Think of financial principles not as rigid rules from a textbook, but as a reliable compass for navigating your family’s money journey. These are the core ideas that help you make smart, confident decisions about everything from daily spending to long-term goals. They cover concepts like the time value of money, risk and return, diversification, and much more.

Exploring the Core Principles of Finance for Families #

In this guide, we’ll break down ten fundamental finance principles and translate them into practical, everyday steps you can take right now. Each concept builds on the last, giving you a clear path toward mastering your household finances.

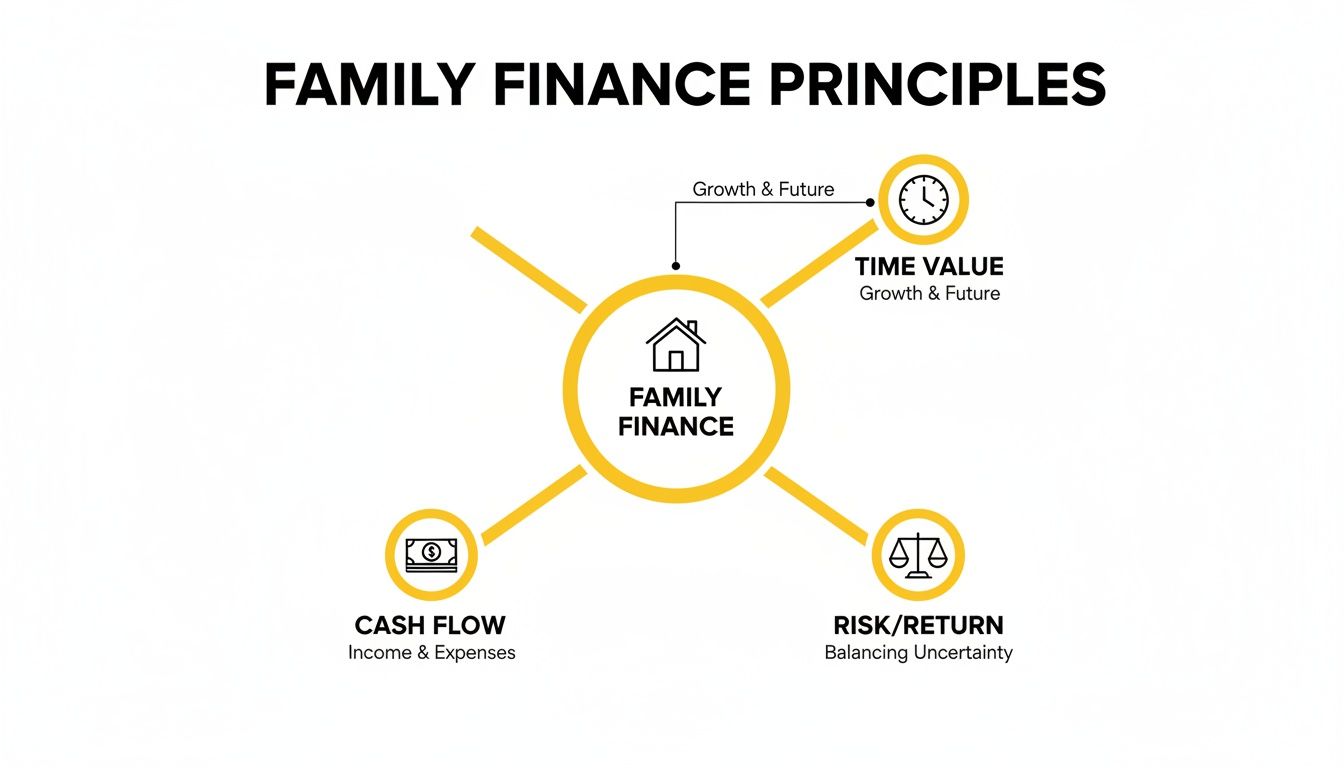

It really boils down to a few key ideas:

- The Time Value of Money explains why the money you have today is more powerful than the same amount in the future.

- Risk and Return is the classic balancing act between aiming for growth and protecting what you have.

- Cash Flow is simply about understanding the money coming in and going out of your household.

These three concepts are the foundation of solid family financial planning, as you can see below.

The best financial plans are the ones that weave these principles into your daily habits and decisions.

The 10 Core Finance Principles at a Glance #

To give you a quick overview, here’s a table that summarizes the ten key principles we’ll be exploring. Think of it as your cheat sheet for connecting these big ideas to your own family’s financial life.

| Principle | Core Idea | Practical Application for Families |

|---|---|---|

| 1. Time Value of Money | Money available now can earn interest and grow. | Start a “pay yourself first” habit by setting up automatic monthly transfers to savings. |

| 2. Risk and Return | To get a potentially higher return, you have to accept greater risk. | Create a balanced investment portfolio with a mix of safer bonds and growth-oriented stocks. |

| 3. Diversification | “Don’t put all your eggs in one basket.” | Spread your money across different asset types, like savings accounts, stocks, and real estate. |

| 4. Liquidity | You need quick and easy access to cash for emergencies. | Build and maintain an emergency fund that covers 3–6 months of essential living expenses. |

| 5. Leverage | Using borrowed money can magnify both your gains and your losses. | Carefully compare interest rates and terms before taking out a loan for a car or home. |

| 6. Capital Structure | This is the mix of your own money (equity) and borrowed money (debt) you use. | Decide whether to pay for a big home repair with savings or a home equity loan. |

| 7. Cash Flow | It’s all about tracking your income versus your expenses to ensure stability. | Manually log your family’s transactions in an app like Econumo to get a clear picture of where your money goes. |

| 8. Valuation | This means figuring out what an asset or purchase is actually worth. | Do your homework to find the fair market price before buying a major item like a new car. |

| 9. Agency & Moral Hazard | Aligning goals and responsibilities helps avoid financial conflicts of interest. | As a couple, set clear, transparent rules for spending from a joint account. |

| 10. Market Efficiency | Financial markets tend to quickly price in all available information. | Instead of trying to beat the market, consider low-cost index funds for long-term investing. |

Keep this summary handy as you review your budget and savings plans. It’s a great reminder of the “why” behind your financial actions.

Time, Risk, and the Bedrock of Your Finances #

Before we get into the nitty-gritty of budgeting and tracking, we need to talk about two ideas that are at the very heart of finance: the Time Value of Money and the Risk-Return Tradeoff. I know they sound a bit like textbook terms, but they’re actually simple, powerful concepts you already use every day. Grasping them is the key to making smarter decisions, from saving for a new car to planning for retirement.

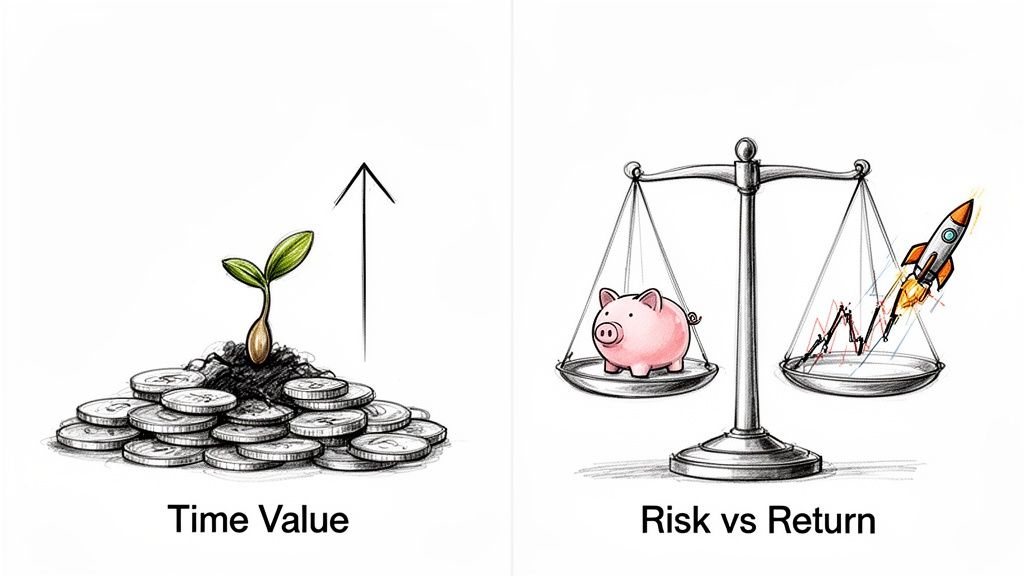

Think of the Time Value of Money (TVM) this way: a dollar in your hand today is worth more than a dollar you’re promised next year. Why? Because you can put today’s dollar to work right now. You can invest it, let it earn interest, and watch it grow. This growth-on-growth is what’s known as compounding.

It’s like planting a tree. A small sapling today is far more valuable than the promise of a sapling next spring. If you plant it now, it has a whole year to grow roots, get stronger, and start producing fruit. Money works the exact same way. This simple truth is why starting to save early, even with tiny amounts, can dramatically change your financial future.

Why Time is Your Most Powerful Financial Asset #

Understanding TVM isn’t just theory; it helps you prioritize what to do with your money. It’s the reason financial experts tell you to pay down high-interest debt aggressively and start saving for retirement as soon as you get your first job.

- The Magic of an Early Start: Someone who starts saving $100 a month at age 25 can easily end up with more money than someone who starts saving $200 a month at age 40. Those extra 15 years of compounding make an enormous difference.

- The Vicious Cycle of Debt: High-interest debt is just TVM working against you. The interest compounds month after month, making that original debt grow bigger and more expensive to pay off.

- Making Smarter Choices: When faced with a decision, like taking a lottery win as a lump sum or in yearly payments, TVM is the tool you use to figure out which option is actually worth more in today’s dollars.

The lesson is crystal clear: time is one of the most valuable assets you have. The sooner you put your money to work, the harder it can work for you.

“The two greatest forces in the universe are compound interest and the human tendency to procrastinate. One of them will work for you, and the other will work against you.”

This really drives home the importance of acting now. When you’re ready to plan your long-term savings, it’s crucial to know all your options. For a deeper dive, check out our guide on retirement accounts to see if you can have an IRA and a 401(k) at the same time.

The Inescapable Dance of Risk and Return #

Going hand-in-hand with time is the Risk-Return Tradeoff. This is one of those fundamental truths in finance: if you want the chance to earn higher returns, you almost always have to accept more risk. There’s no such thing as a free lunch.

Imagine you have two places to put your savings. The first is a government-insured savings account. It’s about as safe as it gets; your money is virtually guaranteed not to disappear. The downside? Its growth will be painfully slow, maybe not even enough to keep up with inflation.

The second option is investing in a promising new tech startup. This is a much riskier bet. The company could go bust, and you could lose every penny. But if it takes off? Your investment could multiply many times over. That’s the tradeoff right there: low risk offers low potential returns, while high risk opens the door to high potential returns.

For couples and families, figuring out this balance is a team sport.

Getting on the Same Page About Risk:

- Have the Talk: Kick things off with an open conversation about how you both feel about financial risk. Is one of you a cautious saver while the other is an optimistic investor? There’s no right or wrong answer.

- Connect Risk to Your Goals: Your comfort with risk should be tied directly to your goals. For short-term goals, like a down payment on a house in two years, you’ll want to stick with low-risk options. But for long-term goals, like a retirement that’s 30 years away, you can afford to take on more risk because your portfolio has plenty of time to recover from any market bumps.

- Find Your “Us” Strategy: You don’t need to have identical risk tolerances. Many couples find a middle ground by creating a blended portfolio. The bulk of your money might go into stable, diversified investments, while a smaller, separate slice is set aside for higher-risk assets that one partner feels more excited about.

Once you truly understand that money today is more powerful than money tomorrow, and that real growth requires taking smart, calculated risks, you’re ready to start making intentional financial decisions that will build a secure future for your family.

Building Financial Resilience Through Your Choices #

While dreaming about long-term growth is the fun part, building a truly strong financial foundation means preparing for life’s inevitable bumps in the road. This is where some core financial principles shift from growing wealth to protecting it. By making smart, resilient choices today, you’re really just creating a safety net that gives your family stability and peace of mind, no matter what happens.

Let’s walk through three key ideas—diversification, liquidity, and leverage—that are absolutely crucial for managing risk and building that kind of financial resilience.

The Power of Diversification #

You’ve heard it a million times: “Don’t put all your eggs in one basket.” That’s diversification in its purest form.

Think of your financial life like a well-balanced diet. You wouldn’t just eat broccoli for every meal; you need a mix of different nutrients to stay healthy. In the same way, your finances need a mix of different assets to weather the market’s natural ups and downs.

Spreading your money across different investments—like stocks, bonds, and real estate—helps cushion the blow if one area takes a hit. This is so important because markets can be incredibly volatile. We’ve seen global equity markets hit near all-time highs after dramatic rebounds, which just goes to show how quickly things can change. This volatility is a powerful reminder not to be too concentrated in one thing, a core lesson for any family trying to build long-term stability. You can get a better sense of these market dynamics in this global market outlook.

Keeping Your Finances Liquid #

Next up is liquidity. It’s a simple concept that just asks: how quickly can you turn an asset into cash without it losing a chunk of its value?

Think of it as your financial first-aid kit. When an emergency strikes—a sudden job loss, an unexpected medical bill—you need cash now, not assets that are tied up for the long term.

Your checking and savings accounts? Highly liquid. Your house, on the other hand, is not; selling property can take months. The goal is to find the right balance for your situation.

A well-stocked emergency fund is the ultimate expression of liquidity. It’s not an investment meant to generate high returns; its job is to be there, ready and waiting, when you need it most.

For families, this usually means building an emergency fund that can cover three to six months of essential living expenses. This cash buffer is what stops you from having to sell investments at the worst possible time or go into debt just to handle a crisis.

Understanding Leverage: The Double-Edged Sword #

Finally, let’s talk about leverage. At its core, leverage simply means using borrowed money to try and increase your potential return on an investment. It’s an incredibly powerful tool that can work for you or against you, which is why it’s one of the most important principles for families to get right.

A mortgage is the classic example of leverage working in your favor. It lets you buy a valuable asset—your home—with only a fraction of its total cost upfront. As your home’s value (hopefully) grows, your return on that initial down payment is magnified.

But leverage has a dark side. High-interest debt, like credit card balances, is leverage working in reverse. The interest payments drain your cash flow and magnify your losses, trapping you in a cycle that’s incredibly hard to break.

A Family’s Guide to Using Leverage:

- Good Debt: This is usually low-interest debt used to buy something that will likely grow in value. Think of a mortgage or a student loan for a high-earning career path.

- Bad Debt: This is the high-interest stuff, often used for things that lose value the second you buy them, like credit card debt from a vacation or a new TV.

The key is to use debt strategically to build wealth while being absolutely ruthless about paying down any high-interest debt that’s holding you back. By getting a handle on diversification, liquidity, and leverage, you can build a financial structure that can withstand shocks and support your family’s goals for years to come.

Fueling Your Goals With Smart Cash Flow Management #

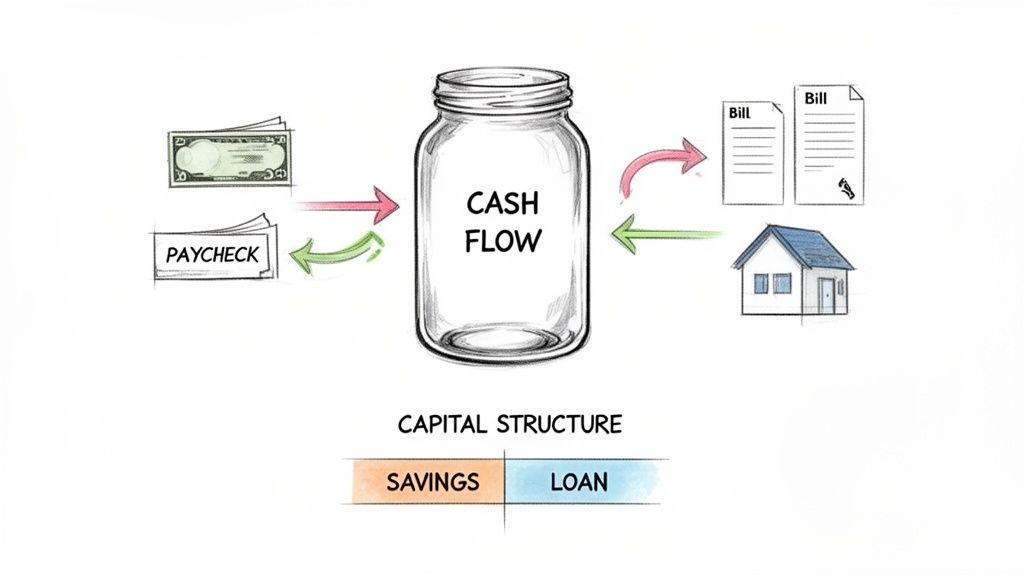

Once you’ve built a solid financial foundation, it’s time to look at the engine that drives it all. This is where we get into how you actually fund your goals and manage the money coming in and out of your household every day. The two principles we’ll cover here—capital structure and cash flow—are what turn your financial plans from ideas on paper into reality.

Think of your financial life as a car. These concepts control how fuel gets to the engine. Get them right, and you’ll find yourself accelerating toward your destination.

Understanding Your Household Capital Structure #

Capital structure sounds like something you’d only hear in a corporate boardroom, but every family has one. It’s simply the mix of your own money (equity) and borrowed money (debt) you use to pay for big life goals.

Let’s say you’re planning a major home renovation. You really only have two ways to pay for it:

- Equity: Use the cash you’ve carefully saved up over the years.

- Debt: Take out a home equity loan or a personal loan.

Most people end up using a combination of both. That specific mix is your family’s capital structure, and it has a huge effect on your financial risk. Using all cash is great because you have zero debt, but it can wipe out your savings. Using all debt keeps your cash safe, but now you have a monthly payment and interest costs hanging over your head. Finding that sweet spot is one of the most important financial decisions you can make.

The goal is to build a sustainable capital structure. For families, this means using debt strategically for things that grow in value (like a home), while relying on your own savings for lifestyle choices and smaller goals. This keeps financial strain to a minimum.

Thinking this way forces you to be more intentional about how you fund every major purchase—from a new car to a child’s education—and ensures your choices are setting you up for long-term financial health.

Why Cash Flow Is The Most Important Principle of All #

While capital structure is about funding the big stuff, cash flow is about your day-to-day financial reality. It’s the lifeblood of your budget, tracking every dollar that comes in as income and every dollar that goes out as an expense. Honestly, it’s the single most important measure of your financial well-being.

So many people fall into the trap of thinking a high income automatically means they’re wealthy. But if your expenses are just as high, you’re not actually getting ahead. This is exactly why the old saying “cash is king” is still so true.

Having a positive cash flow—meaning more money is coming in than going out—is the real sign of financial stability. That leftover margin is what allows you to save, invest, and crush your debt. Without it, you’re just spinning your wheels, no matter how much you earn.

Gaining Control Through Mindful Tracking #

The best way to get a handle on your cash flow is to track it. Diligently. When you mindfully log each transaction, you gain a powerful, real-time picture of where your money is really going. This isn’t just about number-crunching; it’s about building awareness.

- Spot the Spending Leaks: You’d be amazed how those small, frequent purchases can blow a hole in your budget over a month.

- Fine-Tune Your Budget: With clear data in front of you, you and your partner can make informed, collaborative decisions about where to cut back.

- Speed Up Your Goals: Every single dollar you save by improving your cash flow is a dollar you can throw at paying off debt faster or boosting your investments.

This hands-on approach creates a direct link between your daily habits and your biggest goals. If you’re looking for practical ways to get started, our guide on how to start tracking your income and expenses offers several effective methods. By mastering these two crucial principles of finance, you’re putting fuel in the tank and making sure you have the resources to reach your destination.

Making Smarter Financial Decisions Together #

Once you have a good handle on how money flows in and out of your household, you can start focusing on the principles that really drive smart, long-term financial choices. The final few concepts we’ll cover—valuation, agency, and market efficiency—are all about making sure you’re paying the right price, working together as a team, and investing with a realistic mindset. Nailing these is what turns your day-to-day efforts into lasting wealth.

Think of these ideas as the bridge connecting your daily spending habits to your biggest financial goals. They’re what will help you move forward with confidence.

Determining an Asset’s True Worth With Valuation #

At its core, valuation is simply the process of figuring out what something is really worth. This is one of the most practical finance principles out there because it comes into play with nearly every major purchase you’ll ever make, from a house or a car to an investment in the stock market. Knowing an asset’s real value is your single best defense against overpaying.

It’s pretty intuitive. A seller might list a used car for $15,000, but that’s just their asking price. The car’s actual value depends on its mileage, its condition, and what similar models are selling for. When you research those things, you’re performing a valuation. It’s a simple bit of due diligence that ensures you pay a fair price and protects your hard-earned cash.

For families, this principle becomes crucial when:

- Buying a Home: You look at what comparable houses in the neighborhood have sold for recently to put in a competitive, but fair, offer.

- Investing in Stocks: You peek behind the curtain of market hype to understand a company’s financial health before you buy its shares.

- Selling an Asset: You figure out a fair market price to make sure you get what your own asset is truly worth.

The Agency Principle: Keeping Your Family Aligned #

The agency principle sounds a bit corporate, but it’s really about what happens when one person (the “agent”) makes decisions on behalf of another (the “principal”). In a family, you and your partner are constantly acting as agents and principals for each other, especially when you have joint finances. This principle is all about maintaining transparency and making sure you’re rowing in the same direction.

For example, a conflict could pop up if one partner decides to make a risky investment using shared funds, knowing the other person will have to share in any potential losses. This is a classic example of a related concept called moral hazard. The only real antidote is open communication and clear ground rules.

By establishing shared goals and maintaining total transparency—for example, by tracking all joint account spending in an app like Econumo—you actively practice the agency principle. This builds trust and ensures both partners are working toward the same future.

When you take the time to sit down and create a budget together, you’re doing more than just crunching numbers. You’re aligning your goals and shutting down the potential for financial misunderstandings. Our guide on how to budget as a couple is a great place to start those conversations.

Embracing Market Efficiency for Long-Term Growth #

Finally, there’s the principle of market efficiency. This theory suggests that financial markets are incredibly good at pricing all available information into assets almost instantly. In plain English, it means that consistently trying to “beat the market” by picking hot stocks or timing your trades perfectly is next to impossible, even for the pros.

For families, this idea should feel liberating. It frees you from the pressure of thinking you need to be a stock-picking genius. Instead of making risky, short-term bets, you can focus on a strategy that has a much, much better track record for building wealth: consistent, long-term, diversified investing.

This commonsense approach is backed by global trends. As savings patterns shift worldwide, a growing percentage of adults are using formal financial accounts, which shows the power of having a disciplined plan over time. Households that adopt formal tracking and joint planning consistently achieve better financial outcomes. You can dig into more insights on this trend and its impact in the World Bank’s Global Findex database.

Turning Financial Principles into Real-World Action #

Okay, so we’ve covered the big ideas. But knowing the theory is one thing—actually putting it to work in your daily life is where you’ll see the real change. This is where the rubber meets the road, turning abstract concepts into concrete habits that build a solid financial future.

Think of it like learning to cook. You can read a dozen recipes, but until you actually get in the kitchen and start chopping vegetables, you’re not making dinner. The principles are your recipe, but your daily choices are what actually put food on the table. When you start connecting every financial move you make to one of these core concepts, you’re not just building better habits; you’re truly understanding why they work.

Master Your Cash Flow with Mindful Tracking #

If you do only one thing, do this: get a handle on your Cash Flow. The most effective way I’ve found to do this is by logging every single transaction by hand. Forget letting an app sync with your bank and do it for you. Taking just a few seconds to manually enter what you spent forces you to look it right in the eye.

That small action creates a powerful sense of awareness. It closes the gap between the budget you think you have and the reality of your spending. It’s the difference between getting a summary at the end of the month and feeling the weight of each purchase as you make it.

For anyone concerned about privacy, manually logging your expenses in a tool like Econumo also means your sensitive financial data stays yours and yours alone. This deliberate process turns budgeting from a chore you do later into an active, intentional part of your day.

Manually tracking your spending is the Cash Flow principle in its purest form. It gives you an immediate, unfiltered look at your financial reality—and that’s the essential first step to improving it.

Applying the Principles to Your Family’s Goals #

For couples and families, these principles aren’t just rules; they’re a shared language for making decisions together. Getting on the same page with your financial strategy is one of the most important things you can do for your relationship and long-term goals.

Here’s how you can start:

- Practice the Agency Principle: Set up shared accounts where everything is out in the open. This is the Agency Principle in action. It builds trust by making sure both partners are looking at the same numbers, which helps head off misunderstandings before they start.

- Tackle Leverage and Time Value of Money: Create a specific, aggressive plan for paying down debt. When you throw extra money at high-interest loans, you’re flipping the script on Leverage and making the Time Value of Money work for you, not against you.

- Handle Valuation Across Currencies: If you’re an expat or have family abroad, you’re already doing real-world Valuation every day. Using a tool that tracks multiple currencies helps you see the true value of your money as exchange rates shift.

These personal decisions connect to a much bigger picture. Did you know that over 90% of global trade now relies on financial services? Our individual financial health is directly tied to these massive systems. This connection, explored in recent analysis by UNCTAD on the role of finance in global trade, shows why understanding things like your own borrowing power is no longer optional. It’s a fundamental skill for thriving in today’s world.

Common Questions About Financial Principles #

Putting financial principles into practice with your family often brings up tough questions. You might grasp the concepts, but turning them into action is what really builds confidence.

In the examples below, we tackle common scenarios couples face. Our aim is to give you clear, concise answers so you can move forward with conviction.

Which Principle Is Most Important For New Budgeters #

For families taking their first budgeting steps, Cash Flow Is King. You need a clear view of what’s coming in and what’s going out before you can save, invest, or tackle debt effectively.

Achieving positive cash flow—where income exceeds expenses—is the bedrock of every financial goal. Mastering this principle gives you the insights you need to make every other decision with purpose.

How Can Partners Agree With Different Risk Tolerances #

Disagreements over risk are common and tie directly back to the Risk-Return Tradeoff. The key is honest communication, respect for each other’s comfort zone, and a plan that accommodates both perspectives.

A practical way to balance these viewpoints is to split investments into:

- Core Portfolio: A conservative allocation—think diversified, low-cost index funds—for shared goals like retirement.

- Satellite Portfolio: A smaller slice earmarked for higher-risk ideas that one partner wants to explore.

This structure honors both levels of comfort and keeps your main objectives on solid ground.

It’s not about forcing one view on the other. It’s about crafting a joint plan where you both feel confident in your path.

Should I Pay Off Debt Or Invest Extra Money #

This classic dilemma pits the Time Value Of Money against Leverage. Usually, the interest rate on your debt points the way.

Compare what you pay in after-tax interest to what you might earn:

- If you carry high-interest debt (credit cards at 15–25% or more), paying it off first is almost always the smarter move.

- If you have low-interest debt (mortgages or student loans under 7%), investing extra cash might yield higher long-term gains.

Treat paying down high-rate debt as a guaranteed return equal to that rate—it’s like putting money in a risk-free account.

Ready to put these principles into action? With Econumo, you can:

- Track your cash flow in detail

- Manage joint accounts seamlessly

- Build targeted budgets to accelerate debt repayment

Take control of your financial story today by trying the live demo.