Before you can start stashing cash away, the first step in your home-buying journey begins with a question: what does “home” actually look like for you? A vague idea of a “nice house in a good neighborhood” won’t cut it. To build a savings plan that actually works, you need a crystal-clear vision you can slap a price tag on.

What’s Your Target? Defining Your Homeownership Goal #

This is where you move from daydreaming to doing. Start thinking about your life, not just today, but five or ten years from now. Are you picturing a starter condo downtown, a sprawling suburban house with a yard for the kids, or maybe a quiet spot in the country? Each of those dreams comes with a wildly different cost.

Zeroing In On Your Ideal Location #

Nothing impacts a home’s price more than its location. Pinpoint a few neighborhoods or towns that feel right for your lifestyle.

Think about the practical stuff:

- Commute: How much of your day are you willing to spend getting to work?

- Schools: If you have kids (or plan to), the quality of the local schools is a huge factor.

- Amenities: What do you need close by? Parks, grocery stores, your favorite coffee shop?

- Property Taxes: These can vary dramatically even between neighboring towns and will affect your monthly budget for years to come.

Once you have a few places in mind, hit the real estate sites. Look at what homes that fit your criteria are actually selling for. This isn’t just window shopping—it’s market research. You might find that a three-bedroom in one town costs $550,000, while a nearly identical house one town over is priced at $475,000. That $75,000 gap is a game-changer for your savings plan.

Understanding the Modern Savings Timeline #

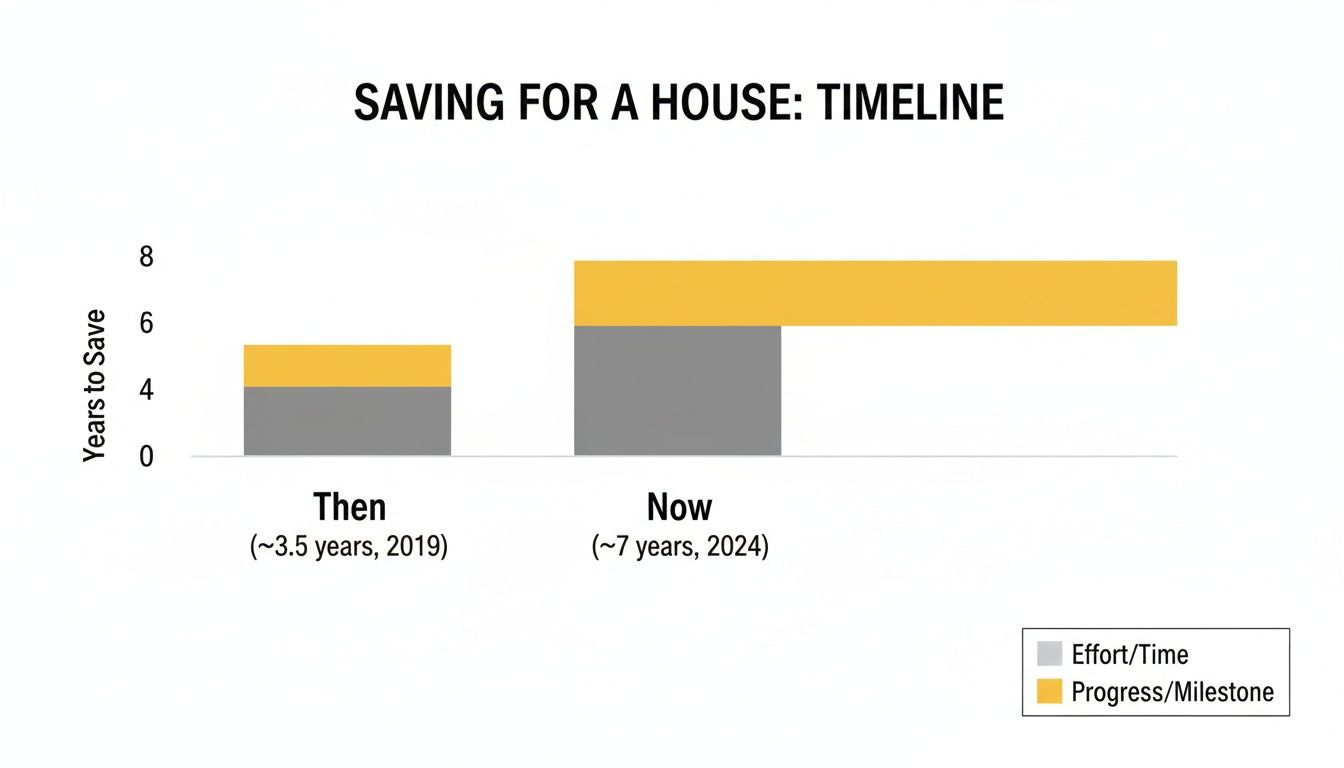

Let’s be real: setting a clear goal is more critical now than ever. Saving for a down payment has become a marathon. The typical U.S. household now needs about seven years to save up, with the median down payment soaring to $30,400—a jump of nearly 118% from $13,900 in 2019. This is largely because home prices themselves have swelled by almost 45% in that same timeframe. You can get the full picture on the current savings timeline from HousingWire to see what you’re up against.

This isn’t meant to scare you. It’s meant to empower you. Knowing the real-world numbers is what makes a specific, well-researched goal so vital. It lets you work backward and build a plan that’s ambitious but actually achievable.

A well-defined goal transforms a wish into a project. It gives you a finish line to run toward, making it easier to stay motivated when you have to say ’no’ to a spontaneous vacation or an expensive dinner out.

Turning Your Vision Into a Number #

After all that research, you should have a solid price range. Now, pick a number to anchor your plan. Let’s say the homes you like are consistently selling for around $420,000.

That figure—$420,000—is your new North Star. It’s the number you’ll use to calculate everything else, from your down payment target to estimated closing costs.

Having a concrete goal makes the whole process feel real. You’re no longer just “saving for a house.” You are now “saving for a $420,000 house in Northwood.” That kind of clarity is what will keep you going for the long haul.

Calculating Your True Savings Target #

That sticker price on a real estate listing? It’s just the starting line. To get a real handle on how much you need to save for a house, you have to look beyond the sale price and figure out the total cash you’ll actually need on closing day. This comes down to two big numbers: your down payment and the closing costs that often catch people by surprise.

Your down payment is simply the chunk of the home’s price you pay upfront. How much you need depends on the type of loan you get and your own financial strategy. Some government-backed loans, like FHA loans, have low minimums around 3.5%, but aiming higher can pay off big time.

The magic number you often hear is 20%. Hitting that 20% down payment mark is a huge milestone because it means you get to dodge Private Mortgage Insurance (PMI). PMI is an extra monthly fee lenders tack on to protect themselves when you have less equity, and avoiding it can literally save you hundreds of dollars every single month.

Understanding Down Payment Realities #

In today’s market, having a solid down payment is more important than ever. Buyers are bringing more cash to the table, with recent data showing the average down payment has climbed to 14.4% of the purchase price. The median amount now sits at a hefty $30,400—more than double what it was back in 2019. This really highlights how competitive things have gotten. You can dig into the specifics in this down payment report from Realtor.com to see how the trends look in different areas.

This next chart really drives home how much longer it’s taking people to save up.

As you can see, the timeline to save for a home has nearly doubled. That makes setting a clear, accurate savings goal from the very beginning absolutely critical.

The Hidden Costs of Buying a Home #

Okay, so you have your down payment figured out. But that’s not the end of the story. You also need to budget for a bundle of fees called closing costs. These are all the expenses that go into finalizing your mortgage and closing the deal.

Think of closing costs as the administrative bill for the whole transaction. They usually run between 2% and 5% of the loan amount, which can easily tack on thousands of extra dollars. On a $400,000 home, you could be looking at an additional $8,000 to $20,000.

Forgetting to budget for closing costs is one of the most common mistakes first-time homebuyers make. It creates a last-minute scramble for cash and can jeopardize the entire purchase.

So what are you actually paying for? The list can feel long, but here are some of the usual suspects:

- Lender Fees: This covers the bank’s work to create and process your loan, including application and origination fees.

- Appraisal Fee: A third-party appraiser has to confirm the home’s market value. This is to make sure the lender isn’t lending more than the property is actually worth.

- Title Insurance: This is a crucial protection for both you and the lender against any future ownership claims on the property.

- Home Inspection: While sometimes optional, I always recommend a thorough inspection. It’s your best shot at finding potential problems before you’re locked in.

- Prepaid Expenses: You’ll often have to pay for things like your first year of property taxes and homeowner’s insurance upfront.

Getting a realistic estimate of these expenses is a non-negotiable part of your savings plan. For more help on this, check out our guide on how to track your income and expenses effectively.

Putting It All Together in a Practical Example #

Let’s make this real. Here’s an estimated breakdown for a hypothetical $400,000 home purchase to show you how these numbers add up. In this scenario, you’re aiming for a 15% down payment to be competitive without completely draining your savings.

Sample Home Purchase Cost Breakdown #

| Cost Category | Estimated Percentage | Estimated Cost | Notes |

|---|---|---|---|

| Home Price | 100% | $400,000 | The agreed-upon purchase price. |

| Down Payment | 15% | $60,000 | The initial amount you pay upfront. |

| Closing Costs | 3% | $12,000 | Covers fees like appraisal, title, and lender charges. |

| Total Cash Needed | - | $72,000 | This is your true savings target. |

See the difference? Your actual savings goal isn’t just the $60,000 down payment. You’d really need $72,000 in cash to get the keys to your new home. Knowing this complete figure from the start is the key to creating a realistic plan and avoiding any last-minute panic.

Building Your House Savings Plan #

Okay, you’ve got your target number. Now comes the fun part: building the machine that gets you there. A generic budget isn’t going to cut it for a goal this big. We need a dedicated plan of attack, which means actively steering your money toward your future front door.

The most powerful strategy I’ve seen is also the simplest: pay yourself first. Before the bills, before groceries, before you even think about that weekend trip, a chunk of your paycheck goes straight into your house fund. Treat it like a non-negotiable bill, just like rent. It’s a fundamental mindset shift.

Set up an automatic transfer for the day after you get paid. This takes willpower completely out of the equation. The money is gone before you even have a chance to miss it or talk yourself into spending it.

Find Where Your Money is Hiding #

To make the “pay yourself first” method stick, you have to know exactly how much you can realistically set aside. This calls for an honest look at where your money is going right now. I can’t tell you how many people I’ve worked with who are shocked to discover their “spending leaks”—those small, frequent purchases that quietly drain hundreds from their account.

We’re talking about things like:

- That daily coffee habit: $5/day is $150/month.

- All those streaming subscriptions you forgot about: easily $45/month.

- Ordering takeout a few too many times: $200/month (or more).

Just by plugging these three common leaks, you could free up $395 every single month. That’s an extra $4,740 a year going straight into your house fund. If you want a more detailed process for finding your number, our guide on how much to save per paycheck is a great place to start.

Your budget isn’t a financial straitjacket. It’s a tool that gives you permission to spend money on the things that truly matter to you, and right now, that’s your future home.

Once you see where the money is going, you can start making conscious choices. It’s not about cutting out all the fun, but about aligning your daily spending with that long-term dream of owning a home.

Choose the Right Place to Stash Your Cash #

Where you keep your down payment savings is almost as important as how much you’re saving. Your everyday checking account is the worst place for it—it’s far too easy to spend, and it earns you basically nothing.

The goal here is a balancing act: you need to keep your money safe from market swings but still have it earn a little something to keep up with inflation. Since you’ll need this cash in the next few years, high-risk investments are definitely off the table.

Here are the best low-risk spots for your house fund:

| Account Type | Best For | Potential Return | Key Feature |

|---|---|---|---|

| High-Yield Savings Account | Most savers looking for safety and a solid interest rate. | Moderate | FDIC-insured and offers a much higher APY than a typical savings account. |

| Money Market Account | Savers who want easy access via checks or a debit card. | Moderate | Blends features of both savings and checking accounts. |

| Short-Term Certificate of Deposit (CD) | Those who won’t need a chunk of their funds for a fixed time. | Slightly Higher | You get a fixed interest rate for a specific term (like 12 months). |

For most people saving for a down payment, a High-Yield Savings Account (HYSA) is the clear winner. Your money is FDIC-insured up to $250,000, so it’s completely safe. But the real benefit is the interest rate, which can be 10-20 times higher than what you’d get at a traditional bank. This lets your money work for you, helping you reach your goal a little faster.

Whatever you choose, open a completely separate account just for this goal. Nickname it “Future Home” or “Down Payment Fund.” It’s a small psychological trick, but it constantly reminds you what that money is for, making you far less likely to raid it for something else.

Putting Your Savings Plan on the Fast Track #

Watching your house fund grow can sometimes feel like watching paint dry, especially if homeownership is still a few years away. If you want to pick up the pace, the most effective strategy is a one-two punch: bring more money in while simultaneously getting rid of high-interest debt. This combination is, without a doubt, the fastest way to charge up your savings.

Don’t immediately assume you need a second job to boost your income. Start right where you are. Is it time for a raise? Do some research on what your role and experience are worth in the current market, build a strong case for your value, and schedule that conversation with your boss. Even a modest 5% raise on a $60,000 salary puts an extra $250 in your pocket every month—money that can go straight into your house fund.

Smart Ways to Earn More on the Side #

Beyond your day job, a side hustle can make a serious dent in your savings goal. The trick is to find something that fits your life and skills without burning you out.

Here are a few ideas to get you started:

- Freelance Your Craft: If you’re a writer, designer, or developer, platforms like Upwork can connect you with paying projects.

- Monetize a Hobby: Love photography, baking, or crafting? You could turn that passion into a small weekend business.

- Join the Gig Economy: Apps like TaskRabbit let you earn cash by helping people with everyday tasks, from assembling IKEA furniture to running errands.

This hustle is a real-world response to today’s housing market. With typical monthly payments soaring to $2,807, many aspiring homeowners are getting creative. A recent report found that 30% of Gen Z buyers used income from an extra job to fund their down payment. It’s a clear sign of the determination people are showing to overcome high prices and mortgage rates, a trend detailed in these homebuyer trends from World Property Journal.

Why Paying Down Debt Is a Power Move #

At the same time you’re working to earn more, you need a plan for any existing debt. High-interest debt, especially from credit cards, is like an anchor dragging on your savings goals. Every dollar you pay in interest is a dollar that could have gone toward your down payment.

But there’s another crucial reason. Lenders look very closely at your debt-to-income (DTI) ratio, which is just your total monthly debt payments divided by your gross monthly income. A high DTI can shrink your loan options or even get your application denied. By paying down your debts, you lower that ratio and make yourself a much stronger candidate for a mortgage.

Think of every dollar you pay toward high-interest debt as an investment in your home-buying power. It not only frees up future cash flow but also makes you a more attractive applicant to lenders.

Choose Your Debt Payoff Strategy #

There are two well-known methods for systematically getting rid of debt. The best one for you really comes down to your personality: are you motivated by saving money or by scoring quick wins?

The Debt Avalanche: This method is for the number crunchers. You focus on paying off the debt with the highest interest rate first, making minimum payments on everything else. Once that first debt is gone, you roll its payment amount over to the debt with the next-highest interest rate. It’s the most efficient way to pay less interest over the long haul.

The Debt Snowball: This strategy is all about momentum. You list your debts from the smallest balance to the largest, ignoring interest rates. You attack the smallest debt with everything you’ve got. Once it’s paid off, you get a huge psychological boost and roll that payment into the next-smallest debt. Those quick wins can keep you motivated to see the plan through.

Deciding how to balance debt repayment and saving for your house is a personal call. Some people go all-in on saving, pausing extra debt payments temporarily. Others prefer a 50/50 split, sending extra cash to both goals. There’s no single right answer—the best approach is the one you can stick with consistently.

Getting on the Same Page: Saving as a Couple or Expat #

Saving for a house is a big enough climb on your own. But when you bring a partner into the picture—or start juggling international currencies—the complexity can feel like it doubles overnight. A shared goal demands a shared game plan, whether you’re syncing up with a spouse or converting foreign income.

For couples, the road to owning a home is as much about communication as it is about dollars and cents. You absolutely have to be on the same page about your goals, your timeline, and—most importantly—how you both view money. If one person is a super-saver and the other is a spender, those misaligned expectations will create friction and stall your progress.

These money talks aren’t always easy, but they are completely non-negotiable. You need total transparency about income, existing debts, and personal spending habits before you can even begin to build a unified savings strategy.

Aligning Your Financial Goals as Partners #

The first real step is a mental shift from “my money” and “your money” to “our goal.” This doesn’t mean you have to merge every single bank account tomorrow. It simply means creating a joint vision for where your money is headed.

A fantastic way to do this is by opening a dedicated joint savings account. Give it a nickname like “Future Home Fund.” This simple act creates a central hub for your efforts and makes it easy (and exciting!) to watch your progress together.

Make “money dates” a regular thing. Seriously, put them on the calendar. Use that time each month to look over your budget, celebrate the savings milestones you’ve hit, and tweak the plan if needed. This keeps small financial misunderstandings from snowballing into major roadblocks.

To get the conversation started, try tackling these points:

- Risk Tolerance: How do you both feel about your down payment money? Should it sit in an ultra-safe savings account or are you comfortable with short-term investments that could grow faster but carry some risk?

- Lifestyle Sacrifices: What are you both actually willing to cut back on? Agreeing on this upfront—whether it’s dining out, vacations, or shopping—prevents a lot of resentment down the line.

- Financial Roles: Who’s going to take the lead on tracking the budget? How will you decide to split contributions to the house fund?

These conversations are the foundation of a strong financial partnership. For more in-depth advice, our guide on how to budget as a couple walks you through practical strategies for combining your financial lives.

Managing Finances Across Different Currencies #

For expats or anyone earning income in another country, the challenge of saving for a house gets an extra layer of complexity. Juggling multiple currencies means you’re now dealing with fluctuating exchange rates, international transfer fees, and the headache of piecing together your financial picture from different countries.

Ignoring exchange rates is a rookie mistake that can be incredibly costly. A seemingly small dip in a currency’s value can wipe thousands of dollars off your savings. It’s crucial to use a transfer service with transparent fees and competitive rates.

When you’re dealing with multiple currencies, your net worth is a moving target. The only way to know where you truly stand is to regularly update your financial picture using a single, consistent base currency.

Practical Tips for Global Savers #

To keep your international savings plan from becoming a chaotic mess, you need a system.

Start by picking one primary currency for all your tracking—this should almost always be the currency of the country where you plan to buy. Then, at least once a month, convert all your foreign assets and savings to that currency on paper. This gives you a clean, consolidated snapshot of your progress.

Here are a few more strategies to stay on top of things:

- Automate Your Conversions: Use a financial app that handles multiple currencies to automatically track your global assets. This saves a ton of time and cuts down on the chance of manual error.

- Time Your Transfers Wisely: Keep an eye on exchange rate trends. If you aren’t in a huge rush, you might be able to time your larger transfers to take advantage of more favorable rates, stretching your money further.

- Consolidate Where It Makes Sense: While it might seem easier to leave money scattered, consolidating into fewer accounts can simplify tracking and cut down on bank fees. Just be sure to look into any tax implications in the countries involved first.

Whether you’re getting in sync with a partner or juggling global finances, the solution is the same: a clear, unified plan. Open communication and the right tools are what will ultimately turn that dream of homeownership into a reality.

Common Questions About Saving for a House #

Even with the best-laid plans, buying a house is a journey filled with questions. It’s a massive financial step, and it’s completely normal to feel a bit unsure about some of the details. Let’s tackle some of the most common questions that come up once you decide to save for a house.

How Much House Can I Realistically Afford? #

This is the big one, and the answer goes way beyond the sticker price of a home. Lenders will look at your entire financial life, but they zoom in on two things: your debt-to-income (DTI) ratio and your credit score.

A great rule of thumb to start with is the 28/36 rule.

It’s a classic guideline for a reason. It suggests that your total housing costs—think mortgage payment, property taxes, and insurance—shouldn’t be more than 28% of your gross monthly income. On top of that, your total monthly debt payments (including that new house payment, plus car loans, student loans, and credit cards) should stay under 36% of your gross monthly income.

Let’s say your household brings in $8,000 a month before taxes. Following this rule, your all-in housing payment should ideally be under $2,240 (28% of $8,000). And your total debt, housing included, should stay below $2,880 (36% of $8,000).

Now, some lenders might approve you for more, but sticking close to these numbers is a smart move. It’s the best way to make sure you don’t end up “house poor,” with a beautiful home but no cash left to actually enjoy life.

What Credit Score Do I Need to Buy a House? #

Think of your credit score as your financial report card. A higher score unlocks better mortgage rates, which can save you tens of thousands of dollars over the life of your loan. You don’t need a perfect score, but a strong one makes your mission to save for a house a whole lot easier.

Here’s a quick breakdown of what lenders are generally looking for:

- 740 and above: This is the gold standard. You’ll get the pick of the litter when it comes to the best interest rates and loan terms.

- 670 to 739: You’re in good shape. You should still qualify for competitive rates and have plenty of great loan options.

- 580 to 669: This is often the starting line for many conventional loans. FHA loans are a popular option in this range, but you might be looking at higher interest rates.

If your score isn’t where you want it to be, don’t panic. Just focus on the fundamentals while you’re saving: pay every bill on time, work on paying down credit card balances, and try to avoid taking on any new debt.

Can I Use Retirement Funds for a Down Payment? #

The short answer is yes, but you really need to think this one through. It comes with some serious strings attached.

For first-time homebuyers, it’s often possible to withdraw up to $10,000 from a traditional IRA for a down payment and dodge the usual 10% early withdrawal penalty. However, you’ll still have to pay income tax on that money. Some 401(k) plans also let you take out a loan against your balance, but you have to pay it back, with interest.

While pulling from your retirement can feel like a tempting shortcut, it’s a risky strategy. You’re effectively stealing from your future self and losing out on decades of compound growth that’s almost impossible to get back. Honestly, this should be a last-resort option after all other savings avenues have been explored.

How Long Should I Plan to Save? #

There’s no magic number here—the timeline is deeply personal. It all comes down to your income, how aggressively you can save, and the realities of your local housing market. As we mentioned earlier, the national average has stretched out to around seven years.

To get a handle on your own timeline, you just need to do some simple math. First, figure out your total savings goal (down payment + closing costs). Then, be honest about how much you can set aside each month.

Let’s run the numbers on an example:

- Your Savings Target: $72,000

- Your Monthly Savings: $850

- Your Timeline: $72,000 / $850 = 84.7 months, which is just over 7 years.

Seeing that number in black and white can be incredibly motivating. If it feels too long, you know exactly what you need to do: find ways to boost your income or cut back on expenses to accelerate your savings.

Juggling all these moving parts—from tracking goals to getting on the same page with a partner—can feel like a lot. With Econumo, you can create dedicated savings goals, manage joint accounts with your partner, and get a clear, consolidated view of your financial progress, even across multiple currencies. Take control of your home-buying journey by trying the live demo or joining the waitlist at https://econumo.com.