Getting a handle on your money really just comes down to one thing: the relationship between your income and expenses. It’s a simple idea. Income is what comes in, and expenses are what goes out. The whole game of financial wellness is just making sure more money is coming in than going out, consistently.

The Foundation of Financial Wellness #

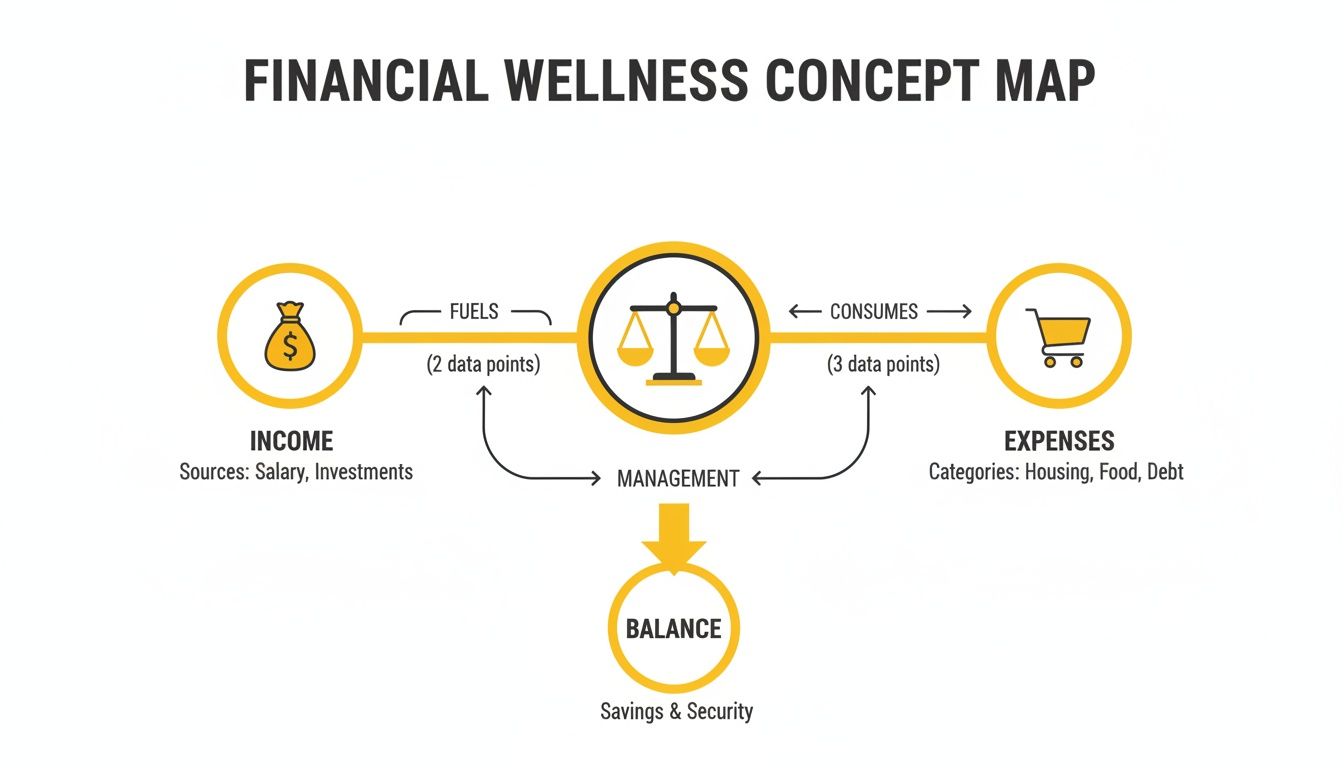

Picture your finances as an old-school balancing scale. On one side, you’ve got all the money flowing into your life—your income. On the other, you have everything you spend money on—your expenses. The goal is to keep the income side tipped down, creating a healthy surplus that you can use to save, invest, and build a secure future.

It helps to think of your household like a small business. For a business to succeed, its revenue has to be higher than its costs. It’s the exact same principle for your personal finances. This simple balance is the absolute bedrock of financial stability.

Why This Balance Matters #

Keeping track of your income and expenses isn’t just about spreadsheets and numbers; it’s about taking back control. Without a clear picture of where your money is going, you’re flying blind. You might be earning a decent paycheck but find yourself wondering where it all disappeared by the end of the month.

Understanding this flow of money helps you answer the big questions:

- Can we actually afford that vacation this year?

- Are we putting away enough for retirement?

- How fast can we realistically pay off our debt?

The answers are always found in the gap between what you earn and what you spend.

To give you a clearer picture, this quick table breaks down the fundamental differences between income and expenses.

Income vs Expenses At a Glance #

| Characteristic | Income | Expenses |

|---|---|---|

| Flow of Money | Money coming into your accounts | Money going out of your accounts |

| Financial Impact | Increases your net worth and resources | Decreases your net worth and resources |

| Primary Goal | To maximize and grow | To manage and optimize |

| Common Examples | Salary, bonuses, side hustle earnings | Rent, groceries, utility bills, travel |

This simple breakdown reinforces that financial health isn’t about how much you earn, but how well you manage the relationship between the two.

The concept map below shows this visually, illustrating how managing the balance between what comes in and what goes out is the key to security.

This visual drives home the point: true financial wellness is all about how you manage the flow of money in your life.

Calculating Your Net Income #

The single most important number you need to know is your net income. This is what’s left after you subtract all your expenses from your total income for a given period. Think of it as your personal “profit.”

A positive net income means you have a surplus. That’s extra cash you can use to build savings, crush debt ahead of schedule, or invest for the future. A negative net income, however, means you have a deficit—you’re spending more than you earn and probably digging yourself into debt.

Knowing this number is empowering. It turns that vague, nagging financial stress into a clear, concrete metric you can actually work with. It’s the starting point for building a budget that truly fits your life and helps you reach your goals.

Identifying Your Income Sources #

When you hear the word “income,” what’s the first thing that comes to mind? For most of us, it’s the paycheck from our 9-to-5 job. And while that’s a huge piece of the puzzle, it’s rarely the only piece. To get a true handle on your finances, you need to account for every dollar coming in the door.

Think of it like this: your household income is a big river. Your main salary is the powerful current, but there are smaller streams feeding into it—a freelance project here, a side hustle there, maybe some investment returns. If you only pay attention to the main current, you’re missing the full picture of your financial power.

Gross Pay vs Net Pay #

One of the first things to get straight is the difference between gross pay and net pay. It’s a simple concept, but one that trips up a lot of people. Gross pay is the big, exciting number on your job offer—your total earnings before anything is taken out.

But the number that actually matters for your day-to-day life is your net pay. This is what we call your take-home pay; it’s the cash that actually hits your bank account after taxes, insurance, and retirement contributions have been deducted.

Key Takeaway: Always, always build your budget around your net income. Using your gross pay is a classic mistake that sets you up for overspending because it’s based on money you never actually get to touch.

When you work with your net income, you’re working with reality. That’s the foundation of any solid financial plan.

Common Income Sources to Track #

Getting a complete view of your money means looking beyond a single salary. This is especially true if you’re managing finances as a couple or family, where multiple income streams are often in the mix. Your first step is to simply list them all out.

You might be surprised by what you find. Common sources include:

- Primary Salary: Your main paycheck from full-time or part-time work.

- Side Hustle Earnings: Money from driving for a rideshare, delivering food, or tutoring.

- Freelance Gigs: Payments for project work like writing, web design, or consulting.

- Investment Returns: Dividends from stocks, interest from a savings account, or profits from selling an asset.

- Rental Income: Cash you collect from a rental property.

Knowing all these numbers is more important than ever. In the United States, real median household income has been pretty stagnant, showing no significant change from pre-pandemic levels after you account for inflation. You can dig into the specifics with these household income findings on census.gov.

This reality check just goes to show why every single dollar from every single source matters. When you identify all your financial inflows, you get a clear, honest view of your resources, which is the first step toward making smarter decisions with your money.

Understanding Where Your Money Goes #

Does your paycheck ever feel like it’s performing a disappearing act? One minute it’s in your account, and the next, poof—it’s gone. You’re left scratching your head, wondering where it all went. The key to solving this little mystery is to start categorizing your spending. When you do, that jumble of transactions starts to tell a clear story about your financial habits. It’s the first step to regaining control.

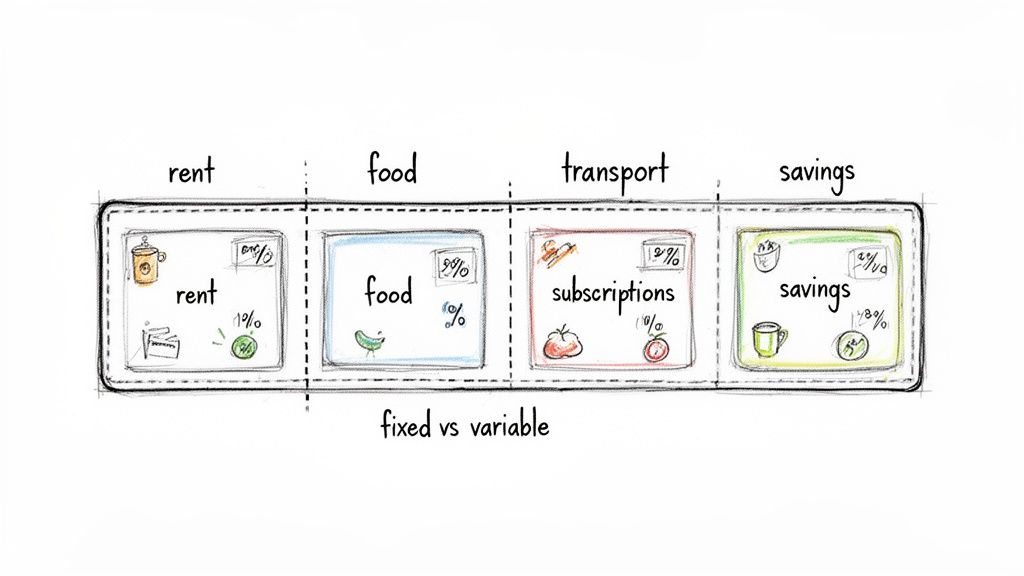

Think of it like sorting your money into different buckets—housing, food, transport, and so on, just like in the drawing above. This simple act of sorting is the foundation of a budget that actually works for you and reflects your real-life priorities.

The easiest way to get started is to separate your income and expenses into two main camps: fixed and variable. This one distinction can bring a surprising amount of clarity to your financial picture, right from the get-go.

Fixed vs Variable Expenses #

Fixed expenses are those predictable, recurring bills that hit your account for the same amount month after month. They’re the non-negotiables, the financial anchors that form the backbone of your budget.

- Rent or Mortgage: The big one—your monthly housing payment.

- Car Payment: That consistent amount you owe on your auto loan.

- Insurance Premiums: Predictable costs for health, auto, or life insurance.

- Subscription Services: Think Netflix, your gym membership, or software subscriptions.

Then you have variable expenses, which are the costs that dance around from one month to the next. This is where your day-to-day choices make the biggest difference and where you have the most room to cut back and save.

- Groceries: Your bill can swing wildly depending on what you’re cooking or where you shop.

- Dining Out: Those coffee runs, work lunches, and weekend dinners all add up.

- Utilities: Electricity and water bills often change depending on the season and your usage.

- Entertainment: Movie tickets, concerts, hobbies—all the fun stuff.

If you’re looking for more ideas on how to organize your spending, check out our comprehensive list of household expenses. It’s a great starting point for building out your own categories.

Distinguishing Needs from Wants #

Okay, once you’ve got your spending sorted, the next layer is to separate your needs from your wants. A need is something absolutely essential for your survival and well-being—think housing, basic food, and healthcare. A want is something that makes life more enjoyable but isn’t strictly necessary, like a daily latte or the newest smartphone.

Separating needs from wants isn’t about depriving yourself. It’s about empowering yourself. It shows you exactly where you can trim the fat without sacrificing your stability, freeing up money for bigger goals like crushing debt or saving for a down payment.

For families, this exercise is especially powerful. Childcare is a need, but a subscription box of premium organic snacks is probably a want. A reliable car to get to work? A need. A luxury SUV with all the bells and whistles? A want. Making these distinctions helps you spend more mindfully and build a solid financial plan that truly serves your family’s long-term goals.

How to Track Your Income and Expenses #

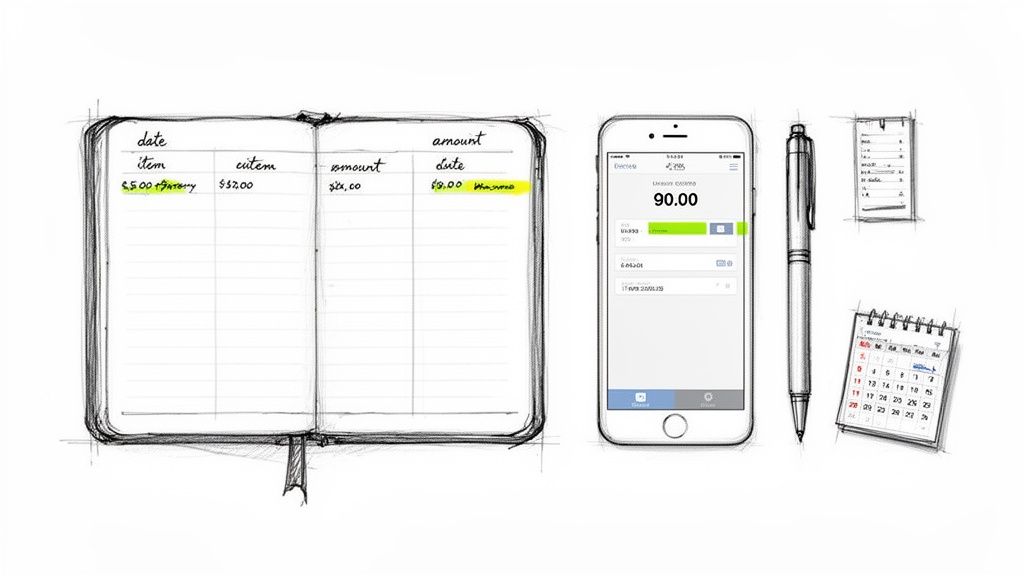

Knowing what money comes in and where it goes is half the battle. The real trick is picking a tracking method that actually fits into your life without feeling like a chore. Honestly, the “best” system is just the one you’ll stick with—whether that’s a classic notebook or a slick app.

Manually writing down every transaction might sound like a drag, but for a lot of people, it’s a powerful way to stay mindful. When you have to physically log that $5 coffee, you start to build a much stronger connection to your spending habits. That simple, conscious effort can completely change how you think about the small financial choices you make every day.

Choosing Your Method #

There are a few solid ways to track your income and expenses, and each has its own vibe.

- Pen and Paper: This is as simple as it gets—just a dedicated notebook. It’s tangible, completely private, and you don’t need any tech skills. If you like a bit of structure, a printable monthly expense tracker is a great way to start.

- Spreadsheets: A step up from paper, spreadsheets give you the power to sort, filter, and calculate everything automatically. You can build your own custom categories, create charts to visualize your spending, and see your entire financial year at a glance.

- Budgeting Apps: For pure convenience, nothing beats a dedicated app. Many can link directly to your bank accounts to pull in transactions automatically, categorize your spending for you, and even send alerts if you’re getting close to your budget limits.

The goal isn’t perfection; it’s consistency. Choosing a method you enjoy using is the single most important factor for success. Whether digital or analog, a consistent tracking habit is what builds lasting financial awareness.

No matter which tool you land on, the core idea is the same: you’re creating a clear, organized log of every dollar that comes in and every dollar that goes out. This information is the bedrock for every smart financial decision you’ll make from here on out.

Practical Tips for Couples and Travelers #

Throwing a partner or international travel into the mix can make things a little more complex, but the basic tracking principles don’t change.

- For Couples: The key is to figure out what’s “yours, mine, and ours.” A lot of couples find success with a joint account for shared bills like rent and groceries, while keeping separate personal accounts for their own spending. This hybrid system gives you both autonomy while making sure all the shared responsibilities are covered.

- For Travelers: Juggling multiple currencies can be a headache. I’d recommend using a budgeting tool that handles multi-currency tracking. It’ll convert your expenses back to your home currency on the fly, so you have a real-time picture of what you’re spending and can avoid any nasty surprises when you get home.

The Importance of Reconciliation #

Finally, tracking is only helpful if your numbers are right. Once a month, take some time to sit down and reconcile your records. All this means is comparing the spending you’ve tracked against your official bank and credit card statements.

Reconciliation is great because it helps you:

- Catch any typos or errors you made during manual entry.

- Spot fraudulent charges or weird transactions right away.

- Uncover those sneaky subscription services you forgot you were even paying for.

Think of it as a quick quality check for your finances. This simple monthly habit ensures your budget is built on solid, reliable information, which gives you the confidence you need to plan for the future.

Building a Budget That Actually Works #

Knowing where your money goes is the first step, but telling it where to go is the real game-changer. Once you have a clear picture of your income and expenses, you can create a budget that puts you firmly in control.

The best budgets aren’t about restriction; they’re about freedom. They are simple, realistic, and align your spending with what you truly value. A good budget gives every dollar a job, whether that’s covering groceries, saving for a down payment, or finally crushing that credit card debt. It turns money from a source of stress into a tool for building the life you want.

A Simple Framework to Get Started #

You don’t need a complicated spreadsheet to get going. One of the most popular and effective starting points is the 50/30/20 rule. It’s a simple guideline for divvying up your after-tax income.

Here’s the breakdown:

- 50% for Needs: This chunk covers the absolute must-haves. Think rent or mortgage, utilities, groceries, transportation, and insurance.

- 30% for Wants: This is for everything that makes life more enjoyable but isn’t strictly necessary for survival. This includes dining out, hobbies, streaming services, and that new gadget you’ve been eyeing.

- 20% for Savings and Debt Repayment: This final piece is all about your future. Use it to build an emergency fund, save for retirement, invest, or make extra payments on student loans or credit cards.

Think of this rule as a flexible guide, not a rigid law. The real goal is to find a balance between living well today and planning for a secure tomorrow.

A budget isn’t about limiting your freedom—it’s about creating it. By directing your resources intentionally, you gain the power to pursue major goals and reduce the financial anxiety that can strain relationships.

Having a clear plan helps you and your partner have productive conversations about money, turning what could be a point of conflict into a collaborative planning session.

Adapting Your Budget to Your Life #

Life changes, and your budget should change with it. A new job, a growing family, or a sudden drop in income are all signals that it’s time to revisit and adjust your plan. Setting aside a little time each month to review your spending is the best way to stay on track and make small tweaks before they become big problems.

This is especially critical if your income isn’t the same every month. For anyone dealing with fluctuating paychecks, our guide on budgeting for irregular income provides specific strategies for creating stability.

In our connected world, it’s also worth noting that financial planning often crosses borders. Global wealth distribution reveals stark inequalities, with the richest 10% holding a massive share of worldwide income. For expats and international families, navigating these different economic realities with multi-currency tools is crucial for managing income and expenses effectively. You can explore more about global income distribution on ourworldindata.org.

Ultimately, a great budget is a living document. It evolves with you, serving as a reliable roadmap as you and your family work toward your most important financial goals.

Got Questions About Managing Your Money? #

Diving into your finances for the first time usually kicks up a few questions. That’s totally normal. Getting those questions answered is what helps build confidence and turns a chore into a real, empowering habit.

Let’s walk through some of the most common hurdles people run into when they start getting serious about where their money is going. We’ll keep it simple and practical, so you can use these ideas right away—whether you’re sharing finances with a partner, dealing with a fluctuating paycheck, or just trying to prepare for whatever life throws at you.

How Often Should My Partner and I Actually Talk About Money? #

When it comes to money talks, consistency beats intensity every time. A quick weekly check-in is probably the best habit you can build. It doesn’t have to be a big deal—just 15 minutes to look over recent spending, see if you’re on track with your goals, and make sure you’re both still on the same page.

This little sync-up is frequent enough to spot any overspending before it gets out of hand but short enough that it never feels like a drag.

Then, at the end of each month, set aside a bit more time for a proper review. This is when you can:

- Zoom out and see the real spending patterns that emerged.

- Check in on your progress toward those big, shared savings goals.

- Tweak next month’s budget based on what worked and what didn’t.

Using a shared tool where all the numbers are in one spot makes this process a whole lot smoother and less stressful.

What’s the Best Way to Handle Unexpected Expenses? #

Life happens. The car breaks down, the vet sends a surprise bill—it’s not a matter of if but when. The absolute best defense against these financial curveballs is an emergency fund. Think of it as a savings account that’s off-limits for anything but true emergencies, holding three to six months’ worth of your essential living costs.

An emergency fund is your financial safety net. It turns a potential crisis into a manageable inconvenience, keeping you out of debt when you’re already stressed.

When you’re building your budget, make saving for this fund a priority. Treat it like a bill you have to pay. If you’re starting from scratch, aim for a mini-fund of $1,000 first. Once you hit that, keep contributing until you have that 3-6 month cushion. It’s honestly one of the most powerful moves you can make for your peace of mind.

How Can I Possibly Budget with an Irregular Income? #

Budgeting when you’re a freelancer or work on commission feels tricky, but it’s definitely doable. You just need a different strategy. The key is to figure out your baseline. Look back at your earnings over the last six to twelve months and calculate your average monthly income. This gives you a realistic number to work with.

When you create your monthly budget, use a conservative number—something on the lower end of your average. In the months you earn more than that baseline, sweep the extra cash straight into savings or a separate “buffer” account. Then, during the leaner months, you can pull from that buffer to cover your regular expenses without any stress. This approach evens out the financial rollercoaster and gives you a predictable foundation, even when your income isn’t.

Ready to get a real handle on your financial journey? With Econumo, you can track your income and expenses, work with your partner on shared goals, and build a budget that actually fits your life. It’s flexible, private, and made for modern households.

Explore the live demo or join the waiting list today.