, it’s a disaster waiting to happen. In a world of credit cards, digital wallets, and currencies that seem to change value every hour, that quaint system falls apart fast. It’s a rotary phone in a smartphone world.

Today’s travelers run into completely different money problems. If you’re traveling with your partner, trying to split costs fairly can become a trip-ruining argument. “I got the museum tickets, you got dinner, but what about the train fare?” For families, tracking dozens of little purchases for snacks and souvenirs across multiple currencies is next to impossible. This chaos is the perfect recipe for a vacation argument.

The Hidden Costs of a Bad System #

When your budgeting method is broken, it’s not just about losing track of a few dollars. The real cost is your peace of mind.

The constant mental gymnastics—converting euros to dollars, trying to remember your account balance, figuring out who owes what—adds a layer of stress to everything. Instead of soaking in the sights of a new city, you’re stuck doing math in your head. This is where a modern approach changes everything. We need a system built on clarity, collaboration, and a bit of flexibility.

A great travel budget isn’t about restriction; it’s about empowerment. It gives you the confidence to spend on what matters most, knowing you have a clear plan for your finances.

How to Actually Enjoy Spending Money on Vacation #

A good travel budget actually encourages mindful spending. It’s not about being cheap; it’s about being intentional. When you can see exactly where your money is going, you can make smarter decisions in the moment.

For example, maybe you see you’ve spent way less on transportation than you’d planned. That insight gives you the freedom to say “yes” to that spontaneous cooking class or a fancier dinner without an ounce of guilt. Suddenly, your budget isn’t a rulebook—it’s a dynamic guide that makes your trip better. By getting a handle on your money, you give yourself permission to truly live in the moment.

Laying Your Financial Foundation Before You Go #

Alright, this is where the fun really begins.## Laying Your Financial Foundation Before You Go

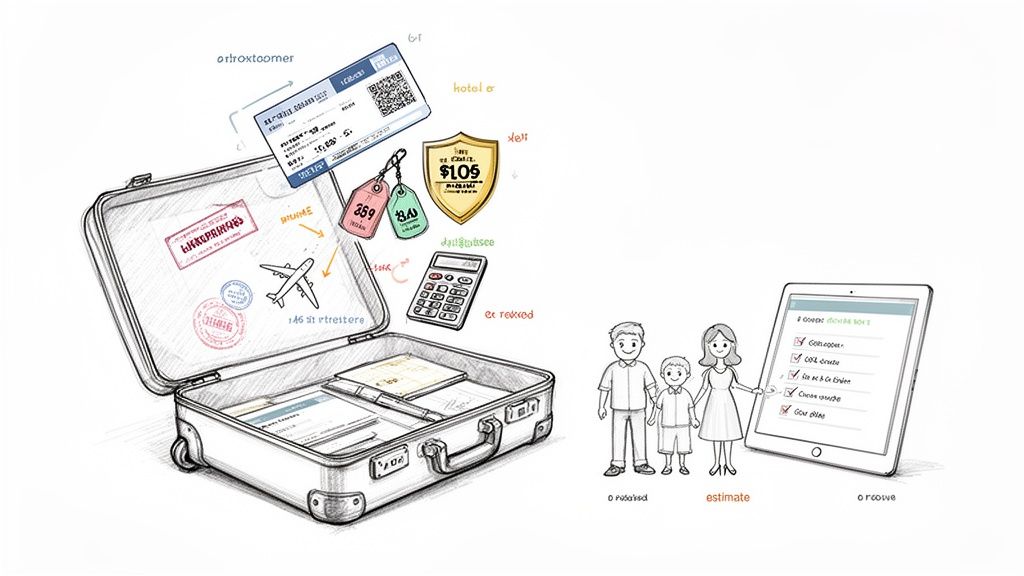

Alright, this is where the fun really begins. Your dream trip starts to feel real the moment you put actual numbers to it. Before you even pull a suitcase out of the closet, you need to pin down the major, upfront costs. These are the big-ticket items that form the bedrock of your travel budget.

I’m talking about the essentials: flights, a place to stay, travel insurance, and any visas you might need. Getting these figures right is absolutely crucial because they’ll likely be the biggest chunk of your spending. If you miscalculate one of these, it can easily throw your whole plan out of whack.

If you’re planning with a partner or your family, a shared spreadsheet or budgeting app is a lifesaver here. It keeps everyone on the same page and avoids any “I thought you were booking that!” moments down the line.

Researching Your Core Travel Costs #

To build a budget you can trust, you need to replace guesswork with real-world estimates. I always recommend tackling the biggest expenses first since they’ll have the most impact on your bottom line.

- Flights: Start with flight aggregators to get a baseline, but always double-check prices directly on airline websites. Be flexible with your dates if you can—flying on a Tuesday is almost always cheaper than a Friday. And don’t forget to factor in baggage fees, which can add up fast.

- Accommodations: Explore a mix of options. Compare hotels with vacation rentals on sites like Airbnb or Vrbo. For families, an apartment with a kitchen can be a game-changer, potentially saving you enough on meals to justify a higher nightly rate.

- Travel Insurance: This isn’t an optional extra; it’s a must-have. Get quotes from a few different providers and read the fine print to make sure you’re covered for medical emergencies, trip cancellations, or lost luggage.

- Visas and Entry Fees: Some destinations require a visa, which always comes with a fee. The only place to get accurate, up-to-date info is on the official government or embassy websites for the country you’re visiting.

This research is more important now than ever. With business travel spending projected to hit $1.64 trillion by 2025, we’re seeing a direct impact on leisure travel prices. Average airfares in the U.S./Canada are expected to reach $705, and global hotel rates are climbing to $165 per night. For families, this means planning ahead is the best way to lock in reasonable prices.

How It All Comes Together: A Sample Budget #

Let’s look at how to structure this part of your planning. The goal is to get a clear picture of your major fixed costs before the trip even starts.

Below is a simple table showing how a family of four might break down their pre-trip expenses for a mid-range international vacation. Think of it as a template you can adapt for your own adventure.

Sample Pre-Trip Budget Breakdown For A Family Of Four #

| Expense Category | Description | Estimated Cost (USD) | Notes For Couples/Families |

|---|---|---|---|

| Flights | Round-trip international flights for four people. | $4,800 | Book 3-6 months in advance for the best prices. Consider budget airlines for short hops. |

| Accommodations | 13 nights (e.g., 7 nights in an apartment, 6 in hotels). | $2,600 | An apartment with a kitchen can drastically reduce food costs for families. |

| Travel Insurance | Comprehensive family plan covering medical, cancellation, and baggage. | $450 | Ensure coverage is per person, not just per policy, especially for adventure activities. |

| Visas/Entry Fees | Required entry permits for the destination country. | $200 | Check official government websites for exact fees and processing times. |

| Pre-Booked Tours | Major activities like theme park tickets or guided tours booked in advance. | $600 | Booking popular attractions early can save money and guarantee entry. |

| Total Pre-Trip | The foundational cost of your trip. | $8,650 | This is the amount you need to save before you start thinking about daily spending. |

This table isn’t just a list of numbers; it’s your financial blueprint. It gives you a clear savings target and the confidence to move on to the next stage of planning.

The goal is to build a transparent and agreed-upon financial foundation. When both partners can see and contribute to logging these big expenses in one place, it eliminates misunderstandings and builds a sense of shared ownership over the trip’s finances.

Once you have these core costs locked in, the hard part is over. You’ve anchored your travel budget. With this solid base, you can confidently start planning for your daily spending on food, local transport, and all the fun stuff. The clarity you gain here makes the rest of the process so much smoother.

And if you need a little help hitting that savings goal, our guide on the 100 envelope challenge has some creative ideas to get you there faster.

Nailing Your Daily Trip Expenses #

Okay, you’ve got your big pre-trip costs like flights and hotels squared away. That’s the easy part. Now comes the real challenge: figuring out what you’ll spend each day on the ground.

This is where most travel budgets fall apart. Just picking a round number like “$100 a day” is a recipe for disaster. Why? Because no two travel days are the same. One day you might be wandering through a free park, and the next you’re paying for a guided tour and a fancy dinner. To get this right, you have to get specific.

Break Down Your On-the-Go Spending #

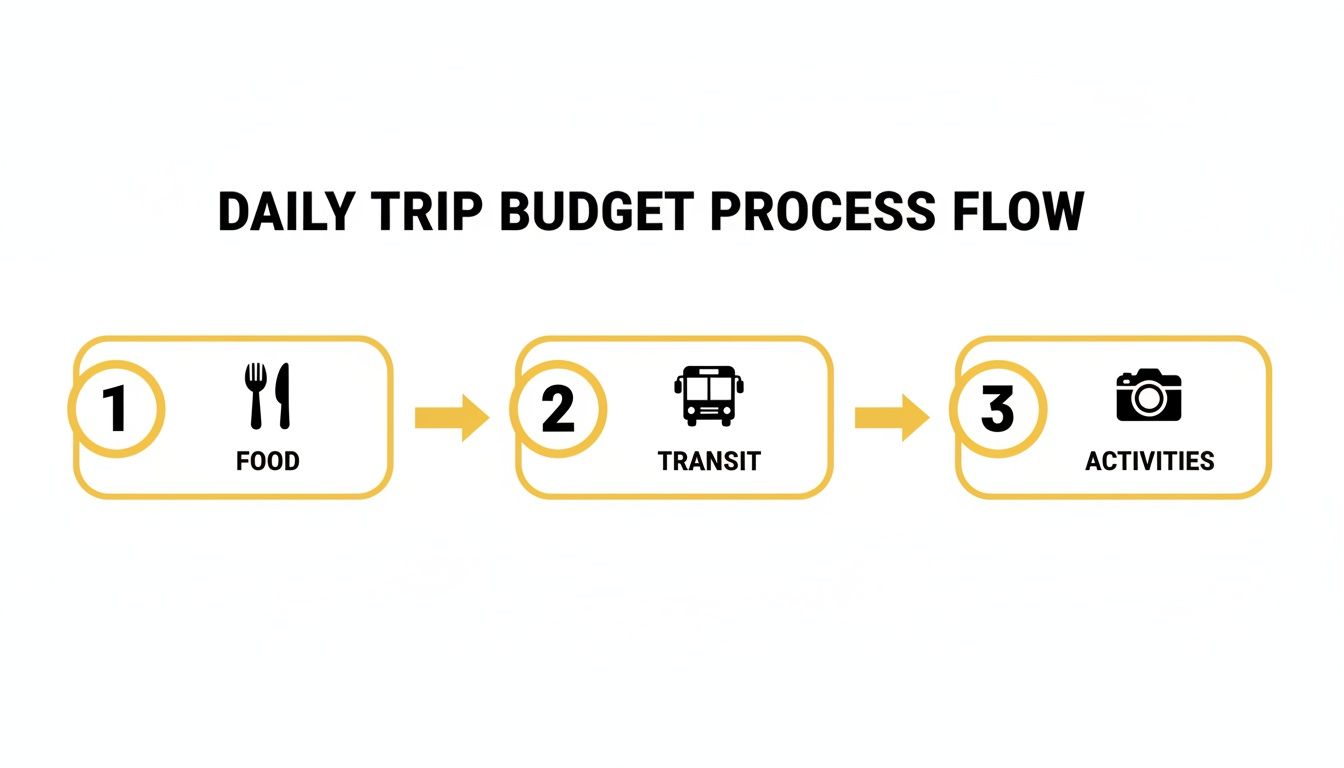

Let’s start by thinking about your daily spending in a few key buckets. This isn’t about creating a complicated spreadsheet; it’s about realistically mapping out where your money is likely to go.

Here are the main categories I always use:

- Food & Drinks: This is the big one. Are you a grab-and-go street food person, or do you live for long, sit-down dinners? Maybe it’s a mix. Be honest about your style. A family grabbing groceries for breakfast and packing picnic lunches will have a wildly different food budget than a couple dining out for every meal.

- Local Transportation: How are you actually getting from point A to point B? Look up the cost of a weekly metro pass versus what a typical taxi or Uber ride costs. For a family of four, a few cab rides might surprisingly be cheaper—and a lot less stressful—than buying four separate train tickets.

- Activities & Entertainment: This covers everything from museum entries and tour fees to souvenirs or that spontaneous boat trip you hadn’t planned on. Make a list of your “must-do” activities and find their exact prices online ahead of time.

- The “Just in Case” Fund: I always build in a small buffer for the little things. Think daily coffees, a gelato stop, laundry, or replacing a forgotten tube of toothpaste. It all adds up.

Set Daily Allowances You Can Actually Stick To #

Once you have your categories, it’s time to put some real numbers to them. This takes a bit of research, but trust me, it’s worth it. Instead of just guessing what food costs in Paris, a quick search for “average price of a croissant in Paris” or “cost of a three-course meal in Le Marais” will give you a much more accurate picture.

The secret to an accurate travel budget is detail. Don’t just say “$150 a day.” Instead, think: “$15 for breakfast and coffee, $25 for lunch, $50 for dinner, $15 for transport, and $40 for activities.” Right away, that feels more real and manageable, doesn’t it?

This approach also gives you incredible flexibility. If you save money with a cheap picnic lunch one day, you know exactly how much extra you have to play with for a nicer dinner the next night. No guesswork, no guilt.

You Must Budget in the Local Currency #

This is non-negotiable for international trips. Planning in U.S. Dollars while you’re spending in Euros or Yen will completely throw you off. You have to do your research and set your daily budget in the local currency.

Doing this forces you to get a real feel for what things actually cost. A 20 Euro lunch might sound cheap, but when you see how it impacts your daily Euro budget, you get a much clearer picture. This is especially true today. Affluent travelers now make up 25% of global travel spending, driving up prices for popular tours and restaurants. At the same time, the average traveler’s budget is tightening, with expected spending per trip down 18% year-over-year. Budgeting in the local currency is your best defense against these shifting costs. You can get more insight into how travel trends are shaping vacation costs on Visa.com.

Use Digital “Envelopes” to Track in Real-Time #

Remember the old-school method of putting cash for different expenses into separate envelopes? We can do the same thing with modern budgeting apps. Just create a digital “envelope” for each of your categories: Food, Transportation, Activities, etc.

Every time you buy something, log it in the right category. Buy two metro tickets? Pop it into your “Transportation” envelope. Grab some gelato? That goes in “Food.” This simple habit is incredibly powerful. At any point during the day, you can glance at your phone and know instantly:

- Exactly how much you’ve spent in each category.

- How much you have left for the rest of the trip.

- Where you might be overspending.

This real-time feedback lets you make smart adjustments on the fly, turning your budget from a source of stress into your most helpful travel tool.

Managing Multiple Currencies And Shared Costs #

Traveling abroad introduces a couple of financial headaches that can quickly turn a dream trip into a mess: juggling different currencies and figuring out how to split costs with your travel buddy. If you don’t have a solid plan, you’re opening yourself up to sneaky bank fees and the kind of awkward money conversations that nobody wants to have on vacation.

The good news? A little bit of planning goes a long way. With the right strategy, you can easily avoid these common money traps and keep the focus where it should be—on enjoying the experience, not arguing over expenses.

Navigating Foreign Currency Without Losing Money #

One of the most bewildering parts of international travel is dealing with exchange rates and all the hidden fees. Banks and those currency exchange kiosks you see at the airport often take a hefty slice, quietly chipping away at your travel funds.

A classic trap to watch out for is something called Dynamic Currency Conversion (DCC). This is when a credit card machine at a shop or restaurant asks if you want to pay in your home currency instead of the local one. It might seem helpful, but the exchange rate is almost always a rip-off. Always, always choose to pay in the local currency.

My single best piece of advice for your travel budget is to get a travel-friendly debit or credit card. Look for one with no foreign transaction fees and, ideally, one that reimburses ATM fees. This move alone can save you hundreds of dollars on a single trip.

With global travel roaring back, this is more important than ever. International visitor spending is expected to hit a record $2.1 trillion in 2025, blowing past pre-pandemic numbers. If you’re hopping between countries using euros, pounds, and dollars, that massive flow of money is a reminder of how much can be lost to hidden fees. You can read more about the growth in global travel spending on WTTC.org.

The Simple Workflow For Multi-Currency Tracking #

So, how do you track a purchase in Japanese Yen while keeping your main budget in US Dollars? The trick is to log every expense in the currency you actually spent.

- Log Locally: When you grab a coffee in Rome for €3, just pop it into your budgeting app as €3. Don’t try to do the conversion in your head.

- Let the App Convert: A good multi-currency tool will handle the hard part, automatically converting that €3 to your home currency using the real-time exchange rate.

- Review in Your Home Currency: At the end of the day, you get a clean summary of what you spent in a currency you actually understand. No more mental gymnastics for every single purchase.

This visual shows just how simple it is to categorize your daily spending as it happens.

Using this method means your spending on food, transit, and activities is tracked accurately right when it happens, giving you a crystal-clear picture of where you stand. You can get into the nitty-gritty of this by reading our guide on how to avoid currency conversion fees.

Keeping Shared Costs Fair And Drama-Free #

For couples and families, splitting costs fairly is the key to a happy, harmonious trip. The old “I’ll get this one, you get the next” approach is a surefire way to create confusion and, eventually, resentment.

A much better way is to use a shared budgeting tool where both of you can log expenses right from your own phones. This creates one unified, transparent view of the trip’s finances.

Here’s how to make it work seamlessly:

- Tag the Payer: When you add an expense, just tag who paid. Did you buy the museum tickets? Tag yourself. Did your partner cover dinner? Tag them.

- See Who Owes What: The app should keep a running tally of who’s paid for what. In a single glance, you can see if the balance is getting lopsided.

- Settle Up Simply: You can choose to settle up at the end of the trip or whenever you feel like it. This completely eliminates those awkward “you owe me $17.50 for lunch” moments.

This kind of transparency takes all the guesswork out of shared expenses. Everyone can see exactly where the money went and who paid for what, letting you focus on making memories instead of chasing down receipts.

Staying On Track Without Ruining Your Vacation #

A travel budget sitting in a spreadsheet back home is just a wish list. It’s completely useless. The real magic happens when you bring it with you and use it as an active, on-the-ground tool.

This doesn’t mean you need to be glued to your phone, crunching numbers while you should be soaking in the views. It’s about building a simple, quick routine to log what you spend. The goal isn’t to restrict your fun—it’s to empower it.

Manually taking five seconds to log that delicious gelato or those two train tickets does something powerful. It connects you to your spending in the moment, turning your budget from a static plan into a dynamic guide that helps you make better decisions.

The Power of the Daily Check-In #

The single most important habit for staying on budget is the daily check-in. This isn’t a stressful accounting session. It’s a quick, two-minute glance at your spending categories, usually done over morning coffee or just before heading out for the day.

This simple routine helps you answer one crucial question: “How are we doing?”

By looking at where your money is going each day, you can make smarter, more confident decisions on the fly. You’re no longer just guessing; you’re operating with real data. This is where you can spot opportunities to adjust your plans in a way that actually makes your vacation better.

For instance, you might see you’ve spent way less on transportation than you planned. Seeing that surplus isn’t just a number—it’s an opportunity. That’s your green light to splurge on that spontaneous boat tour you saw advertised, completely guilt-free. Your budget becomes a flexible guide, not a ball and chain.

Turning Data Into Better Decisions #

Seeing your spending in real-time lets you make small corrections before they snowball into big problems. If you notice your “Dining Out” category is getting a little high after a few days, you can decide to have a fun picnic lunch in the park the next day instead of another pricey sit-down meal.

This proactive approach really works:

- It Prevents Overspending: Small daily tweaks are so much easier than the gut-punch of realizing you’ve blown half your budget with a week left to go.

- It Encourages Mindful Spending: You start to naturally think about what really matters to you. Is another souvenir really worth more than an amazing dinner on your last night?

- It Reduces Financial Anxiety: Knowing exactly where you stand eliminates that constant, nagging worry about whether you can afford something.

Your travel budget is your permission slip to spend. By actively tracking your money, you give yourself the freedom to enjoy every moment, knowing that each purchase fits into the bigger picture you planned.

A Practical Tracking Workflow #

The process itself should be effortless. The moment a transaction happens, one person pulls out their phone and logs it. It takes seconds.

Did your partner pay for the museum tickets with their card? They log it. Did you grab snacks with cash? You log it.

This shared responsibility is key for couples and families. It prevents one person from becoming the dreaded “accountant” of the trip and keeps everyone engaged and aware of the financial picture. This simple habit keeps your budget accurate and turns money management into a seamless part of the journey. Sticking to a budget can be tough, but a clear system makes all the difference, and you can learn more about building these habits in our complete guide on how to stick to a budget.

Answering Your Biggest Travel Budget Questions #

Even the most meticulously crafted budget plan runs into questions. That’s just part of the process. This is where we tackle those common financial puzzles that pop up when you’re planning a trip. Think of this as your practical guide for handling those tricky “what if” moments.

From the age-old question of when to start, to dealing with those surprise expenses that love to appear out of nowhere, getting these details right can be the difference between a stressful trip and a relaxing one. A prepared traveler is, after all, a happy traveler.

How Far in Advance Should I Start My Travel Budget? #

Honestly? The best time to start budgeting is the second you start daydreaming about a destination.

For any significant trip, I always recommend starting the planning and saving process 6 to 12 months ahead of your departure date. This isn’t just about being organized; it’s a strategic move that does two incredibly valuable things for your wallet.

First, that long runway gives you plenty of time to hunt for deals on the big stuff—flights and accommodation. Booking these major expenses well in advance can lock in some serious savings before you’ve even packed your bags.

More importantly, it makes the whole savings goal feel less like a mountain and more like a gentle hill. A $4,800 dream vacation sounds like a lot of cash to find. But break that down over 12 months, and it becomes a much more digestible $400 per month. That simple mental shift can turn a huge financial hurdle into a steady, achievable plan, keeping you motivated and out of last-minute travel debt.

What’s the Best Way to Handle Unexpected Expenses? #

Surprises are part of the adventure, but they shouldn’t torpedo your budget. The absolute best defense is a good offense: build a Contingency Fund directly into your budget from day one. It’s your financial safety net, set up long before you leave home.

A good rule of thumb is to set aside 10-15% of your total estimated trip cost. For a $5,000 trip, that means having an extra $500 to $750 waiting in the wings.

Now, here’s the key: you have to treat this fund with respect. This isn’t extra cash for souvenirs or a last-minute fancy dinner. It is strictly for genuine, unforeseen problems.

- A sudden toothache that requires a dentist.

- A canceled train that means you need to buy a new, last-minute ticket.

- Replacing your phone charger after leaving it at the last hotel.

By keeping this money siloed off in its own category, you won’t be tempted to spend it. When a real emergency pops up, you can handle it without raiding your funds for food, activities, or other essentials, and your trip stays on track.

Should I Budget in My Home Currency or the Local One? #

This is a classic question, and the answer is both—but for different jobs. Think of it like using two different camera lenses: one for the wide, overall shot and another for the close-up details.

Your home currency is for the big-picture planning. Use it to set your total savings goal and budget for those major pre-trip expenses you’ll pay for from your home bank account, like international flights and hotel deposits. It gives you a clear, stable target to aim for.

But for all your day-to-day spending on the ground—coffees, bus tickets, museum entries—you absolutely have to think, budget, and track in the local currency. A vague “$20 for lunch” budget is useless until you know what that actually gets you in Japanese Yen or Mexican Pesos. Researching local costs and setting your daily allowances in the currency you’ll actually be spending makes your budget realistic and stops you from doing that constant, error-prone mental math every time you buy something.

How Can Couples Manage a Shared Budget Without Arguing? #

Let’s be real: money can be a major source of friction on a trip. But it doesn’t have to be. The secret ingredients to a peaceful shared budget are transparency and collaboration, starting from the very first conversation.

First, sit down together and get on the same page about the total budget and, just as importantly, the travel style. Are we talking budget backpacking or a comfortable, mid-range getaway? Aligning on this foundational piece prevents a lot of mismatched expectations down the road.

Next, find a shared digital tool where you can both see and log expenses in real-time. This isn’t about micromanaging; it’s about creating an open book. This simple act prevents one person from becoming the reluctant “trip accountant” and stops financial secrets before they start.

Here are a few tips that have worked wonders for us:

- Tag Who Paid: When you log an expense, make a note of who paid. It keeps things feeling fair and balanced.

- Have a 2-Minute Morning Huddle: Over coffee, just quickly glance at where you are with the budget. It’s not about blame; it’s a quick sync-up. “Hey, looks like we went big on dinner last night, so maybe a picnic lunch today?”

- Celebrate the Wins: When you come in under budget for a day, high-five! Acknowledging the wins makes budgeting feel like a team sport, not a chore.

When you make financial planning a shared, open process, the stress melts away, and you can focus on what actually matters—enjoying your trip together.

Ready to build a travel budget that actually works for you, your partner, or your family? Econumo is designed for collaborative, multi-currency financial planning, giving you the clarity and control you need for a stress-free vacation. Try the live demo or self-host for free today at https://econumo.com.