Ever come home from a trip, looked at your credit card statement, and had that sinking feeling? The numbers just don’t add up. That beautiful €50 dinner in Rome somehow cost you $57, not the $54 you expected. You’ve just met the quiet thief of travel budgets: hidden currency conversion fees.

These little charges aren’t just a minor annoyance. They’re a real drain on your funds, especially on longer trips. Banks and payment processors often bake a markup of 3-5% into the exchange rates they give you. It’s called the “spread”—the profitable gap between the real market rate and the one you actually get.

Understanding the Spread and Other Sneaky Fees #

Think of the spread as a convenience tax for converting money on the spot. It adds up fast. A family exchanging $5,000 for a European vacation could lose between $150 and $250 before they even buy their first coffee. It’s a significant chunk of change that could be spent on actual experiences.

The good news is, you can fight back. The first step is awareness. For instance, you can use a tool like Econumo to log your spending in different currencies without being forced into an immediate, costly conversion. This helps you see the real cost of things. You can find more tips on getting the best exchange rates in our detailed guides.

The key takeaway is simple: every time a bank or merchant converts money for you, they are likely taking a cut. Your goal is to minimize how often this happens and ensure you’re in control when it does.

Beyond the spread, the other major culprit is something called Dynamic Currency Conversion (DCC). You’ve probably seen it. An ATM or card machine asks if you’d like to pay in your home currency. It feels helpful, but it’s a trap. Saying yes means you’re letting the merchant’s bank set the exchange rate, and you can bet it won’t be in your favor.

Here’s a quick rundown of the most common fees you’ll encounter and how to deal with them.

Your Quick Guide to Common Conversion Fees #

This table breaks down the most frequent fees and the best move to avoid them, giving you an immediate advantage.

| Fee Type | Where You’ll See It | Your Best Move |

|---|---|---|

| The Spread | On almost any currency exchange done by a bank or payment processor. | Use multi-currency accounts or specialist FX services to exchange money ahead of time at a better rate. |

| Dynamic Currency Conversion (DCC) | At foreign ATMs and point-of-sale card machines (shops, restaurants). | Always, always choose to pay in the local currency. |

| Foreign Transaction Fee | A separate fee charged by your bank on your credit/debit card statement. | Get a credit or debit card that explicitly has no foreign transaction fees. |

| ATM Withdrawal Fee | Charged by both your bank and the foreign ATM operator. | Use a debit card that reimburses ATM fees and withdraw larger amounts less frequently. |

By understanding these two primary costs—the spread and DCC—you can start building a solid defense. Knowing how to spot these fees is the first step toward keeping more of your money where it belongs: in your pocket.

Choosing the Right Cards and Accounts for Travel #

The single most effective thing you can do to sidestep currency conversion fees is to pick the right financial tools before your trip begins. Your everyday bank cards are built for life at home, and using them abroad can feel like a financial penalty, racking up surprisingly high charges on every transaction.

The secret is to pack your wallet with cards and accounts designed for international spending.

This isn’t about finding one magical “perfect” card. Frankly, that doesn’t exist. A smart strategy often involves a combination of tools. A digital nomad getting paid in euros has very different needs from a family on a two-week holiday in Japan, but both can—and should—avoid those unnecessary fees with a bit of planning.

The Three Main Contenders #

When you’re figuring out how to pay for things abroad, your best options really boil down to three categories. Each one shines in different situations.

- No-Foreign-Transaction-Fee (FTF) Credit Cards: These are your best friends for big-ticket items like hotels, rental cars, and nice restaurant dinners. You get great fraud protection and often rack up valuable travel rewards.

- Specialized Travel Debit Cards: Perfect for pulling cash out of an ATM. Many of the newer digital banks offer debit cards that waive international ATM fees entirely or even reimburse you for what the local ATM operator charges.

- Multi-Currency Accounts: For frequent travelers, expats, or anyone doing business across borders, these are a total game-changer. They let you hold, manage, and spend in different currencies, so you can convert money when the rate is good and spend like a local later on.

Your goal should be to build a travel wallet that gives you the flexibility to pay for things without getting dinged. This means having a card for secure payments and a cheap way to get cash when you need it.

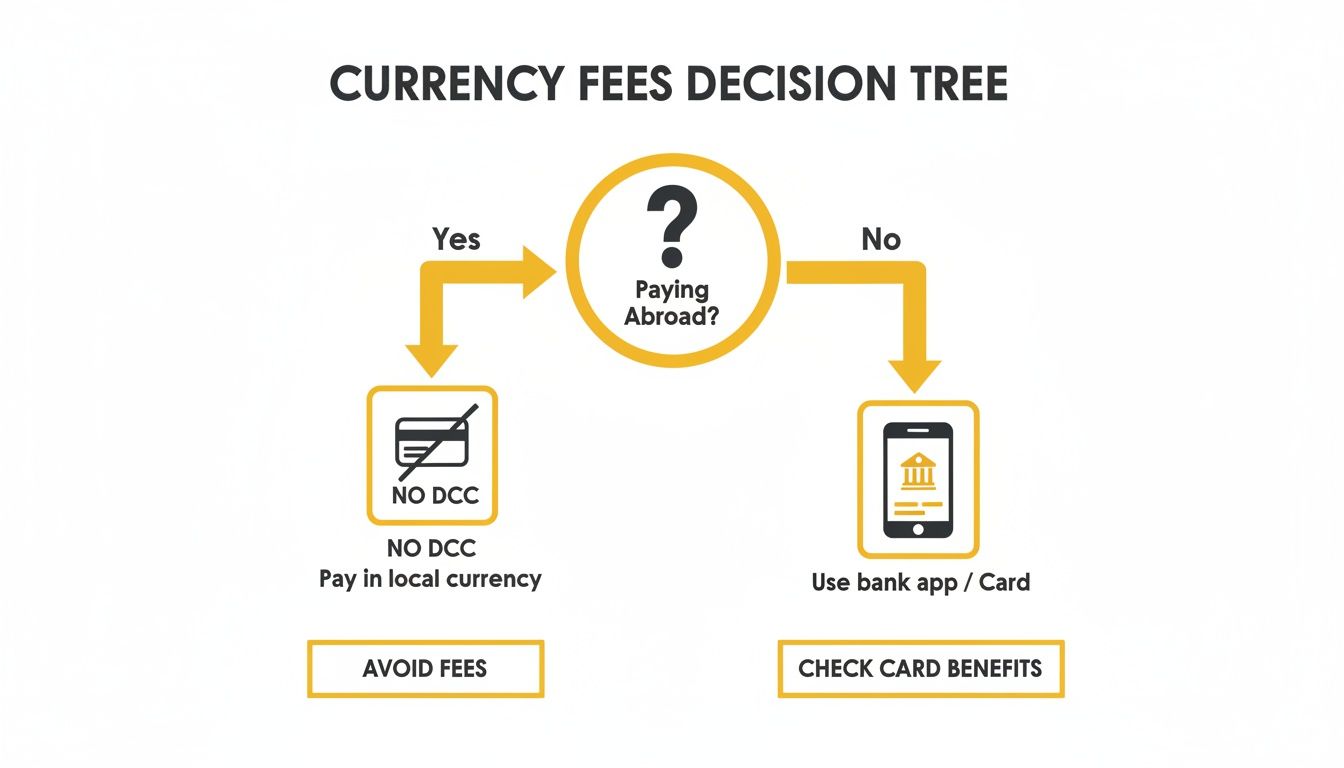

This decision tree gives you a simple mental model for what to do when you’re at the checkout counter abroad.

As the chart shows, the first and most important decision is always saying “no” when a card machine offers to charge you in your home currency. That’s a surefire way to get a terrible exchange rate.

Comparing Your Best Options for International Spending #

It’s crucial to understand the subtle differences between these tools. For instance, while a no-FTF credit card is fantastic for paying a hotel bill, using it to withdraw cash from an ATM is a terrible idea—it usually triggers steep cash advance fees and immediate high-interest charges. A travel debit card is what you want for that.

Let’s lay out how these options stack up. I’ve included a standard bank card as a baseline so you can see just how much you stand to save.

| Financial Tool | Best For | Typical Fees | Key Benefit |

|---|---|---|---|

| Multi-Currency Account | Frequent travelers, digital nomads, and expats managing multiple currencies. | Low conversion fees (when you convert), minimal or no monthly fees. | Ability to hold foreign currency and spend it directly, avoiding on-the-spot conversions. |

| No-FTF Credit Card | Hotel bookings, car rentals, restaurant bills, and other large purchases. | No foreign transaction fees, but potential interest if balance isn’t paid. | Purchase protection, travel rewards, and fraud liability. |

| Travel Debit Card | Withdrawing local cash from ATMs. | Low or no foreign ATM fees; some reimburse third-party ATM charges. | Direct access to cash at a fair exchange rate without cash advance penalties. |

| Standard Bank Card | Domestic use only; emergencies abroad if no other option exists. | ~3% foreign transaction fee, plus potential ATM charges from both banks. | Familiarity, but it’s the most expensive option for international travel. |

Thinking through how you’ll use each tool is the key. You wouldn’t use a screwdriver to hammer a nail, and you shouldn’t use your regular debit card to pay for a vacation.

How This Plays Out in the Real World #

Let’s make this tangible. Imagine you’re a freelancer who just got paid €2,000 by a client in Germany. If you have a multi-currency account like Wise (formerly TransferWise) or Revolut, you can have that money deposited directly into a dedicated EUR balance. You can just hold it there, and on your next trip to Spain, spend those euros with your account’s debit card, completely bypassing any conversion fees.

Or think about a couple on holiday in Tokyo. They use their no-FTF credit card to pay the ¥150,000 hotel bill, earning travel points and instantly avoiding what would have been a ¥4,500 (roughly 3%) foreign transaction fee.

Later, when they need some cash for the street food stalls, they stop at a 7-Eleven ATM and use their travel debit card to pull out ¥20,000. Their bank doesn’t charge them a fee, and the exchange rate is excellent.

Using this kind of strategic combination is the core principle behind knowing how to avoid currency conversion fees. It ensures you’re always getting the best possible deal, no matter how you’re paying.

Smart Ways to Pay and Withdraw Cash Abroad #

The best strategies for saving money abroad aren’t about complex financial maneuvers. They happen in the small, everyday moments of your trip. Knowing which card to pull from your wallet is half the battle; the other half is knowing how to use it when the bill comes.

The choices you make when paying for dinner or pulling cash from an ATM can either protect your budget or slowly bleed it dry through hidden fees.

One of the sneakiest and most expensive traps out there is Dynamic Currency Conversion (DCC). It’s that seemingly helpful offer you see on a card machine: “Would you like to pay in your home currency?” It feels familiar and easy, but it’s a financial Trojan horse.

When you say yes, you’re not letting your bank handle the currency exchange. Instead, you’re giving the merchant’s payment processor the green light to set the rate.

Trust me, their rate will always be worse than what your credit card network (like Visa or Mastercard) would give you. We’re talking about a padded markup of 4-7% in many cases. That’s a huge price to pay for a moment of supposed convenience.

The Golden Rule: Always Pay in the Local Currency #

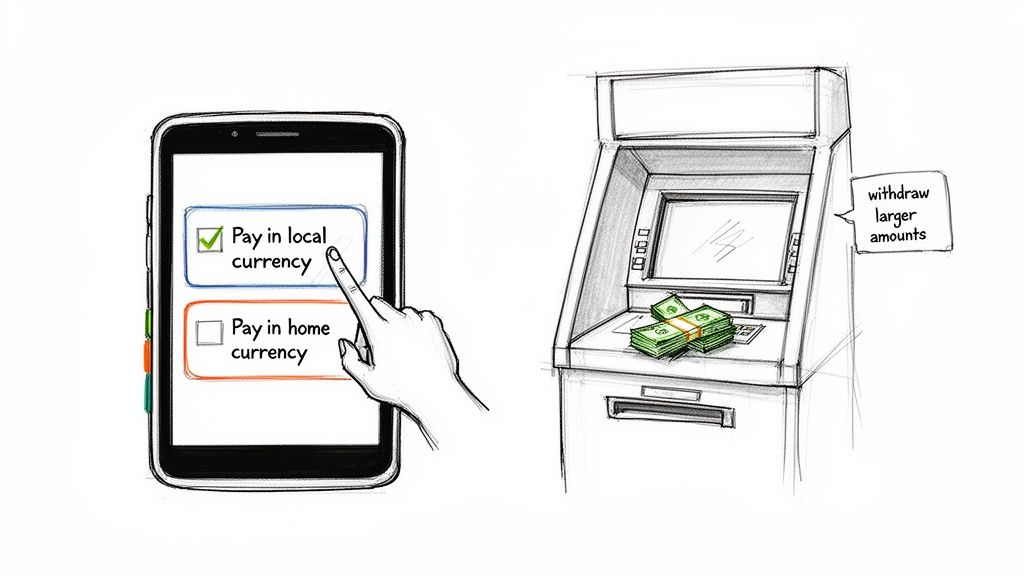

If you remember just one thing, make it this: always choose to pay in the local currency. No exceptions. Whether you’re in Japan, Mexico, or France, make sure you select JPY, MXN, or EUR on that card terminal. This simple action forces your own bank to handle the conversion, almost always at a much fairer rate.

Be vigilant. Sometimes, a well-meaning cashier might select your home currency for you. If a terminal ever asks for your PIN without showing the amount in the local currency, don’t be afraid to speak up. A simple, polite phrase like, “Can you please charge me in [local currency]?” works wonders. For example, in Spain, you’d say, "¿Puede cobrarme en euros, por favor?"

The impact of DCC adds up on a global scale. As official foreign exchange reserves climbed to $12.54 trillion in early 2025, that volatility trickles down to travelers. When these reserves shift, so do the everyday exchange costs, and DCC can tack on an extra 2-4% markup for unsuspecting tourists. Savvy travelers know that declining DCC—a choice honored in about 70% of cases in Europe—is the key to getting the true market rate. You can dive into the full data on global reserves by checking out the latest international financial statistics on IMF.org.

Smart ATM Withdrawal Habits #

Even with the best travel cards, you’ll probably need some cash. But how you get that cash matters immensely. Using the wrong ATM can hit you with a double-whammy of fees: one from the ATM owner and another from your own bank.

A few good habits can save you a surprising amount of money at the cash machine:

- Use Partner ATMs: Before you leave home, check if your bank has partnerships with any international banks. Sticking to an in-network or partner ATM often means you can skip the local operator fee, saving you several dollars with every withdrawal.

- Withdraw Larger Amounts: Don’t take out small sums of cash every other day. It’s much smarter to plan ahead and make fewer, larger withdrawals. This drastically cuts down on the number of flat fees you’ll get hit with over your trip.

- Decline the ATM’s Conversion Rate: Just like at a store, ATMs will try to lure you with the same DCC trick, offering to convert the transaction for you. Always decline this offer. Let your own bank handle the conversion. The ATM’s rate is designed to profit the machine’s owner, not to save you money.

Turning these simple actions into reflexes—always choosing local currency and being strategic about ATM withdrawals—is the foundation of learning how to avoid currency conversion fees. These small choices, repeated throughout your journey, add up to significant savings, leaving more money in your pocket for the experiences you traveled for.

Use a Multi-Currency Account to Sidestep Bank Fees #

The right travel card is perfect for your daily coffee or a souvenir, but it’s not the best tool for bigger international money moves. When you’re dealing with larger sums—like paying an invoice from an overseas client, covering your rent as an expat, or sending a significant amount of money to family—you need to shift your strategy.

This is exactly where multi-currency accounts come in. They are a total game-changer.

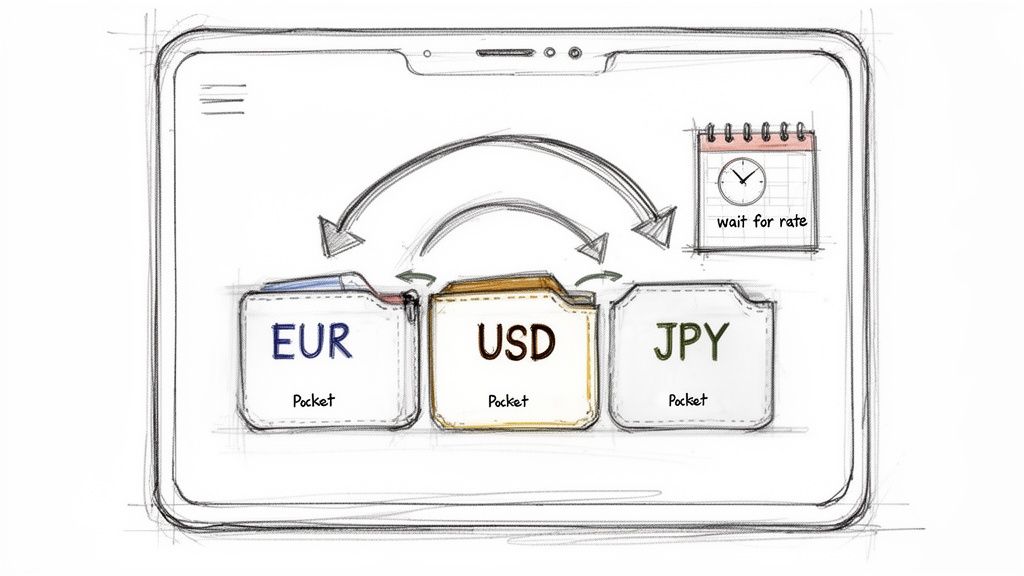

Think of it this way: instead of a regular bank account that only holds your home currency, a multi-currency account lets you hold, send, and receive money in several different currencies at once. It’s like having local bank details in the UK, the US, and Japan, all managed from a single app.

This setup lets you completely bypass the terrible exchange rates and steep wire transfer fees that traditional banks love to charge.

You Control When You Convert #

The real magic of a multi-currency account is timing. You’re no longer stuck accepting whatever exchange rate is on offer the moment you need to send or receive money. You can hold foreign cash in its original currency and wait to convert it when the market moves in your favor.

Let’s say you’re a US-based freelancer and a client in Germany pays your €5,000 invoice. Instead of your bank automatically converting it to dollars at a lousy rate, the euros land in your EUR balance. Now you have options. You could leave the money as euros for an upcoming trip to Spain, or you can keep an eye on the market and convert it to USD only when the euro is strong.

That kind of control is simply impossible with a standard bank account.

The global foreign exchange market is massive—daily volumes in New York alone hit $1,377.7 billion in April 2025. Big institutions trade currencies with razor-thin margins. Meanwhile, families sending money abroad often get hit with 3-6% in conversion fees. A couple wiring $2,000 could lose $60-$120 on that one transfer. Do that ten times, and you’ve lost nearly $1,200. Multi-currency accounts help you reclaim that money. You can dive into the data yourself in the latest foreign exchange volume survey from the New York Fed.

How This Works in the Real World #

These accounts aren’t just for globetrotting entrepreneurs. They are incredibly practical for anyone learning how to avoid currency conversion fees on a larger scale.

Here are a few common scenarios:

- You’re an Expat: An American living in Japan can have their USD salary deposited into their USD balance. At the same time, they can pay rent and local bills directly from a JPY balance—all from the same account. They’re free to move money between the two only when the USD/JPY exchange rate is good, not just because a bill is due.

- You’re an International Student: A student from Canada studying in the UK can have their family send them Canadian dollars. The student can just hold the CAD and convert it into British pounds in smaller chunks as they need it, dodging one big, poorly timed conversion at the start of the semester.

This hands-on approach is key. You can use a tool like Econumo to manually track your different currency balances, which gives you a complete overview of your finances without ever forcing a conversion you don’t want. To get started, check out our guide on multi-currency support and tracking.

Putting It All Together with a Smart Budgeting App #

Knowing the tricks to dodge fees is great, but it’s only half the story. The real secret to mastering how to avoid currency conversion fees is to actually track your spending and see if what you’re doing is working. This is where theory gets put to the test, and a good multi-currency budgeting app becomes your best friend.

Without a solid tracking system, it’s shockingly easy to let those “small” fees pile up until they’ve taken a real bite out of your travel fund. An app like Econumo that handles different currencies turns a complicated mess into a simple, clear picture of your finances. You get to see the true cost of your trip, down to the last cent.

See Your Spending in Real Time #

Let’s say you’re taking the family on a dream trip to Japan. Instead of constantly doing mental math to figure out what you’re spending, you can just set up a “Tokyo Vacation” budget right in the app, using Japanese Yen (JPY).

So, when you spend ¥3,000 on an amazing ramen dinner with your no-fee credit card, you log exactly that: ¥3,000. The app tracks your spending in Yen, so you always know precisely how much of your budget you’ve used. No guesswork involved.

This gives you total clarity. You’re not just hoping the exchange rate is good; you’re actively logging every transaction in its original currency. It’s incredibly empowering to see exactly where every yen, euro, or peso is going.

This is a game-changer, especially if you’re managing a shared travel budget with a partner or family. Everyone can log their expenses in the same app, all feeding into one unified, accurate budget. You’ll know instantly if you’re on track or if you need to dial back the souvenir shopping for a day or two.

For more ideas on tools to manage your money, take a look at our list of the best open-source personal finance software.

By turning smart financial habits into a concrete plan, you stay in the driver’s seat with your money, no matter where your adventures take you.

Still Have Questions About Currency Conversion Fees? #

Even with the best plan, things can get confusing on the ground when you’re trying to save money on your travels. Let’s walk through a few common questions that pop up, so you can feel totally confident in your fee-dodging strategy.

Is It Really Always Better to Pay in the Local Currency? #

Yes. 100% of the time. Seriously.

When you see an offer on a card machine to pay in your home currency—say, US dollars while you’re in Spain—that’s a system called Dynamic Currency Conversion (DCC). It’s a trick, plain and simple. The merchant’s bank is offering to convert the money for you, but at a terrible exchange rate that pads their profits.

Always, always choose to pay in the local currency (euros in Spain, baht in Thailand, etc.). This forces your own bank or card network, like Visa or Mastercard, to handle the conversion. Their rates are dramatically better and can save you anywhere from 4% to 7% on that single transaction.

There is no situation where accepting the “convenience” of DCC saves you money. It’s a classic tourist trap. Make it a habit to always hit ’no’ and pay like a local.

Should I Get Foreign Cash Before My Trip? #

For the most part, no. Exchanging a big wad of cash at your local bank or, even worse, at an airport currency exchange kiosk is one of the most expensive ways to get foreign money. They roll terrible rates and high fees into the transaction.

A much smarter move is to wait until you land and use a fee-free travel debit card to pull cash directly from a local ATM. You’ll get a far more competitive exchange rate. If showing up in a new country with absolutely no cash makes you nervous, just exchange a tiny amount—enough for a cab ride or a snack—and get the rest when you arrive.

What’s the Difference Between a Spread and a Fee? #

This is a fantastic question because these two things often work together to take more of your money. It’s a bit of a one-two punch.

- A Fee is an obvious charge you can see. Think of a “$5 ATM withdrawal fee” or a “3% foreign transaction fee” that shows up as a separate line item on your bank statement. It’s upfront.

- The Spread is more of a hidden cost. It’s the difference between the real, mid-market exchange rate (the one you see on Google) and the less favorable rate you’re actually given.

A provider might advertise “fee-free” exchanges, but they can still make a ton of money by giving you a bad rate (a wide spread). Your goal is to find options that minimize both the upfront fees and the hidden spread.

Ready to stop guessing and start tracking? With Econumo, you can log every expense in its original currency, giving you a perfect picture of your spending without any confusing conversions. See exactly where every dollar, euro, and yen is going. Explore the live demo on econumo.com and take control of your travel budget.