Sending money across borders can feel like a maze, but it doesn’t have to be. This guide offers a straightforward international money transfer comparison, breaking down the smoke and mirrors of exchange rates, hidden fees, and transfer speeds. I’ll walk you through the process so you can confidently choose the right service, whether you’re supporting family back home, managing business abroad, or just paying for a vacation rental.

Finding the Best Way to Send Money Abroad #

Choosing the right way to send money internationally is all about balancing cost, speed, and simple convenience. The best service for a large, one-time payment to a supplier is probably the worst choice for sending small, regular amounts to a loved one. The first step is getting to know the key players and what they’re actually good at.

This guide will break down your main options, putting them head-to-head. We’ll look at everything from the old-school systems of traditional banks to the nimble platforms of modern fintech services. The goal is to give you a clear framework you can use to size up any provider you come across.

Your Primary Transfer Options #

The market for sending money is dominated by a few types of services, and each one has its own pricing quirks and ideal use case. With global remittances hitting a record $818 billion in 2023, it’s clear these services are a financial lifeline for millions. This explosion in cross-border payments, detailed in trends from federalreserve.gov, just underscores the growing need for better, cheaper ways to move money.

- Traditional Banks: They feel familiar and secure, but they’re often the most expensive route. You’ll typically pay for that comfort with high fees and uncompetitive exchange rates.

- Specialist Fintech Services: Companies like Wise (which used to be TransferWise) or Remitly built their businesses on transparent pricing, much better exchange rates, and faster delivery times.

- Digital Wallets & P2P: Services like PayPal or its Xoom service are great for instant transfers, but their fee structures can get complicated, especially when converting currencies.

The real trick in any international money transfer comparison is to look right past the ads promising “zero fees.” The true cost is almost always tucked away in the exchange rate markup—the gap between the rate they give you and the real, mid-market rate you see on Google.

To stay on top of your finances, you have to track these transfers properly. Using open-source personal finance software helps you log the exact amounts sent and received, giving you a crystal-clear picture of what each transfer truly cost you.

| Feature | Traditional Banks | Fintech Specialists | Digital Wallets |

|---|---|---|---|

| Best For | Large, infrequent transfers where security is the absolute top priority. | Most everyday situations, from personal remittances to paying freelancers. | Instant, smaller transfers between two people who both have accounts. |

| Typical Speed | 3-5 business days | Same day to 2 days | Instant to a few hours |

| Cost Structure | High fixed fees + significant FX markup | Low, transparent fees + minimal FX markup | Variable fees, often higher for currency conversion |

Understanding the True Cost of Your Transfer #

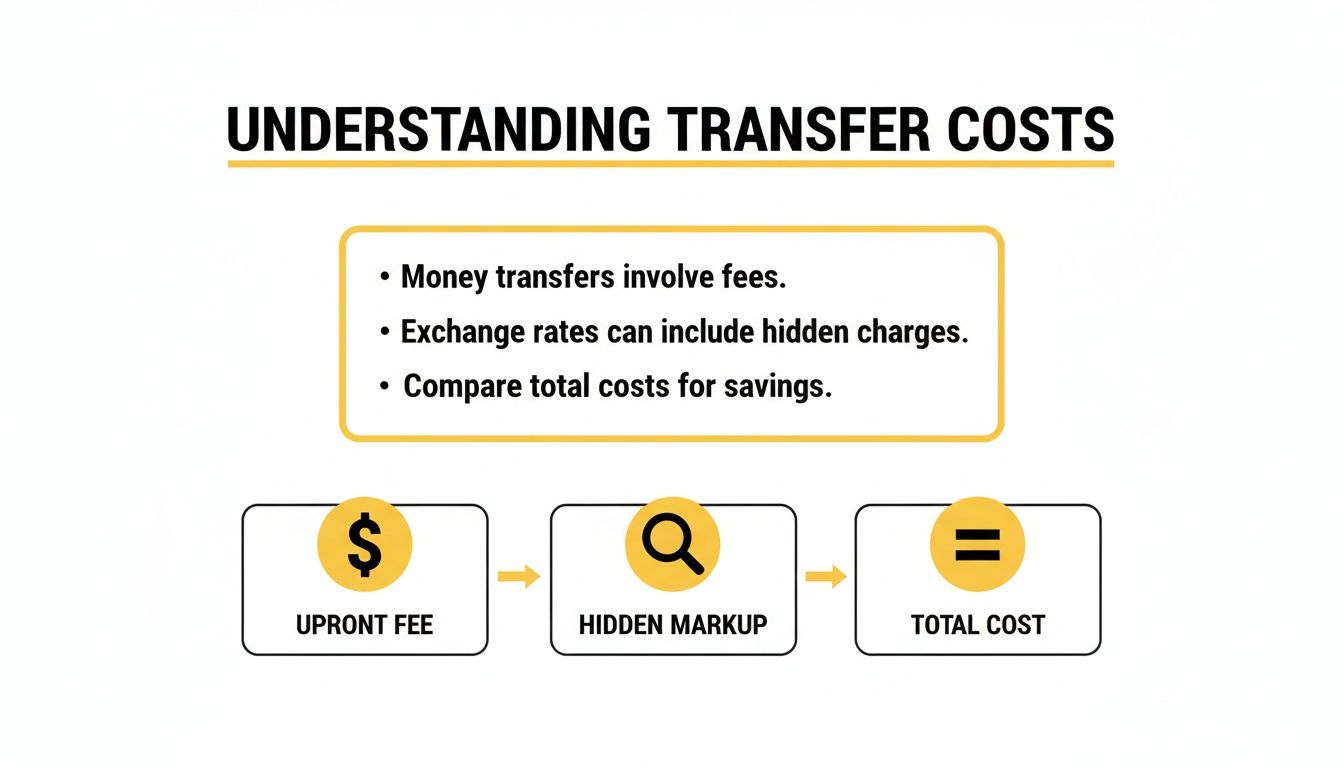

When you’re comparing ways to send money abroad, the number you see advertised as the “fee” is almost never the full story. To really know what you’re paying, you have to look deeper. The real cost is actually made up of two different parts, and together they determine how much of your money actually makes it to the other side.

The first part is the upfront transfer fee. This is the one they tell you about—a flat fee like $4.99 or a small percentage of what you’re sending. You’ll often see services advertising “zero fee” transfers, but don’t be fooled. That’s usually a marketing trick, and it just means they’re making their money in a less obvious way.

That brings us to the second, and usually much bigger, cost: the exchange rate markup. This is the hidden fee. It’s the gap between the exchange rate they offer you and the real one you see on Google or Reuters, known as the mid-market rate. The mid-market rate is the true, wholesale price of a currency, and anything less than that is a cut the provider is taking for themselves.

Uncovering the Hidden Markup #

Providers build their profit into the exchange rate they give you. They get a much better rate on the wholesale market and then offer you a slightly worse one. That difference, or “spread,” is pure profit for them and a direct cost to you. Even a tiny-looking markup of 1-2% can take a serious bite out of your transfer, especially if you’re sending a large amount.

The real challenge when comparing services isn’t about finding the lowest fee. It’s about looking past the ads to figure out the total cost. A service with a $10 fee but a great exchange rate can easily be cheaper than a “zero fee” service with a bad one.

This is why just comparing upfront fees will lead you astray. These combined costs are still stubbornly high across the board. In early 2025, the global average cost to send money home was still around 6.49% of the amount sent—more than double the G20’s target of 3%. You can read more about these global remittance costs on fxcintel.com.

How to Calculate Your Total Cost #

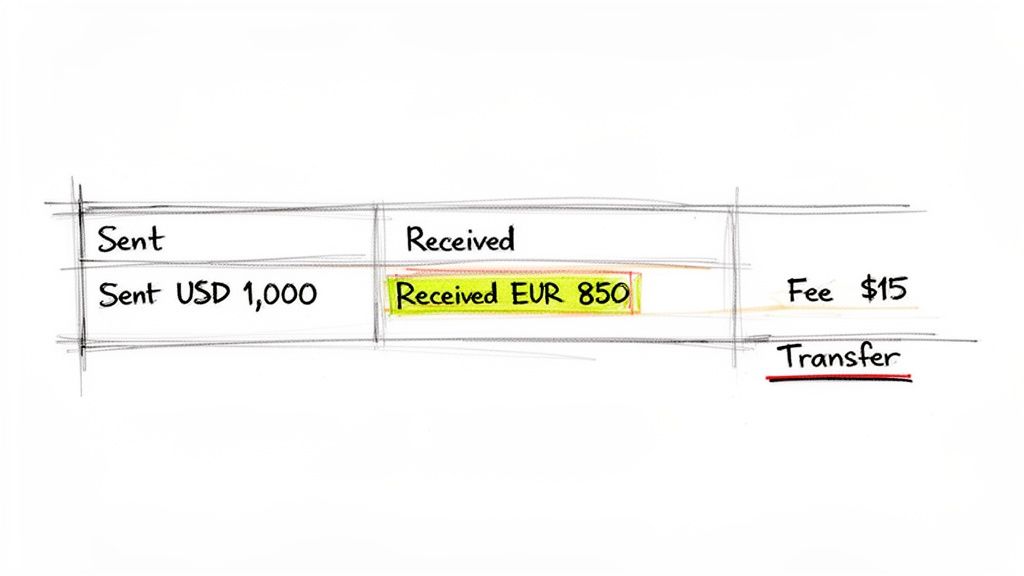

Figuring out what you’re really paying is actually pretty simple. Once you know how, you can cut through the marketing noise and see the true numbers for yourself. It just takes three quick steps.

- Find the mid-market rate: Before you do anything else, check a neutral source like Google or XE.com for the real-time exchange rate for your currencies (say, USD to EUR).

- Get a quote from the provider: Go to the provider’s site and plug in your transfer details. They’ll show you the exchange rate they’re offering and the final amount your recipient will get after all fees.

- Calculate the difference: Now, compare the amount your recipient would get using the mid-market rate versus what the provider is actually sending. That difference is your total, all-in cost.

Let’s walk through a quick example to see it in action.

Scenario: Sending $1,000 from the US to Europe

- Mid-Market Rate: Let’s say 1 USD = 0.93 EUR. At this rate, $1,000 should equal €930.

- Provider A (Your Bank): Charges a $25 fee and gives you a rate of 1 USD = 0.90 EUR. Your recipient gets €877.50. The total cost to you is $56.45.

- Provider B (A Fintech Specialist): Charges a $5 fee and gives you a much better rate of 1 USD = 0.92 EUR. Your recipient gets €915.80. The total cost is just $15.27.

In this scenario, Provider B is over $41 cheaper, even though you started with the same $1,000. Keeping track of these costs is crucial for accurate budgeting, and learning how to properly handle managing income and expenses in multiple currencies will help keep your finances crystal clear.

Comparing Your International Transfer Options #

Okay, so you now know how to spot the real cost of a transfer. It’s time to put that skill to use. When you’re comparing ways to send money internationally, it helps to think less about specific brand names and more about the type of service you’re using. The three big players are your traditional bank, a specialist fintech company, or a digital wallet.

Each one is built on a totally different business model, and that directly affects how much you’ll pay, how fast your money gets there, and what the whole experience feels like. Grasping this framework makes it so much easier to size up any new service you come across.

This image really breaks down where your money goes, showing you the obvious upfront fee and the not-so-obvious markup hidden in the exchange rate.

Remembering that the total cost is a mix of both is your secret weapon against misleading “zero-fee” ads.

To give you a quick lay of the land, here’s a simple breakdown of how these methods stack up against each other.

At-a-Glance International Transfer Method Comparison #

| Transfer Method | Best For | Typical Speed | Cost Structure | Security Level |

|---|---|---|---|---|

| Traditional Banks | Very large, one-off transfers where security is the top priority. | 3-5 business days | High flat fees ($25-$50) + large FX markup (3-5%). | Very High |

| Specialist Fintechs | Most everyday transfers; sending money to family, paying freelancers. | A few hours to 2 days | Low, transparent fees + minimal FX markup (<1%). | High |

| Digital Wallets | Instant, small P2P payments where speed trumps cost. | Instantaneous | Complex fees + often high FX markups (2.5-4%). | High |

This table is just a starting point. The right choice really depends on what you’re trying to do, so let’s dig into the details for each.

Traditional Banks: The Familiar and Secure Route #

For most people, their own bank is the first place they think of for sending money abroad. It feels safe and convenient because it’s the same institution that handles your mortgage and checking account. Banks rely on the SWIFT network, a system that’s been the plumbing of international finance for decades.

That long-established infrastructure is what gives you a solid sense of security. You’ve got a branch you can walk into and a customer service number you already know. But that legacy system is also its greatest weakness—it’s incredibly slow and expensive by modern standards.

A wire transfer through a bank can easily take 3-5 business days because your money has to hop between several intermediary banks, and each one might skim a little off the top. On top of that, banks are notorious for offering terrible exchange rates. You can expect a markup of 3-5% over the real rate, plus a hefty flat fee of $25 to $50.

The Bottom Line: Banks are all about perceived security. They’re really only the best option for moving massive, six-figure sums where their high transfer limits are a necessity. For those critical, high-value transfers, some people are willing to pay a premium for the peace of mind that comes with a global financial institution.

For anything smaller or more frequent, though, those costs are just too high to justify.

Specialized Fintech Services: The Modern Challenger #

In the last ten years, companies like Wise and Remitly have completely turned this industry on its head. They were built specifically to fix the problems with the old banking system, and their whole game is about transparency and lower costs.

These services give you an exchange rate that’s much, much closer to the mid-market rate you see on Google, often with a markup of less than 1%. Their fees are also crystal clear—usually a small fixed fee and a tiny percentage of the amount you’re sending. You know exactly what you’re paying before you commit.

They’re also way faster. Instead of using the clunky SWIFT system, they have a network of local bank accounts. This clever workaround means they can often get your money to its destination on the same day, sometimes even within a few hours.

And honestly, the user experience is just better. Their apps are clean, simple, and a world away from the confusing online portals of most banks. You can set up and send a transfer from your phone in a few minutes.

The Bottom Line: Fintechs win on transparency and efficiency. They took one specific service—international transfers—and perfected it. Their entire business is built on showing you the real cost, which is a direct attack on the hidden fees that banks have relied on for years.

These services are the go-to choice for almost everyone. Whether you’re sending money home to family, paying bills overseas, or managing life as an expat, their mix of low cost, speed, and ease of use is hard to beat for personal transfers under $10,000.

Digital Wallets: The Speed Champions #

Then you have digital wallets like PayPal or Skrill. These services are in a different category altogether, focusing on instant peer-to-peer (P2P) payments. Their absolute biggest strength is speed. If you and the person you’re paying both have a PayPal account, the money can move between you instantly, any time of day.

This is perfect for things like splitting a dinner bill with a friend overseas or sending a quick cash gift. Nothing beats the convenience of sending money with just an email address.

But—and it’s a big but—this convenience often comes with a confusing and expensive fee structure, especially when you’re converting currencies. A “friends and family” transfer in the same currency might be free, but an international one can get hit with both a fixed fee and an exchange rate markup that can be even worse than a bank’s.

The key is to understand what they are: payment networks, not dedicated money transfer services. Their system is built for instant digital transactions, not for giving you the best deal on currency exchange. The final cost can be a bit of a lottery, changing based on the countries, currencies, and even how you fund the transfer.

This digital-first approach is massively popular. The global volume of cross-border payments hit roughly $1 quadrillion in 2024, and a huge chunk of that is moving through these digital channels. It’s no wonder that 67% of people now prefer using apps for speed and security. As this trend grows, keeping control of your own financial data is more important than ever, which is where a self-hosted app like Econumo comes in handy. For more on this, you can check out some fascinating insights into 2025 payment trends on jpmorgan.com.

Which Transfer Service Is Right for You? #

Choosing an international money transfer service isn’t a one-size-fits-all deal. It’s really about matching the right tool to your specific situation. What works for a freelancer paying an invoice is completely different from what a family needs to send support home.

The best way to figure this out is to walk through a few real-world examples. Forget generic feature lists for a moment. Instead, let’s look at how different priorities—cost, speed, convenience—steer you toward very different solutions.

We’ll break down three common scenarios to show you how to think through the decision-making process for yourself.

Scenario 1: The Expat Managing Shared Bills #

Picture this: you’re an expat living in Germany, but you still split a mortgage and a few subscriptions with your partner back in the United States. Every month, like clockwork, you need to send $1,500 to their US bank account. Your main goal here is simple: keep costs low and predictable.

Speed isn’t the priority since the bills are on a set schedule. What you really care about are low, transparent fees and a great exchange rate. You want to avoid any nasty surprises, like hidden markups that nibble away at the total amount your partner receives.

A traditional bank wire would be a terrible choice. You’d get hit with a high flat fee (often around $40) and a mediocre exchange rate, a costly double-whammy that adds up over time. Digital wallets aren’t a great fit either; they’re fast, but their exchange rate markups on larger, recurring payments can be surprisingly high.

Recommendation: A specialized fintech service like Wise or OFX is the clear winner here. Their entire business model is built for this. You’ll get a minimal markup on the exchange rate and a clear, upfront fee, ensuring your partner gets a consistent amount every single time. It’s hands-down the most cost-effective way to handle regular, planned transfers.

Scenario 2: The Family Member Sending Support Home #

Now, let’s think about someone sending $200 home every couple of weeks to support their family. The payments are small but frequent, and reliability is everything. This money might be for daily essentials, so getting it there on time and with as few fees as possible is crucial.

For small, regular remittances like this, high flat fees are a killer. A $30 wire transfer fee from a bank would eat up 15% of the money before you even factor in the exchange rate. That makes traditional banks completely impractical.

Here, the mission is to find the service with the absolute lowest cost structure for smaller amounts. You need to look past the advertised fee and compare the final amount the recipient will get. Some services might waive a fee but then make up for it with a less favorable exchange rate. This is where doing a quick international money transfer comparison before each transfer really pays off.

For recurring family support, every dollar counts. The goal is to find a service that combines low percentage-based fees with a competitive exchange rate, ensuring the maximum value reaches your loved ones with every single transfer.

Recommendation: Again, a specialized fintech service that focuses on remittances is your best bet. Providers like Remitly or WorldRemit are designed for exactly this purpose. They offer competitive rates on smaller transfers and have flexible delivery options, including cash pickup, which can be a lifesaver for some recipients. Their fee structures are just much better suited for frequent, low-value payments.

Scenario 3: The Business Owner Paying Invoices #

Finally, imagine you’re a freelancer or remote business owner who needs to pay an international contractor’s $5,000 invoice. The game changes again. Cost is still important, but now professionalism, speed, and business features enter the picture.

A three-to-five-day wait for a bank wire might be too slow and could strain a professional relationship. You might also need a service that can connect to your accounting software or handle batch payments to multiple contractors. This isn’t just a personal transfer; it’s a business transaction.

Many people default to digital wallets like PayPal for this, but the fees on a $5,000 payment can be steep, and their exchange rates aren’t always the best. You need a solution that balances speed and cost while providing a smooth, professional experience for everyone involved.

Recommendation: A specialized fintech service with a business account is the ideal choice. Platforms like Wise Business offer the same low costs and incredible speed as their personal accounts but layer on features built for commerce. This gives you fast, affordable transfers along with the tools you need to manage your international payments like a pro.

How to Track Your International Transfers #

Picking the right transfer service is only half the job. If you really want to get a handle on your global finances, you have to track every single transfer accurately. The problem is, automated bank feeds often stumble when dealing with multiple currencies, leaving your budget a complete mess.

This is where a little manual effort goes a long way. By taking a minute to log the details yourself, you get a perfectly clear picture of what each transfer really cost you. It’s a simple habit that makes all the difference when you’re managing money across borders.

Why Bother With Manual Entry? #

When you log a transfer by hand, you’re forced to look at the real numbers. It’s no longer just an abstract transaction—you see the exact fees and the bite the exchange rate took out of your money. It’s this kind of financial mindfulness that keeps you honest and helps you make better choices next time.

Over time, you’ll build up an invaluable record of your transfer history. You can easily glance back and see which providers gave you the best deal for different amounts and destinations, making your next international money transfer comparison that much easier.

Manually recording each transfer turns you from a passive observer into the active manager of your own money. It’s the single best way to see the true, all-in cost of moving funds, ensuring no hidden fee or rate markup slips by unnoticed.

This kind of detailed tracking is fundamental for anyone serious about budgeting. For a deeper dive, you can learn more about the best practices for handling multi-currency budgeting on our documentation page.

How to Record a Transfer in Econumo #

Using a budgeting app like Econumo makes this process a breeze. The goal is to create a transaction that captures two things: the money that moved between accounts and the separate cost of the transfer itself.

Here’s a simple breakdown of how to do it:

- Start a New Transfer: Inside the app, choose the “Transfer” transaction type.

- Pick Your Accounts: Select the account the money left (e.g., “US Checking - USD”) and the one where it arrived (e.g., “German Savings - EUR”).

- Enter Both Amounts: This is the most important part. In the “Sent” field, put the exact amount that left your account ($1,000 USD). In the “Received” field, enter the exact amount that landed in the other account (€920 EUR). The app automatically calculates the effective exchange rate for you.

- Log the Fee Separately: Now, create a second entry—this time an “Expense.” Label it “Bank Fees” or “Transfer Fees” and enter the fee you paid (e.g., $5.00).

This two-step process keeps your records pristine. By splitting out the fee, you prevent transfer costs from accidentally inflating your other spending categories, giving you a much more accurate view of your budget.

Got Questions? We’ve Got Answers #

Even with all this info, you might still have a few things on your mind. Let’s tackle some of the most common questions people have when sending money abroad. Think of this as a quick-reference guide to help you feel completely confident in your choice.

What’s the Actual Cheapest Way to Send Money? #

Here’s the honest truth: there’s no single “cheapest” service that wins every time. The best deal is a moving target that depends entirely on your specific situation—how much you’re sending, the currency pair, where it’s headed, and how fast you need it there.

That said, for most everyday personal transfers, like sending a few hundred or a couple of thousand dollars to family, specialized fintech services are consistently the best value. Their low, upfront fees and exchange rates that hug the real mid-market rate almost always beat the pants off what traditional banks offer.

The real trick is to stop thinking about just the advertised fee and start looking at the total cost. A “zero fee” transfer can easily cost you more than a transfer with a $5 fee if the exchange rate has a big markup hidden inside.

To find the true cheapest option, you have to compare the final amount your recipient will actually get in their account.

How Can I Be Sure My Money Is Safe? #

Sending money across borders can feel a little nerve-wracking, I get it. But modern digital transfer services are built with serious security, often even stronger than the old-school systems. When you’re checking out a provider, keep an eye out for a few key trust signals.

The big one is regulatory compliance. Any legitimate service will be licensed and monitored by government financial authorities.

- In the United States, look for registration with FinCEN (Financial Crimes Enforcement Network).

- Over in the United Kingdom, they need to be authorized by the FCA (Financial Conduct Authority).

- In Europe, they should be regulated by a national bank or a similar authority within the EU.

These aren’t just fancy acronyms; these agencies enforce strict rules on how your money and data are protected. On top of that, look for standard digital security features.

- Two-Factor Authentication (2FA): This is a must. It adds a critical layer of protection by requiring a code from your phone to access your account.

- SSL Encryption: Make sure their website and app use strong encryption to protect your info—just look for that little padlock icon in your browser’s address bar.

Stick with a regulated service that has these features, and you can rest easy knowing your money is being handled with the same level of care you’d expect from your main bank.

How Long Does an International Transfer Really Take? #

This one varies wildly. A transfer can take anywhere from a few seconds to a full week, so it’s important to match the service to your level of urgency.

Traditional bank wires that use the old SWIFT network are the snails in this race. Because the money has to hop between several intermediary banks, these transfers usually take 3-5 business days to land, and sometimes even longer if you hit a weekend or holiday.

Specialized fintech services are a world apart. They get around the clunky SWIFT system by using their own networks of local bank accounts. Because of this, most of their transfers are done within a few hours to two business days, and it’s not uncommon for them to arrive on the same day.

Then you have the speed demons: digital wallets like PayPal. If you and your recipient both have an account, the money can move between you instantaneously. But that speed usually comes with a price tag in the form of higher fees or not-so-great exchange rates. It’s the classic trade-off: do you need it cheap, or do you need it now?

Ready to get a real handle on your cross-border finances? With Econumo, you can manually track every international transfer, log multi-currency transactions with precision, and see the true cost of fees and exchange rates. Start building mindful spending habits and achieve perfect clarity in your budget by trying our live demo at https://econumo.com today.