Before you can even think about paying off debt fast, you have to face the music. That means getting a crystal-clear picture of every single dollar you owe. I’m talking about gathering up all your statements and laying it all out: the balance, the interest rate, and the minimum payment for each account. This is your starting line, the non-negotiable first move before you can build a real plan to get ahead.

First, Understand Every Dollar You Owe #

You can’t win a fight if you don’t know who you’re up against. Just paying bills as they show up in your inbox is playing defense, and it’s a surefire way to stay stuck in a cycle. The goal here is to go on the offense, and that starts with total, unflinching clarity. This means building a “debt inventory”—a master list that puts all your financial obligations out in the open.

This isn’t just about adding up a big, scary number. A truly useful debt inventory digs into the details for each and every account.

- Creditor Name: Who gets your money? (e.g., Chase, SoFi, Honda Financial)

- Total Balance: What’s the full amount you owe them right now?

- Interest Rate (APR): This is the killer detail. It’s the price you’re paying to borrow that money.

- Minimum Monthly Payment: What’s the least you have to pay each month to stay current?

Pulling all this together can feel daunting, I get it. It’s often easier to avoid looking at the numbers. But you can’t fix what you don’t acknowledge. Seeing it all in one place transforms that vague, heavy feeling of stress into a concrete problem you can actually solve.

How to Build Your Debt Inventory #

Alright, let’s get practical. Start by grabbing all your recent statements, whether they’re digital PDFs or papers stuffed in a drawer. This is for everything: credit cards, student loans, your car payment, any personal loans, even those medical bills you’ve been putting off.

Fire up a simple spreadsheet or just grab a notebook and list out each debt with those four key pieces of information.

For instance, your list might start to look something like this:

| Creditor | Total Balance | Interest Rate (APR) | Minimum Payment |

|---|---|---|---|

| Visa Card | $4,500 | 22.9% | $110 |

| Student Loan | $28,000 | 5.8% | $315 |

| Car Loan | $12,300 | 4.5% | $250 |

Look at that. This simple table makes it obvious that the Visa card, even with the smallest balance, is your most expensive debt by a mile, thanks to that brutal 22.9% APR. This is the kind of insight that will fuel your entire strategy.

A Crucial Step for Couples and Families #

If you’re tackling this with a partner, getting everything down on paper is the only way to truly get on the same page. This isn’t about blame; it’s about teamwork. Set aside some time where you can both sit down, judgment-free, and just get the facts straight. This shared understanding is the foundation you’ll build your debt-free future on.

“Creating a debt inventory isn’t about feeling shame over what you owe. It’s about taking control. You’re transforming abstract financial stress into a clear, manageable list that you can start to conquer, one item at a time.”

Once your inventory is complete, you’ve got the raw data you need to pick a repayment strategy and build a budget that actually works. It’s the most important step because it dictates everything that comes next. Before you can get a handle on your income and expenses, you have to know exactly where that money is going—and where it needs to go first.

Pick Your Debt-Payoff Game Plan #

Alright, you’ve laid out all your debts and can see the full picture. Now comes the fun part: deciding how you’re going to attack it. This isn’t just a numbers game; it’s about picking a strategy that clicks with your personality. If you don’t believe in the plan, you won’t stick with it.

The two heavyweights in the debt-payoff world are the Debt Snowball and the Debt Avalanche.

One is designed for quick, psychological wins to keep your motivation high. The other is pure, cold, hard math designed to save you the most money. There’s no single right answer, just the one that will keep you in the fight for the long haul.

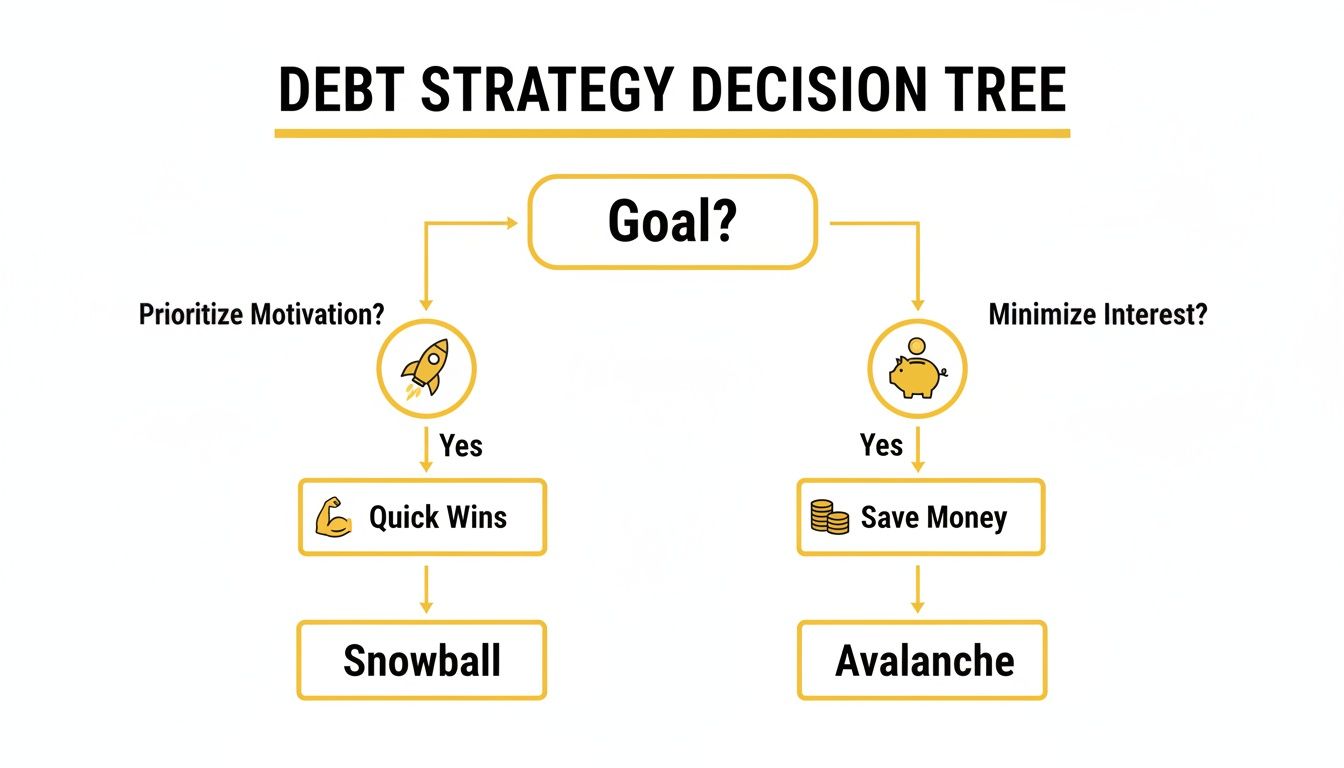

This decision tree gives you a quick visual to help you figure out which path makes the most sense for you.

As you can see, if you thrive on momentum and quick victories, the Snowball is likely your best bet. But if your main goal is to minimize the interest you pay over time, the Avalanche method is your most powerful weapon.

The Debt Snowball Method: Psychology Over Math #

The Debt Snowball method is all about building momentum. You list your debts from the smallest balance to the largest, ignoring the interest rates completely. You’ll make minimum payments on everything, but you throw every extra penny you have at that smallest debt.

Once it’s gone—poof!—you take the entire payment you were making on it (the minimum plus all the extra cash) and roll it onto the next smallest debt. This creates a “snowball” of money that gets bigger and bigger, knocking out debts faster and faster as you go.

The real magic of the Snowball method is how it makes you feel. Crossing that first debt off your list, maybe just a few months in, is a huge motivational boost. It gives you the confidence you need to keep going when you’re staring down those much bigger balances.

Imagine a family with these debts:

- A store credit card with a $700 balance

- A personal loan with a $3,000 balance

- A car loan with a $12,000 balance

With the Snowball method, they’d focus all their energy on that $700 credit card. It doesn’t matter if the car loan has a higher interest rate. Getting that first win quickly is the entire point.

The Debt Avalanche Method: Math Over Psychology #

If saving as much money as possible is what gets you fired up, then the Debt Avalanche is your strategy. This approach is all about efficiency. You list your debts by their interest rate (APR), from highest to lowest. Again, you make minimum payments on all of them.

But here, all your extra money goes directly to the debt with the highest interest rate. By tackling your most expensive debt first, you stop more interest from piling up, which saves you money and gets you out of debt faster.

Let’s look at that same family, but now we’ll add the interest rates:

- Store credit card: $700 balance at 24.99% APR

- Personal loan: $3,000 balance at 11.5% APR

- Car loan: $12,000 balance at 5.2% APR

Using the Avalanche method, they’d still target the store card first, but this time it’s because of its brutal 24.99% APR. Once that’s paid off, all that payment money would pivot to the personal loan, the next most expensive debt on the list.

Debt Snowball vs Debt Avalanche: Which Is Right for You? #

So, how do you choose? It really comes down to what drives you: quick wins or long-term savings. Neither is “better” than the other; they just work differently. This table breaks down the core differences to help you decide.

| Feature | Debt Snowball Method | Debt Avalanche Method |

|---|---|---|

| Prioritization | Smallest balance to largest | Highest interest rate to lowest |

| Psychological Impact | High motivation from early wins | Slower start, but satisfaction from saving money |

| Financial Impact | May pay more in total interest | Saves the most money on interest over time |

| Best For | People who need to see quick progress to stay motivated | People driven by numbers and long-term efficiency |

At the end of the day, both methods work if you stick with them. Some people even use a hybrid approach—starting with the Snowball to knock out a tiny debt or two for a quick boost, then switching to the Avalanche to save the most on interest.

No matter which path you choose, using a tool to visualize your progress can make a huge difference. Check out some of the best debt payoff apps that can help you stay on track and celebrate your wins along the way.

Both roads lead to the same incredible destination: being completely debt-free. Your choice is just about the journey you want to take to get there.

Build a Budget That Accelerates Your Payoff #

Your debt payoff plan—whether you choose the Snowball or Avalanche method—is only as good as the fuel you give it. And that fuel is cash. The only way to free up more of it is with a budget built for one single purpose: getting aggressive about what you owe.

This isn’t about just keeping tabs on your spending. It’s about creating a high-impact financial plan that intentionally shoves every possible dollar toward your freedom.

So, forget any old ideas about a budget being a restrictive, joy-killing chore. Think of it as your secret weapon. The whole point is to stop passively watching where your money disappears and start actively telling it where to go. Right now, its main destination is that debt you’re targeting.

Find the “Cash Leaks” With a Spending Audit #

First things first: you need to conduct a serious spending audit. This means grabbing your bank and credit card statements from the last 30 to 60 days and facing the unfiltered truth of where your money has been going. You’re on the hunt for “cash leaks”—those sneaky, often small expenses that drain your bank account without you really noticing.

Look for culprits like:

- Forgotten Subscriptions: Are you still paying for a streaming service you haven’t touched in months? Or that gym membership you keep meaning to use?

- The Convenience Tax: How much are those daily coffees, lunches out, and delivery fees really costing you? It’s amazing how quickly these little things can add up to hundreds a month.

- Impulse Buys: Be honest about the unplanned purchases from Amazon or the things you grabbed at the checkout counter.

Once you spot these patterns, you can make some conscious changes. I’ve seen people free up $150-$200 per month just by cutting a few unused subscriptions and packing lunch twice a week. That’s a huge chunk of change you can immediately throw at your debt.

Use a Zero-Based Budget for Maximum Impact #

For anyone truly serious about getting out of debt fast, the zero-based budget is a game-changer. The idea is simple: at the beginning of the month, every single dollar of your income gets a specific job. Your income minus all your expenses (including debt payments and savings) should equal zero.

This forces you to be incredibly intentional. Instead of waiting to see what’s “left over” at the end of the month, you decide upfront exactly how much is going to your debt. For example, if your spending audit uncovers an extra $350, you don’t just leave it sitting there—you immediately assign it to your target debt in your budget.

A budget isn’t about limiting your freedom; it’s about creating it. By controlling your spending today, you are buying back your financial freedom for tomorrow. Every dollar you intentionally direct toward debt is a step closer to liberation.

It definitely takes discipline, but it’s hands-down the fastest way to channel all your available cash into your repayment plan.

Get on the Same Page as a Couple or Family #

If you’re tackling debt with a partner or as a family, a budget only works if everyone is on the same team. This is where a collaborative tool can make all the difference. Using an app like Econumo lets both partners see and manage the same budget in real-time. You can track shared bills, watch your progress toward joint goals, and keep the lines of communication wide open.

This shared view turns budgeting from a solo chore into a team sport. When both of you can see how skipping takeout for a week directly helps crush a credit card balance, it reinforces those good habits and keeps everyone motivated. The budget stops being a source of conflict and becomes your shared roadmap.

Interestingly, this whole idea of managing debt relative to income applies to entire countries, too. The United States has a debt-to-GDP ratio over 120%, and the United Kingdom’s is over 100%, yet they remain major economic powers because they can afford to service that debt. For a household, this just shows that your ability to pay off debt fast has more to do with your income stability and interest rates than the raw total you owe.

When you combine a detailed spending audit with a zero-based budget and get your whole household on board, you create a powerful financial engine. It’s not just about cutting back; it’s about being strategic. Our complete guide on how to reduce monthly expenses has even more ideas to help you find extra cash. This is how your budget becomes your best weapon in the fight for financial freedom.

Boost Your Income to Get Debt-Free Sooner #

Budgeting is a fantastic defensive strategy, but let’s be honest—there’s a limit to how much you can cut. You still need to eat, keep the lights on, and live. Your ability to earn more, however? That has virtually no ceiling.

This is where you shift your mindset from one of scarcity (slashing every cost) to one of abundance (creating new income streams). It’s not about wishful thinking; it’s about making a real plan to bring in more cash. Every extra dollar you make becomes another soldier in your army, marching straight toward your biggest debt target. This is how you go on the offensive and start conquering your debt, not just managing it.

First, Maximize Your Main Paycheck #

Before you start delivering pizzas or walking dogs, the most efficient place to find more money is your current job. Think about it: a raise at your 9-to-5 boosts your income without asking for more of your time. It’s the ultimate win-win.

Start by building your case. Document your wins, quantify your contributions with hard numbers, and do your homework on what your skills are worth in the current market. When you sit down with your boss, lead with the value you’ve delivered, not just your personal financial needs. A successful conversation here could add thousands to your bottom line overnight—money you can immediately throw at your debt.

“The fastest way to pay off debt is to attack it from both sides. Cut expenses ruthlessly, but also find ways to earn more. Treating that new income as ‘debt-only’ money is the key to supercharging your progress.”

Don’t underestimate the impact. Even a modest 5% raise on a $60,000 salary adds an extra $3,000 to your pocket each year. That alone could wipe out a pesky credit card balance or take a massive chunk out of a car loan, all without you having to change a single thing about your daily life.

Find a Side Hustle That Fits Your Life #

If a raise isn’t happening right now, or if you just want to light a fire under your debt-payoff plan, a side hustle is a total game-changer. The trick is finding something that fits your life and your skills without leading to complete burnout. The goal is sustainable income, not a second full-time job that you’ll ditch in a month.

Here are a few realistic ideas that don’t require a huge investment to get started:

- Freelance Your Skills: Are you a talented writer, a whiz with graphic design, or a social media guru? Platforms like Upwork or Fiverr are full of people looking for exactly what you can do. You get to be your own boss and set your own hours.

- Tap into the Gig Economy: The flexibility of services like DoorDash, Instacart, or Uber is hard to beat. You can work for a couple of hours on a Saturday morning or a few evenings a week to make extra cash entirely on your own terms.

- Turn a Hobby into Cash: If you love baking, woodworking, or making jewelry, why not sell your creations? A platform like Etsy makes it easy to turn something you already enjoy into a profitable side business.

For couples, this can be a great team-building exercise. Maybe one of you is the creative genius, and the other is a pro at marketing and shipping. By working together, you can build something fun, make extra money, and tackle your shared financial goals as a unified team.

Commit Every Extra Dollar to Debt #

This is the most important part of the entire strategy. Any money you earn from a raise or a side hustle is “debt money.” It cannot, under any circumstances, get mixed into your regular budget or used to inflate your lifestyle.

The second that freelance payment lands in your bank account or you cash out your earnings from a delivery gig, immediately send it as an extra payment to your target debt. This simple act of discipline is what prevents “lifestyle creep” from eating up your progress. You have to build a mental wall around this new income and give it one job, and one job only: to buy back your financial freedom, one dollar at a time.

Slash Your Interest Rates and Starve Your Debt #

Think of high interest as the gasoline fueling your debt fire. The higher the rate, the faster your balances swell, making you run harder just to stand still. Cutting your interest rates is like shutting off the fuel supply—it gives you a real fighting chance to put out the fire for good.

This isn’t some complex financial trick. It’s about taking simple, direct action. A lower interest rate means more of every single payment goes straight to the principal, and that’s the only way you’ll ever get ahead.

Pick Up the Phone and Ask for a Better Rate #

I know it sounds almost too simple, but one of the most effective things you can do is call your creditors and ask for a lower rate. Credit card companies, especially, would much rather keep you as a paying customer—even at a lower rate—than lose you to a competitor or, worse, have you default.

Before you dial, get your game plan together:

- Arm yourself with your history: Be ready to mention how long you’ve been a loyal customer and point to your track record of on-time payments.

- Do a little recon: See what rates competitors are offering for someone with a similar credit profile. This is great leverage. You can say something like, “I’ve been getting offers in the mail for cards with a 15% APR.”

- Be polite but persistent: The person on the phone is just doing their job. Be kind, state your case clearly, and if they say no, don’t be afraid to politely ask, “Is there a supervisor or someone in the retention department I could speak with?”

A simple script can help you feel more confident. Try this: “Hi, I’ve been a customer for five years and I’ve always paid on time. I’m working really hard to pay down my balance, and I was hoping you could help by lowering my APR. Is there anything you can do for me?” You’d be surprised how often this works.

Use a Balance Transfer to Hit the Pause Button on Interest #

If your current lender won’t play ball, a balance transfer card can be your secret weapon. These cards offer a promotional period—often 12 to 21 months—with a 0% introductory APR.

For over a year, every single penny you pay goes directly to knocking down the principal. No interest. Nothing. This is your chance to make a huge dent in your debt.

But you have to be careful. Watch out for the fine print:

- The Transfer Fee: Most cards charge a one-time fee of 3% to 5% of the amount you transfer. Do the math to make sure the interest savings are worth this upfront cost.

- The Cliff: When that 0% intro period ends, the rate will skyrocket. The goal is to have the balance paid off before that happens.

- New Purchases: Be very careful about making new purchases on the card. Often, the 0% rate only applies to the transferred balance, while new spending gets hit with a high APR.

A 0% balance transfer card is a temporary ceasefire in your war against interest. Use that time wisely to attack the principal with everything you have. Don’t treat it as a vacation from your debt.

Consolidate Your Debts into One, Simpler Payment #

Another powerful option is a debt consolidation loan. You take out one new loan from a bank or credit union to pay off all your other high-interest debts. You’re left with a single monthly payment, and if you do it right, it will be at a much lower interest rate.

This move simplifies your life and can save you a ton of money. Imagine rolling several credit cards with a 22% APR into one personal loan at 9% APR. The difference in your monthly interest charges would be massive, dramatically shortening your path to zero.

This strategy isn’t just for individuals; it’s used on a global scale. Japan, for example, has a public debt-to-GDP ratio of around 230%, one of the highest in the world. How does the country manage it? By borrowing at incredibly low interest rates. The lesson is the same for your household: locking in a lower rate is the most powerful move you can make to get your debt under control. You can find more data on public debt management at Statista.com.

Just be sure to shop around for the best rates and read all the fine print for things like origination fees or prepayment penalties. The goal here is to save money, not just shuffle it around.

How to Stay Motivated on Your Debt-Free Journey #

Let’s be honest: paying off debt is more than a math problem. It’s a mental marathon. You can have the most detailed budget and a killer repayment plan, but if you lose motivation halfway through, it’s all for nothing. Staying fired up is the secret sauce that keeps your whole plan from falling apart.

This is all about building the mental grit to see this thing through to the end. It’s about finding ways to celebrate your progress, bounce back from setbacks, and keep your eye on the prize—even when it feels a million miles away. This human side of money is often what separates the people who succeed from those who give up.

The pressure to get out of debt is mounting for a reason. Global public debt has ballooned to over $100 trillion. That’s not just some abstract number for economists to worry about; it has a real impact on our wallets. When governments borrow more, interest rates tend to creep up on everything from credit cards to car loans and mortgages. Every extra dollar you throw at your debt right now is a powerful move to secure your financial future. You can dive deeper into these global trends in this UNCTAD report on global debt.

Make Your Progress Visual #

Staring at numbers on a banking app can feel pretty uninspiring. To really feel the momentum, you need to see your progress in a tangible way. A visual tracker is one of the most powerful motivational tools you can have in your corner.

It doesn’t need to be fancy. Try one of these:

- A classic thermometer chart that you color in for every $100 you pay off.

- A big glass jar you drop a marble into for every $50 payment you make.

- A paper chain where you satisfyingly rip off one link for each payment.

Watching that thermometer fill up or hearing the clink of another marble provides a rewarding jolt of encouragement that a digital balance just can’t match. It’s a physical, daily reminder of how far you’ve come.

Celebrate Small Wins the Smart Way #

If you wait until you’re completely debt-free to pop the champagne, you’re going to burn out long before you get there. You have to reward yourself for hitting smaller milestones along the way. Did you just knock out your first credit card? That’s a huge deal and deserves to be celebrated!

The trick is to celebrate without blowing up your budget.

Celebrating progress isn’t about spending money. It’s about acknowledging your hard work and discipline. The reward is a pat on the back, not another bill to pay.

Instead of an expensive dinner out, consider a celebratory hike, a special meal you cook at home, or a movie marathon with all your favorite snacks. The idea is to connect your debt-repayment journey with positive experiences, reinforcing the great habits you’re building.

Find Your Accountability Partner #

Going it alone is tough. Really tough. Sharing your goals with a trusted friend, your partner, or a family member can make all the difference. An accountability partner isn’t there to nag you; they’re your personal cheerleader and the person who gives you a gentle nudge when you feel like giving up.

Set up a quick weekly check-in. Even a five-minute text to say, “I hit my extra payment goal this week!” can feel incredibly validating. Knowing someone else is in your corner adds a powerful layer of commitment to your plan.

Handling Unexpected Setbacks #

Life is messy. The car is going to break down, the roof will leak, and an unexpected bill will show up right when you least expect it. This is exactly why you have an emergency fund, but it’s your mindset that will determine if a setback completely derails you.

When something goes wrong, don’t panic. Acknowledge the frustration, use your emergency savings for what they’re meant for, and then get right back on your plan with the very next payment. One tough month doesn’t wipe out six months of incredible progress. Remember, the goal is progress, not perfection.

Staying on track is so much easier when you have the right tools. Econumo was built to help you and your family manage money as a team. With features like shared budgets, manual transaction tracking that forces mindfulness, and a clear view of your progress, you can turn your debt-free goals into a reality. Take control of your finances and try the live demo on econumo.com to see how it can work for you.