When you boil it down, creating a family budget is about four things: agreeing on your financial goals together, figuring out your total household income, tracking where your money is actually going, and then creating a realistic monthly plan based on that info. It’s how you turn a free-for-all into a team sport, cutting down on stress and putting you both back in the driver’s seat.

Why Most Family Budgets Fail and How Yours Can Succeed #

Let’s be real—the thought of sitting down to make a family budget can feel like a chore. For most people, it conjures up images of rigid spreadsheets, tense conversations about who spent what, and a general feeling of being told “no.” It’s no surprise that so many families give up after just a few weeks.

The real problem? Most budgets are built around restriction. They focus on what you can’t do instead of what you want to achieve. This guide is all about flipping that idea on its head. A great family budget isn’t a rulebook; it’s a roadmap you build together to get your family where you actually want to go.

Shifting from Restriction to Empowerment #

Instead of a financial straitjacket, think of your budget as a plan for freedom. It’s the strategy that empowers you to finally book that dream vacation, knock out that lingering credit card debt, or start saving for a down payment on a bigger home. When you and your partner are pulling in the same direction toward a goal that excites you both, the small, daily spending choices become so much easier.

This kind of proactive planning is more critical than ever. The Global Family Inflation Index from Remitly paints a stark picture of rising costs. For families in the United States, the price tag for essentials is projected to hit $82,476 a year by 2035—a staggering 48% jump from 2025, with healthcare being a major driver. A budget helps you get ahead of these trends instead of being caught off guard.

A successful budget is a communication tool first and a math tool second. It transforms money conversations from a source of conflict into a platform for teamwork and shared goals.

The Foundation of a Lasting Budget #

For a budget to actually stick, it needs a few things that old-school, rigid plans always seem to miss.

- Collaboration Over Control: This has to be a team sport. Both partners need an equal say in how the budget is made and managed. It’s not one person’s job to be the “enforcer.”

- Flexibility for Real Life: Life happens. The car will need new tires, the dishwasher will break. A budget that can’t bend with these surprises is a budget that’s doomed to fail.

- Connection to Your ‘Why’: Every dollar you assign a job should tie back to a bigger goal. That’s what gives you the motivation to skip the impulse buy and stick to the plan.

When you build your financial plan around these principles, you create something that doesn’t just look good on paper—it actually works in the messy, wonderful reality of family life.

Aligning Your Finances with Your Family’s Future #

Before a single number gets crunched, the first real step in creating a family budget is to just talk. A budget isn’t a spreadsheet of restrictions; it’s a roadmap to the life you want to build together. Real success begins when you and your partner are on the same page about your dreams, both shared and individual.

This conversation becomes your “why.” It’s the motivation you’ll lean on when an impulse buy is calling your name or when an unexpected expense throws you a curveball. Without that shared vision, a budget feels like a chore, and chores are easy to abandon.

Turning Dreams into Actionable Goals #

Find some time for a low-pressure “dream session” with your partner. Put the kids to bed, pour a couple of drinks, and just brainstorm. The goal isn’t to solve everything overnight, but to get all your hopes for the future out on the table.

Forget vague goals like “save more money.” You have to get specific. To get the ball rolling, try asking each other questions like these:

- What’s one thing we could get in the next year that would make life a little better? (Think: a robot vacuum, a new grill for the backyard.)

- If we had the cash, where would we go on vacation in the next three years?

- What big life events are on the horizon in the next 5-10 years? (Maybe it’s a new car, a down payment, or starting college funds.)

- What does “retirement” actually look like to you?

This kind of open dialogue is the foundation of solid financial planning for married couples. It’s all about understanding what truly matters to each other.

Creating a Financial Roadmap #

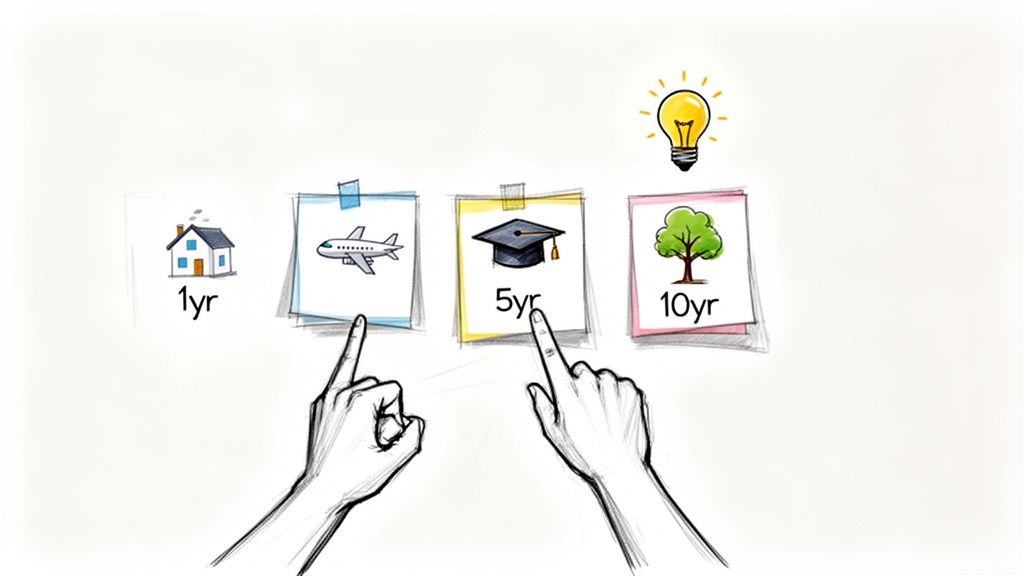

Once you have a list of ideas, it’s time to bring them down to earth and give them some structure. Organizing your goals by timeline transforms a wish list into a real, practical plan that will guide your budget.

1. Short-Term Goals (The Next 12 Months) These are your quick wins—the goals that keep you motivated. Think about finally building a $1,000 emergency fund, knocking out that nagging credit card balance, or saving up for a fun weekend trip.

2. Mid-Term Goals (1-5 Years) Here’s where the bigger, more exciting stuff lives. This category is for things that require steady saving over time, like a down payment on a home, a new car, or that big family vacation you’ve been talking about.

3. Long-Term Goals (5+ Years) This is all about the big picture. These are the goals that will secure your family’s future, like consistently contributing to retirement, making sure the kids’ college is funded, or even paying off the mortgage early.

When you categorize your goals this way, you start to see a direct line between your daily choices and your future dreams. Skipping a $5 coffee suddenly feels less like a sacrifice and more like a small, intentional step toward that family vacation fund.

With a shared vision locked in, you’re no longer just “cutting back.” You’re actively and intentionally building the life you designed together. That unity is the secret sauce for making a family budget actually stick.

Taking an Honest Look at Your Family’s Finances #

Once you’ve talked about your shared goals, it’s time to switch from dreams to data. You can’t draw a map to where you’re going if you don’t know where you’re starting. This is where you roll up your sleeves and get a crystal-clear snapshot of your family’s current financial situation. It might feel a little daunting, but we’ll break it down into two simple parts: figuring out what you earn and seeing where it all goes.

The point here isn’t to judge past decisions. Think of it more like a doctor running diagnostics before prescribing a treatment—you need the real facts to build a plan that actually works.

Figuring Out Your True Household Income #

First things first, let’s nail down your total monthly take-home pay. This is the actual cash you have to work with after taxes, insurance, and other deductions are taken out. For anyone with a steady 9-to-5, this is pretty simple. Just look at your last pay stub.

But for many families, income isn’t that straightforward. It’s crucial to count every dollar that comes in the door.

- Salaried Employees: Grab your most recent pay stub. The number you’re looking for is the net pay—the amount that hits your bank account—not your gross salary.

- Hourly or Irregular Income: If your pay fluctuates, look back at the last three to six months of your bank statements. Calculate an average monthly take-home pay and use that as a conservative baseline. It’s always better to underestimate income than to overestimate it.

- Side Hustles and Freelance Work: Add up all the income from your freelance gigs, side projects, or small business ventures. Just remember to mentally set aside a chunk of this for taxes before you count it as spendable cash.

Add it all together, and you’ll have one solid number: your total household net income. This is the foundation of your entire budget.

A budget built on wishful thinking is doomed from the start. Using your real take-home pay, not your gross salary, ensures you’re working with reality.

Tracking Every Penny for One Full Month #

Now for the part that’s often a real eye-opener: tracking your spending. For one month—just 30 days—you and your partner need to log every single purchase. That daily coffee, the app you forgot you subscribed to, that pack of gum at the checkout. Everything.

Right now, the goal isn’t to cut back. It’s simply to gather information. You want to see where your money actually goes, not where you think it goes. Trust me, most people are floored when they see how those small, “harmless” purchases can add up to hundreds of dollars.

You can use a simple notebook, a spreadsheet, or a budgeting app. A tool like Econumo is built for this, letting multiple users track shared finances easily. Whatever tool you choose, consistency is what matters most. At the end of the month, you’ll have a powerful set of data that tells the true story of your family’s spending habits. You can find more strategies for this in our guide to understanding your income and expenses.

Making Sense of Your Spending #

Okay, you’ve got a month’s worth of data. Now what? It’s time to organize it. Grouping your purchases into categories helps you spot the patterns and see exactly where your money is going.

Start by sorting everything into three main buckets:

- Fixed Expenses: These are the bills that are pretty much the same every month. Think mortgage or rent, car payments, insurance premiums, and daycare. They’re predictable.

- Variable Expenses: These are the costs you need to cover, but the amounts change. Groceries, gas for the cars, electricity bills, and general household supplies all fall in here.

- Discretionary Expenses: This is all the “want-to-have” stuff. Dining out, movie tickets, hobbies, streaming services, and shopping for fun—it all lands in this category.

This exercise is often incredibly revealing. You might find that your family’s discretionary spending is way higher than you thought, which could be the very thing holding you back from your savings goals.

Understanding these spending dynamics becomes even more critical as a family grows. The economic reality of a household shifts significantly with each new member.

How Household Size Impacts Annual Per-Person Spending #

| Region | Single Person Household | Five-Person Household | Spending Difference |

|---|---|---|---|

| North America | $55,760 | $40,400 | -28% |

| Europe | $31,230 | $23,540 | -25% |

| Asia Pacific | $12,740 | $9,890 | -22% |

Source: Data adapted from the World Economic Forum’s analysis.

As you can see, the per-person spending power decreases as a household gets larger. In North America, an individual in a five-person family spends about 28% less than someone living alone. This is exactly why a family budget can’t be static; it has to evolve with your family.

By finishing this financial deep dive, you’ve done the hardest part. You’ve replaced guesswork with cold, hard facts, giving you a solid foundation to build a family budget that actually works.

Choosing the Right Budgeting Method for Your Family #

Alright, you’ve put in the work to get a crystal-clear picture of your income and expenses. That’s genuinely the hardest part. Now, we get to the more creative step: building a plan that actually fits your family’s personality and lifestyle.

There’s no magic “best” way to create a family budget. The right method is simply the one you can stick with when life gets busy. Every family is different—some people love detailed spreadsheets, while others just want broad guidelines. Let’s walk through a few of the most popular approaches to find the perfect fit for you.

The 50/30/20 Rule: Keeping It Simple #

If the thought of tracking dozens of spending categories makes your head spin, the 50/30/20 rule is a fantastic place to start. Think of it less as a strict budget and more as a high-level guide for your money.

The idea is brilliantly simple. You just divide your after-tax income into three buckets:

- 50% for Needs: This is for all the absolute essentials—the things you must pay to keep your life running. We’re talking mortgage or rent, utilities, groceries, transportation, insurance, and the minimum payments on any debts.

- 30% for Wants: This is your lifestyle fund. It covers everything that makes life more enjoyable but isn’t strictly necessary: dining out, hobbies, streaming subscriptions, vacations, and that morning latte.

- 20% for Savings & Debt Payoff: This slice is all about building a stronger financial future. It includes contributions to your emergency fund, retirement accounts (like a 401(k) or Roth IRA), college savings, and any extra payments you make to get out of debt faster.

The real beauty of this method is its simplicity. It helps you focus on the big picture without getting lost in the weeds. The only catch? It requires a bit of discipline to keep your “wants” from sneaking into the “needs” category.

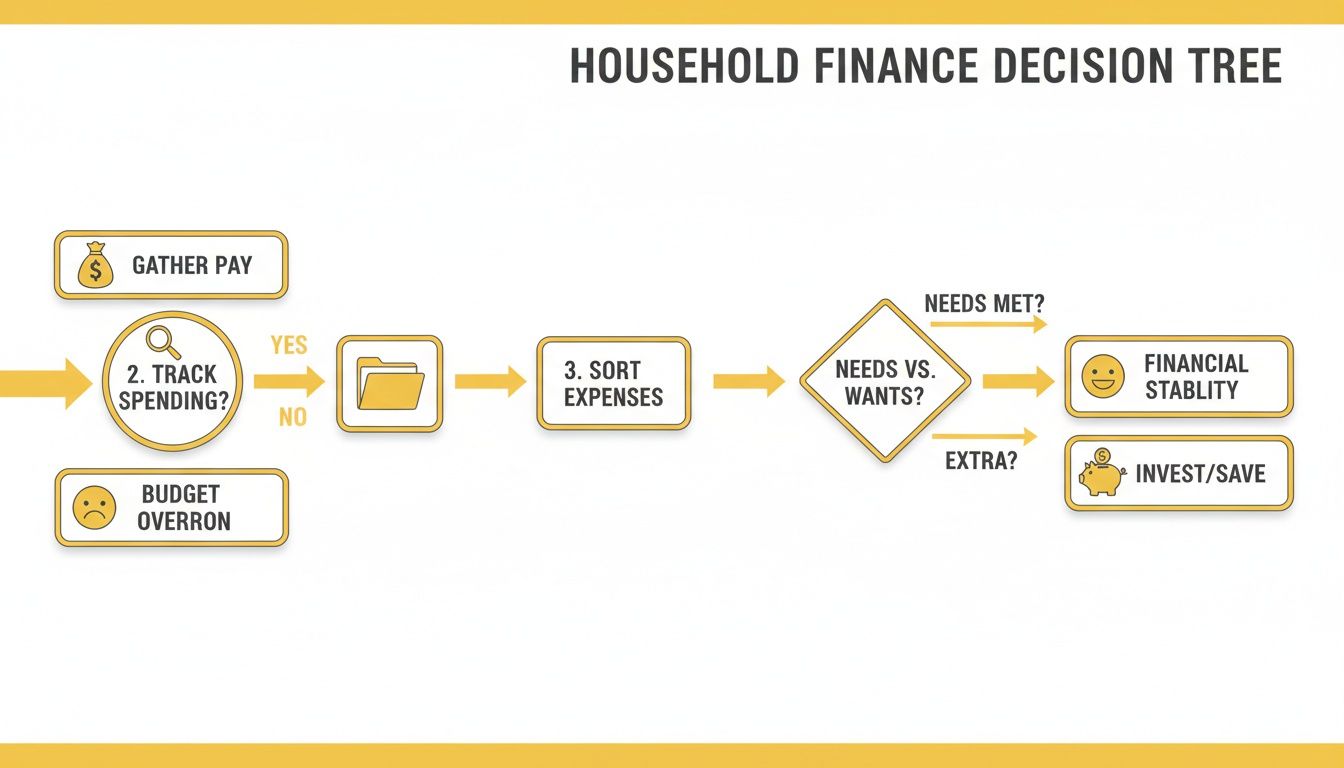

Zero-Based Budgeting: Giving Every Dollar a Job #

For families who want to be more intentional with their money, zero-based budgeting is a game-changer. The core principle is straightforward: income minus expenses must equal zero.

At the beginning of each month, you sit down and give every single dollar you earn a specific “job” until there’s nothing left to assign. This doesn’t mean you have zero dollars in the bank! A “job” can be anything from buying groceries to paying down your credit card or moving money into your vacation fund.

It’s about making a proactive plan for your money instead of looking back at the end of the month and wondering where it all went.

This decision tree gives you a great visual of the prep work needed before you can build a budget like this.

As you can see, a solid budget starts with gathering your income details, tracking your spending, and sorting it all into clear categories. This groundwork is what makes a zero-based budget so effective.

Zero-based budgeting forces you and your partner to have honest conversations about what truly matters. Since every dollar needs a home, you have to agree on your priorities—is it aggressively paying off the car loan this year or finally saving up for that big family trip?

This hands-on approach builds incredible financial awareness, but it does take more time than other methods. A tool like Econumo is perfect for this style, as its multi-user accounts and focus on manual entry are designed to support this kind of intentional money management.

The Envelope System: A Hands-On Approach to Spending #

Are you a visual person who finds it a little too easy to overspend with a quick swipe of a card? The envelope system might be exactly what you need. It’s essentially a cash-based version of zero-based budgeting that works wonders for reining in those tricky variable spending categories.

Here’s how it works:

- Find Your Trouble Spots: First, identify the spending areas where you consistently go over budget. Common culprits are groceries, dining out, entertainment, or personal “fun money.”

- Label Your Envelopes: Grab some physical envelopes and label one for each of those problem categories.

- Fill ‘Em Up: At the start of the month, withdraw the exact amount of cash you budgeted for each category and put it into its designated envelope.

- Spend Only What’s Inside: When you go to the grocery store, you can only use the cash from the “Groceries” envelope. Once that money is gone, you’re done spending on groceries for the month. No exceptions.

This method creates a real, physical limit on your spending. You can literally see the money disappearing, which makes you far more conscious of every purchase. It’s fantastic for changing habits, though it can be a bit tricky for online shopping or paying fixed bills.

Sample Monthly Family Budget Template (Based on a $6,000 Net Income) #

To help you visualize what a zero-based budget looks like in practice, here’s a sample breakdown for a family with a $6,000 monthly take-home pay. This is just an example—your own categories and numbers will be unique to your life and goals.

| Category | Sub-Category | Budgeted Amount | Notes/Goals |

|---|---|---|---|

| Housing | Mortgage/Rent | $1,800 | |

| Electricity | $120 | ||

| Water/Sewer | $80 | ||

| Internet | $70 | ||

| Transportation | Car Payment | $400 | Pay extra $50 next month |

| Gas | $250 | ||

| Car Insurance | $150 | ||

| Food | Groceries | $700 | Try one less takeout meal |

| Restaurants/Takeout | $200 | ||

| Personal | Clothing | $100 | |

| Personal Care | $80 | ||

| Hobbies/Entertainment | $150 | ||

| Giving | Charity | $100 | |

| Debt Payoff | Credit Card (Extra) | $200 | Goal: Pay off by December |

| Savings | Emergency Fund | $300 | Goal: Build up to $10k |

| Vacation Fund | $150 | Sinking fund for summer trip | |

| Kids’ College Fund | $150 | ||

| Total | $6,000 | Income - Expenses = $0 |

Notice how every single dollar of the $6,000 income is assigned a job. This is the power of a zero-based plan—it leaves nothing to chance and ensures your spending aligns perfectly with your goals.

Don’t Forget Sinking Funds #

No matter which budgeting method you land on, incorporating sinking funds is a non-negotiable for family financial success. These are simply small savings buckets you create for specific, non-monthly expenses that you know are on the horizon.

Think about all those costs that tend to pop up and wreck your budget:

- Holiday gifts in December

- Annual car insurance or life insurance premiums

- Unexpected (but inevitable) car repairs

- That big family vacation

- Back-to-school shopping in the fall

Instead of scrambling to find an extra $1,200 when the car insurance bill arrives, a sinking fund lets you plan for it. You’d simply create a “Car Insurance” fund and automatically save $100 every month. When the bill comes due, the money is already sitting there, waiting to be spent.

This simple strategy transforms potential financial emergencies into boring, predictable expenses, giving your budget the resilience it needs to handle real life without stress.

Weaving Your Budget into Your Daily Rhythm #

A budget is useless if it just sits in a spreadsheet. Its real power is unleashed when it becomes a living, breathing part of your family’s weekly routine. This is how your plan stops being a rigid document and starts being a dynamic tool that works for your life, not the other way around.

The goal isn’t to follow a static plan to perfection. It’s about building financial habits that keep you and your partner aligned, informed, and in control. This means creating simple, consistent rituals that make managing money feel less like a chore and more like a shared project.

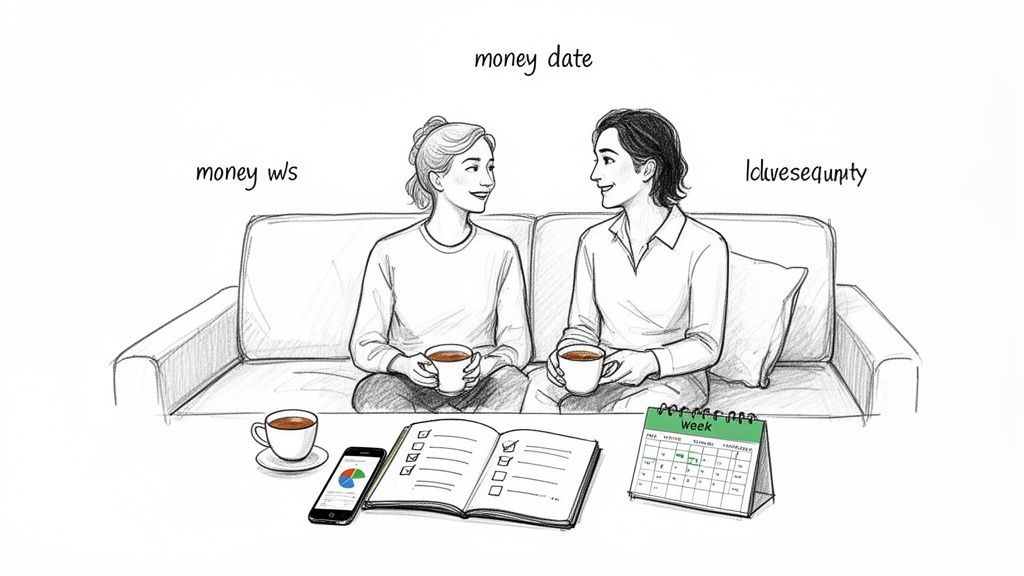

The Weekly Money Date #

One of the best habits you can build is the weekly “money date.” Think of it as a scheduled, low-stress time for you and your partner to connect on your finances—more like a casual coffee chat about your goals than a stuffy board meeting.

The rules are simple: keep it short (15-20 minutes is perfect), stay positive, and look forward. This isn’t the time to pick apart every purchase or play the blame game. It’s a quick check-in to make sure you’re both still on the same page.

Here’s a simple agenda to get you started:

- Share a Win: Kick things off by sharing one thing that went well financially this week. Maybe you crushed the grocery budget or talked yourselves out of an impulse buy.

- Glance at the Week: Quickly look over your spending. Any surprises? Are you still on track in your main categories?

- Plan Ahead: What’s coming up on the calendar? A birthday party? A doctor’s appointment? Make small tweaks to the plan to handle it.

This regular touchpoint keeps small issues from snowballing into big problems and ensures the financial conversation is always open.

A weekly money date reframes budgeting from an act of enforcement to an act of collaboration. It’s your dedicated time to operate as a financial team, making adjustments and celebrating progress together.

Keeping the Conversation Productive #

The tone of your money dates is everything. If you want to keep them from becoming a source of tension, it helps to have a few go-to conversation starters.

Positive Conversation Starters:

- “I saw we’re really on track with our savings goal for the vacation. Great job, team!”

- “What’s one thing we can do next week to make staying on budget a little easier?”

- “Is there anything coming up that we need to plan for financially?”

This team-based approach is what makes a budget stick in the long run. For more ideas on this, check out our guide on how to stick to a budget. The secret is to stay flexible and always remember you’re on the same team.

Tracking in Real-Time Without the Hassle #

For your weekly check-ins to actually work, you need current information. The best way to stay on top of things is to track spending as it happens, but it doesn’t have to be a drag. You just need to find a method that fits into your life.

Whether you use a dedicated app like Econumo, a simple notes app, or just snap photos of receipts, the important thing is to have a system. The five minutes it takes to log your spending each day will save you from an hour of stressful guesswork at the end of the month.

A Good Budget Bends, It Doesn’t Break #

Life is messy and unpredictable. Your budget needs to handle a curveball without completely falling apart. This is why making adjustments isn’t a sign of failure—it’s a sign of a healthy, realistic financial plan.

External factors can also force your hand. For example, in Q2 2025, real household income per capita in OECD countries rose by 0.4%. Some countries, like Poland, saw a 3.1% jump thanks to lower inflation and new benefits. These kinds of shifts show why a rigid annual budget just doesn’t cut it anymore; your plan has to be able to adapt.

When an unexpected expense pops up—like a car repair—or your income changes, call a quick money huddle. Look at the budget together, find places you can temporarily pull back, and make a joint decision on how to cover the cost. This proactive approach turns a potential crisis into a manageable problem you solve as a team.

Answering the Tough Questions About Family Budgeting #

Look, even the best-laid financial plans can hit a snag. When you’re blending two lives, two different money mindsets, and a shared future, you’re going to have questions. That’s not just normal—it’s expected.

Instead of letting these hurdles throw you off track, the trick is to see them coming and have a game plan ready. Let’s walk through some of the most common challenges families run into and find some real-world solutions to keep your financial teamwork strong.

What If My Partner and I Have Totally Different Spending Habits? #

This is easily the most common source of money-related tension for couples. It’s the classic saver vs. spender scenario. One person gets a kick out of watching the savings account grow, while the other loves the freedom of a spontaneous purchase. The goal here isn’t about one person winning; it’s about finding a middle ground that feels good for both of you.

The first step is to talk—really talk—about why you each see money the way you do, without any judgment. Our financial habits are almost always tied to how we grew up. Getting that backstory can build a ton of empathy and turn what could be an argument into a genuine conversation.

A strategy that works wonders for this is the “yours, mine, and ours” approach.

- “Ours” Joint Account: This is mission control for all your shared expenses—the mortgage, bills, groceries, and everything else that keeps the household running. You both agree on how much to contribute to cover these costs.

- “Yours” & “Mine” Personal Accounts: This is the game-changer. Each of you gets your own separate account with a set amount of “fun money” each month. This is for guilt-free spending. No questions asked. No permission needed.

This system creates the perfect balance. You’re tackling the family’s needs as a team, but you still have the personal freedom to spend on your own priorities without feeling like you’re being micromanaged.

How Do We Actually Budget for Unexpected Expenses? #

A surprise car repair or a sudden trip to the ER can feel like a torpedo to your budget. But here’s the thing: these expenses aren’t truly “unexpected.” Life is full of them. The only real surprise is not being prepared.

Your best defense is a solid emergency fund. This needs to be your number one savings goal. Aim to stash away 3-6 months of essential living expenses in a separate high-yield savings account. Set up an automatic transfer every month and treat it like a non-negotiable bill.

For those less-dramatic costs that pop up once or twice a year, you need sinking funds. Think of these as targeted mini-savings accounts for specific future purchases.

A sinking fund turns a potential financial crisis into a boring, predictable expense. You’re not reacting to a problem; you’re simply executing a plan you’ve had in place for months.

For example, you know your $1,200 car insurance premium is due every year. Instead of scrambling when the bill arrives, you set up a “Car Insurance” fund and put $100 into it every month. When the bill comes, the money is just sitting there waiting. This works beautifully for holidays, annual subscriptions, and back-to-school shopping.

We Keep Quitting After a Month. How Do We Make a Budget Stick? #

If your budget consistently falls apart by week three, you’re probably dealing with “budget fatigue.” This usually boils down to two things: your budget is way too restrictive, or it’s not connected to anything you actually care about.

First, give it a reality check. A budget that has zero room for fun isn’t a plan; it’s a punishment. And nobody sticks with a punishment for long. You have to build in money for the things that make life enjoyable, whether it’s a family pizza night or a personal hobby. A plan that doesn’t account for being human is designed to fail.

Second, you have to constantly tie your day-to-day choices back to your big, exciting goals. Don’t think of it as, “We can’t spend $50 on takeout.” Reframe it as, “This $50 gets us one step closer to our Disney World fund.” That little mental shift changes everything. Budgeting stops feeling like deprivation and starts feeling like empowerment. You’re giving your small sacrifices a real, powerful purpose.

What Are the Very First Steps We Should Take Today? #

Getting started is often the hardest part because it feels so overwhelming. Don’t try to create the perfect, all-encompassing family budget in one afternoon. Instead, just focus on these two small, achievable actions this week.

- Schedule a 30-Minute “Dream Session.” Pick a time when you’re both relaxed and just talk about one big financial goal that gets you both excited. It could be a vacation, wiping out a credit card, or saving for a down payment. Write it down and stick it on the fridge where you’ll both see it every day.

- Track Your Spending for 7 Days. Seriously, that’s it. For one week, just write down every dollar that goes out the door. You can use a notes app or a simple budgeting tool. Don’t judge the spending or try to change it yet. The only goal here is to get a clear picture of where your money is actually going.

These two things—finding your shared “why” and getting an honest look at your spending—are the foundation for everything else. Get these right, and you’ll be on your way to building a family budget that finally works for you.

Ready to turn these ideas into action? Econumo is built for families who want to manage their money as a team. With multi-user accounts for collaborative tracking and easy-to-create budgets, you can finally get on the same page and build the financial future you’ve been dreaming of. Try the live demo or get started for free at Econumo.