When you hear the term “self hosted finance manager,” what comes to mind? It’s simply finance software that you install and run on your own server. This gives you absolute control over your financial data.

Instead of handing over sensitive information like your income, expenses, and net worth to a third-party company, you become the sole gatekeeper. This approach ensures your data stays completely private, shielded from prying eyes, and free from recurring subscription fees.

Understanding the Self Hosted Finance Manager #

Think of your financial data like a personal journal. Would you rather keep it locked in a safe inside your house, or store it in a public locker where someone else holds the master key? That’s the core idea behind a self hosted finance manager—you’re building your own private financial fortress.

Unlike popular cloud-based services that store everything on their servers, self-hosting puts you firmly in the driver’s seat. You control the software, the hardware it runs on, and most importantly, the data itself. This principle of “tech independence” means you’ll never be at the mercy of sudden price hikes, feature removals, or policy changes that could lock you out of your own financial history.

The Homeowner vs Renter Analogy #

A great way to grasp the difference is to compare owning a home to renting an apartment.

Cloud Services (Renting): Using a cloud-based finance app is like renting. It’s convenient, and someone else handles all the maintenance (servers, security, updates). The catch? You have to follow the landlord’s rules, pay recurring rent (subscriptions), and you can’t really customize your space. The landlord also holds a key to your front door.

Self-Hosting (Owning): Running a self hosted finance manager is like owning your home. You have total freedom to customize everything exactly how you want it. There are no monthly “rent” payments to a software company, and you enjoy ultimate privacy. The trade-off is that you’re responsible for the upkeep—things like security, backups, and maintenance.

This distinction is becoming more important every day. The personal finance app market is expected to hit USD 38.2 billion by 2026, driven by smartphones and Open Banking APIs. Yet, this growth is happening alongside massive user distrust in the cloud. After major data breaches exposed 2.6 billion records worldwide in 2023, it’s no surprise that 58% of users are wary of how companies handle their data. You can learn more about these personal finance market trends and what drives them.

Why Data Ownership Matters #

In a world where personal data is often treated like a product, keeping your financial information private has never been more critical. A self hosted solution guarantees that your spending habits, investment details, and net worth won’t be analyzed, sold to data brokers, or exposed in a corporate data breach.

For those interested in exploring this path, our guide on open-source personal finance software is a great next step. This level of control is the fundamental reason why so many individuals, families, and privacy advocates are choosing to manage their own financial software. It’s about more than just budgeting; it’s about reclaiming ownership of your financial story.

The Pros and Cons: What You Gain vs. What You Give #

Going the self-hosted route is a big decision. It’s not just about picking some new software; it’s about fundamentally changing how you handle your financial data. You’re trading the convenience of a cloud service for a level of control and privacy that commercial products just can’t offer.

On one side of the scale, the upsides are huge. First and foremost, you get absolute data privacy. Every transaction, budget, and savings goal lives on hardware that you own and manage. This completely sidesteps the risk of your sensitive information being sold to advertisers or getting swept up in a massive corporate data breach.

Then there’s the sweet escape from “subscription hell.” So many cloud tools chip away at your bank account with recurring fees. With a self-hosted app, you might have a small one-time cost for hardware, but after that, it’s yours. No more monthly bills just to access your own financial data.

The Power of Being in the Driver’s Seat #

The freedom you get with a self-hosted finance manager goes way beyond just privacy and cost savings. You have the ultimate power to bend the software to your will and make it fit your financial life like a glove.

- Custom-Tailored Features: You can tweak the code, connect it to other tools with APIs, or just pick a solution with niche features that big companies would never bother building.

- Your Data, Forever: Your financial history belongs to you, period. You’ll never have to worry about a service shutting down and taking years of your data with it.

- No Surprise Updates: You decide when—or if—to update. You won’t log in one day to a completely new interface you hate or find that your favorite feature has vanished.

By learning some of the fundamentals, you can host most things yourself. Not because you need to, but because you want to, and the feeling of using your own services just gives you pleasure.

This feeling of “tech independence” is incredibly empowering. You stop being just another user and become the builder of your own financial system. It’s a satisfying process that sharpens your tech skills while strengthening your connection to your money.

The Responsibilities You Take On #

Now for the other side of the scale: the trade-offs. With great power comes great responsibility, and self-hosting is no exception. These aren’t necessarily deal-breakers, but they are jobs you have to own to keep your system running smoothly and securely. The biggest hurdle is the initial setup.

While tools like Docker have made things much easier, getting a self-hosted finance manager up and running still takes some effort. You’ll need to work through the documentation, get your server configured, and make sure it’s all working as expected. For a tech hobbyist, this is a fun weekend project. For a total beginner, it might feel a little intimidating at first.

Once you’re set up, you become the system administrator for your own financial data. This boils down to two critical, non-negotiable tasks.

- Consistent Backups: The safety of your data is now 100% on you. You need to set up a rock-solid, automated backup system. A hard drive failure is a fact of life, but losing your entire financial history is a disaster you can and must prevent.

- Regular Maintenance: Think of software updates as your digital deadbolts and window locks. They are your first line of defense against security threats. You have to get into a simple rhythm of checking for and applying updates to keep your financial fortress safe.

For a busy family, this might be a “set it and forget it” backup to a separate network drive. For a solo user, it could be a monthly calendar alert to run a few commands. The important part is acknowledging that this hands-on maintenance is the price of admission for total ownership. Seeing both sides clearly helps you make a smart choice that lines up with your skills, your free time, and your desire for true financial independence.

Is a Self-Hosted Finance Manager Right for You? #

Deciding to self-host your financial software is less of a technical choice and more of a personal one. It’s definitely not for everyone, so let’s walk through the kinds of people who get the most out of taking the reins of their financial data. Do you see a bit of yourself in these descriptions?

Thinking through these profiles can help you figure out if your own priorities line up with the self-hosting mindset. This isn’t just for tech experts—it’s for anyone who values control, privacy, and flexibility above all else.

Who Thrives with a Self-Hosted Setup? #

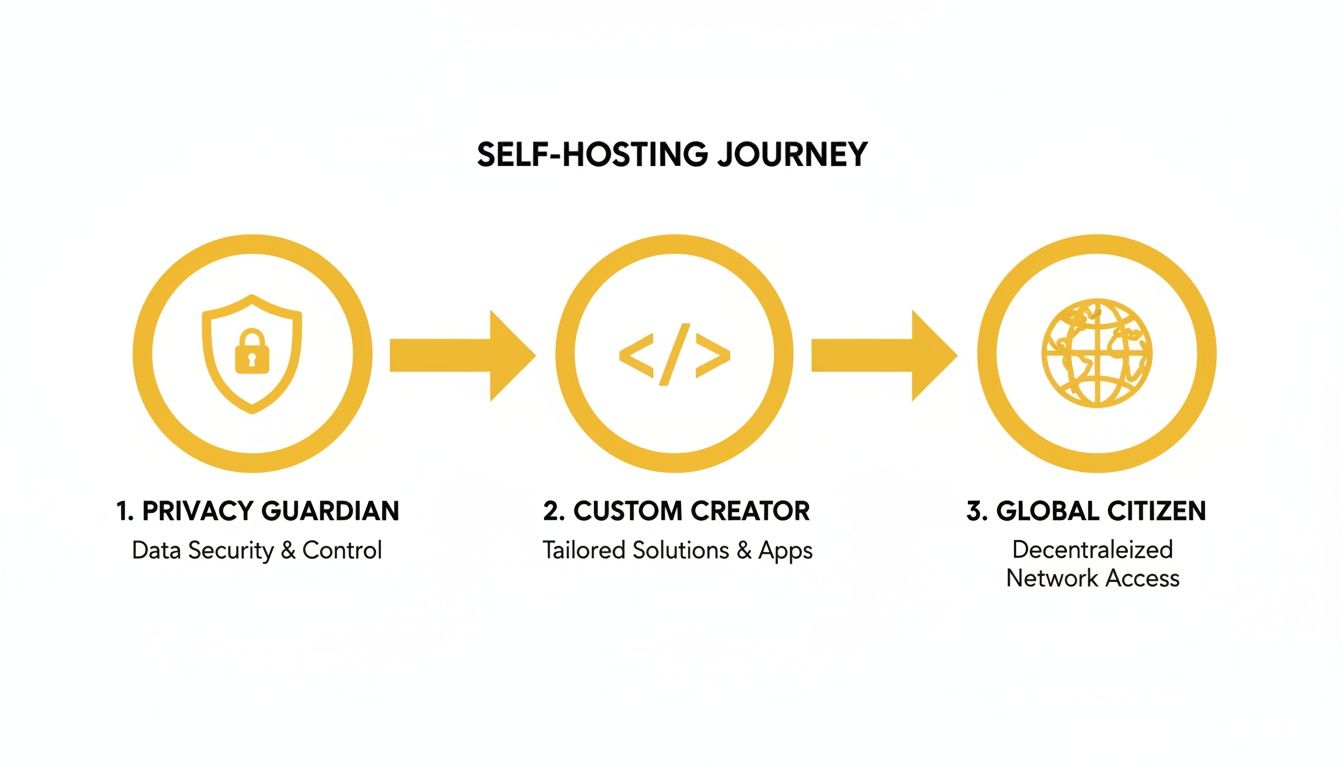

Let’s look at four common personalities who find that a self-hosted system fits them like a glove. Each is driven by a different core motivation, from total privacy to complete customization.

The Privacy Guardian: For this person, data ownership is everything. The thought of their income, spending habits, and net worth sitting on some company’s server is a non-starter. They worry about data breaches, or their information being sold off to the highest bidder. Self-hosting isn’t just a feature for them; it’s a fundamental requirement.

The Customization Creator: This is the tinkerer, the person who loves to make their tools their own. They see a finance manager as a flexible platform, not just a rigid app. They’re the ones who will connect it to other services with an API, write their own scripts to generate unique reports, or tweak the code to build their dream financial dashboard.

This demand for control is making waves. The personal finance software market is expected to grow from USD 1.48 billion in 2025 to USD 2.39 billion by 2033. While cloud tools still lead, self-hosting is no longer a tiny niche. It now attracts 22% of users who prioritize security, a significant jump from just 12% in 2020. A recent Deloitte survey even noted that 76% of small businesses achieve better data isolation with on-premise solutions—a feeling many individuals share. You can explore more about the personal finance software market trends here.

More Reasons to Take Control #

Beyond pure privacy and tech tinkering, a couple of other profiles find self-hosting indispensable. Their reasons are born from practical, real-world needs that mainstream apps often overlook.

The Global Citizen: This person’s financial life isn’t confined to one country. They might be an expat, a digital nomad paid in crypto, or just someone who travels constantly. They need a tool that can juggle multiple currencies seamlessly, without the clunky interfaces or hidden fees found in most commercial software. A self-hosted manager gives them the power to tame that financial complexity.

The Deliberate Budgeter: For this user, financial clarity comes from being hands-on. They actively avoid automatic bank feeds because manually entering each transaction helps them connect with their spending. That small moment of friction forces them to pause and ask, “Where is my money really going?” It turns budgeting from a passive report into a mindful, intentional practice.

If you’re the kind of person who gets genuine satisfaction from building and maintaining your own systems, self-hosting can be an incredibly rewarding project. There’s just something special about using a service you built yourself.

So, if any of these sound like you—the privacy advocate, the tinkerer, the world traveler, or the mindful spender—then a self-hosted finance manager is probably a fantastic fit. It’s about choosing a tool that aligns with your financial journey and your core values.

Your Essential Self-Hosting Deployment Checklist #

Jumping into self-hosting is a huge step toward taking full control of your financial data. It’s an exciting move that turns you from just a user into the architect of your own secure financial world. Think of this checklist less like a rigid technical manual and more like a friendly guide to getting your setup right.

We’ll walk through the process in clear, manageable stages. From picking the right hardware to layering on essential security, each step builds on the last. The aim here is to build something that’s not just powerful, but also stable and easy to look after for years to come.

This visual captures the journey perfectly, showing how you’ll grow into different roles: the Privacy Guardian, the Custom Creator, and finally, the Global Citizen.

As you can see, mastering one stage sets you up for the next, leading you toward a financial system that’s truly yours.

Choosing Your Hardware Foundation #

First things first: you need to decide where your finance application is going to live. This is the physical home for your data, and you’ve got a few great options. The best one for you really boils down to your budget, technical comfort, and how you want to access your finances.

- A Dedicated Low-Power Device: Something small like a Raspberry Pi is a fan favorite for good reason. It’s cheap to buy, sips electricity, and has more than enough juice to run a finance app for your whole household. It’s the perfect little “set it and forget it” home server.

- An Old Computer: Got an old laptop or desktop collecting dust? Give it a new purpose! This is an awesome, zero-cost way to get started, as long as you’re okay with leaving it running 24/7.

- A Virtual Private Server (VPS): For about $5-$7 a month, you can rent a small server from a provider like DigitalOcean or Hetzner. This gets you a public-facing server managed by pros, which can make setting up remote access much simpler.

Simplifying Installation with Docker #

Once your hardware is sorted, it’s time to install the software. This used to be a real headache, filled with dependency issues and manual configuration. Thankfully, Docker has completely changed the game, making it incredibly easy for almost anyone.

Think of Docker like a standardized shipping container for an application.

The developers package everything—the app, the database, all the little bits it needs to run—into a neat, self-contained box called an “image.” All you have to do is run a couple of simple commands to download that box and start it up on your server.

This approach means no more worrying about software conflicts or painful setup steps. It keeps the application isolated, which makes it more secure and way easier to manage, update, and back up down the road.

For a deeper look at the specific commands and setups, head over to our detailed guide on setting up your own self-hosted environment.

Implementing Non-Negotiable Security #

Alright, your application is up and running. Now for the most important part: locking it down. Security isn’t just an afterthought; it’s the bedrock of a system you can actually trust with your financial life. When you’re managing your own setup, a few key practices are absolutely essential.

The table below outlines the core security measures you should put in place. These aren’t just suggestions—they are fundamental to protecting your sensitive data from both external threats and simple accidents.

| Security Measure | Why It’s Critical | Implementation Focus |

|---|---|---|

| Automated Backups | Protects against hardware failure, data corruption, or accidental deletion. Your data’s safety is now entirely your responsibility. | Set up a daily automated script to back up data to a separate location (e.g., another drive, NAS, or secure cloud storage). |

| HTTPS Encryption (TLS/SSL) | Scrambles data between your browser and server, making it unreadable to anyone trying to intercept it. Mandatory for remote access. | Use a free service like Let’s Encrypt and a reverse proxy like Nginx Proxy Manager to easily enable HTTPS. |

| A Simple Update Routine | Patches security vulnerabilities discovered in the software. Running outdated software is a major security risk. | Check for updates at least once a month. With Docker, this is often as simple as pulling the latest image and restarting the container. |

Nailing these three pillars—backups, encryption, and updates—ensures that your self-hosted system is not just functional but genuinely secure. It’s the peace of mind you need when taking ownership of your financial data.

Okay, you’ve got the basics of self-hosting down. But knowing why you want to do it is one thing; finding the right tool to make it happen is another. That’s where Econumo comes in.

We built Econumo to be the self-hosted finance manager we always wanted—powerful enough for nerds like us, but simple enough for anyone to use. It’s designed to bridge that gap between the technical freedom of self-hosting and the smooth, intuitive experience you expect from modern software.

Econumo is our answer to the problems we’ve talked about. It gives you a secure, private home for your financial data where you’re in complete control. And to make sure everyone can achieve financial sovereignty, our free community edition comes packed with all the core features you need to get started.

Made for How Real People Manage Money #

Let’s be honest: money is rarely a one-person show, especially when you have a partner or family. Econumo was built from the ground up for collaboration. Its native multi-user support makes it incredibly easy for you and your partner to share a single, unified view of your finances.

You can finally manage those joint accounts without stepping on each other’s toes, track shared vacation expenses, or build a savings plan together. It’s all seamless and secure. By enabling shared access, you can both log transactions and check on budgets from your own devices, keeping everyone in the loop. You can learn exactly how to set this up in our guide to family and shared financial access.

A Closer Look at Econumo’s Features #

- Multi-User & Shared Access: Designed for couples and families who need to plan their financial lives together.

- Multi-Currency Support: A must-have for frequent travelers, expats, or anyone dealing with money in more than one currency. Manage it all effortlessly.

- Clean, Responsive Interface: A polished, premium experience whether you’re on a big desktop screen or checking things on your phone.

- Powerful API Access: For those who like to tinker, our API lets you build custom integrations, automate workflows, and create your own financial dashboards.

This shift toward self-hosted tools isn’t happening in a vacuum. The personal finance software market is expected to hit USD 2.1 billion by 2034, but more importantly, a huge chunk of users are demanding more control. With 67% of consumers saying they value data privacy over convenience, solutions like Econumo are becoming essential. You can discover more insights on the personal finance market’s growth.

Econumo is more than just a list of features—it’s a philosophy. It’s about giving you the tools to build a private, collaborative financial command center that is 100% yours.

Ready to see for yourself? Feel free to play around with our live demo to get a feel for the platform. When you’re ready to take the reins, our self-hosting documentation gives you a clear, step-by-step guide to get your own instance running smoothly. It’s time to stop renting your financial data and start owning it.

Frequently Asked Questions #

Stepping into the world of a self-hosted finance manager can feel like a big move. It’s totally normal to have questions about the setup, the costs, and what it’s really like day-to-day. We’ve pulled together the most common questions we hear to give you clear, straight-up answers so you can decide with confidence.

Think of this as your guide to demystifying the technical stuff. We want you to focus on the real prize: taking full ownership of your financial life.

Is It Difficult to Set Up a Self-Hosted Finance Manager? #

Honestly, while it takes more effort than just signing up for a cloud service, modern tools have made it surprisingly doable. The phrase “setting up a server” sounds way more intimidating than the reality often is.

Tools like Docker have been a complete game-changer here. It packages all the software and its dependencies into a neat little box called a container. This means you can often get everything running with a few simple commands instead of wrestling with complex manual installations. It takes the guesswork out of the equation.

If you’ve ever tinkered with a Raspberry Pi, set up a personal blog, or even just followed a detailed online tutorial for a project, you’ve probably got the skills you need. For a total beginner, it might take a dedicated afternoon and a good guide, but the reward is a lifetime of owning your financial data.

How Much Does It Cost to Self-Host a Finance App? #

This is one of the best parts—the cost can be as low as zero. A lot of people get started using hardware they already have, which means the only investment is a little bit of their time.

Here’s a quick breakdown of what to expect:

- Using Existing Hardware: Got an old computer or a Raspberry Pi gathering dust? If you can leave it running, your only real cost is the tiny bit of electricity it uses. This is the perfect way to start without spending a dime.

- A Basic Virtual Private Server (VPS): For a more serious, always-on setup, renting a small VPS from a provider like DigitalOcean or Hetzner is a great option. You can find reliable plans for around $5 to $7 per month.

When you stack that against the premium plans of cloud-based finance apps—which can easily hit $10 to $15 per month—self-hosting often comes out cheaper. For that small monthly fee, you get complete privacy, no feature restrictions, and you can add your whole family without paying extra per person.

The real win isn’t just saving a few bucks a month. It’s the freedom from being locked into a company’s ecosystem. You’re investing in a system you own, not just renting access to one.

This independence means you’re safe from sudden price hikes, feature changes, or the service you depend on shutting down entirely.

What Happens If I Forget to Update My Software? #

This is probably the single most important responsibility that comes with managing your own finance app. Updates aren’t just for shiny new features; they deliver critical security patches that protect you from newly discovered threats.

Running outdated software is like leaving a window wide open in your house—it’s an unnecessary risk. Automated bots are constantly scanning the internet for servers with known security holes. Forgetting to update could leave your financial data exposed.

The best approach is to build a simple, repeatable maintenance routine.

- Set a Calendar Reminder: Seriously, just create a recurring event for the first Saturday of the month to “Check for Software Updates.”

- Keep It Simple: With a Docker setup, updating is usually as easy as running two or three commands in the terminal.

- Check for News: Before you update, take 30 seconds to check the project’s official blog or forum for any major announcements.

A few minutes of proactive care each month is a tiny price to pay for securing your entire financial history. It’s the core discipline that makes self-hosting both safe and sustainable.

Can I Access My Finances From My Phone? #

Absolutely. It’s a common myth that self-hosting chains you to your desktop. Modern self-hosted finance managers are built as web applications with responsive designs, meaning they look and work great on any device.

The application’s layout automatically adjusts to fit whatever screen you’re using, whether it’s a big monitor, a tablet, or your smartphone. You get a clean, consistent experience everywhere.

Once you’ve configured your server for secure remote access (using HTTPS), you can safely log into your financial dashboard from anywhere in the world. This gives you the same on-the-go convenience as a native mobile app without having to download anything. You can log an expense while you’re out, check your budget before a big purchase, or review your savings goals on your lunch break. It’s the best of both worlds: total data ownership and modern accessibility.

Ready to take control of your financial story? Econumo is a powerful, privacy-first platform built for individuals and families just like you. Get started by self-hosting our free community edition or explore our features with the live demo. Your journey to financial independence starts today.