A realistic monthly food budget for two usually lands somewhere between $700 and $1,200. That number covers groceries and a bit of fun money for dining out. Of course, your final figure will really depend on where you live, what you like to eat, and how often you’d rather have someone else do the cooking.

Pinpointing Your Starting Budget #

Before you can build a budget that actually works, you need a realistic starting point. Just pulling a number out of thin air is a recipe for failure. The goal here is to find a number that genuinely fits your lifestyle, your city’s cost of living, and your shared financial goals. There’s no one-size-fits-all answer; what’s perfect for your friends might be way too restrictive (or too loose) for you.

A few key things will shape what your ideal food budget looks like:

- Where You Live: It’s no secret that a grocery run in New York City is going to hit the wallet a lot harder than one in a small town in Ohio.

- Your Diet: Sticking to strictly organic, gluten-free, or keto diets almost always costs more than a standard shopping list.

- Cooking vs. Takeout: Do you two enjoy cooking from scratch most nights? Or do you lean on pre-made meals, takeout, and meal kits? The more you cook, the more you can control your spending.

- Your Social Life: How often are you grabbing coffee, meeting friends for happy hour, or going out for a nice date night? These things add up fast and need a spot in the budget.

The Food Budget Spectrum #

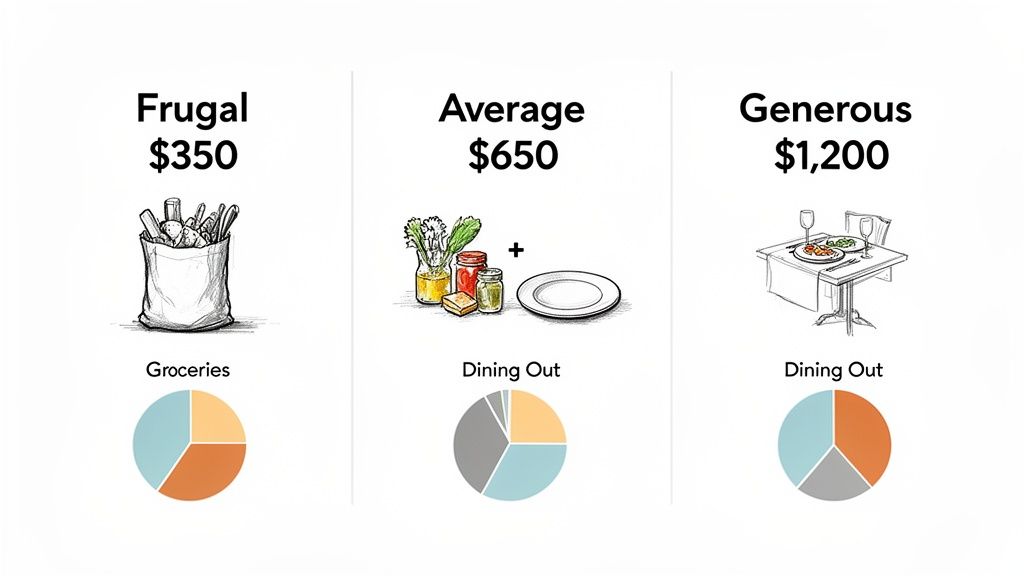

To give you a better idea of what this looks like in practice, let’s break it down into three common spending levels. Think of these as guideposts, not strict rules, to help you figure out where you and your partner might land.

Here’s a table breaking down how those numbers might be allocated. This can help you see where your money could go in each scenario.

Sample Monthly Food Budgets for Two (USD) #

| Spending Category | Frugal Budget | Average Budget | Generous Budget |

|---|---|---|---|

| Groceries | $450 | $600 | $750 |

| Dining Out | $100 | $250 | $400 |

| Coffee/Snacks | $50 | $100 | $150 |

| Total | $600 | $950 | $1,300 |

A frugal approach means you’re cooking at home almost exclusively and keeping restaurant trips to a minimum. On the other hand, a generous budget leaves plenty of room for nice dinners out and higher-end ingredients. Most couples find their sweet spot is somewhere in the middle, balancing home-cooked meals with the occasional splurge.

Your first budget is just a starting guess. The real magic happens in the first month as you track your actual spending. That’s the data you’ll use to make smart adjustments together.

It’s impossible to ignore how much food prices have shot up recently. In the US, some experts now recommend that two adults should plan for around $800 a month just for groceries if they cook most of their meals. That figure makes a lot of sense when you realize that grocery prices have jumped by a whopping 29% since February 2020.

Budgeting for two is a whole different ballgame than going it alone. If you’re curious about the contrast, take a look at our guide on the average grocery cost for one person.

Creating Your Core Food Budget Categories #

Just having a single number for your monthly food budget is a starting point, not a real plan. The secret to actually making it work is breaking that big target down into smaller, more manageable pieces. This is how you stop wondering where your money went and start making intentional choices together.

Before you start guessing, the best thing to do is play financial detective for an hour. Grab a coffee, sit down together, and pull up your bank and credit card statements from the last month. Remember, this isn’t about blaming anyone for their spending; it’s purely about gathering honest data to build a plan that actually works for you.

Figure Out Where Your Money is Really Going #

As you go through your statements, you’ll start to see patterns. The goal here is to group every single food-related purchase into a logical category. This is where being a team is so important—you need to build a budget that feels fair and sustainable for both of you.

Try bucketing your spending into these four main areas:

- Groceries: This is your foundation. It’s everything you buy at the supermarket to cook at home.

- Dining Out: Think sit-down restaurant meals, date nights, and that Sunday brunch you both love.

- Takeout & Delivery: This is for the DoorDash orders, Uber Eats, and grabbing a quick pizza on the way home.

- Coffee & Snacks: Don’t overlook the daily lattes, afternoon energy drinks, or quick convenience store runs. These little purchases add up faster than you think.

The “latte factor” is a real thing. If one of you spends $100 a month on coffee, that habit needs its own line item in the budget. Hiding it or ignoring it will only cause arguments later. Honesty upfront is key.

Looking at spending in other places can also provide a helpful reality check. For instance, a couple’s food budget in the UK often lands somewhere between £400 and £700 a month. Many find they’re spending £95-115 each week just on essentials, which can easily hit £480-520 monthly before any treats. This insight, from a guide on realistic food budgeting, shows just how critical flexible and collaborative tracking is, especially if you’re a couple managing multiple currencies.

Setting Your New Spending Targets #

Okay, you’ve done the detective work and have your totals from last month. Now it’s time to set your new targets.

Let’s run through a quick example. Imagine a couple finds out they spent a whopping $1,100 on food last month. It broke down like this: $650 on groceries, $300 on dining out, and $150 on a mix of coffee and takeout.

Their new goal is to trim that down to $950. Here’s how they might decide to allocate their new budget:

- Groceries: $600 (a small cut, maybe by swapping a few brands)

- Dining Out: $250 (fewer spontaneous dinners out)

- Coffee & Takeout: $100 (making coffee at home more often)

Suddenly, they have a clear action plan. They’ve moved from a vague wish to “spend less” to having specific, achievable goals for each part of their food life.

Smart Ways to Slash Your Grocery Spending #

Alright, you’ve got your budget categories locked in. Now for the fun part: finding real savings at the grocery store. This isn’t about spending hours clipping coupons; it’s about building smart habits that trim your bill week after week. The biggest shift is moving from a reactive shopper to a proactive planner.

It all starts with a little trick I call reverse meal planning. Instead of deciding you want to make a specific recipe and then buying all the ingredients at whatever price they happen to be, you flip the script. First, check your grocery store’s weekly flyer or app. See that chicken thighs and bell peppers are on sale? Great. Then you plan your meals—like fajitas or a sheet-pan dinner—around those deals.

This simple change stops you from paying full price for ingredients and gets you cooking with what’s most affordable right now.

Outsmart the Supermarket #

Let’s be real: grocery stores are meticulously designed to make you spend more. Those tempting, high-profit items are always at eye level, and the end-of-aisle displays are rarely the best deal. To protect your food budget, you need a game plan to navigate the aisles without falling into the traps.

One of the most powerful tools hiding in plain sight is unit pricing. It’s that tiny print on the shelf tag showing the cost per ounce, pound, or item. A giant “family-size” box of crackers might look like a bargain, but the unit price will tell you if the smaller, on-sale box is actually the cheaper option. Checking this every time becomes second nature and saves a surprising amount of money over a year.

Your pantry is your secret weapon against expensive, last-minute runs to the store. When you’re stocked with staples like rice, pasta, canned goods, and spices, you’re always just a few minutes away from a cheap and easy meal.

Another huge money-saver is simply cutting down on waste. A shocking amount of the average food budget goes straight into the trash. Actively working to reduce food waste at home is one of the single most effective ways to lower what you spend each month.

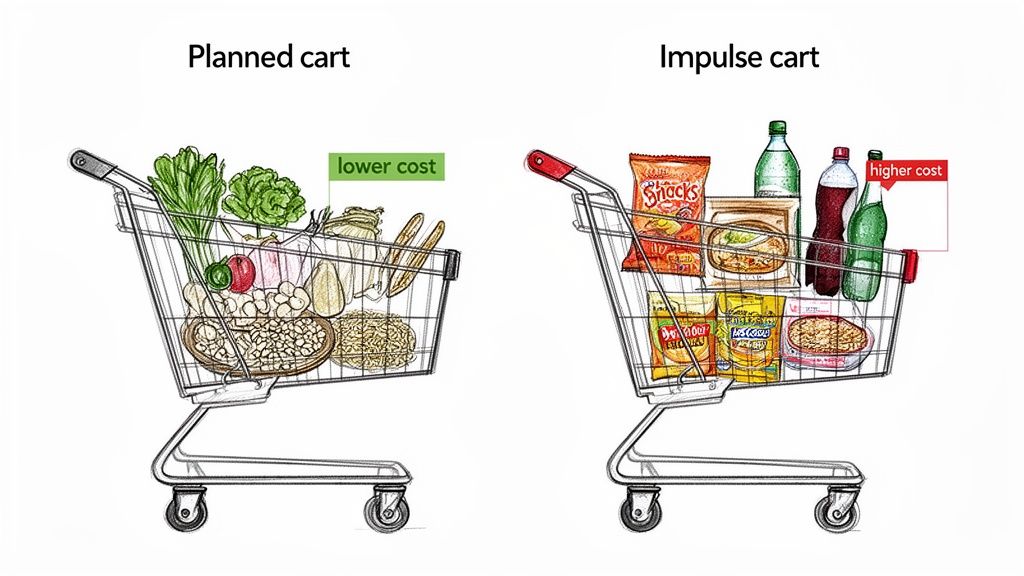

Planning in Action: A Tale of Two Shopping Trips #

Let’s see how this plays out for a couple with two very different approaches.

Trip #1: The Impulse Run

- No list, just vibes. They wander the aisles grabbing what looks good.

- They toss in pre-cut veggies and brand-name snacks.

- Don’t feel like cooking, so they grab a pricey rotisserie chicken.

- Buy another jar of pasta sauce, forgetting they have two at home.

- Final Bill: $185

Trip #2: The Strategic Stock-Up

- Walk in with a list based on the weekly sales flyer.

- Buy a whole chicken ($8) to roast instead of the rotisserie chicken ($12).

- Opt for store-brand products, which are often identical to name brands.

- Stick to the perimeter of the store for fresh produce, meat, and dairy, skipping the processed food aisles.

- Final Bill: $115

That’s a $70 difference. In one trip. By planning ahead, checking what they already had, and making a few intentional swaps, the couple in the second scenario easily hit their budget. Multiply that by four weeks, and you’re talking about serious savings that can be put toward a vacation, debt, or investments. This is how you turn a weekly chore into a powerful financial tool you manage together.

Managing Your Shared Budget as a Team #

Budgeting as a couple is a team sport, and nowhere is that more obvious than with food. You can create the world’s most perfect plan, but it’s bound to fail if you aren’t both on the same page about how you’ll contribute and track your spending.

The goal isn’t just about crunching numbers; it’s about finding a system that feels fair, transparent, and—most importantly—doable for both of you.

Your first big conversation should be about how you’re going to split the costs. There’s no magic formula here. What works for your friends might not work for you, and that’s completely fine. It’s all about what feels right for your specific financial picture and relationship.

Choosing Your Split Strategy #

Before you start tracking a single dollar, you need to agree on how you’ll fund your food budget. Each method has its own quirks, so it’s worth talking through them to find the one that feels the most equitable for your partnership.

Here are the three most common ways couples tackle this:

- The 50/50 Split: Simple and straightforward. You each put the exact same amount into a shared food fund or joint account every month. This approach promotes a strong sense of equal partnership, but it can create friction if one person earns significantly more than the other.

- Proportional to Income: This is often seen as a fairer method when there’s an income gap. You each contribute a percentage based on what you earn. For example, if you bring in 60% of the total household income, you’d cover 60% of the food budget.

- One Pays Groceries, One Pays Dining Out: Some couples find it easier to “own” entire categories. One of you might handle all the grocery runs, while the other picks up the tab for restaurants, takeout, and coffee. This can work great if the totals are similar, but you’ll need to check in often to make sure one person isn’t accidentally shouldering a much bigger financial load.

There are a ton of ways to approach this. If you want to dive deeper, we have a whole guide on how to budget as a couple that can help you find your groove.

The Power of the Weekly Check-In #

Once you’ve landed on a contribution strategy, communication is your secret weapon. A budget isn’t a rigid set of rules designed to make you feel bad; it’s a flexible roadmap. And for it to stay flexible, you have to talk about it.

A weekly 15-minute “money check-in” can completely change the game. This isn’t about grilling each other over receipts. It’s a quick, low-stress chat to see where you’re at, give each other a high-five for sticking to the plan, and make small adjustments for the week ahead—no blame involved.

This simple habit stops tiny misunderstandings from snowballing into major resentments. Let’s say an impromptu dinner with friends blew your dining-out budget for the week. Instead of letting it cause tension, your check-in is the perfect time to say, “Oops! Okay, let’s plan a few extra home-cooked meals this coming week to get back on track.”

To keep things running smoothly, it’s vital to track shared purchases and split costs effectively. That transparency turns budgeting from a dreaded chore into a shared project, making both your finances and your partnership stronger.

Tracking and Tweaking Your Budget Together #

Think of your food budget less like a rigid contract and more like a living, breathing plan. It’s meant to evolve as your habits, priorities, and even the price of avocados change. Using the right tools is what turns this from a chore into a genuinely insightful way to manage your money as a team.

Modern budgeting apps are fantastic for this. They do more than just log expenses; they show you the story behind your spending. Seeing a pie chart that reveals 30% of your food budget went to last-minute takeout can be the wake-up call you both need to get serious about that Sunday meal prep routine.

Finding Your Tracking Groove #

How you actually track your spending comes down to personal preference. What works for one couple might feel like a hassle to another. The most important thing is finding a system you can both stick with.

There are really two ways to go about it when managing a monthly food budget for two:

- Go Automated: This is where you link your bank accounts and credit cards to a budgeting app. Transactions get pulled in and categorized automatically, giving you a real-time snapshot with almost zero daily effort. It’s perfect for a high-level view without getting bogged down in the details.

- Manual Entry: This method means you’re plugging in every purchase by hand. It definitely requires more discipline, but it creates a powerful awareness of your spending. The simple act of typing in that $6 coffee makes you think twice about where every dollar is going.

A lot of couples land on a hybrid approach. They might automate their shared accounts but manually log any cash purchases. It’s all about creating shared visibility that keeps you both accountable and on the same page.

A budget isn’t a judgment—it’s just data. Use that data to have productive conversations about what you value. Maybe you both decide that the weekly farmers’ market haul is more important than Friday night pizza delivery.

The All-Important Monthly Check-In #

A simple, consistent review is what makes a budget work long-term. Carve out 20-30 minutes at the end of each month to sit down together and just look at the numbers.

This isn’t about pointing fingers. It’s a team huddle to see what went well and what didn’t. Ask yourselves a few key questions:

- Which categories did we nail?

- Where did we go over, and why did that happen?

- What adjustments should we make for next month?

This process lets you make small, manageable tweaks instead of drastic changes. For instance, staying on top of food price trends is a game-changer. The USDA’s food price outlook findings predict that prices for food-away-from-home could jump by 3.3% in 2026. Knowing that might prompt you to shift a little more money from your “dining out” category into “groceries” next month.

By refining your plan month after month, your budget becomes a finely tuned tool that helps you reach your financial goals together. You can also explore our breakdown of the best family budget software to find a tool that clicks with your style.

Common Questions About Food Budgeting for Two #

Even with the best plan, you’re bound to hit a few snags when you start budgeting together. It’s completely normal. Let’s walk through some of the most common questions and hurdles couples run into.

What Is the Biggest Mistake Couples Make When Starting a Food Budget? #

Hands down, the biggest mistake is setting a wildly unrealistic goal right out of the gate. I see it all the time: a couple who normally spends $1,200 a month on food decides they’re going to slash it to $600 overnight. It sounds great in theory, but it’s a recipe for burnout and frustration.

A much better approach is to start by tracking what you actually spend for a full month. No judgment, just data. Once you have that honest baseline, aim for a small, manageable reduction—maybe 10-15%. Real, lasting change comes from small, consistent wins, not from making drastic cuts you can’t stick with.

The point of a budget isn’t to deprive yourselves. It’s about being intentional with your money so it goes toward what you both truly value, whether that’s saving for a house or just enjoying a nice dinner out once a week.

How Do We Handle Unexpected Food Expenses? #

Life happens. Friends drop in for a spontaneous dinner party, or you get invited to a last-minute potluck. A good budget is flexible enough to roll with the punches.

The easiest way to handle this is to build a small buffer into your overall budget—you could call it a “Miscellaneous” or “Entertainment” fund. When something pops up, you can pull from that category without guilt.

Another option is to simply adjust on the fly. If you know you’re hosting this weekend, maybe you cut back on your dining-out or grocery spending for the following week to balance the books.

My Partner and I Have Very Different Spending Styles. How Can We Agree? #

This is probably the most common challenge, and the answer always comes down to communication. The goal isn’t for one person to “win” the argument; it’s to find a middle ground that respects both of your priorities.

A great strategy is to build separate “personal” food allowances into the budget. This is a small amount of cash for individual things—the fancy coffee one of you loves, a solo lunch out, or specific snacks. It gives each of you autonomy without derailing your shared goals.

When it comes to shared expenses like groceries, agree on the total number and let go of the small stuff. As long as the final receipt is under your limit, it’s a win. One of you might care more about organic produce while the other wants to splurge on high-quality coffee. Both can fit, as long as you work together to stay under that overall cap.

Ready to stop guessing and start building a financial plan that works for both of you? Econumo gives you the tools to create a shared budget, track your spending together, and hit your goals as a team. Try the live demo today and see how simple managing money as a couple can be.