Getting out of debt faster really boils down to two things: knowing exactly what you owe and picking a smart plan to attack it. Before you do anything else, you need a crystal-clear picture of every single balance, minimum payment, and—most importantly—interest rate. Once you have that, you can decide whether the quick wins of the Debt Snowball method or the money-saving power of the Debt Avalanche method is the right fit for you.

Getting Started with a Clear Debt Repayment Plan #

That feeling of being buried under a mountain of debt is all too common, but getting clear on the numbers is your first real step toward digging out. Before you can even think about making extra payments, you have to know exactly where you stand. Think of this as creating a financial map—no jargon, no judgment, just the facts.

Your first job is to make a complete list of every single debt you’re carrying. Don’t gloss over anything.

- Credit Cards: Write down each card, the current balance, its APR, and the minimum monthly payment.

- Student Loans: Note the total balance, interest rate, and what you’re required to pay each month.

- Car Loan: Document the remaining balance, the interest rate, and that monthly payment.

- Personal Loans: Add any loans from banks or credit unions, along with their terms.

- Medical Bills: Even if they’re interest-free for now, get them on the list. You need the full picture.

Just doing this—getting it all out of your head and onto a single page—can be incredibly empowering. You’re moving from a vague cloud of anxiety to a concrete list you can actually work with.

Organizing Your Financial Picture #

With your list in hand, it’s time to organize it. A simple spreadsheet works great, but a notebook or a budgeting app like Econumo will do the trick, too. The real key here is to sort your debts in two different ways so you can see the problem from both angles.

First, order them from the smallest balance to the largest. Then, make a second list ordering them by the highest interest rate (APR) down to the lowest.

This dual perspective is what sets you up for success because it lays the groundwork for the two most popular debt payoff strategies. Seeing it all laid out gives you an honest look at your situation, which is exactly what you need to choose your path forward. Of course, knowing what you owe is only half the battle; you also need to understand your cash flow. To get a handle on that, check out our guide on how to track your income and expenses.

A debt inventory isn’t just a list of numbers; it’s a declaration of intent. It’s the moment you stop letting debt happen to you and start actively managing it.

Introducing the Core Repayment Philosophies #

Once your debts are organized, you’re ready to choose your strategy. It really comes down to two main schools of thought.

- The Debt Snowball: This method is all about building momentum and motivation. You’ll make minimum payments on all your debts except the one with the smallest balance. You throw every extra penny you have at that smallest debt until it’s gone. Then, you take the money you were paying on it and roll it over to the next smallest debt. It creates a “snowball” effect that feels fantastic.

- The Debt Avalanche: This approach is pure math. You make minimum payments on everything except the debt with the highest interest rate. By attacking your most expensive debt first, you’ll save the most money on interest over the long run.

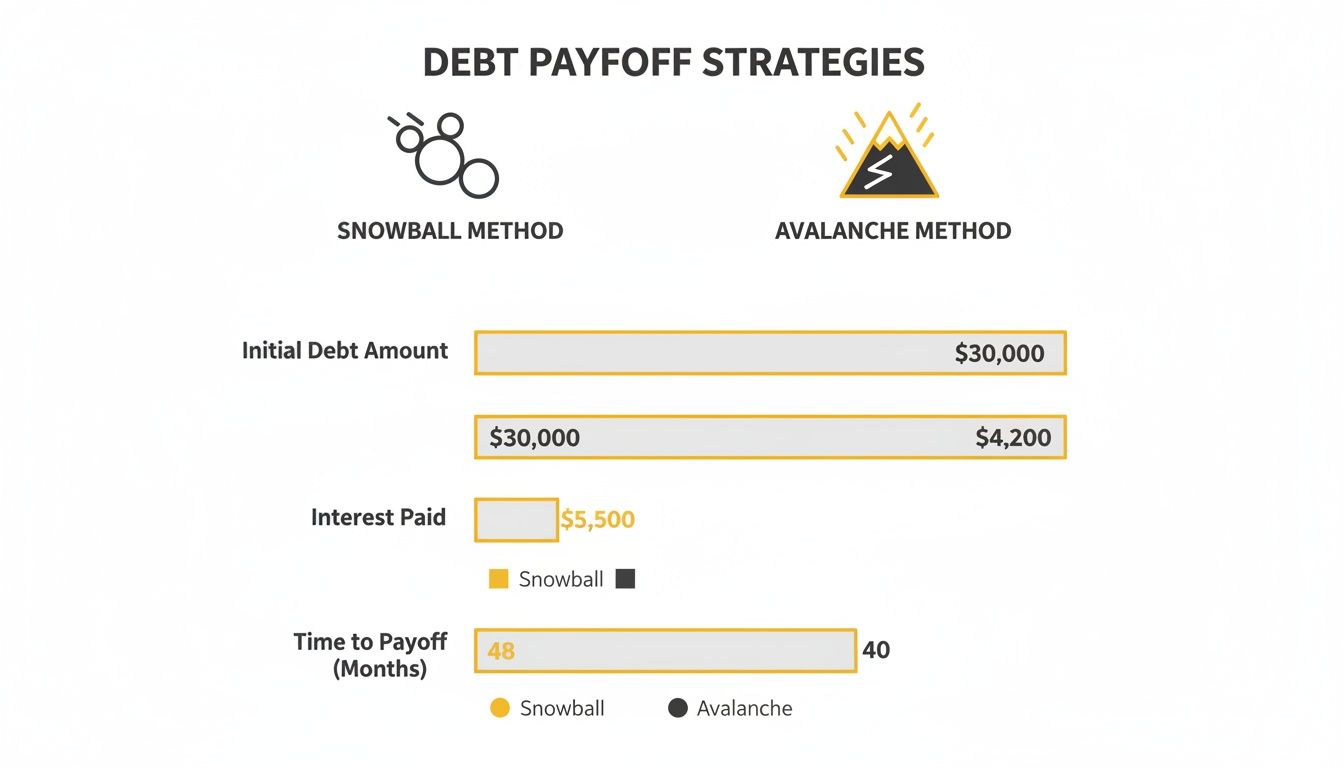

Each strategy has its fans for good reason. Before we dive deeper into how to choose, here’s a quick look at how they stack up.

Debt Repayment Methods at a Glance #

This table offers a quick comparison of the two most popular debt repayment strategies to help you decide which is right for you.

| Method | Strategy | Best For | Key Benefit |

|---|---|---|---|

| Debt Snowball | Pay off debts from smallest to largest balance. | People who need quick wins to stay motivated. | Psychological boost from seeing balances disappear fast. |

| Debt Avalanche | Pay off debts from highest to lowest interest rate. | People focused on the most cost-effective path. | Saves the most money on interest over time. |

The Snowball gives you quick, motivating wins that can keep you going when things get tough. The Avalanche is brutally efficient, saving you money and shortening your repayment timeline if you can stick with it.

Your organized debt list is the map, and these two strategies are your potential routes to financial freedom. Now, let’s figure out which one is best for you.

Choosing Your Strategy: Debt Snowball vs. Debt Avalanche #

Okay, you’ve laid all your cards on the table and have a clear, organized list of everything you owe. Getting that visibility is a huge first step, but now it’s time to go on the offensive. This is where you decide how you’re going to attack your debt, and it’s probably the most important choice you’ll make on this journey.

The two most popular—and effective—methods are the Debt Snowball and the Debt Avalanche. Think of them as two different philosophies. One is all about psychology and building momentum, while the other is pure, cold, hard math. Neither one is universally “better,” but one will almost certainly be a better fit for you.

The Power of Momentum with the Debt Snowball #

The Debt Snowball method is perfect if you thrive on quick wins. It’s designed to build momentum and keep you motivated for the long haul.

Here’s how it works: You keep making the minimum payments on all your debts, but you throw every extra dollar you can find at the debt with the smallest balance—completely ignoring the interest rate.

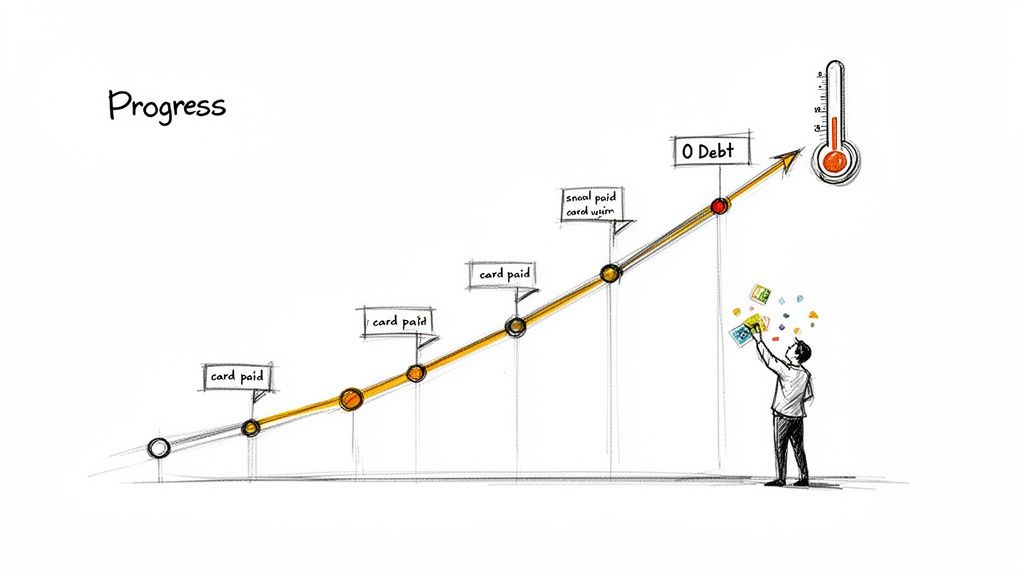

Once that smallest debt is gone, you celebrate! Then, you take the full amount you were paying on it (the minimum plus all the extra cash) and roll it over to the next smallest debt. This creates a powerful snowball effect. With each debt you knock out, the payment you’re making on the next one gets bigger, and you start paying things off faster and faster.

The real magic of the Debt Snowball isn’t the math; it’s the motivation. Seeing a balance hit zero is a massive psychological boost that gives you the fuel to keep going.

This isn’t just theory. We’ve seen people pay off staggering amounts of debt with this method because it helps build habits that actually stick. Research from the Journal of Consumer Research even found that people who focused on paying off one debt at a time were more likely to see the entire process through. You can dig into more global debt trends on IMF.org to see the bigger picture.

The Financial Efficiency of the Debt Avalanche #

If your main goal is to save the most money possible and you’re driven by numbers, the Debt Avalanche is your weapon of choice. This strategy is all about financial efficiency.

With this approach, you ignore the balances and focus entirely on the interest rates. You’ll make minimum payments on everything except the debt with the highest Annual Percentage Rate (APR).

You throw every spare dollar at that high-interest beast until it’s wiped out. By targeting your most expensive debt first, you drastically cut down the total amount of interest you’ll pay over time. Once it’s gone, you move on to the debt with the next-highest rate, and so on.

It’s the most financially optimized way to pay off debt. You might not get the quick hit of closing an account in the first few months, but your bank account will definitely thank you in the end.

This comparison shows how each method would tackle the same set of debts. Notice the difference in total interest paid and how long it takes.

As you can see, the Snowball gives you faster wins early on, but the Avalanche method saves you more money on interest over the life of the loans.

A Real-World Comparison #

Let’s look at a quick example. Meet Alex, who has three debts and an extra $200 a month to put toward them.

- Credit Card: $1,500 at 22% APR (Minimum: $50)

- Personal Loan: $5,000 at 10% APR (Minimum: $100)

- Student Loan: $10,000 at 5% APR (Minimum: $120)

Alex’s Snowball Plan: Alex goes after the credit card first because it has the smallest balance ($1,500). The total monthly payment becomes $250 ($50 minimum + $200 extra). That card will be paid off in about 6 months—a huge motivational victory!

Alex’s Avalanche Plan: Alex targets the credit card first because it has the highest interest rate (22% APR). The total monthly payment is also $250. In this case, both methods start the same way.

But let’s flip it. What if the personal loan was $1,500 at 10% and the credit card was $5,000 at 22%? The Snowball method would still attack the smaller $1,500 loan first. The Avalanche, however, would go straight for the 22% APR credit card, saving Alex a ton of money on interest in the long run.

How to Choose the Right Path for You #

So, which one is it? Your choice between Snowball and Avalanche boils down to one simple question: What will keep you going?

- Choose the Snowball if: You need to see progress to stay motivated. If you’ve struggled to stick with financial plans before, those quick wins can build the confidence you need to see it through.

- Choose the Avalanche if: You’re a numbers person who loves to optimize. If the thought of paying one more cent in interest than you have to drives you crazy, this is your path.

Ultimately, the best strategy is the one you’ll actually follow. Pick one, commit to it, and start knocking out those balances.

Build a Budget That Destroys Debt #

Picking a smart repayment strategy like the Debt Snowball or Avalanche is a huge win, but that’s only half the battle. Your plan needs fuel, and that fuel comes directly from your budget. A generic, set-it-and-forget-it budget just won’t do the job here. You need a financial plan built from the ground up to find and redirect every spare dollar toward your debt.

This isn’t about living on rice and beans. It’s about being strategic and intentional with your money. The whole point is to conduct an honest audit of your finances to uncover “found money”—cash that’s currently slipping through the cracks—and give it one single, critical job: destroying your debt.

Start With a Financial Deep Dive #

Before you can make any changes, you have to know exactly where your money is going. Vague ideas like, “I spend too much on takeout,” aren’t helpful. You need cold, hard data.

For one full month, track every single dollar that leaves your accounts. Using a tool like Econumo to manually log your spending can be incredibly powerful. This hands-on approach forces you to confront each purchase, creating a level of awareness that automatic tracking can sometimes miss. After 30 days, categorize everything—groceries, gas, subscriptions, entertainment—and you’ll have a brutally honest picture of your spending habits.

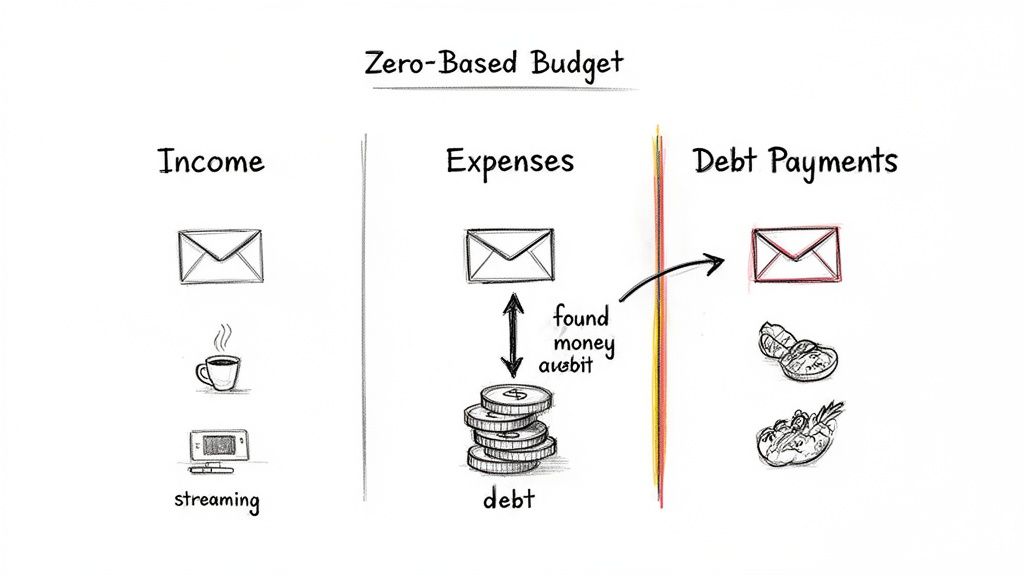

Embrace the Zero-Based Budget #

Once you have your data, it’s time to build a budget that actively works for you. One of the most effective methods for crushing debt is zero-based budgeting. The idea is simple but powerful: every single dollar of your income gets a specific job.

The formula looks like this: Income - Expenses - Savings - Debt Payments = 0

This method leaves no room for mindless spending. If you bring in $4,000 a month, you’ll plan precisely where all $4,000 will go. You’ll cover your essential living costs, set aside some for savings, and then funnel every remaining penny directly into your debt repayment plan. It turns your budget from a passive report into an active, forward-looking strategy.

Find Your “Found Money” #

With all your spending categories laid out, you can start making strategic cuts to free up cash. This isn’t about eliminating fun; it’s about optimizing what you spend. Ask yourself some tough questions about each non-essential expense:

- Subscriptions: Are you really using all seven of those streaming services? Could you pause a few while you focus on your debt?

- Dining Out: Can you dial back restaurant meals from four times a month to just two? Packing a lunch a few days a week can easily free up $100 or more each month.

- Convenience Spending: That daily gourmet coffee or the delivery app fees add up much faster than you think. How much are you truly paying for convenience?

Found money isn’t about earning more; it’s about reclaiming the money you already have. An extra $150 a month might not feel like much, but when you aim it at a high-interest credit card, it can shave years off your repayment timeline.

Make Mindful Spending Your New Normal #

Creating a debt-destroying budget is one thing. Actually sticking to it is another. The real key is to shift your mindset from one of restriction to one of intention. Instead of thinking, “I can’t afford that,” you start asking, “Is this purchase more important than my financial freedom?”

This mental shift is what leads to long-term success. If you need a hand turning your budget into a sustainable habit, our guide on how to stick to a budget is packed with practical tips that build lasting financial discipline. The goal is to make mindful spending feel automatic.

Your budget is the most powerful weapon in this fight. By giving every dollar a purpose and consciously directing your resources, you transform your income into a relentless force for becoming debt-free.

Pour Gasoline on the Fire: Supercharge Your Progress by Increasing Your Income #

Budgeting is fantastic for getting control of the money you already have—it’s the essential first step. But if you really want to torch your debt and get it out of your life for good, nothing beats bringing in more cash. A new stream of income, aimed squarely at your debt, can literally shave years off your payoff timeline.

This doesn’t mean you need to get a second full-time job and burn yourself out. It’s about getting creative and finding smart ways to boost your earnings, even just for a little while. The trick is to treat this new money differently. It has a special job to do.

Finding a Side Hustle That Actually Works for You #

Thanks to the gig economy, there are more ways than ever to earn extra cash without a massive commitment. The goal here isn’t to find the perfect, high-flying side business, but to find something you can realistically do without hating your life.

Here are a few ideas to get you started:

- Jump into the Gig Economy: Driving for Uber or delivering for DoorDash or Instacart offers incredible flexibility. You can work when you want, and even a few hours on a Saturday can net you an extra $50-$100 to immediately throw at your smallest debt.

- Monetize a Skill You Already Have: Are you a decent writer? Know your way around social media? Maybe you’re great at organizing things. Platforms like Upwork or Fiverr are full of people looking for help on short-term projects.

- Sell Your Stuff: We all have things lying around that we haven’t touched in years. Go on a treasure hunt in your own home. Old electronics, furniture, clothes in good condition—list them on Facebook Marketplace or Poshmark for a quick injection of cash.

A quick tip from experience: The best side hustle isn’t always the one that pays the most per hour. It’s the one you can stick with consistently. An extra $200 a month, every single month, aimed like a laser at your debt, will make a much bigger impact than a one-time $500 score that leaves you exhausted.

The One Rule You Absolutely Cannot Break #

This is the most critical part of the entire strategy: Every dollar you earn from your side hustle goes straight to your debt. Do not pass Go, do not collect $200. This money cannot mingle with your regular budget, or it will get swallowed up by groceries, gas, and random Amazon purchases. I’ve seen it happen time and time again.

You need a system. The moment that Instacart payment hits your account, log in to your credit card portal and make a payment. Don’t let it sit. This discipline is what turns your extra effort into actual, measurable progress.

And this isn’t just a nice theory—the numbers back it up. With global debt on the rise (you can see the staggering figures in the Global Debt Monitor from IIF.com), more people are turning to side gigs to get ahead. On average, gig workers can make an extra $1,200 a month, and 40% of them are using it to pay down debt.

Even better, a Ramsey Solutions study of 10,000 people found that those who got an extra job paid off $5,300 more in debt per year. They became debt-free twice as fast as people who only focused on budgeting.

What This Looks Like in Real Life #

Think about someone like Sarah, who was staring down a $7,000 credit card balance. She started pet-sitting on weekends and brought in an extra $300 a month. By sending that money straight to her credit card, she paid it off a full 18 months ahead of schedule and avoided over $1,200 in interest payments.

Or take Mark, a graphic designer who picked up a few small freelance projects. That extra $500 a month completely knocked out his car loan two years early. Suddenly, he had hundreds of dollars freed up in his monthly budget to start investing. These aren’t wild success stories; they’re the result of a focused, consistent effort.

Supercharge Your Payoff Plan: Advanced Tactics to Get to Zero Debt Faster #

Alright, you’ve got your budget dialed in and a primary payoff method (like the snowball or avalanche) running. Think of that as the engine of your debt-free car. Now, it’s time to add the turbocharger.

These next moves are all about accelerating your progress and trimming months—or even years—off your repayment timeline. They take a bit more proactive effort, but the results are more than worth it. We’re talking about smart, strategic plays that make your money work harder for you.

Tactic 1: Negotiate Your Interest Rates #

This is one of the most effective and underused strategies out there. Did you know you can often lower your interest rate just by asking? Especially with credit cards. So many people assume these rates are carved in stone, but that’s rarely true. A single phone call could literally save you thousands.

Creditors want to keep customers who pay on time. If that’s you, you have more leverage than you think. A lower interest rate means more of every single payment hits the principal balance instead of just getting eaten up by interest.

Here’s a simple script you can use as a starting point:

“Hello, I’ve been a loyal customer for [number] years and I’m really focused on paying down my balance. I’ve been getting other offers with lower interest rates, but I’d much rather stick with you. Could you take a look at my account to see if I qualify for a lower APR?”

It’s polite, direct, and positions you as a loyal customer they want to keep. The worst they can say is no. But even a small drop of 2-3% can make a huge difference over the life of the debt.

Tactic 2: Get Smart with Consolidation and Balance Transfers #

Debt consolidation can feel like a game-changer, but you have to go in with your eyes open. The basic idea is to roll multiple high-interest debts into one new loan that has a single, lower interest rate. This makes your life simpler and, more importantly, slashes the total interest you’ll pay.

There are two main ways people do this:

Balance Transfer Credit Cards: These are fantastic tools. They often lure you in with a 0% introductory APR for a set time, usually anywhere from 12 to 21 months. Moving your high-interest card balances over to one of these gives you a precious, interest-free window to attack the principal with everything you’ve got. The catch? Watch out for the balance transfer fee (typically 3-5%) and make sure you have a rock-solid plan to pay it all off before that promo period ends and the rate skyrockets.

Personal Consolidation Loans: You can also get a fixed-rate personal loan from a bank or credit union and use that money to wipe out all your other debts. You’re then left with one predictable monthly payment, hopefully at a much friendlier interest rate than your credit cards. This is a great route for people with good credit who need a more structured, longer-term plan.

A word of caution: Consolidation isn’t a get-out-of-jail-free card. It’s a strategic tool. It only works if you commit to changing the spending habits that got you into debt in the first place. If you consolidate your cards only to run up the balances again, you’ll be in a much deeper hole.

To make this stick, you need to tighten up your spending. For real-world advice on that, our guide on how to reduce monthly expenses has practical steps that go hand-in-hand with a consolidation strategy.

Tactic 3: Hack Your Payment Schedule #

You’d be shocked at how small, consistent tweaks to how and when you pay can create massive momentum. Forget just paying on the due date. Let’s get a little more creative.

The Bi-Weekly Payment Trick This is a classic for a reason. Instead of making one monthly payment, you split it in half and pay that amount every two weeks. Since there are 52 weeks in a year, you end up making 26 half-payments. That adds up to 13 full monthly payments. You sneak in a whole extra payment each year, and you barely even feel it. This simple trick can shave years off a mortgage or car loan.

Before you jump in, give your lender a quick call. You need to confirm two things: that the extra payments go directly to the principal and that they don’t hit you with fees for paying more often.

The “Round Up” Method This one is beautifully simple. Every time you make a payment, just round it up to a nice, even number. Is your car payment $377? Pay $400. Is the credit card minimum $82? Send them $100.

That little bit of extra cash is usually easy to absorb into your budget, but it relentlessly chips away at your principal balance. Over a few years, all those small “round ups” compound into serious interest savings and get you to the finish line that much faster.

Staying Motivated When the Going Gets Tough #

Getting out of debt isn’t a straight line—it’s more of a marathon with unexpected hurdles. You can have the best strategy in the world, but your motivation is what will carry you through when the finish line feels miles away.

Let’s be real: life happens. The car will break down. An unexpected medical bill will pop up. These moments are frustrating, but they don’t have to completely derail your plan. The real key to long-term success is building resilience and finding ways to celebrate how far you’ve come.

Figure Out Your “Why” #

Before you even start crunching the numbers, stop and ask yourself why you’re doing this. Seriously, what does a debt-free life actually look like for you?

Is it the freedom to quit a job you hate? The peace of mind that comes with a fully-funded emergency fund? Or maybe it’s just being able to afford a real vacation without putting it on a credit card.

Whatever your reason is, write it down. Stick it on your bathroom mirror, make it your phone’s background, or tape it to your laptop. When you’re tempted to overspend or feeling discouraged, that powerful reminder will be exactly what you need to see. It’s no longer about sacrifice; it’s about investing in the future you want.

Make Your Progress Visual #

Watching that total debt number slowly tick down is great, but it can take a long time to see a major difference. To keep your spirits up, you need a visual way to track your progress.

You can get as simple or as creative as you like. A few ideas I’ve seen work wonders:

- A Debt Thermometer: Just draw a big thermometer on a poster board and color in a new section for every $500 or $1,000 you pay off. It’s incredibly satisfying.

- A Paper Chain: Make a paper chain with one link for every $100 of debt you have. Every time you pay off another $100, you get to physically tear a link off the chain.

- A Marble Jar: Get two jars. Fill one with marbles, where each marble represents a certain amount of debt. As you pay it down, move marbles from the “debt” jar to the “paid off” jar.

These tangible trackers give you a much-needed psychological boost, especially when you’re staring down a huge balance.

Celebrating small wins isn’t frivolous; it’s a strategic part of the process. When you pay off a credit card, treat yourself to something small and meaningful that won’t undo your hard work—like a nice dinner at home or a day at the park.

Find Your People #

You don’t have to do this alone. In fact, you shouldn’t. Talking about your financial goals with a partner, a close friend, or a family member you trust creates a built-in support system. It keeps you accountable and gives you someone to cheer you on.

If you’re working on this with a partner, getting on the same page is non-negotiable. Try setting up regular, low-stress “money dates” to go over your Econumo shared budget and celebrate what you’ve accomplished together. This turns paying off debt from a personal burden into a team mission. Having someone to remind you of your “why” during the tough spots can make all the difference.

Got Questions About Paying Off Debt? We’ve Got Answers #

As you start getting serious about paying off debt, questions are bound to pop up.Getting clear on the details is what keeps you moving forward, so let’s tackle some of the most common things people ask when they’re on this journey.

Should I Stop Investing While I’m Paying Off Debt? #

This is a classic dilemma, and honestly, the answer usually comes down to the numbers. If you’re dealing with high-interest debt—think credit cards with a 20% or higher APR—it almost always makes sense to press pause on investing.

Look at it this way: paying off a credit card with 22% interest is like earning a guaranteed 22% return on your investment. You’d be hard-pressed to find that kind of guaranteed return in the stock market.

The big exception here is your employer’s retirement match. If your company matches your 401(k) contributions, you should absolutely contribute enough to get the full match. Turning down a 100% match is literally walking away from free money, and you don’t want to do that.

What’s the Best Way to Pay Off Debt with a Partner? #

When you’re in a relationship, tackling debt becomes a team sport. The single most important thing is to get on the same page. Sit down and create a shared vision for what your life will look like without this debt. What will you do with all that freed-up money? That’s your motivation.

To make it work, you have to be intentional. Try these strategies:

- Set up regular “money dates.” Grab a coffee or a glass of wine and review your progress in a low-pressure environment. Keep it positive.

- Use a shared budget. This creates total transparency and makes sure you’re both pulling in the same direction. No guesswork involved.

- Celebrate the wins. Did you pay off a small card? Did you hit a major milestone? High-five, go out for a cheap dinner—do something to acknowledge your hard work.

Open and honest communication is everything. It stops money from becoming a source of stress and keeps you both fired up.

Snowball vs. Avalanche: Which One Is Actually Better? #

Ah, the great debate. The truth is, this is less about which method is “better” in a vacuum and more about which one is better for you. Your personality is the deciding factor.

From a purely mathematical standpoint, the Avalanche method will always save you the most money in interest. But the best plan is worthless if you don’t stick to it.

If you’re someone who thrives on seeing quick results and needs those little psychological wins to stay motivated, the Snowball method is a game-changer. The momentum you build from knocking out small debts can be incredibly powerful.

Some people even create a hybrid model. They might use the Snowball method to eliminate one or two small debts for a quick victory, then pivot to the Avalanche method to tackle the bigger, high-interest balances with newfound confidence.

Ready to take control and build your debt-destroying budget? Econumo provides the tools you need for manual tracking, shared budgets, and staying aligned with your partner on your financial goals. Explore the features and start your journey at Econumo.com.