If you want to improve your credit score, it really comes down to a few core habits: always pay your bills on time, keep your credit card balances low, and only apply for new credit when you actually need it. Get those three things right, and you’re building the foundation of a strong financial life by proving you’re a reliable borrower.

Your Quick Guide to a Better Credit Score #

Trying to figure out how to raise your credit score can feel like you’re trying to solve a puzzle with half the pieces missing. Lenders use that three-digit number as a quick snapshot of your financial reliability, and it affects everything from the interest rate on your mortgage to your chances of getting approved for an apartment. A higher score doesn’t just open doors; it can save you a serious amount of money over time.

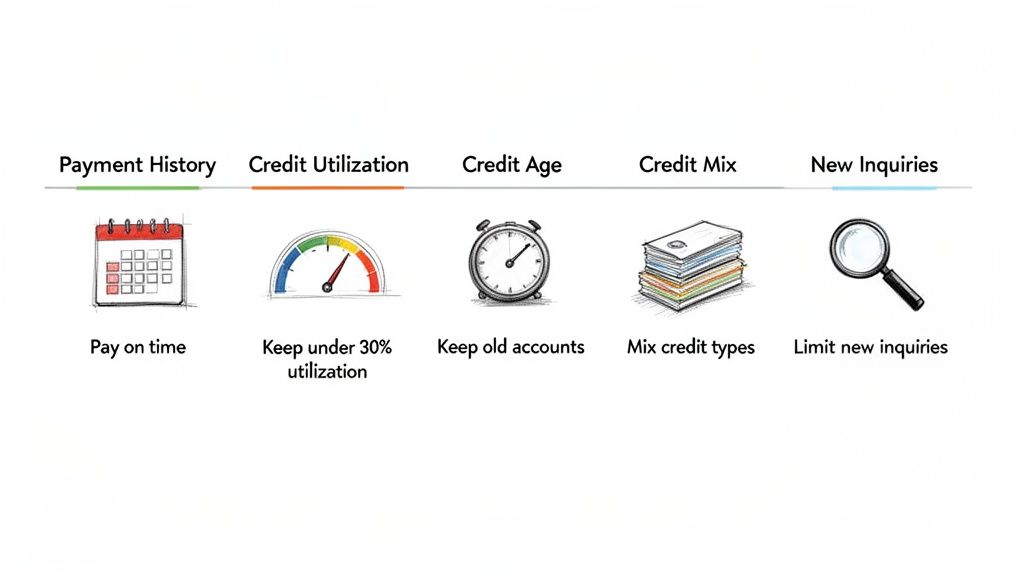

The good news is, the formula isn’t some big secret. Your score is built on five main pillars, and some are much more important than others. If you focus your energy on the ones that carry the most weight, you can make real progress without feeling totally overwhelmed.

A common myth I hear all the time is that you need a high income to have a good credit score. That’s just not true. Your income isn’t even a factor. What really matters is how consistently you manage the credit you have, whether it’s a little or a lot.

Let’s break down those five pillars. I’ve put them into a simple table so you can see exactly what lenders care about and the single best thing you can do for each one.

The Five Pillars of Your Credit Score #

| Factor | Why It Matters | What to Do |

|---|---|---|

| Payment History (35%) | This is the big one. It’s all about proving you can be trusted to pay back what you owe. A solid track record of on-time payments is the most powerful signal you can send to lenders. | Pay every single bill on time. I can’t stress this enough. Even one late payment can tank your score. Set up autopay for at least the minimums so you never forget. |

| Credit Utilization (30%) | This is simply the percentage of your available credit that you’re currently using. High balances make you look overextended and risky. | Keep your balances below 30% of your total credit limit. If you really want to see a boost, aim for under 10%. Paying down your cards is one of the fastest ways to see your score jump. |

| Length of Credit History (15%) | A long credit history gives lenders more data to work with. It shows you have years of experience managing credit responsibly. | Keep your oldest credit accounts open, even if you don’t use them much. Closing an old card shortens your history, which can actually hurt your score. |

| Credit Mix (10%) | Lenders feel more confident when they see you can juggle different kinds of debt, like credit cards (revolving credit) and a car loan or mortgage (installment loans). | Diversify your credit over time, but only when it makes sense. Don’t take out a loan just for the sake of it. But if you’re ready for a big purchase, having different loan types helps. |

| New Credit (10%) | Every time you apply for new credit, it triggers a “hard inquiry” on your report. A bunch of these in a short time can look like a red flag to lenders. | Only apply for new credit when you really need it. Try to space out applications by at least a few months to minimize the impact of those hard inquiries. |

Getting a handle on these five factors is the first and most important step. If you’re looking to tackle your credit utilization, having a clear debt payoff strategy is key. We have a guide that digs into different approaches you can use for that, which you can find here: how to pay off debt faster.

Mastering Your Payment History for Lasting Impact #

If there’s one thing to focus on when building your credit, it’s this: your payment history. It’s not just another piece of the puzzle; it’s the foundation. This single factor accounts for a massive 35% of your FICO score, making it the most powerful influencer of your financial reputation.

At the end of the day, lenders just want to know if you’re a reliable borrower. Consistently paying your bills on time is the clearest way to prove that you are.

Of course, life gets hectic. Juggling work, family, and everything in between means a due date can easily slip through the cracks. But the fallout from even one missed payment can be surprisingly severe and stick around for a long time.

The Real Cost of a Single Late Payment #

It’s a common myth that a payment isn’t truly “late” until it’s a month overdue. The reality is that most lenders can report you to the credit bureaus once a bill is just 30 days past its due date. A single 30-day late mark can knock a significant number of points off your score.

Worse yet, that negative mark doesn’t just disappear. It can linger on your credit report for up to seven years.

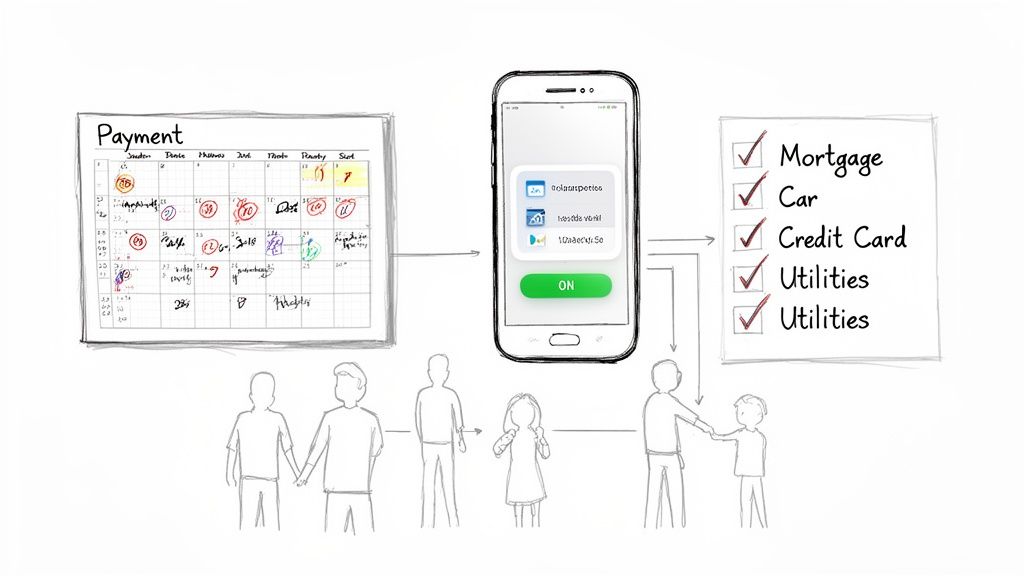

Think about a typical family budget: a mortgage, a car loan, student debt, and a few credit cards. That’s a handful of different due dates to keep track of every single month. One oversight doesn’t just mean a late fee; it creates a blemish that can make future loans more expensive or harder to get.

Lenders see your payment history as a direct reflection of your financial discipline. A recent late payment flashes like a warning sign, suggesting risk—even if it was an honest mistake. That’s why preventing them in the first place is the name of the game.

This is where you have to stop relying on memory. You need a system.

Bulletproof Strategies for Never Missing a Due Date #

Building a perfect payment history isn’t about having a perfect memory; it’s about creating a foolproof system that removes the chance for error. The goal is to make on-time payments feel automatic.

Here are a few strategies I’ve seen work time and time again:

- Set Up Autopay as Your Safety Net: For every single account, set up automatic payments for at least the minimum amount due. This is your backstop. You can always pay more manually, but this simple step guarantees you’ll never be marked as late.

- Use a Centralized Calendar: Whether it’s a digital calendar or a dedicated app, put all your due dates in one place. Set alerts for a few days before each bill is due to give yourself a cushion.

- Consolidate Your Due Dates: Many creditors, especially credit card companies, are happy to let you change your payment due date. Try to align several bills to the same day or week of the month. It’s so much easier to manage.

For couples or families sharing finances, coordination is everything. You need a shared system to avoid the classic “I thought you paid it” scenario.

Managing Shared Bills and Joint Accounts #

When your finances are intertwined, so is your credit. A missed payment on a joint mortgage or a co-signed car loan hits both of your credit scores, no questions asked. This makes clear communication and a single source of truth absolutely essential.

This is exactly the kind of challenge Econumo is built for. With joint-account tracking, you and your partner get a transparent, unified view of all your shared bills and due dates. There’s no more guessing about who’s handling what.

Econumo’s manual transaction workflow also helps by encouraging a more mindful approach. Instead of payments just happening in the background, you actively log them, which reinforces good habits and keeps everyone aligned. This kind of proactive management is a core part of building a solid budget—the very thing that ensures you have the money ready when your bills come due. If you’re looking to get that foundation in place, our guide on how to stick to a budget is a great place to start.

By creating one central hub for all your bills, you can turn a chaotic mess of due dates into a simple, predictable process. That’s how you master your payment history and build a credit score that truly reflects your reliability.

The Secret to Lowering Your Credit Utilization Ratio #

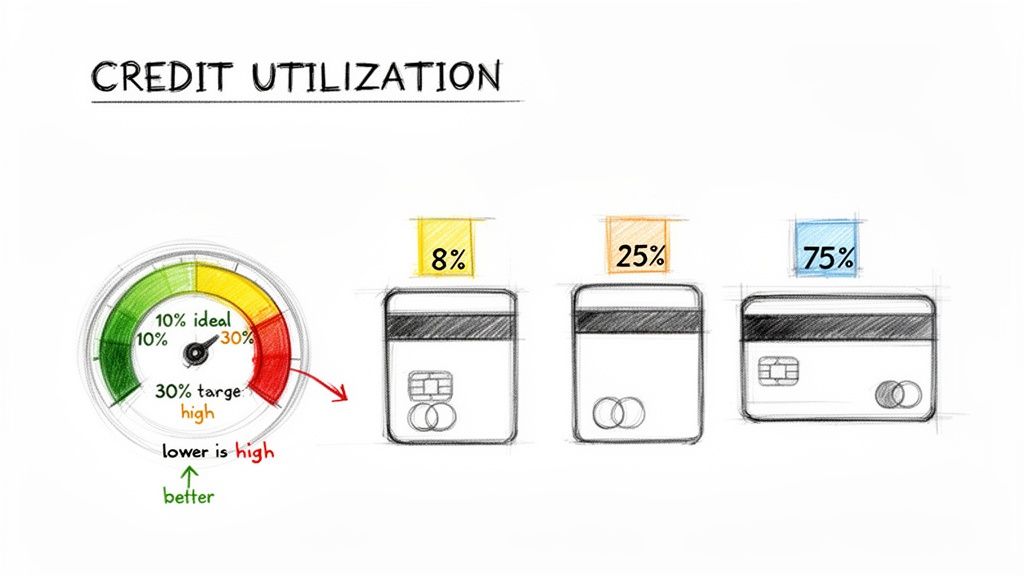

Once you’ve got your on-time payments down pat, the next biggest lever you can pull is your credit utilization ratio (CUR). It sounds a bit technical, but all it really means is the percentage of your available credit you’re actually using. This one factor makes up a massive 30% of your credit score, putting it right up there with your payment history in terms of importance.

Think of it from a lender’s perspective. They see your total credit limit as a safety net. If you’re consistently using most of it, it can signal that you’re stretched thin and relying on debt to get by. That looks risky, and lenders get nervous about risk.

This isn’t just theory—it’s playing out in real-time. As the economy tightens, people lean more on credit. By April 2024, the average credit card utilization had crept up to 35%, a significant jump from the year before. This trend has a direct impact on credit scores. According to Equifax’s comprehensive report, people with even one late payment saw their utilization skyrocket from 67% to a staggering 75% between 2019 and 2023.

But here’s the good news: because your utilization is a snapshot of your current balances, you can change it fast. Tackling this is often the quickest way to see a real, noticeable bump in your score.

Understanding the Magic Numbers #

So, what should you aim for? Most experts will tell you to keep your utilization below 30%. If you can get it under 10%, you’re in the sweet spot and will likely see the biggest boost to your score.

Let’s run the numbers with a quick example:

- You have two credit cards:

- Card A has a $5,000 limit.

- Card B has a $3,000 limit.

- Your total available credit is $8,000.

- You owe $2,800 on Card A and $400 on Card B, for a total balance of $3,200.

- Your overall utilization is $3,200 ÷ $8,000, which comes out to 40%.

In this case, your 40% overall utilization is higher than ideal. But lenders also zoom in on the utilization of each individual card. Card A is at 56% ($2,800 / $5,000), which is a big red flag all on its own.

Key Takeaway: It’s not just your overall utilization that matters. Maxing out a single card can drag your score down, even if your other cards have zero balances. The goal is to keep low balances across the board.

Actionable Strategies to Lower Your Utilization #

Knowing the numbers is one thing, but actually changing them is what counts. It all boils down to two things: paying down your balances or increasing your credit limits. Here are a few practical ways to get it done.

1. Pay Down Balances Strategically The most obvious way to lower utilization is to pay down your debt. But how you do it matters. Targeting the card with the highest utilization first (like Card A in our example) can often give you a faster score boost than simply paying off the smallest balance. This is where a focused budget becomes your best friend. In Econumo, you can create a specific budget category for “High-Interest Debt” to keep this goal top of mind. By using the manual transaction workflow to track every extra payment, you see your progress in real-time, which helps keep the momentum going.

2. Make Mid-Cycle Payments Most of us wait for the monthly statement to show up before paying the bill. Here’s a pro tip: you don’t have to. Your card issuer typically reports your balance to the credit bureaus on your statement closing date. So, if you make a big purchase, you can pay it off before the statement even closes. This makes it look like you used less credit that month, which can instantly lower your reported utilization.

3. Ask for a Credit Limit Increase If you’ve been a responsible customer, it’s often worth asking your credit card company for a limit increase. You can usually do this right from their website or app. If the limit on Card A from our example went from $5,000 to $7,000, your utilization on that card would immediately drop from 56% to 40%—without you paying off a single dollar. The key, of course, is not to use that new credit. The goal is to improve the ratio, not to spend more.

Of course, to pay down debt aggressively, you need to find the cash first. A great place to start is by taking a hard look at your spending to see where you can trim the fat. For some solid ideas, check out our guide on how to reduce monthly expenses. Getting your CUR under control is a powerful move toward a better score and more financial freedom.

Building a Long and Diverse Credit History #

While paying your bills on time and keeping your card balances low will give you the quickest score boosts, the real secret to a rock-solid financial profile is playing the long game. This comes down to two things: the length of your credit history and your credit mix.

Together, these factors make up a combined 25% of your FICO score. Think of it as your financial resume—a longer, more detailed history shows lenders you have years of experience managing debt, making you a much more predictable and trustworthy borrower.

Why You Should Never Close Your Oldest Credit Card #

It’s a common temptation to tidy up your wallet by closing that old credit card you never use anymore. It feels like a smart, minimalist move, but when it comes to your credit score, it can seriously backfire.

Closing an old account, especially your oldest one, hurts your score in two major ways. First, it drags down the average age of your accounts. Lenders reward longevity; an account you’ve managed well for over a decade is a powerful testament to your stability. Close it, and you erase that positive history, causing your score to dip.

Second, it shrinks your total available credit. This instantly spikes your credit utilization ratio. Imagine you have $20,000 in total credit and close an old card with a $5,000 limit. Suddenly, your total credit drops to $15,000, and your existing balances now look much larger in comparison.

My advice? If an old, unused card has no annual fee, just keep it open. Use it for a small purchase every few months—a coffee or a tank of gas—and pay it off immediately. This keeps the account active and preserves your hard-earned credit history.

The Power of a Healthy Credit Mix #

Beyond just the age of your accounts, lenders also want to see that you can handle different kinds of credit. This is your “credit mix,” which generally falls into two buckets:

- Revolving Credit: Things like credit cards and lines of credit, where your balance can go up and down.

- Installment Loans: Loans with fixed payments and a set end date, like a mortgage, auto loan, or personal loan.

Having a healthy blend of both shows you’re a versatile borrower. It proves you can manage the discipline of fixed monthly payments just as well as the flexibility of a credit card. You should never take on debt just to improve your mix, but as you naturally take out loans for a car or home, this diversity will strengthen your credit profile over time.

A long and varied history acts as a buffer against financial surprises. It’s what helps elevate scores steadily, and it’s a key reason that 23% of Americans reached a FICO score of 800 or higher in early 2024. That’s up from just over 21% the year before. You can discover more insights about these FICO score trends and what they mean for you.

Getting Started If You Have a Thin Credit File #

For anyone just beginning their credit journey, it can feel like a catch-22. You need credit to build a credit history, but you need a credit history to get approved for credit.

Thankfully, there are a few proven ways to get your foot in the door. One of the most effective strategies is to become an authorized user on a credit card belonging to a parent or another trusted family member with excellent credit. Their long record of on-time payments gets added to your credit report, giving you an instant foundation.

This is a scenario where families need clear communication. With Econumo, you can use joint-account tracking to get a single view of both revolving debts and installment loans for the entire household. The manual transaction workflow also helps everyone stay mindful of their spending and ensures every payment is accounted for, which is critical when you’re building credit together.

How to Find and Fix Errors on Your Credit Report #

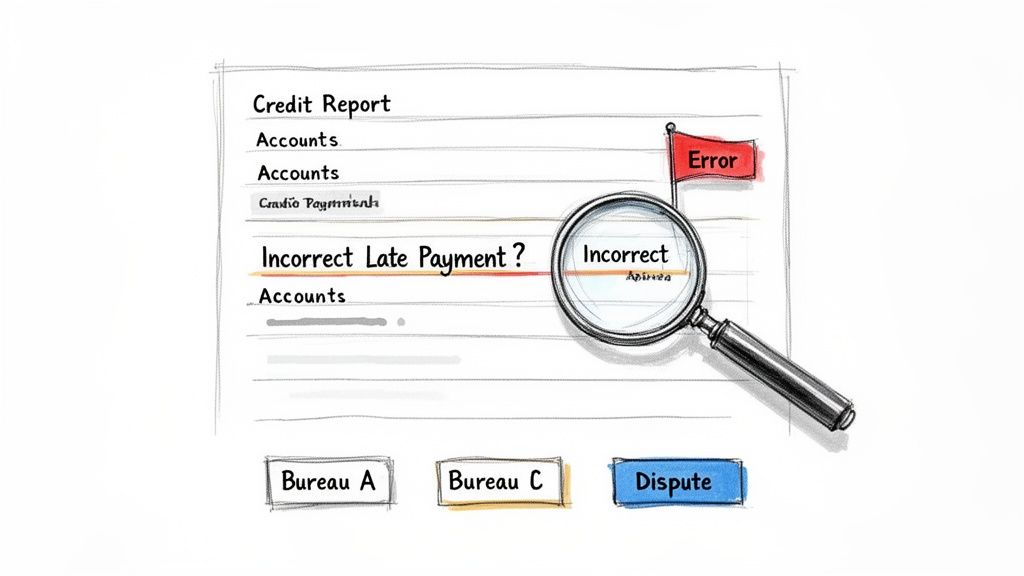

Your credit score isn’t just a random number; it’s calculated directly from the data in your credit reports. You can think of your reports as the blueprint for your score. If there’s a flaw in that blueprint—an error or an inaccuracy—it can unfairly drag your score down and make everything from a car loan to a mortgage more expensive.

Mistakes on credit reports are surprisingly common. They can range from simple typos in your personal info to fraudulent accounts opened in your name. Taking the time to regularly check your reports is a crucial, and often overlooked, step in managing your financial health.

This isn’t just about spotting major fraud. Even a small mix-up, like a payment reported late when you know you paid on time, can do real damage. Ensuring your report is a true reflection of your financial habits is one of the most powerful ways to improve your credit score.

Getting Your Free Credit Reports #

First things first, you need to get your hands on your reports. Federal law gives you the right to a free copy of your credit report every 12 months from each of the three major credit bureaus: Equifax, Experian, and TransUnion.

The only official, government-authorized website for this is AnnualCreditReport.com. Be careful of other sites that promise “free” reports but might try to sign you up for a paid service. Stick with the official source to get what you’re entitled to, no strings attached.

I always recommend pulling all three reports at once to compare them side-by-side. Lenders don’t always report to all three bureaus, so you might find an error on one report that doesn’t show up on the others.

Reviewing your credit reports is like giving your finances an annual check-up. You’re not just looking for problems; you’re verifying that everything is healthy and accurate, which is the foundation of a strong credit score.

What to Look For When Reviewing Your Reports #

Once you have your reports, it’s easy to feel a bit overwhelmed. They’re dense documents packed with account numbers, dates, and industry jargon. To make it manageable, focus your review on a few key areas.

Here’s a checklist of common errors I tell people to hunt for:

- Personal Information Errors: Is your name spelled correctly? What about your address and Social Security number? A simple typo could mean your file has been mixed with someone else’s.

- Incorrect Account Status: Look for accounts incorrectly marked as late, delinquent, or in collections when you know you’ve paid on time.

- Accounts You Don’t Recognize: This is a huge red flag for identity theft. If you see a credit card or loan you never opened, you need to act fast.

- Duplicate Accounts: Sometimes, a single debt can accidentally be listed twice, making it look like you owe more than you really do.

- Outdated Negative Information: Most negative items, like late payments or collections, are supposed to fall off your report after seven years. Make sure old blemishes have actually been removed.

How to Dispute an Error and Get It Fixed #

Finding an error can be frustrating, but the good news is there’s a clear process for disputing it. Let’s walk through a common scenario: you find a credit card payment from six months ago marked as “30 days late,” but you have bank records proving you paid it on time.

The Fair Credit Reporting Act (FCRA) gives you the right to dispute any information you believe is inaccurate. You’ll need to file a dispute directly with the credit bureau that’s reporting the error. You can usually do this online, by phone, or by mail.

For the best results, I suggest filing your dispute in writing and including copies (never originals!) of any supporting evidence, like the bank statement showing the on-time payment. Clearly explain why the information is wrong and what you want them to do—in this case, correct the late payment to “paid as agreed.”

The bureau then has about 30 days to investigate your claim with the company that reported the information. If they find the information is inaccurate, they are legally required to correct it and send you the results. Fixing an error like an incorrect late payment can give your score a healthy, and often immediate, boost.

Your Top Credit Score Questions, Answered #

Once you start digging into the world of credit, a lot of questions pop up. It’s one thing to know the rules of the game, but it’s another thing entirely to see how they apply to your actual life. Let’s tackle some of the most common things people wonder about on their journey to a better score.

Getting these details right gives you the confidence to put your energy where it will make the biggest impact.

How Long Does It Really Take to Improve My Credit Score? #

This is the big one, and the honest answer is: it depends on what you do. If you have high credit card balances, you could see a positive jump in your score in as little as 30 to 60 days just by paying them down. Why? Because you’re quickly lowering your credit utilization, and that’s a huge factor.

Getting a major error removed from your report can also give you a pretty fast boost. But the real heavy lifting—like building a rock-solid history of on-time payments or increasing the average age of your accounts—is a long-term project. The full effect of these good habits unfolds over months and years, not weeks.

Think of it this way: Quick fixes can give you a nice bump, but building a truly excellent, resilient credit score is a marathon. Consistency is the name of the game.

Will Checking My Own Credit Score Hurt It? #

Absolutely not. This is a stubborn myth that, frankly, keeps people in the dark about their own finances. When you pull your own credit report or check your score through a monitoring service, it’s considered a “soft inquiry.”

Soft inquiries have zero effect on your score. They’re totally different from a “hard inquiry,” which is what happens when a lender pulls your report because you’ve applied for something like a new credit card or a car loan. Those can cause a small, temporary dip. So please, check your score as often as you want. It’s one of the smartest (and safest) financial habits you can have.

How Do Joint Accounts Affect Our Credit? #

When you have a joint account, you’re financially tethered to the other person. That account and its entire history—every payment, every balance, good or bad—shows up on both of your credit reports.

This means if one person makes a late payment on a shared car loan, it dings both of your scores equally. But the reverse is also true: a long, perfect payment history on a joint mortgage will lift you both up. This is why having open conversations about money and being on the same page is non-negotiable for couples or family members with shared accounts.

Should I Close My Old, Unused Credit Cards? #

Tempting as it might be to simplify, the answer is usually no. Keeping old, unused credit cards open (especially those with no annual fee) is often the smarter move. Closing an account can backfire in two ways.

First, you lose that card’s credit limit, which shrinks your total available credit. This can immediately spike your credit utilization ratio, which can lower your score. Second, if it’s one of your oldest accounts, closing it can reduce the average age of your credit history—another key scoring factor.

A better strategy? Use the card for a tiny, planned purchase every few months (like a coffee) and pay it off immediately. This keeps the account active and preserves the valuable credit history you’ve already built.

Ready to stop wondering and start managing your money with real clarity? Econumo gives you the tools for smart budgeting, joint-account tracking, and building better financial habits, all while putting your privacy first. See how it works at https://econumo.com.