Before you even think about spreadsheets or budgeting apps, the first real step in managing money as a couple is simply talking. Seriously. The most successful shared budgets are built on open, honest conversations about your financial histories, habits, and dreams. This chat is the real bedrock of your financial life together.

Starting the Money Talk Without the Tension #

Let’s be honest: the “money talk” can feel heavy. It’s rarely just about the numbers. It’s all tangled up with our upbringing, our fears, and our personal values. The goal here is to turn what feels like a potential minefield into a genuine team-building exercise. This is your first win.

This isn’t about judging each other’s past mistakes. It’s about getting to the why behind them. What did you learn about money growing up? Are you a natural saver who gets a sense of security from a healthy bank balance? Or are you someone who values experiences and is quicker to spend? Understanding these core financial personalities is everything.

Creating a Safe Space for Honesty #

The key to a good money talk is making it a judgment-free zone. Pick the right time and place—not when you’re both stressed out from work or exhausted. Plan it. Grab a coffee on a lazy weekend morning when you can both be relaxed, present, and open.

This isn’t an interrogation about salary and debt, either. Ease into it with some open-ended questions to get the ball rolling:

- “What’s one big thing you’d love for us to accomplish with our money in the next five years?”

- “What’s your first memory of money? How did it make you feel?”

- “If we suddenly had an extra $500 this month, what’s the first thing you’d want to do with it?”

These questions aren’t about dollars and cents; they’re about uncovering what truly matters to each of you. Without this understanding, you’re just two people with linked accounts, not a team with a shared vision.

It’s easy to feel like you’re the only ones struggling with this, but you’re not alone. A surprising 54% of engaged Americans don’t see eye-to-eye on financial goals, and two-thirds find it tough to even have the conversation. You can find more insights on this common challenge from NerdWallet, which really highlights why starting here is so critical.

The most important part of your first financial conversation is to listen more than you speak. Your goal is to understand your partner’s perspective, not to win an argument or prove your way is better.

Aligning on Your Shared Future #

Once you’ve opened up about your past experiences and personal values, it’s time to look forward together. This is where you shift from talking about “my goals” and “your goals” to defining “our goals.” What do you want to build as a team?

Don’t worry about creating a rigid, 10-year plan right now. Just dream a little. What gets you both excited?

- Becoming debt-free? Imagine a life with no student loans or credit card debt hanging over your heads. That freedom can be a huge motivator.

- Buying a home? Talk about it. What kind of neighborhood? What does the house feel like?

- Traveling the world? Make a fun list of all the places you want to see together.

- Saving for an early retirement? What would that actually look like? What would you do with all that time?

By agreeing on a few big, exciting goals, you give your budget a purpose. Suddenly, it’s not about cutting back and feeling restricted. It’s about making smart, intentional choices to create the life you both really want. This shared vision is the glue that will hold you together when you hit a bump in the road or disagree on a purchase. It turns budgeting from a chore into your shared project.

Finding a Financial System That Works for You #

Okay, you’ve had the big money talks. Now comes the practical part: building the actual system you’ll use to manage your day-to-day finances together.

There’s no magic “best” way to do this. The right approach is simply the one that feels fair, transparent, and comfortable for both of you. You’re looking for a structure that supports your shared goals while still respecting your individual need for some financial freedom.

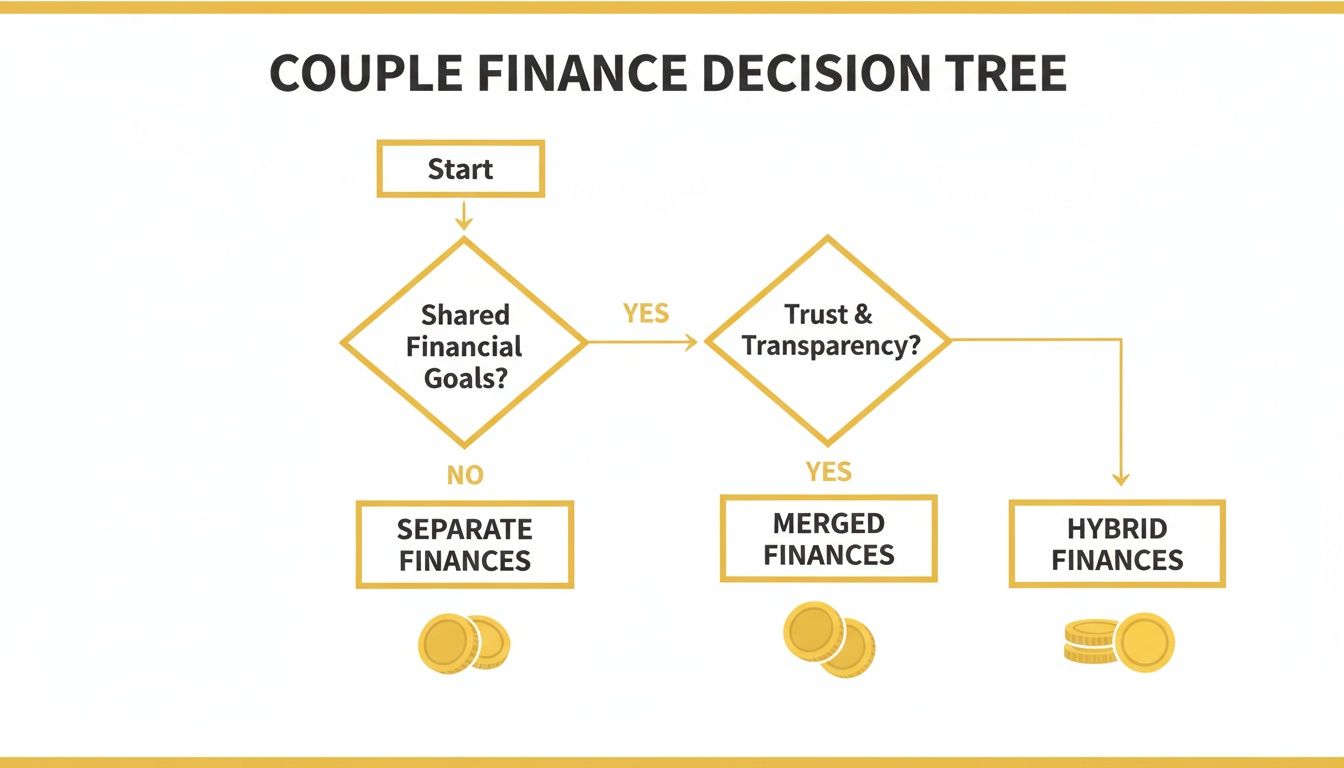

Most couples land on one of three systems: keeping finances totally separate, merging everything into one pot, or a popular hybrid “yours, mine, and ours” model. Each has its own vibe and works for different kinds of partnerships.

The Three Core Financial Systems for Couples #

How you structure your bank accounts is a huge decision. It’s the foundation that will shape how you spend, pay bills, and save for everything from vacations to a down payment.

Let’s break down the main options:

Totally Separate: You both keep your own checking and savings accounts, period. You’ll need to figure out a fair way to split shared bills—maybe one of you pays the rent while the other covers utilities and groceries, or you just send each other money as things come up. This system gives you the most personal autonomy.

Completely Merged: This is the all-in approach. All income goes into joint accounts, and every single expense is paid from that shared pool. It’s a true “what’s mine is yours” philosophy and can definitely simplify tracking shared goals. But it requires a massive amount of trust and constant communication.

The Hybrid Approach: This is often the sweet spot and the most common choice for a reason. You each keep your own separate accounts for personal, guilt-free spending, but you also contribute to a joint account for all the shared stuff—mortgage, bills, groceries, you name it. It strikes a great balance between teamwork and independence.

It’s important to remember that even with a great system, disagreements can pop up. A recent Fidelity Investments study on couples and money found that while most couples feel good about their finances, a whopping 45% still argue about money. The study also showed that one in five primary decision-makers feels burned out from managing it all alone, which is exactly why a collaborative system is so critical.

Which System Is Right for You? #

The best setup really depends on your life. Things like a big income difference, existing debt from before you met, or just your personal feelings about financial privacy can all play a role.

Take a couple like Sarah and Tom. Sarah’s a freelance designer with an income that goes up and down, while Tom has a steady corporate salary. Merging everything made Sarah anxious during slow work months. So, they landed on a hybrid system. They each contribute a set percentage of their monthly income to a joint account for bills. This way, it always feels fair, no matter who earned more that month. It took the pressure off and let them work as a team.

To help you decide, let’s look at a quick comparison of the three main systems couples use.

Comparing Couple Budgeting Systems #

| System | How It Works | Best For | Potential Challenges |

|---|---|---|---|

| Separate | Each partner manages their own accounts. Shared expenses are split and paid for individually. | Couples who highly value financial independence, have very different spending habits, or are earlier in their relationship. | Can feel less like a team effort. It requires a lot of coordination to make sure bills are paid fairly and on time. |

| Merged | All income is pooled into joint accounts. All individual and shared expenses are paid from this single source. | Couples who are completely aligned on financial goals and view their money as a single, shared unit. | Can cause friction if spending styles clash. One partner might feel a loss of personal freedom or control. |

| Hybrid | Partners maintain separate accounts for personal spending and contribute to a joint account for shared expenses. | Most couples, especially those with different incomes, pre-existing debt, or those who want both teamwork and autonomy. | Requires setting up and managing an extra account, but the clarity and peace of mind it brings usually outweigh the hassle. |

Ultimately, this choice is less about the bank accounts and more about the partnership itself.

Your financial system isn’t set in stone. It’s perfectly okay to start with one method and change it later as your life, incomes, and relationship evolve. The goal is to find what works for you right now.

Whether you merge everything or keep it all separate, the system’s job is to support your shared vision. Modern tools can make this much easier, with features for shared access and collaborative planning no matter how your accounts are structured. To see how that works, check out our guide on how to set up shared access for your budget and get started.

Choosing a Budgeting Method You Can Stick With #

Alright, you’ve decided how to structure your bank accounts. Now comes the fun part: picking a budgeting method that actually works for you both. This isn’t about finding some magic formula—it’s about choosing a strategy that fits your personalities and financial goals.

Think of it as your shared roadmap. This is the tool that turns your big dreams into a concrete monthly action plan. The best method is simply the one you can stick with, month after month, without feeling constrained. It should bring clarity, not conflict.

The Zero-Based Budget: For Ultimate Control #

If you’re the type of couple that loves to know where every single dollar is going, the zero-based budget might be your perfect match. The idea is simple but powerful: your income minus your expenses equals zero.

Every dollar gets a specific job before the month even begins—paying rent, funding your vacation, or being set aside for date nights. Nothing is left to chance. This method is especially great for couples with irregular income, like freelancers or those who rely on commissions, because it forces you to be incredibly intentional with whatever comes in.

Here’s how it plays out: Let’s say Alex is a freelance designer with a fluctuating income, and Ben has a steady salary. At the start of the month, they sit down and estimate their total income. First, they assign money to essentials like rent and utilities. Next, they fund their savings goals, like that down payment. Finally, they allocate what’s left to variable costs like groceries and entertainment. If there’s any cash left over, it’s deliberately assigned to a goal, maybe an extra debt payment, so no money gets “lost.”

This proactive approach creates a sense of stability, even when Alex’s income bounces around.

The 50/30/20 Rule: Simple and Balanced #

Does tracking every penny sound exhausting? If so, the 50/30/20 rule offers a much more flexible framework. It’s a popular percentage-based method that gives you structure without the tiny details.

You simply divide your after-tax income into three buckets:

- 50% for Needs: This covers the absolute must-haves—housing, utilities, transportation, and groceries.

- 30% for Wants: This is the fun stuff! Think dining out, hobbies, travel, and anything else that makes life enjoyable.

- 20% for Savings & Debt Repayment: This is for your future. It’s where you’ll build your emergency fund, save for retirement, or aggressively pay down loans.

This method is fantastic for couples who want clear guidelines but don’t want to get bogged down in a dozen different categories. It strikes a healthy balance between living for today and building a secure tomorrow.

This visual guide can help you decide which financial system—separate, merged, or a hybrid—best supports the budgeting style you choose.

As the flowchart shows, there’s no single right way to set things up. The goal is to find a structure that reduces friction and makes it easier for you to work together as a team.

The Envelope System: A Hands-On Approach #

For a more tangible, old-school method, there’s the classic envelope system. This approach works wonders for couples trying to get a handle on overspending in specific areas, like “eating out” or “groceries.”

You literally use physical (or digital) “envelopes” for your variable spending categories. At the start of the month, you fill each one with its budgeted amount of cash. When the money in an envelope is gone, you’re done spending in that category until next month. Simple as that.

It creates a hard stop that makes overspending nearly impossible. While using cash might feel a bit dated, it creates a powerful psychological link to your spending. Physically seeing the money disappear makes your financial choices feel much more real.

No matter the method, external pressures can make things tricky. The Knot’s Global Wedding Report found that 63% of US couples planning a wedding said the economy forced them to increase their budgets or make tough choices. This just goes to show why having a structured-but-flexible system is so critical for navigating big goals together.

Ultimately, the key is to try a method, see how it feels, and be ready to adapt. Your budget isn’t set in stone; it’s a living tool that should evolve with you. The perfect system is the one that gets you to your goals with the least amount of stress.

How to Build and Track Your Shared Budget #

Okay, this is where the rubber meets the road. All those important conversations you’ve had are about to become a real, working plan. Building and tracking your first shared budget might sound intimidating, but it’s really just a matter of breaking it down into a few manageable steps.

Let’s get practical and turn those goals into a day-to-day reality. It all starts with gathering up the puzzle pieces of your financial life.

Gathering Your Financial Documents #

Before you can chart a course forward, you need a crystal-clear picture of where you’re standing right now. Block out an hour together, grab some coffee, and round up all the necessary documents. The goal here isn’t to judge past spending, but to get an honest, factual baseline.

You’ll want to have these items handy:

- Income Statements: Grab your last couple of pay stubs or any records of income from freelance work or side hustles. This will show your total monthly take-home pay.

- Recurring Bills: Pull up the latest statements for your big, predictable expenses—think rent or mortgage, utilities, car payments, insurance, and any subscriptions you both use.

- Debt Balances: Make a simple list of all your debts. For each student loan, credit card, or personal loan, jot down the total balance, interest rate, and the minimum monthly payment.

- Recent Spending: This one is a real eye-opener. Skim through the last one or two months of your bank and credit card statements. This reveals where your money actually goes, which can be surprisingly different from where you think it goes.

Getting all this information in one place gives you the raw data you need to build a budget that actually reflects your real life, not just an ideal one.

Creating Budget Categories That Make Sense #

Now that you can see the flow of your money, it’s time to give it some direction by creating budget categories. This step is what makes a budget feel personal and sustainable. Forget generic templates; your categories should mirror your lifestyle and priorities.

Start with the easy stuff—the fixed expenses that are pretty much the same every month.

- Housing (Rent/Mortgage)

- Utilities (Electricity, Water, Gas)

- Insurance (Health, Auto, Renters)

- Debt Payments (Student Loans, Car Note)

Next, move on to your variable expenses. These costs change from month to month but are still necessities. Your past bank statements will be a huge help in estimating a realistic monthly amount for these.

- Groceries

- Transportation (Gas, Public Transit)

- Household Supplies

Finally, carve out space for your discretionary spending and savings goals. This is where you actively design the life you want. Get more specific than just “Fun Money.”

A great budget doesn’t just track bills; it makes room for joy. Creating dedicated categories like ‘Date Nights,’ ‘Weekend Getaway Fund,’ or ‘Hobby Supplies’ turns your budget from a restriction into a tool for enabling the life you want together.

This level of detail makes it so much easier to see exactly where you can tweak your spending to free up cash for the things that matter most to both of you.

Choosing the Right Tool for the Job #

How you actually keep track of all this comes down to personal preference. The best tool is simply the one you’ll both stick with. Your two main camps are classic spreadsheets and dedicated budgeting apps.

Spreadsheets are the ultimate DIY option. They’re free, incredibly flexible, and you can customize them to your heart’s content. The downside? They require consistent manual data entry and can be a bit clunky if you’re not careful with your formulas.

Budgeting apps, on the other hand, bring automation to the table. Most can link directly to your bank accounts, automatically categorize your spending, show you cool visual reports, and even send you alerts. If you go this route, look for features that are built for partners:

- Multi-User Access: Can you both log into the same dashboard?

- Joint Account Views: Does it seamlessly handle your shared and individual accounts?

- Goal Tracking: Can you set up and monitor progress toward shared goals, like saving for a down payment?

Many modern apps, like Econumo, are designed with this kind of collaboration in mind. For a closer look, our guide on how to set up and manage your budgets walks through the specific features that help couples stay on the same page. The key is finding a system that makes tracking feel less like a chore and more like a shared, empowering habit.

How to Keep Your Budget on Track (and Handle Disagreements) #

Here’s a little secret: a budget isn’t a “set it and forget it” document. It’s a living, breathing tool that has to adapt as your life changes. The real magic of budgeting as a couple isn’t just in making the plan, but in the small, consistent habits you build around it.

This is where you turn your budget from a potential source of conflict into a genuine source of strength. It all comes down to regular communication, a little flexibility, and having a game plan for when things inevitably go off the rails.

The Power of the Money Check-In #

If there’s one habit that will make or break your shared budget, it’s the regular money check-in. This shouldn’t feel like a high-stakes performance review. Think of it more as a calm, consistent touchpoint to make sure you’re both still rowing in the same direction.

Honestly, the best way to do this is to make it a low-key date night. Schedule a quick 20-30 minute meeting once a week or every two weeks. Grab a glass of wine, put your phones away, and make it a comfortable, positive ritual.

During your check-in, you just need to cover a few key things:

- Look Back: How did you do against your budget categories? Where did you crush it?

- Celebrate Wins: Did you stick to the grocery budget? Hit a small savings goal? High-five and acknowledge the progress. It matters.

- Look Ahead: What’s coming up? Any birthdays, appointments, or other one-off expenses you need to plan for in the next week?

- Make Adjustments: Do you need to shuffle some money from one category to another? Is one category proving totally unrealistic?

This simple, consistent rhythm takes all the anxiety out of money talks. It just becomes a normal, productive part of your routine.

Handling Budget Roadblocks Without the Blame Game #

Let’s be real: no budget is perfect. Life happens. An unexpected car repair comes up, or one of you has a slightly-too-fun night out with friends. The way you handle these moments is what really defines your financial partnership.

The key is to focus on solutions, not blame. When a mistake happens, the conversation should never, ever start with, “You spent how much?!” That’s a one-way ticket to a fight. Instead, you have to approach it as a team.

Shift your focus from “what went wrong?” to “how can we fix this together?” This simple change in perspective turns a potential argument into a collaborative problem-solving session.

For instance, if the “Dining Out” category is completely blown by the 20th of the month, the conversation becomes: “Okay, we’re over budget on dining. What’s our game plan for the rest of the month? Maybe we can try some of those fun meal kits at home?” This approach constantly reinforces that you’re a team tackling a shared challenge, not opponents.

Staying Flexible When Life Changes #

Your budget needs to be just as dynamic as your life is. A plan that worked perfectly when you were both working standard 9-to-5 jobs might need a complete overhaul if one of you decides to go back to school or start a business.

Be ready to sit down and completely rethink your budget for major life events, including:

- A Change in Income: A promotion, a job loss, or a switch to freelancing all demand an immediate budget review.

- New Financial Goals: Deciding to save for a house, a new car, or that bucket-list trip will require you to re-prioritize where your money is going.

- Growing Your Family: A new baby brings a whole new world of expenses that need to be factored into your plan.

Consistently reviewing your financial roadmap helps you stay in the driver’s seat. A huge part of this is just staying on top of your transactions, and our guides on effective expense tracking can give you some practical ways to build that habit. Ultimately, a budget that doesn’t evolve with you will quickly become useless. Treat it like a flexible guide, and it will remain a powerful tool that serves your shared goals, no matter what life throws your way.

FAQs: Answering Your Top Budgeting Questions as a Couple #

Even the best-laid financial plans can hit a few snags. It’s totally normal for questions and tricky situations to pop up as you start merging your financial lives.

Let’s walk through some of the most common hurdles couples face and how to clear them together.

How Should We Budget if One Partner Earns a Lot More? #

This is a big one, and it comes up all the time. The secret here is to stop thinking about strict equality and start focusing on fairness. A 50/50 split on everything rarely feels fair when one person takes home significantly more than the other.

A much more balanced approach is to contribute proportionally. Instead of splitting bills down the middle, each of you contributes a percentage of your income to your shared pot.

Here’s how that looks in the real world:

Let’s say Partner A brings home $6,000 a month and Partner B brings home $4,000. Your total household income is $10,000.

- Partner A earns 60% of the total income.

- Partner B earns 40% of the total income.

If your rent is $2,500, Partner A would cover $1,500 (60%), and Partner B would kick in $1,000 (40%). This way, you’re both carrying the weight relative to your means, and no one is left feeling stretched thin while the other has plenty of disposable income.

What Is the Best Way to Handle Irregular Income? #

When your income is all over the place—think freelance gigs, sales commissions, or a side hustle—a rigid monthly budget just won’t cut it. You need a more flexible game plan.

Start by figuring out your “bare-bones” budget. This is the absolute minimum you need to cover the essentials: housing, utilities, groceries, and any required debt payments. That’s your first priority.

Every time a paycheck comes in, immediately set aside enough to cover those core expenses. Everything you earn above that baseline is where you can start making progress on your goals.

A zero-based budget is perfect for this. When that extra cash lands in your account, sit down together and decide exactly where it’s going. For example, you might agree to split any surplus income like this:

- 50% gets thrown at a big savings goal (like a house down payment).

- 30% goes toward knocking out high-interest debt.

- 20% is set aside for fun, like a vacation fund.

Pro Tip: Try to build a buffer fund with at least one month’s worth of essential expenses. Having that cash cushion makes the slow months so much less stressful and prevents you from dipping into savings.

Can We Budget Together but Keep Our Finances Private? #

Of course. Budgeting as a team doesn’t require you to give up all financial privacy. Plenty of couples want to collaborate on shared goals without having to account for every single dollar they spend personally.

The “yours, mine, and ours” system is a fantastic solution for this.

It’s simple: you each keep your own personal checking and savings accounts for your individual spending. Then, you open one joint account that’s used only for shared expenses—think rent, groceries, and utility bills.

You both agree on a fair amount to transfer into the joint account each month, whether it’s a fixed number or a percentage of your income. This way, you’re tackling your shared financial life as a unit, but you still have total freedom and privacy over your own money. No one feels like they have to justify buying a coffee or spending on a hobby.

It’s the perfect balance between building a unified financial front and respecting each other’s independence.

Ready to build a budget that respects your privacy and shared goals? Econumo offers collaborative tools designed for couples, with flexible options like self-hosting to keep your financial data completely in your hands. Start building your shared financial future with Econumo today.