So, what exactly is open source personal finance software? Put simply, it’s a type of financial tool where the source code—the very blueprint of the software—is open for anyone to see, use, and even improve upon.

Think of it like a community cookbook for managing your money. It’s completely transparent, you can tailor the recipes to your taste, and it isn’t controlled by a single corporate entity. This approach puts you in the driver’s seat, giving you total ownership of your financial data.

Understanding the Core Idea of Open Source Finance #

At its heart, open source finance is built on transparency and community collaboration. This is a world away from the proprietary or “closed-source” software you might get from a big company, where the programming instructions are kept under lock and key.

Imagine a restaurant that guards its recipes like state secrets. You can eat the food, but you have no idea what ingredients are used, how it’s prepared, or if you could make it better yourself. Most commercial finance apps operate this way. You hand over your sensitive data and just have to trust that they’re handling it correctly, with no real way to verify what’s happening behind the scenes.

The Power of a Community Cookbook #

Open source flips that model on its head. It’s the community cookbook where everyone can read the recipe (the source code), suggest improvements, and share their own variations. This creates a powerful ecosystem where users and developers collaborate to build a better, more secure tool for everyone.

This collaborative approach brings some major benefits:

- Complete Data Ownership: Your financial data lives on your own terms, often on a server you control (known as self-hosting). No third-party snooping.

- Unwavering Transparency: You—or any expert in the community—can look at the code to check for security holes or hidden data trackers.

- Endless Customization: Need a specific feature? You or another developer can build it. The software molds to your needs, not the other way around.

Open source empowers you to become the master of your financial domain. Instead of renting access to a service, you own the entire platform, ensuring your data remains private and your tools are tailored precisely to your financial goals.

To get a clearer picture, let’s look at a side-by-side comparison.

Open Source vs Proprietary Finance Software At a Glance #

Here’s a quick breakdown of how these two approaches stack up against each other.

| Feature | Open Source Software | Proprietary Software |

|---|---|---|

| Source Code | Publicly available for anyone to view and modify. | Kept secret and owned by the company. |

| Cost | Typically free, with optional paid support. | Usually requires a one-time purchase or subscription. |

| Data Privacy | You control your data, often hosted on your server. | Data is stored on the company’s servers. |

| Customization | Highly customizable; add your own features. | Limited to the features offered by the vendor. |

| Community Support | Supported by a community of users and developers. | Official customer support from the company. |

| Transparency | Fully transparent; you can see exactly how it works. | A “black box”—you trust the company’s claims. |

As you can see, the choice often comes down to what you value most: the convenience of a managed service or the control and privacy of an open platform.

This isn’t just a niche movement, either. While the global personal finance software market was valued at USD 1.39 billion in 2024, open source alternatives are carving out a serious space. More people and small organizations are choosing these cost-free solutions to avoid hefty upfront costs and recurring subscription fees, making powerful financial management accessible to all. You can discover more insights about the personal finance software market and its growth.

Ultimately, opting for open source personal finance software is a conscious choice. It’s a move to prioritize privacy, control, and long-term flexibility over the plug-and-play convenience of a locked-down system. It’s about building your financial future on a platform you can actually own and trust.

Why Choose Open Source for Your Finances? #

Picking the right software to manage your money is a big deal. You’ve got plenty of slick, commercial apps to choose from, but they often come with hidden trade-offs. Open source personal finance software offers a different path—one that puts you firmly in control of your own data and gives you the freedom to manage your money, your way.

Think of it less as “renting” a service and more like “owning” your financial toolkit. When you go with an open source tool, you’re not just a user on a platform; you’re part of a community. This fundamentally changes the relationship you have with your software, making you an empowered owner of your financial story.

Let’s dive into the four big reasons why this approach is so powerful.

You Get Total Privacy and Control Over Your Data #

Let’s be honest: your financial data is about as personal as it gets. When you use a typical budgeting app, you’re handing over your transaction history, account balances, and spending habits to a third-party company. You have to trust they’ll keep it safe and won’t use it in ways you wouldn’t approve of.

Open source flips the script with self-hosting. It sounds technical, but the concept is simple: you run the software on your own private space, like a small computer at home or a cheap cloud server. Your data never has to touch a company’s server. It stays with you, locked in your own digital vault that no one else can access, analyze, or sell.

By self-hosting your finances, you cut out the middleman entirely. Your data is yours and yours alone, making you the sole guardian of your financial life.

This is the ultimate in financial privacy. No prying eyes, no corporate data mining—just you and your numbers.

It’s Incredibly Flexible and Customizable #

Most off-the-shelf finance apps are built for the “average” person, but who is really average? Maybe you’re a freelancer with fluctuating income, or an expat juggling multiple currencies. Closed-source software forces you into its pre-defined boxes, and if you need a specific feature, all you can do is hope the developer adds it one day.

Open source software, on the other hand, is built to be tweaked. Since the code is open, you can mold it to fit your life perfectly.

- Custom Budget Categories: Forget generic labels. Create categories that actually reflect your spending, no matter how unique.

- Personalized Reports: Track what truly matters to you. Want to see how much you’re spending on your side-hustle or how close you are to that down payment? You can build a report for it.

- Connect Your Tools: If you’re a bit tech-savvy, you can even build custom integrations and connect your finance tool to other services you use.

Your software should adapt to you, not the other way around. Open source makes that happen.

You’ll Save a Lot of Money in the Long Run #

Subscription fees are a sneaky drain on your finances. Many of the most popular budgeting apps charge monthly or yearly, and those fees add up fast. It’s a little ironic to pay a recurring fee to a tool that’s supposed to help you save money.

Most open source finance tools are completely free to use. You might have a small cost for a server if you choose to self-host (we’re talking a few dollars a month), but you say goodbye to mandatory subscriptions forever. This makes it a much smarter financial choice for the long haul, leaving more cash in your pocket for your actual goals.

It’s Driven by a Passionate Community #

Finally, open source projects aren’t built by a faceless corporation in some distant office park. They’re built and maintained by a worldwide community of developers and users who are passionate about the software. People contribute their time and skills simply because they want to make it better.

This collaboration is a huge advantage. With so many experts looking at the code, security issues get spotted and fixed incredibly fast. New features are suggested and built by the very people who need them. This means the software is constantly improving based on real-world needs, not a corporate roadmap, ensuring it stays secure, relevant, and powerful for years.

What to Look For: Essential Features of Great Finance Software #

Picking the right open source finance software is a lot like choosing a good chef’s knife—you need the one that fits your hand and does the job you need it to do. It’s easy to get distracted by bells and whistles, but a few core features are what truly separate a useful tool from just another piece of digital clutter.

Think of these features as your personal checklist. As you look at different options, you can measure them against what you actually need, whether you’re managing a family budget, living abroad, or just trying to be more intentional with your spending.

Powering Teamwork with Collaborative Budgeting #

Let’s be honest: managing money with a partner or family can get messy. It often feels like you’re both working from different instruction manuals. This is where collaborative budgeting steps in. It creates one central place for your finances, a shared “source of truth” where everyone can see what’s coming in, what’s going out, and how you’re tracking toward your goals.

For any household, this is a huge step up. No more guessing games or awkward “by the way, I spent…” conversations. You get a clear, real-time picture of your shared financial life, turning budgeting from a chore into a team sport.

For example, a couple saving for a house can set up a shared budget. When both partners log their income and expenses, they can instantly see their combined progress toward that down payment, which keeps everyone on the same page and motivated.

Managing a Global Life with Multi-Currency Support #

If you’re a digital nomad, an expat, or just someone who deals with money in different countries, multi-currency support isn’t a “nice-to-have”—it’s a must. Without it, you’re stuck trying to mentally convert currencies on the fly, and your net worth statement is basically a rough guess.

Good software lets you track accounts in their native currencies, like Euros, Pounds, or Yen, and then automatically handles the conversion to show you the big picture in your main currency. It takes the headache out of manual math and gives you a clean, consolidated view of your finances, no matter where in the world your money is.

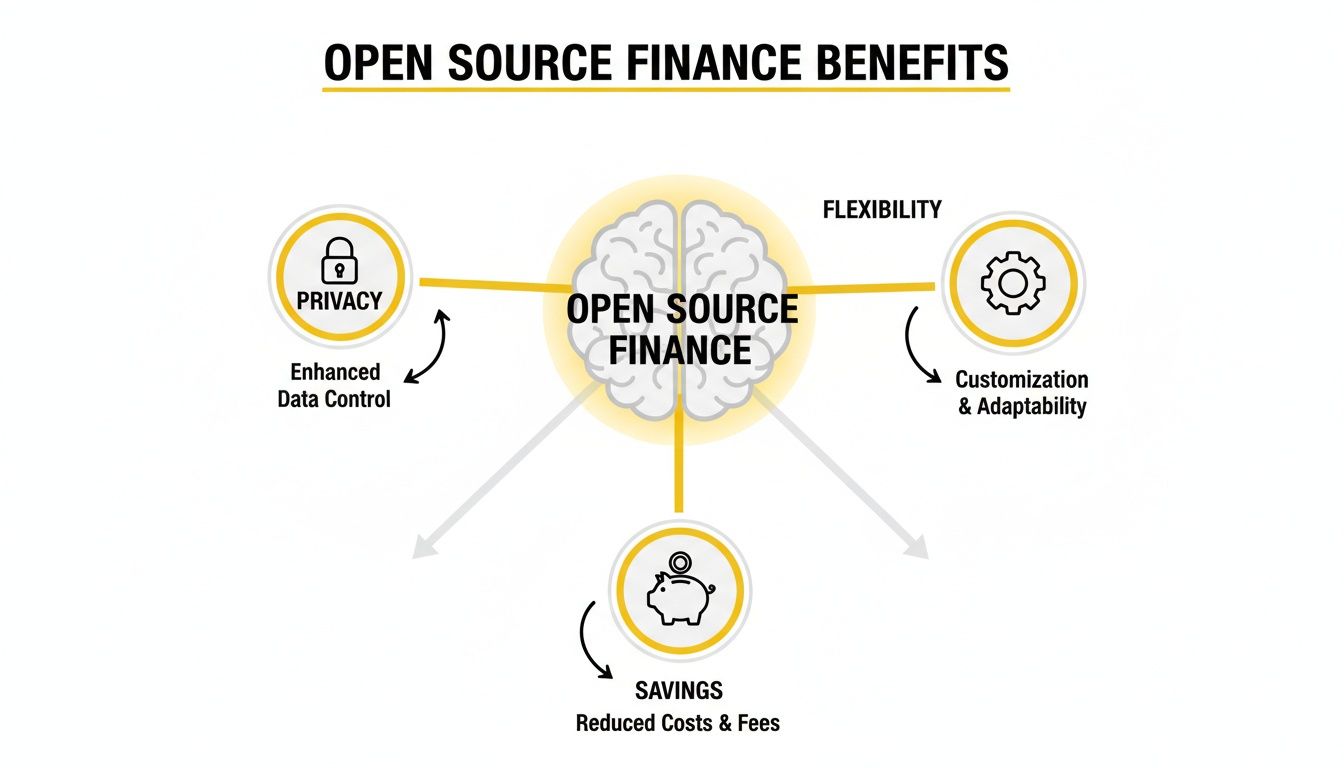

Privacy, flexibility, and cost savings are the three pillars of open source finance. They give you a solid foundation for taking charge of your financial future by putting you in control of your own data.

This infographic shows how owning your data (privacy), shaping your tools (flexibility), and cutting out fees (savings) all work together to your advantage.

Building Awareness with Manual Transaction Entry #

Automatic bank syncing is convenient, but it has a downside: it can make you a passive observer of your own spending. Manual transaction entry, on the other hand, forces you to be an active participant. By taking a few seconds to log each purchase, you become acutely aware of where your money actually goes.

This simple act builds a powerful habit. It’s a deliberate, mindful approach that helps you spot the little leaks in your budget and make more intentional decisions. If you have a lot of history to bring over, you can check out our guide on CSV import and export to get started faster.

Tracking Progress with Robust Reporting Tools #

You can’t manage what you don’t measure. Strong reporting tools act as your financial dashboard, turning a long list of transactions into clear, actionable insights. They let you see your progress over time, spot trends in your spending, and check if you’re actually on track to hit your goals.

Look for software that gives you these key reports:

- Cash Flow Statements: See exactly where your money came from and where it went each month.

- Net Worth Tracking: Watch your overall financial health grow (or shrink) over time.

- Customizable Category Reports: Dig deep into specific spending areas, like how much you’re really spending on groceries or subscriptions.

These reports are what transform a simple expense tracker into a serious tool for financial planning.

How Open Source Software Solves Real-World Money Problems #

The theory behind open source personal finance software is great, but its true value shows up when it tackles messy, real-world money challenges. It’s about more than just pretty charts and graphs; it’s about having the right tool to handle your unique financial situation.

Let’s walk through three common scenarios where this kind of software becomes a game-changer, helping everyday people finally get a handle on their finances.

The Family Saving for a Big Vacation #

Picture the Miller family. They’re dreaming of a two-week trip to Italy next summer, but getting their finances in sync is a constant struggle. Juggling two incomes, shared bills, and their own personal spending habits made tracking their progress feel impossible. The frustration was real, and their goal felt like it was slipping away.

This is exactly where collaborative budgeting tools come in. The Millers started using an open source platform that let them:

- Create a Shared Budget: They built a central budget where they could both see all the household money coming in and going out, all in one place.

- Track Joint Savings Goals: They set up a dedicated “Italy Vacation” fund. Seeing every contribution in real-time turned saving from a chore into a motivating team sport.

- Keep Their Own Spending Private: Each partner could still manage their personal spending categories without having to share every little detail, all while contributing to the bigger goals transparently.

By finally working from a single source of truth, the Millers got on the same page and started making serious headway. The software didn’t just track their money—it aligned their entire family’s efforts.

The Digital Nomad Juggling Currencies #

Now, think about Alex, a freelance graphic designer living and working around the world. One month, Alex is earning in Euros, paying rent in Thai Baht, and has savings back home in US Dollars. Figuring out their actual net worth used to be a nightmare of messy spreadsheets and constantly looking up conversion rates.

Multi-currency support was the feature that changed everything. A flexible open source tool gave Alex the power to:

- Log every transaction in its original currency without having to do any math on the fly.

- See a unified dashboard that automatically converted everything into their main currency (USD).

- Get an accurate, up-to-the-minute snapshot of their global financial health with just one click.

This simple feature turned a complex, error-prone chore into a fully automated process. It gave Alex the clarity needed to make smart financial decisions, no matter where in the world they were.

The Individual Tackling Debt with Intention #

Finally, let’s look at Sarah, who was laser-focused on paying off her student loans and credit card debt. She’d tried those “set it and forget it” automated apps, but they made her feel like a bystander in her own financial life. Money just seemed to vanish from her account without her really understanding where it went.

She made a switch to an open source tool that focused on manual transaction entry. It sounds like a small change, but the impact was huge.

By deliberately recording every single purchase—from her morning coffee to her monthly loan payment—Sarah became deeply aware of her spending habits. This mindfulness was the secret to spotting and cutting out the fat.

She used the software’s reports to watch her debt-to-income ratio improve and see her loan balances shrink month after month. For anyone who needs to build better habits, learning how to stick to a budget is the critical first step, and manual tracking is an incredibly powerful way to build that discipline. This intentional approach helped her pay off her debt an amazing 30% faster than she had originally planned.

Getting Started with Your Self-Hosted Finance Hub #

Taking the reins of your financial data by setting up your own software might sound like a job for a software developer, but it’s actually more accessible than you might think. Making the switch from a commercial app to a platform you truly own is an empowering move, and we can break it down into a few manageable steps.

The point isn’t to become a systems expert overnight. It’s about choosing a path that puts you in complete control of your data, and modern tools have made the setup process surprisingly simple. Let’s walk through what it takes to launch your own self-hosted open source personal finance software.

Choosing Where Your Data Will Live #

Your first big decision is picking a home for your software. This is the “self-hosting” part of the equation, and you generally have two main options. Neither requires a massive hardware investment or a deep technical background.

- A Small Home Server: This can be anything from an old laptop gathering dust to a tiny, low-power computer like a Raspberry Pi. This is the perfect choice if you want your financial data to physically live inside your own home, giving you the ultimate level of privacy.

- An Affordable Cloud Service: For just a few dollars a month, you can rent a small, private server (often called a VPS or a “droplet”) from a cloud provider. This gives you the flexibility to access your hub from anywhere in the world without having to manage any physical machines yourself.

The right answer really depends on your personal comfort level and privacy goals. Either way, you end up with a financial platform that you completely control, with no third parties snooping on your data.

Following a Guided Installation Process #

Once you’ve decided where your software will live, it’s time to install it. Forget the command-line nightmares you might be imagining. Modern open source projects often use simple tools that do most of the heavy lifting for you.

One of the most popular tools for this is Docker, which bundles the entire application into a neat, self-contained package. Instead of you having to install a database, then a web server, then all the other dependencies one by one, Docker lets you run a single command that sets everything up at once. It turns a potentially complicated process into a few clear steps.

Most installation guides are written with beginners in mind. They usually provide simple copy-and-paste commands that can get your financial hub running in minutes, not hours. The community behind the software genuinely wants you to succeed.

For a step-by-step tutorial, you can always check out detailed guides like our official self-hosting documentation that breaks down the entire process.

Migrating Your Financial History #

The final piece of the puzzle is getting your old data into your new system. The good news is you don’t have to start from scratch. Almost every financial app out there, from the big-name services to your bank’s website, lets you export your transaction history.

This data usually comes in a universal format like CSV (Comma-Separated Values), which is basically just a simple spreadsheet. Most open source finance tools have a built-in import feature that lets you upload this file and pull your entire financial history right in. This means you get a complete picture of your finances from day one, so you can run reports and track trends without losing any of that valuable historical context.

So, Where Do You Go From Here? #

You’ve seen what open source personal finance software is all about—from its community-first spirit to the practical ways it can reshape how you manage your money. The next step is moving from theory to action. This isn’t about finding some magical, one-size-fits-all app. It’s about picking a tool that actually puts you in control.

The benefits are pretty straightforward. You get total privacy by keeping your financial data on your own turf, far away from corporate data centers. You get the freedom to build budgets and reports that reflect your life, not some pre-packaged template. Most of all, you get to build your financial future on a foundation you own and trust.

Choosing this path is a deliberate move toward financial independence. It’s a way to ditch endless subscription fees for a tool that evolves with you, backed by people who genuinely care about the project.

Your First Move #

Getting started is easier than it sounds. Whether you’re a family trying to get on the same page, an expat juggling different currencies, or just someone who wants to track their spending more deliberately, there’s a clear starting point.

Here are a few ways to jump in:

- Play with an Interactive Demo: Take the software for a spin with zero commitment. Click around, explore the features, and see if it feels right.

- Grab a Community Edition: Ready to get your hands dirty? A free, self-hosted version like Econumo’s Community Edition gives you the complete toolkit.

- Check Out Other Projects: The open source ecosystem is huge. Explore other community-driven tools to find one that matches your technical skills and what you need it to do.

The entire personal finance app market is exploding, projected to hit USD 173.6 billion by 2035. This isn’t just a niche trend; it’s a global shift toward smarter financial management. Open source is a huge part of that, making powerful tools available to anyone, no matter their budget. You can read the full research on the personal finance apps market to get a sense of where things are headed.

The best thing you can do for your financial health is to simply start. By choosing an open platform, you’re doing more than just logging expenses—you’re making a real investment in your own financial know-how and freedom.

The tools are out there. The community is ready to help. Your financial future is waiting for you to shape it. Why not start today?

Frequently Asked Questions #

Diving into open-source finance tools can feel like a big leap, especially if you’re coming from standard, off-the-shelf apps. It’s totally normal to have a few questions. Let’s walk through some of the most common ones so you can feel good about taking back control of your financial data.

Is Self-Hosting My Financial Data Actually Secure? #

This is the big one, and for good reason. The short answer? Yes, it can be incredibly secure—often even more secure than relying on a third-party cloud service.

Think of it this way: would you rather keep your most valuable documents in a safe at home, where you’re the only one with the key, or in a storage unit managed by someone else? Self-hosting is like having that safe at home. You control the entire environment.

Your security comes down to a few key things:

- Physical Control: You decide where your data lives. It could be on a small computer in your closet or a private server you rent. The bottom line is, no employees from some other company can get near it.

- Software Updates: The open-source community is remarkably quick to spot and fix security holes. Staying on top of updates is the single most important thing you can do to keep your setup locked down.

- Network Security: You can use all the standard best practices you’re already familiar with, like strong passwords, a firewall, and two-factor authentication.

Self-hosting puts the responsibility for security squarely on your shoulders, but that’s a good thing. It gives you the power to build a completely private financial fortress, shielded from corporate data breaches or sudden policy changes. Your data’s safety depends on your setup, not on a company’s promises.

Do I Need to Be a Programmer to Use This Stuff? #

Nope, definitely not. While knowing how to code lets you tinker under the hood, most open-source personal finance software is built for regular people. The community gets it—for these tools to catch on, they have to be easy enough for anyone to use, not just developers.

Getting started has become way easier over the years. Many projects use tools like Docker, which bundles everything you need into a simple one-click (or one-command) install. You’ll typically just follow a simple guide, copy and paste a command or two, and the software handles the rest. Once it’s up and running, you use it through a clean web interface, just like any other app you’ve used before.

What Happens If a Project Is No Longer Updated? #

That’s a fair question. In the open-source world, projects sometimes lose steam. But unlike a commercial app that just vanishes when a company goes under, open-source software has a powerful safety net: the code itself.

Since the code is public, the story doesn’t end if the original creators move on. Someone else in the community can simply pick up where they left off. They can “fork” the project—which is just a fancy way of saying they make a copy of the code—and continue building on it, maybe even under a new name. This means a great tool won’t just disappear overnight. You’ll always have the code and the freedom to run it, fix it, or even pay someone to maintain it for you. It’s a kind of resilience that closed-source products just can’t offer.

Ready to take the next step toward financial independence? Econumo offers the tools you need to manage your money with confidence. Try our live demo, self-host the community edition for free, or join the cloud waitlist today.