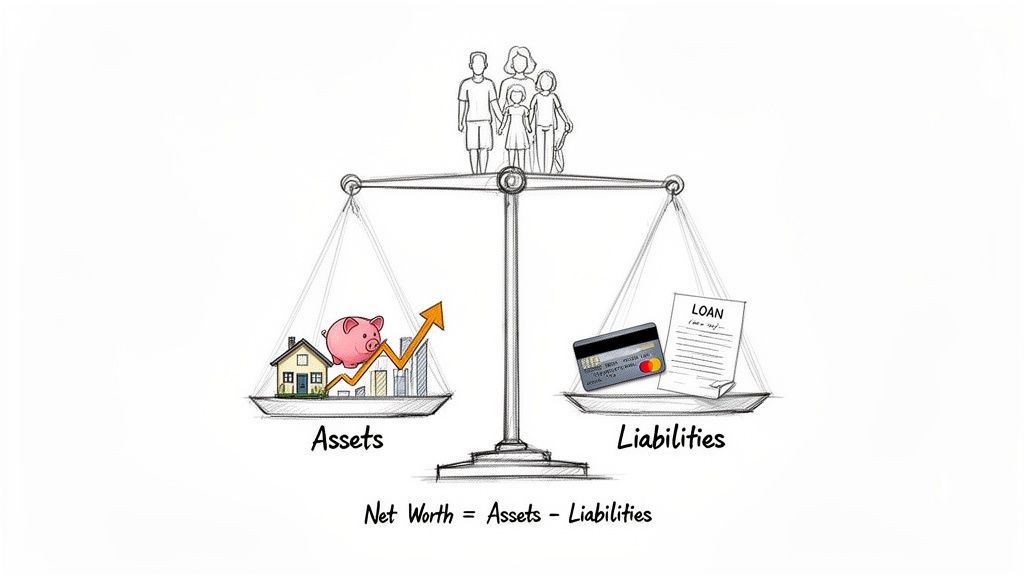

At its core, calculating your net worth is surprisingly straightforward. It’s simply what you own (your assets) minus what you owe (your liabilities). That one number gives you a powerful, honest snapshot of where you stand financially, right now.

What Net Worth Really Means for You #

It’s easy to think of net worth as a metric reserved for millionaires and billionaires, but that’s a huge misconception. In my experience, it’s one of the most useful financial tools for absolutely everyone, no matter your income. It cuts through the noise of a monthly paycheck to reveal the bigger picture of what you’re actually building over time.

Think of it as your personal financial scorecard. It’s not there to judge you—it’s there to inform you. Getting a handle on this number is the first real step toward making smarter decisions and feeling in control of your money.

Why This Simple Calculation Matters #

Knowing your net worth isn’t just about having a number. It’s about being able to set real, meaningful goals and actually see if you’re making progress. It helps you answer some of life’s biggest financial questions:

- Am I saving enough for retirement? Watching your net worth climb year after year is one of the clearest signs your savings and investment strategies are paying off.

- Is my debt-repayment plan working? As you chip away at loans and credit card balances, you’ll see your net worth increase. It’s incredibly motivating.

- Can I handle a big life change? Whether you’re thinking about a down payment on a house or quitting your job to start a business, your net worth provides a realistic starting point.

To get an accurate picture, it’s crucial to understand all your holdings and the best strategies for safeguarding your wealth. Getting familiar with these foundational https://econumo.com/posts/principles-of-finance/ is key to building lasting financial security.

The Net Worth Formula at a Glance #

To make it even clearer, let’s break down the formula into its core components.

| Component | What It Is | Common Examples |

|---|---|---|

| Assets | Anything you own that has monetary value. | Cash, savings accounts, real estate, investments (stocks, bonds), cars |

| Liabilities | Any debt or financial obligation you owe to someone else. | Mortgages, student loans, credit card balances, car loans, personal loans |

| Net Worth | The difference between your total assets and total liabilities. | Assets - Liabilities = Net Worth |

This simple table is all you need to get started. Just list everything you own, subtract everything you owe, and you’ve got your number.

A Real-World Example #

Let’s put this into practice with a quick example. Imagine a family with the following finances:

- Assets: Their home is valued at $400,000, they have $50,000 in savings, their investment portfolio is worth $100,000, and their car has a market value of $20,000. Their total assets come to $570,000.

- Liabilities: They have a $250,000 mortgage, $15,000 in credit card debt, and $30,000 left on student loans. Their total liabilities are $295,000.

By subtracting their liabilities from their assets ($570,000 - $295,000), we find their current net worth is $275,000.

Your net worth is more than just a number; it’s a story of your financial journey. It reflects your past decisions, shows your present standing, and helps you write the next chapter with confidence and clarity.

Tallying Up Your Assets: What You Own #

Before you can get the full picture of your financial health, you need to gather all the positive pieces of the puzzle. This means creating a complete inventory of everything you own that holds monetary value. These are your assets.

The key is to break this down into manageable chunks so it doesn’t feel like an impossible task. We’ll go group by group to make sure nothing important gets missed. Don’t stress about getting every number down to the last penny; the goal here is a realistic and honest appraisal.

Start With Your Financial Accounts #

The easiest place to begin is with your liquid and financial assets—the stuff you can access or convert to cash relatively quickly. For this part, all you need to do is pull up your most recent bank and investment statements. The exact numbers will be right there.

- Cash and Equivalents: Look at the balances in your checking and savings accounts, plus any money market funds. This is the simple “what I have right now” part of your financial life.

- Investment Accounts: Jot down the current market value for all your investments. This includes your 401(k), traditional or Roth IRAs, brokerage accounts with stocks and mutual funds, and anything else you have invested in.

It’s easy to underestimate how much this category contributes to the average person’s wealth. By the end of 2024, private household financial assets surged globally to hit an incredible €269 trillion. That figure shows just how vital investing has become for building wealth, even if inflation has kept real growth in check.

Valuing Your Physical Property #

Next up are the tangible things you own. These are often your biggest assets, but they take a bit more legwork to value since their prices aren’t updated on a daily statement.

For your home, a quick search on Zillow or Redfin will give you a pretty solid market estimate. When it comes to your car, Kelley Blue Book (KBB) is the go-to resource for finding its current private-party sale value.

A crucial tip here: Be objective, not sentimental. You need to value things based on what someone would actually pay for them today, not what you paid or what you wish they were worth.

This category also covers other major physical items you might own:

- Real Estate: This is the current market value of your primary residence, vacation homes, or any rental properties.

- Vehicles: Tally up the value of your cars, motorcycles, boats, or RVs.

- Valuable Collectibles: Only include items with a significant and verifiable resale value. Think fine art, high-end jewelry, or rare collections. Your everyday furniture and old electronics usually aren’t worth including.

If you’re a business owner, your company’s assets and liabilities also play a role. Understanding things like accounts payable and accounts receivable is a good starting point for getting a handle on your business’s financial health and how it impacts your personal net worth.

Once you’ve tallied up every valuable item, you’ll have one side of the net worth equation complete.

Facing Your Liabilities: What You Owe #

Alright, now for the other side of the equation. Looking at your debts isn’t about feeling bad—it’s simply about getting a clear, accurate picture of your financial obligations. An honest list of everything you owe is just as crucial as your asset list for a true net worth calculation.

It can be tempting to round down or conveniently “forget” smaller debts, but precision is key here. Every dollar you owe impacts the final number, so we need a complete and honest inventory. This step is what gives you the clarity to build a real plan for the future.

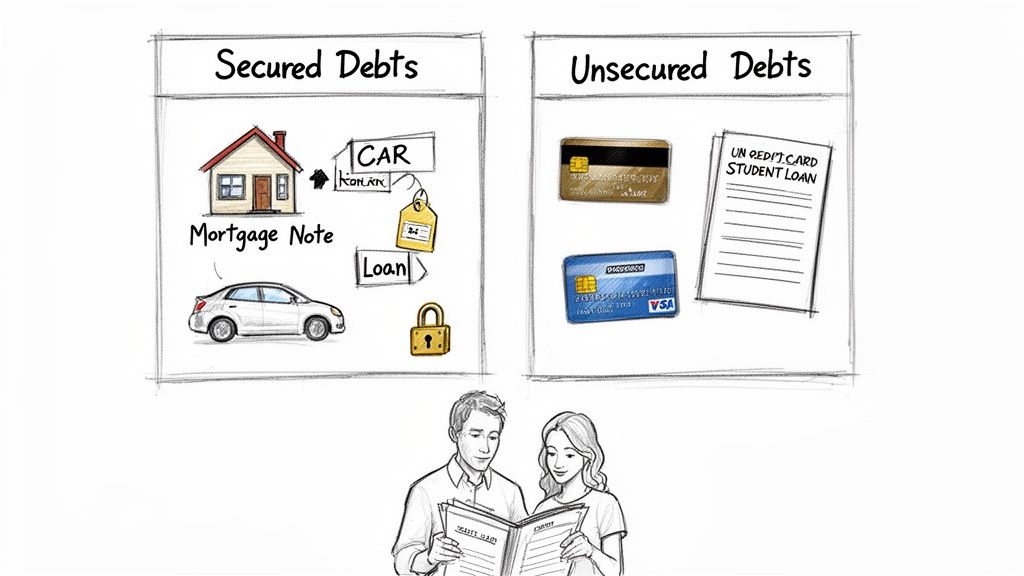

Sorting Out Your Debts #

The easiest way to get started is to break your liabilities into two main groups. This not only helps organize the process but also gives you a better understanding of the kind of debt you’re carrying.

Secured Debts: These are loans that are tied, or “secured,” by a specific asset. Your mortgage and car loan are the most common examples. If you stop paying, the lender has a legal claim to the property.

Unsecured Debts: This is debt with no collateral attached. The lender is essentially trusting your word to pay it back. Think of your credit card balances, personal loans, and most student loans.

Finding the exact numbers is usually pretty simple. Just check the current outstanding balance on your most recent statement or log into your lender’s website.

Think of this part like taking a financial inventory. You’re not making decisions or judging the numbers yet—you’re just getting an accurate count of what’s on the books.

What About Joint and Shared Debts? #

This is a common sticking point for couples and families. How do you handle a mortgage that’s in both of your names? Or a co-signed car loan? The most important things are communication and consistency.

You generally have two ways to approach this:

- Calculate Individually: Each person includes the full amount of any debt they are legally on the hook for. If a $20,000 car loan is in both your names, you each list the full $20,000 on your separate worksheets.

- Calculate as a Household: You pull all assets and liabilities into one combined list. That $20,000 joint car loan is simply listed once on the household’s liability tally.

For couples who have largely merged their finances, the household method is often much simpler. Whichever path you choose, the goal is to ensure every debt is accounted for somewhere without being double-counted if you combine your individual numbers later.

Once you have these figures laid out, you can start to strategize. If you’re looking for some practical ideas, our guide on how to pay off debt faster has some proven methods.

Bringing It All Together to See Your Progress #

You’ve done the heavy lifting of gathering all your numbers. The final step, thankfully, is the easy part.

Your net worth is simply your total assets minus your total liabilities. That one number is your financial starting line—a powerful baseline you can build on from this day forward.

Let’s walk through a complete, real-world example to see how this plays out for a typical household.

Sample Net Worth Calculation for a Household #

Here’s a look at what a family’s financial snapshot might look like once they’ve listed everything out. Notice how every item has a specific place, giving them a crystal-clear picture of where they stand.

| Category | Item | Value |

|---|---|---|

| Assets | Total Assets | $785,000 |

| Home Market Value | $600,000 | |

| Checking Accounts | $8,000 | |

| Savings & Emergency Fund | $40,000 | |

| 401(k) Retirement Accounts | $110,000 | |

| Brokerage Account | $25,000 | |

| Vehicle 1 (KBB Value) | $18,000 | |

| Vehicle 2 (KBB Value) | $4,000 | |

| Liabilities | Total Liabilities | $440,000 |

| Mortgage Balance | $395,000 | |

| Credit Card Balance | $5,000 | |

| Student Loan Balance | $28,000 | |

| Car Loan Balance | $12,000 |

With their numbers laid out, the math is simple: $785,000 (Assets) - $440,000 (Liabilities) = $345,000 (Net Worth). This family now has a concrete number that represents their exact financial position today.

The Real Power Comes from Tracking Over Time #

Knowing your net worth is a great first step, but its true value is unlocked when you track it consistently. A single calculation is just a snapshot in time; regular updates show you the full movie of your financial journey. Are you moving forward, standing still, or maybe even slipping back?

So, how often should you check in? For most people, a quarterly review is the sweet spot. It’s frequent enough to catch important trends and make course corrections, but not so often that you get caught up in the noise of daily market swings. A semi-annual check-in works well, too.

The goal isn’t just to watch the number go up. It’s about understanding why it changed. Did your investments have a great quarter? Did you finally pay off that nagging loan? That context turns a number into a story of your progress.

Using a Tool to Make It Effortless #

This is where a dedicated finance tool really proves its worth. Trying to remember to update a spreadsheet every few months can feel like a chore, and it’s easy to let it slide. A tool like Econumo is designed to make this whole process simple and help you build a lasting habit.

The features are built for the way we actually manage money today:

- Manual Entry: Instead of just syncing data, you manually input your balances. This small act creates a powerful, mindful connection to your numbers and what’s happening with your money.

- Joint Accounts: It’s built for couples and families. You can easily manage shared assets and liabilities to get one unified view of your household’s finances.

- Multi-Currency Support: If you have assets in different countries, Econumo handles the currency conversions for you, giving you an accurate total in your main currency.

Setting up your first net worth statement is straightforward. You just create an entry for each of your assets and liabilities, exactly like we did in the table above. Once your numbers are in, the visual reports take over, generating charts that show your net worth trend over time.

Honestly, there are few things in personal finance more motivating than watching that trend line climb upward. It’s tangible proof that all your hard work—from managing your income and expenses to chipping away at debt—is truly paying off.

Common Net Worth Mistakes to Avoid #

The net worth formula itself is straightforward, but it’s surprisingly easy to get a skewed result. A few common missteps can throw off your number, and since this calculation is all about getting a clear picture of your finances, accuracy is everything. Think of it this way: the final number is only as good as the data you put in.

One of the biggest traps is overvaluing your personal belongings. It’s natural to think of your furniture, electronics, or that art piece you love in terms of what you paid for it. But for a true net worth calculation, you need to use its fair market value—what a stranger would realistically hand you for it today.

This is especially true for cars. Your emotional attachment doesn’t add a dollar to its value. Instead, use a tool like Kelley Blue Book for an objective, current valuation. For most other household items, it’s often best to just assign them a value of zero unless they are genuinely high-value collectibles.

Forgetting the Small Stuff #

It’s also incredibly easy to overlook smaller debts. That “buy now, pay later” plan for your couch, a medical bill you’ve been meaning to pay, or even a small loan from a family member—they all count as liabilities. They might seem insignificant next to a mortgage, but these little debts add up and chip away at your true financial standing.

To catch them all, spend a few minutes combing through recent bank and credit card statements. Look for any recurring payments that point to an outstanding balance you might have forgotten. Every single dollar you owe needs to be on the list.

Your net worth calculation is a private financial tool, not a performance for an audience. The goal is brutal honesty with yourself to get a clear picture, which is the only way to make effective plans for your future.

Using Outdated Information #

Your finances are constantly in motion, and your numbers need to reflect that. Using a home valuation from two years ago or an investment statement from last quarter is a recipe for an inaccurate net worth. Real estate and financial markets can swing wildly in just a few months.

Get into the habit of pulling the most current figures you can find:

- For investments: Use the closing balance from the previous day.

- For real estate: Check current estimates from reputable online sources like Zillow or Redfin.

- For liabilities: Log into your lender’s website to get the exact outstanding balance as of today.

This commitment to fresh data is what makes your calculation a true snapshot of your current reality. An accurate net worth isn’t just a personal metric; it fuels major economic projections, like the anticipated $83 trillion great wealth transfer expected over the next two decades. You can discover more insights about global wealth trends and see how these individual calculations inform the bigger picture. When you do it right, you’re using the same principles that guide global finance.

A Few Common Questions About Net Worth #

Once you get into the rhythm of tracking your net worth, you’ll find a few questions pop up time and again. These are the practical, real-world questions that move beyond the basic math. Let’s dig into some of the most common ones I hear.

How Often Should I Actually Do This? #

You could check it every day, but that’s a recipe for anxiety. Watching the tiny ups and downs of the market is more noise than signal. For most people, a quarterly check-in strikes the right balance.

This cadence is frequent enough to spot trends and see if your strategy is working, but not so frequent that you’re reacting to every little market swing. It transforms the process from a stressful daily chore into a productive quarterly review of your progress.

I Calculated It and It’s Negative. Should I Panic? #

Not at all. A negative net worth is incredibly common, especially early in your career. It’s a starting line, not a sign that you’ve done something wrong.

Think about a newly-minted doctor. She might have a mountain of student debt, but her future earning potential is huge. Her negative net worth is just a temporary snapshot in time.

Your first net worth calculation is just a baseline. What truly matters isn’t the starting number, but the direction it’s moving. The goal is steady, upward progress over time.

Seeing that negative number can be the best motivation you’ll ever get to buckle down and create a solid debt-paydown plan. It’s not a judgment; it’s just data. Use it.

How Do My Partner and I Handle This Together? #

This is a great question, and the right answer really depends on how you and your partner manage your money. There’s no single rulebook for this.

- Mostly Separate Finances: If you keep your accounts and debts largely separate, the easiest way is for each of you to calculate your own net worth. Then, you can simply add them together to get a household total.

- Mostly Combined Finances: If you share everything—joint checking, a mortgage, car loans—it’s far simpler to just calculate one combined household net worth from the get-go.

The most important thing here is to talk about it. Agree on an approach that feels fair and transparent to both of you, and then be consistent. A shared tracking tool can really help keep everyone on the same page.

What’s a “Good” Net Worth for My Age? #

This is easily the most popular question, and honestly, it’s the least important. Comparing yourself to a national average or a friend is a pointless exercise. Their story is not your story.

Everyone’s financial journey is unique. Different careers, different salaries, different family situations, different costs of living—you can’t compare them. The only benchmark that matters is you. Is your net worth trending up from last quarter? From last year? That’s how you know you’re winning.

Ready to stop guessing and start tracking your financial journey with clarity? Econumo provides the tools you need to manage your household finances, monitor your progress, and build a stronger financial future, together. Try the live demo and take control today.