Thinking about opening a joint bank account? It’s a big step, and it’s smart to weigh the convenience against the risks before you dive in. On one hand, a joint account can make things like paying bills and saving for shared goals much simpler. On the other, it means you’re both on the hook for any debts and you’ll give up a bit of financial privacy.

Getting a clear picture of the pros and cons is the only way to know if merging your finances is the right move for you.

What a Joint Bank Account Actually Means #

Before we get into the good and the bad, let’s break down what this thing really is. At its heart, a joint account is just a regular bank account that’s owned by two or more people. The key part is that every single person on the account has equal rights to put money in, take money out, and manage everything inside it.

A good analogy is a shared kitchen pantry. Both partners can stock it with groceries (deposits), and either one can grab what they need to make dinner for the household (withdrawals and payments). It’s a shared resource that makes handling common expenses like rent, utilities, and groceries a whole lot easier.

Understanding Co-Ownership and Access #

The most important feature to wrap your head around is equal ownership. It truly doesn’t matter if one person deposits 80% of the money and the other only puts in 20%—legally, both of you own 100% of what’s in there. This gives both of you full, independent access to the funds.

So, what does that mean in practice? It means either partner can:

- Make deposits with a check, direct deposit, or cash.

- Pull cash out from an ATM or a bank teller.

- Write checks or swipe the debit card for purchases.

- Set up automatic payments for all the shared household bills.

This kind of setup creates a central pot for all your shared finances, which really helps with transparency and teamwork. You can finally stop the endless “who paid for what?” conversation and make daily money management feel a lot less like a chore.

The Right of Survivorship Explained #

There’s another critical feature that comes with most joint accounts: the “right of survivorship.” It sounds like a stuffy legal term, but its meaning is simple and incredibly practical. If one of the account holders passes away, the surviving owner automatically gets full ownership of all the money in the account.

The funds completely bypass the probate court process, which can often be slow and complicated. This ensures the surviving partner has immediate access to cash for bills and other essential expenses. It’s a massive advantage for many people, but you should always double-check that your specific account includes this feature.

Getting these fundamentals down—co-ownership, equal access, and survivorship—is the foundation for figuring out if a joint bank account is the right financial tool for your relationship.

The Upside of Sharing a Bank Account #

Combining your finances with a partner is a big step, but it can be one of the most powerful moves you make in building a life together. The real beauty of a joint bank account lies in its ability to foster simplicity and teamwork, shifting the money conversation from “yours and mine” to just “ours.”

The most obvious win is pure convenience. Picture the end of the month without a shared account: you’re both digging through receipts, sending money back and forth, and trying to remember who paid for groceries versus the internet bill. It can get messy, fast.

A joint account acts as a central hub for all those shared expenses. Both of you can deposit your share, and the rent, utilities, and other bills get paid from that single pot. This one change can completely eliminate the tedious “who owes who” dance.

Stronger Finances, Stronger Relationship #

Beyond just making life easier, sharing an account can genuinely strengthen your relationship. When everything is out in the open—every deposit, every withdrawal—it forces you to have honest conversations about spending habits, priorities, and financial goals.

This isn’t about keeping tabs on each other. It’s about building a solid foundation of trust and transparency. You start operating as a true team, working toward the same things. For many couples, this shift is less about logistics and more about mindset.

The data backs this up. One study that followed newlywed couples over several years found that those who opened joint accounts reported higher levels of financial harmony and a more stable relationship over time. It seems that sharing an account can act as a buffer against common money-related stress.

Hit Your Big Goals, Faster #

A joint account can also put your long-term goals on the fast track. Whether you’re dreaming of a down payment on a house, a once-in-a-lifetime trip, or just a comfortable emergency fund, pooling your resources makes a huge difference.

Think about it in real-world terms:

- Saving for a House: Instead of two separate savings accounts inching along, a joint high-yield account lets you watch your combined progress soar. Seeing that number grow together is incredibly motivating.

- Tackling Debt: If one of you is laser-focused on paying down a student loan, the other can cover a larger portion of the household bills from the joint account. This frees up more of the first partner’s income to crush that debt.

- Investing as a Team: A joint brokerage account streamlines your investment strategy, letting you build a shared portfolio for retirement or other major life goals.

Before we go further, here’s a quick look at the main advantages.

Key Benefits of a Joint Bank Account at a Glance #

| Benefit | How It Helps Your Relationship | Practical Application |

|---|---|---|

| Simplicity | Reduces money-related arguments and blame. | One account for all shared bills like rent, utilities, and groceries. |

| Transparency | Builds trust through open access to all transactions. | Both partners can see spending habits and income in real-time. |

| Teamwork | Fosters a unified approach to financial goals. | Saving for big purchases like a car or a home becomes a shared effort. |

| Efficiency | Helps you reach financial milestones quicker. | Pooled resources can accelerate debt repayment or investment growth. |

This table shows how a joint account isn’t just a financial tool; it’s a relationship tool.

It’s also smart to remember that the legal side of a joint account matters. When you combine assets, they’re often viewed as equally owned, which can have significant implications, especially if you live in a community property state.

Key Takeaway: A joint account turns money management from a solo chore into a team sport. This shared financial space can simplify your daily life, deepen trust, and help you and your partner hit your biggest goals together, much more efficiently.

This collaborative spirit is at the heart of good financial planning. To learn more about setting up a system that works for both of you, take a look at our guide on https://econumo.com/posts/how-to-budget-as-a-couple/. With clear ground rules and open communication, a joint account can become one of the best tools for strengthening your finances and your partnership.

The Risks of Combining Your Finances #

While the convenience of a joint bank account is a big selling point, it’s crucial to walk in with your eyes wide open. Combining finances isn’t just about sharing money; it’s about sharing risk, responsibility, and even a little bit of your personal freedom. Let’s unpack the real-world cons.

One of the first things you’ll likely notice is a loss of financial autonomy. Every purchase, from your morning coffee to a surprise gift, is now visible to your partner. This total transparency can create friction, especially if you have different money philosophies—maybe one of you is a natural saver while the other enjoys spending more freely.

What starts as a minor question about a purchase can easily grow into resentment over time. This lack of privacy can make you feel like you’re constantly under a microscope, unable to make small, personal financial choices without feeling like you have to justify them.

The Dangers of Shared Liability #

The most significant risk, by far, is shared liability. In the eyes of the bank and the law, all the money in a joint account belongs equally to both owners. It doesn’t matter who actually deposited it. This simple fact means you are legally on the hook for your partner’s financial actions related to that account.

Imagine this: your partner writes a check for more than what’s in the account, causing an overdraft. Even if it was entirely their mistake, you are equally responsible for paying the fees and fixing the negative balance. The bank doesn’t care who messed up; they see two owners, and both are liable.

This shared responsibility extends to much more serious problems, too. If your partner has outstanding debts, creditors could potentially come after the funds in your joint account to settle them.

A creditor with a legal judgment against one partner can often garnish the entire account to satisfy a debt. It doesn’t matter if you deposited 90% of the money; legally, it’s all accessible.

This is a critical point to absorb. You could wake up one day to find your shared savings account emptied to pay off a debt you had no part in creating. Understanding these legal implications is vital, especially when you think about complex situations like property division during divorce.

Complicating Financial Independence #

The modern reality is that people are getting married later in life, and this highlights another key con. The average age for a first marriage has risen, which means many people enter a serious relationship with an already established financial life—their own savings, investments, and debts. For them, a full financial merger can feel less like a natural next step and more like an unnecessary complication.

Data from the U.S. Census Bureau backs this up. In 1996, 85% of married couples with financial assets held at least one joint account. By 2023, that number had dropped to 77%. Even more telling, the percentage of couples holding all their accounts jointly plummeted from 53% in 1996 to just 40% in 2023. It’s a clear trend toward maintaining some financial independence. You can dig into these financial trends in the U.S. Census Bureau survey results.

Potential for Messy Breakups #

And finally, if the relationship ends, a joint account can become a major battlefield. Since either partner can withdraw the entire balance at any time without the other’s permission, a messy breakup could lead to one person emptying the account in an instant. While you might have legal options to get the money back, the process is stressful, expensive, and emotionally draining.

Before you make a decision, think hard about these potential pitfalls:

- Unequal Power Dynamics: If one person earns significantly more, they might—consciously or not—start to exert more control over how the money is spent.

- Loss of a Financial Safety Net: Merging everything can leave you incredibly vulnerable if you need to leave the relationship, as you may not have separate funds to fall back on.

- Estate Planning Issues: If you have children from a previous relationship, the “right of survivorship” feature could unintentionally disinherit them. The account funds would automatically pass to your partner, bypassing your will.

Considering these serious drawbacks helps you make a more informed choice about whether the pros truly outweigh the very real cons.

Exploring Smarter Alternatives to Joint Accounts #

Jumping headfirst into a fully merged financial life isn’t the only option. For many couples, the all-or-nothing nature of a traditional joint account just doesn’t feel right. Thankfully, you don’t have to choose between total separation and a complete financial union. Modern approaches offer a healthy middle ground that balances teamwork with the financial independence you’ve worked hard to achieve.

These smarter strategies acknowledge a simple truth: financial harmony doesn’t mean giving up your personal autonomy. Instead, they give you a way to work together without taking on the heavy risks of shared liability or a complete loss of privacy.

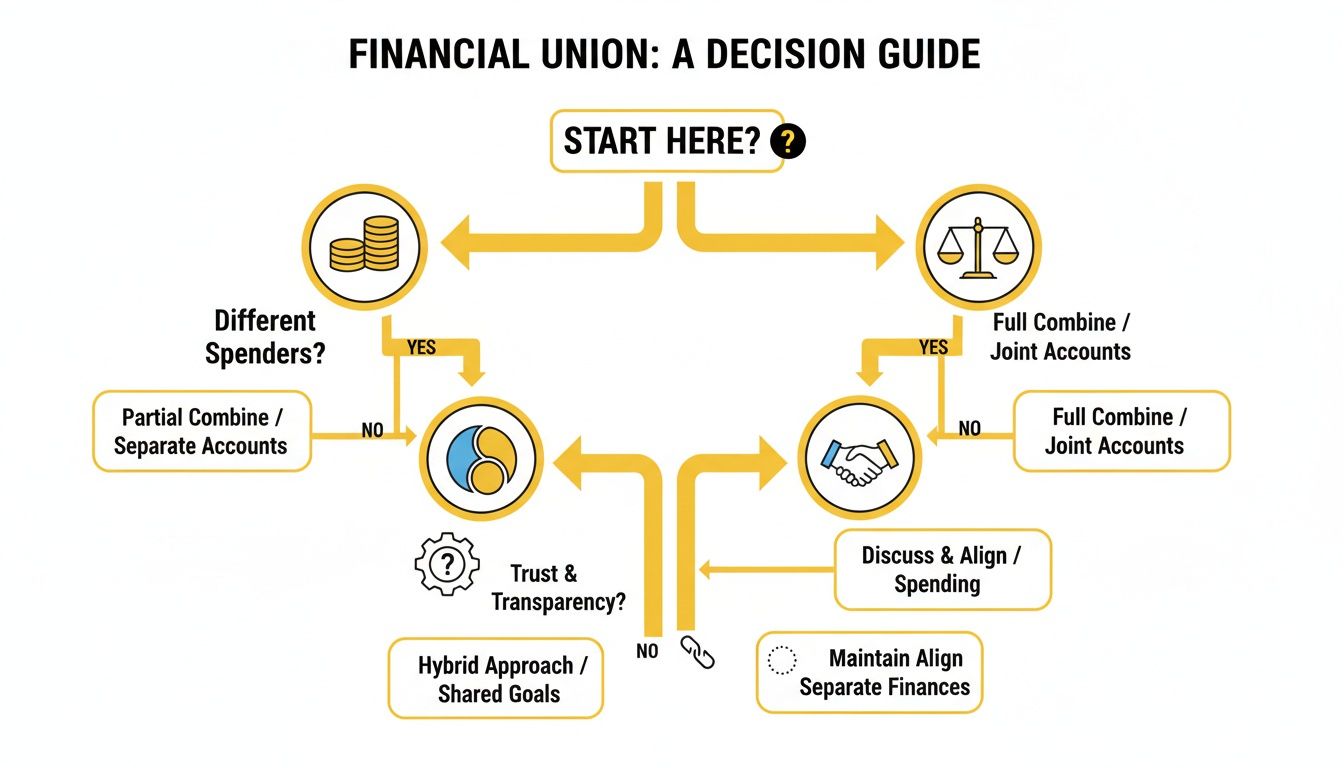

This flowchart can help you think through which path might be the best fit for your relationship’s unique financial style.

As you can see, a big part of the decision comes down to your spending habits. Are you perfectly in sync or financial opposites? Your answer will point you toward the right setup.

The Popular ‘Yours, Mine, and Ours’ Strategy #

One of the most effective and popular alternatives is the ‘yours, mine, and ours’ method. It’s a hybrid approach that really does offer the best of both worlds—you get to team up on shared goals while keeping your freedom for personal spending.

Here’s a simple breakdown of how it works:

- Your Account: You each hang on to your personal checking and savings accounts. This is where your paycheck lands and where you pay for individual expenses—things like your hobbies, grabbing lunch with friends, or buying a surprise gift for your partner.

- My Account: Your partner does the exact same thing with their own accounts. This little bit of separation is crucial for maintaining a sense of financial independence.

- Our Account: Then, you open one joint account together. This account becomes the central hub for all your shared responsibilities—rent or mortgage, utilities, groceries, and contributions to joint goals like a vacation fund.

Every payday, you both agree to transfer a set amount or a percentage of your income into the “ours” account. This automates your shared bills and savings, leaving the rest of your money for you to manage however you want.

This setup neatly sidesteps the biggest drawbacks of a fully joint account. It drastically cuts down on arguments over small personal purchases and shields your individual savings from your partner’s potential debts or spending habits.

The ‘yours, mine, and ours’ approach gives you transparency where it counts (household finances) and privacy where you need it (personal spending). It’s a financial system built on both trust and healthy boundaries.

Embracing Digital Tools for Collaboration #

Beyond just how you structure your bank accounts, a new wave of digital tools offers powerful ways to manage money together—often without needing a joint account at all. Shared budgeting apps, in particular, have become a huge help for couples wanting to stay on the same page.

Think of these platforms as a collaborative dashboard for your entire financial life. You can link all your different accounts (checking, savings, credit cards) to see a complete picture of your collective net worth, track spending in shared categories, and watch your progress toward big goals.

This is where a privacy-first tool like Econumo really shines. Instead of forcing you into a single, shared account, it provides the features you need for real financial teamwork, no matter how your bank accounts are set up.

Here are a few features that make it possible:

- Multi-User Support: Both you and your partner can log in to the same financial dashboard, making sure you’re always looking at the same numbers.

- Collaborative Budgeting: Create shared budget categories for things like “Groceries” or “Date Night” and track your combined spending as it happens.

- Privacy-Focused Self-Hosting: For the ultimate in security and control, Econumo lets you self-host your financial data. This means your sensitive information stays on your own server, a level of privacy you just won’t find with most cloud-based apps.

Tools like these give you the benefits of a joint account—like transparency and teamwork—without the built-in risks. You get a clear, unified view of your financial health while still keeping your own separate accounts.

If you’re looking for ways to organize your money as a team, you might find our deep dive into the best budget apps for families helpful. Ultimately, the right system is the one that fits your relationship, your communication style, and your shared dreams for the future.

How to Open, Manage, and Close a Joint Account #

So, you’ve weighed the pros and cons and decided a joint account is the right move. Great! But the work doesn’t stop there. Setting one up is one thing; making it work for your relationship is another.

Getting the mechanics right—from opening and managing to eventually closing the account—can save you from some serious headaches later on. Think of it like assembling furniture: the instructions are straightforward, but you have to keep tightening the bolts over time to make sure it doesn’t wobble and fall apart under pressure.

The Simple Steps to Opening Your Account #

Getting started is usually the easy part. While the exact requirements can differ a bit from bank to bank, you and your partner will generally need the same standard documents. Plan on visiting a branch together or sitting down to fill out an online application as a team.

Here’s a quick rundown of what you’ll almost certainly need:

- Proof of Identity: You’ll both need a government-issued photo ID. A driver’s license, passport, or state ID card works perfectly.

- Proof of Address: Grab a recent utility bill, your lease agreement, or a bank statement showing your current address. You’ll each need one.

- Personal Information: Be ready with your full names, dates of birth, and Social Security Numbers (or equivalent tax IDs).

- Initial Deposit: You’ll need a little cash to get the account started. This can be a transfer from another account, cash, or a check.

Once you’re approved, you’ll both get debit cards and online banking access. This is the perfect moment to pause, take a breath, and set some ground rules for how you’ll use this shared financial space.

Best Practices for Managing Your Joint Account #

If there’s one secret to successfully managing a joint account, it’s this: communicate, communicate, communicate. Without open and honest conversation, even the best of intentions can get lost in translation and lead to friction.

First, figure out how you’ll fund the account. Will you each put in a fixed amount every month? Or will you contribute a percentage of your incomes? A percentage-based plan often feels fairer, especially if one of you earns significantly more than the other.

Next, you need to talk about spending.

A fantastic strategy is to agree on a “discussion threshold.” For instance, you might decide any purchase over $100 from the joint account needs a quick heads-up first. This isn’t about asking for permission—it’s about staying transparent and respectful.

Finally, make “money dates” a regular thing. It could be a 20-minute chat every Sunday evening or a monthly review over dinner. Use this time to look at recent transactions, see how you’re tracking toward your savings goals, and tweak your budget if needed. Consistent check-ins keep you on the same page and stop small misunderstandings from becoming big problems. Getting your system in order is much easier with the right tools, and you can learn more about creating one with a home finance and bill organizer.

Navigating the Process of Closing an Account #

Closing a joint account requires just as much care as opening it, especially if it’s happening because of a breakup. Since you both have equal rights to the money, you have to handle it together to ensure a clean, fair split. Whatever you do, don’t just drain the account—that’s a surefire way to create a legal and financial mess.

The first step is for both of you to agree to close it. The ideal scenario is going to the bank together to sign the closing documents. If that’s not possible, call your bank to find out their specific process for when one partner can’t be there.

Before you officially close it, make sure all automatic payments and direct deposits have been moved to your separate accounts. Then, agree on how to divide whatever money is left. A 50/50 split is common, but you might agree to something different based on who contributed what. It’s always a good idea to put that agreement in writing. Taking these steps protects both of you and makes a difficult process a little smoother.

A Few Common Questions We Hear All the Time #

When you start digging into the pros and cons of joint bank accounts, a few big questions almost always pop up. These aren’t just minor details—the answers can have huge legal and financial ripple effects on your life.

Let’s walk through the most common questions people ask, because getting clear on these scenarios is crucial before you decide to merge your finances.

What Happens to the Account if One Person Passes Away? #

This is easily one of the most important questions, and the answer is actually one of the biggest selling points for a joint account. Most of them come with something called the “right of survivorship.” It sounds like a stuffy legal term, but what it means in the real world is simple and powerful.

When one account holder dies, the surviving partner automatically becomes the sole owner of every penny in that account. The money is usually accessible right away, completely bypassing the long, often expensive court process known as probate.

This can be a lifesaver during an incredibly tough time. The survivor can keep paying the mortgage, cover bills, and handle immediate expenses without being locked out of their funds. Just be sure to double-check with your bank that the “right of survivorship” is specifically included when you open the account, as it’s not always a given.

Can a Creditor Take Money from the Account for My Partner’s Debt? #

Yes, they absolutely can. This is, without a doubt, the single biggest risk of sharing a joint account. Because you both have equal and total ownership of all the funds, a creditor with a court judgment against just one of you can often drain the entire account to settle that person’s debt.

It doesn’t matter who put the money in. If you deposited 90% of the cash and your partner only put in 10%, a creditor chasing your partner’s debt could legally take 100% of it. In the eyes of the law and the bank, it’s all one pot of money.

This is exactly why you must have a brutally honest conversation about each other’s full financial picture—outstanding loans, credit card debt, potential lawsuits—before you even think about linking your finances. A surprise in this area can be financially devastating.

Are There Tax Problems if I Add Someone to My Account? #

For most people, simply adding a name to your bank account isn’t a taxable event. The government doesn’t view it as a gift right then and there. A “gift” is only considered to have happened when the person who didn’t deposit the money withdraws some for their own personal use.

As long as those withdrawals stay under the annual federal gift tax exclusion limit, you’re usually in the clear. That limit is pretty generous—for 2024, it’s $18,000 per person.

Of course, if you’re dealing with really large sums of money or have a complicated financial life, it’s always smart to have a quick chat with a tax professional. They can give you advice that fits your exact situation and help you steer clear of any unexpected tax bills.

Should an Unmarried Couple Bother with a Joint Account? #

Unmarried couples can absolutely open a joint account, but you need to go into it with a bit more planning. The legal protections that automatically apply to married couples during a divorce simply don’t exist for unmarried partners who split up.

If the relationship ends, figuring out who gets what from the joint account can get messy and emotional, fast. Without a legal framework to fall back on, it can easily turn into a nasty fight that might even land you in court.

To protect yourselves, it’s a great idea to draft a simple cohabitation agreement before you open the account. This is just a written document that clearly lays out the rules of the road:

- How will money go into the account? (e.g., what percentage each of you contributes).

- What will the money be used for? (e.g., rent, groceries, saving for a trip).

- How will you split what’s left if you break up?

Putting it all in writing gives you both clarity and a legal safety net. It’s a practical step that can save you from a world of financial and emotional pain if things don’t work out.

Managing shared finances effectively requires the right tools and a commitment to transparency. Whether you choose a joint account, a hybrid approach, or separate finances, Econumo provides the flexibility to match your style. With multi-user support, collaborative budgeting, and privacy-first self-hosting options, you can build a financial system that strengthens your partnership. Take control of your money together by exploring the live demo or joining the waiting list.