If you’ve ever wondered how much to save from each paycheck, you’re not alone. The classic rule of thumb is to aim for 20% of your take-home pay. This isn’t just a random number; it’s the savings portion of the popular 50/30/20 budget, a simple framework that can really build a strong financial foundation.

Think of it as the starting line. Hitting that 20% mark helps you get into the rhythm of paying yourself first, which is crucial for tackling debt, building an emergency fund, and investing for the long haul.

Your Starting Point For Paycheck Savings #

Figuring out the “right” amount to save can feel overwhelming, but it doesn’t have to be. The 20% savings rule is a fantastic place to begin because it’s easy to remember and gives you a clear, achievable target.

This benchmark isn’t just about stashing cash away; it’s about building a disciplined habit. It forces you to prioritize your future self over those immediate, impulse buys.

The Power of Percentages #

So, why a percentage instead of a fixed dollar amount? Because it automatically adjusts to your life. When you get a raise, your savings get a raise, too. If you have a slow month, your savings target flexes with you. It’s a dynamic strategy that grows as you do. Of course, this all starts with knowing where your money is going, which is why tracking your income and expenses is so important.

Here’s how the 50/30/20 budget breaks down your after-tax income:

- 50% for Needs: This chunk covers your absolute essentials—things like rent or mortgage, utilities, groceries, and car payments.

- 30% for Wants: This is for the fun stuff that makes life enjoyable, like going out to eat, streaming services, hobbies, and vacations.

- 20% for Savings & Debt Repayment: This portion is your powerhouse for the future. It’s for building savings, investing, and aggressively paying down debt (anything beyond the minimum payments).

The whole point is to make saving a non-negotiable part of your budget. By setting aside that 20% right off the top, you ensure your financial goals are being funded before you have a chance to spend that money elsewhere.

The 20% Savings Rule at a Glance #

To see how this plays out in the real world, let’s look at a few examples. This table shows what saving 20% of your bi-weekly paycheck could look like over time.

| Bi-Weekly Take-Home Pay | 20% Savings Per Paycheck | Total Savings Per Month | Total Savings Per Year |

|---|---|---|---|

| $1,500 | $300 | $600 | $7,200 |

| $2,000 | $400 | $800 | $9,600 |

| $2,500 | $500 | $1,000 | $12,000 |

| $3,000 | $600 | $1,200 | $14,400 |

As you can see, even small, consistent contributions add up to a significant amount by the end of the year. It’s the consistency that truly builds wealth.

Give Your Savings A Purpose #

Saving money just for the sake of it feels like a chore. It’s abstract and, honestly, pretty boring. But when you know exactly what you’re saving for, everything changes. Suddenly, you’re not just “saving money”—you’re building a down payment, killing off credit card debt, or paving the way for a work-optional future.

Before you even think about how much to save per paycheck, you have to figure out your ‘why.’ Giving every dollar a specific job is the single best way I know to stay motivated and actually see progress. This isn’t about restriction; it’s about being intentional with your money to build the life you want.

The Three Buckets Every Saver Needs #

Most financial goals boil down to three key priorities. Getting these in the right order is crucial because it ensures you’re building a solid foundation before reaching for bigger things. Think of it as laying the groundwork before you build the house.

- Build Your Emergency Fund: This is job number one, no exceptions. An emergency fund is your safety net for life’s nasty surprises—a sudden job loss, an unexpected medical bill, or a busted transmission. Start with a mini-fund of $500 to $1,000, then work your way up to a fully-funded cushion of 3-6 months’ worth of essential living expenses.

- Attack High-Interest Debt: Got that small emergency fund in place? Great. Now it’s time to go to war with high-interest debt, especially credit cards and personal loans. This kind of debt is like a hole in your financial boat; it’s actively sinking your progress. Paying it off is one of the best investments you can make.

- Invest for the Long Haul: Once your emergency fund is solid and you’re not getting crushed by high-interest debt, you can shift your focus to growing long-term wealth. This is where you start seriously funding accounts like a 401(k) or an IRA, letting your money work for you over time.

This sequence is non-negotiable. Skipping the emergency fund is a classic mistake. Without it, the first unexpected bill that comes along will send you right back into debt, wiping out all your hard work.

Your emergency fund isn’t an investment; it’s insurance. It’s the buffer that keeps a single unexpected event from derailing your entire financial plan, giving you the security to focus on other goals without fear.

Bringing Savings Buckets to Life #

Let’s look at a real-world example. Imagine a couple, Alex and Jamie. They feel like they’re being pulled in a million directions. They want to buy a house, take a nice vacation next year, and they know they should be saving for retirement. It’s overwhelming.

Instead of just throwing all their extra cash into one big savings account and hoping for the best, they create separate “buckets” for each goal. It’s a game-changer.

Here’s how they might divvy up their savings from each paycheck after covering all their essential bills:

- House Down Payment Fund: This is their big one. They open a dedicated high-yield savings account and nickname it “Future Home.” A significant chunk of their savings goes straight into this account.

- Vacation Fund: They want to go on a trip in about a year. They figure out the total cost, divide it by 24 (since they get paid bi-weekly), and set up an automatic transfer for that amount into a separate account called “Vacation 2025.”

- Retirement Accounts: This one is easy. They each contribute to their company’s 401(k), making sure to put in at least enough to get the full employer match. This money comes directly out of their paychecks, so they never even miss it.

By splitting their money into these clear, distinct buckets, Alex and Jamie can see exactly how they’re tracking toward each goal. The visual separation makes it far less tempting to raid the house fund for a spontaneous weekend getaway. It connects their day-to-day choices with their biggest dreams.

Find The Right Savings Strategy For You #

Knowing your goals is one thing, but actually putting money toward them every single paycheck is a whole other ballgame. There isn’t a single “best” way to figure out how much to save per paycheck—the only right answer is the one that actually works for your income, your personality, and your life.

The trick is to find a system that feels sustainable, not like a financial straitjacket.

Let’s walk through a few popular and time-tested methods. Don’t think of these as rigid rules, but as flexible starting points. You might find one clicks with you instantly, or you might mix and match to create a hybrid that’s perfect for you.

The Classic 50/30/20 Rule #

If you’re just starting out or want a dead-simple way to give every dollar a job, this is a fantastic framework. The 50/30/20 rule carves up your after-tax income into three clear buckets, making sure you cover all your bases without overthinking things.

- 50% for Needs: This is for the must-haves—rent or mortgage, groceries, utilities, and getting to work.

- 30% for Wants: Here’s the fun stuff. Think dining out, hobbies, streaming services, and weekend trips.

- 20% for Savings & Debt: This is the powerhouse slice dedicated to your future, from crushing debt to investing.

The beauty of this method is its simplicity. It forces you to look at where your money is really going and gives you a quick reality check. If your “Needs” are creeping up to 70% of your income, it’s an instant red flag that you might need to find ways to trim your monthly expenses before you can make real saving progress.

Pay Yourself First: The Automation Method #

Honestly, this is my personal favorite because it’s the most powerful way I know to guarantee you save money. The logic is simple: the very first “bill” you pay each payday is to your future self. Before a single dollar goes to groceries or Netflix, a set amount is automatically whisked away from your checking account and into your savings.

It just works. It takes willpower completely out of the equation. You aren’t left staring at what’s left over at the end of the month, wondering if you can spare a little for savings; that money is already gone, hard at work for you. It’s all about building a powerful habit that runs on autopilot.

The Flexible Percentage for Variable Income #

If you’re a freelancer, work on commission, or have an income that swings up and down, trying to save a fixed dollar amount can feel impossible. When your paycheck is unpredictable, your savings plan needs to be just as agile.

Instead of a set amount, you commit to saving a specific percentage of every single paycheck, no matter how big or small.

Let’s say you decide to save 15% of whatever you bring in.

- Great month ($4,000 take-home): You save $600.

- Slower month ($1,800 take-home): You save $270.

This approach ensures you’re always making progress. It lets you capitalize on those great months while not causing undue stress during the leaner times.

Comparing Savings Strategies #

Choosing the right approach depends entirely on your financial style and income type. This quick table breaks down the core differences to help you find your best fit.

| Strategy | Best For | How It Works | Key Benefit |

|---|---|---|---|

| 50/30/20 Rule | Beginners and those with stable income seeking a simple budget structure. | Divides after-tax income into 50% for needs, 30% for wants, and 20% for savings/debt. | Provides a clear, balanced framework that’s easy to implement and monitor. |

| Pay Yourself First | Anyone who struggles with the discipline to save what’s “left over.” | Automatically transfers a fixed amount or percentage to savings on payday. | Builds an effortless and consistent savings habit by removing temptation. |

| Flexible Percentage | Freelancers, gig workers, and anyone with a fluctuating income. | A set percentage of each paycheck is saved, regardless of the amount. | Ensures consistent progress and adapts naturally to income volatility. |

Ultimately, the best strategy is the one you can stick with. You might even start with the 50/30/20 rule to get a baseline, then switch to the “Pay Yourself First” method to automate it.

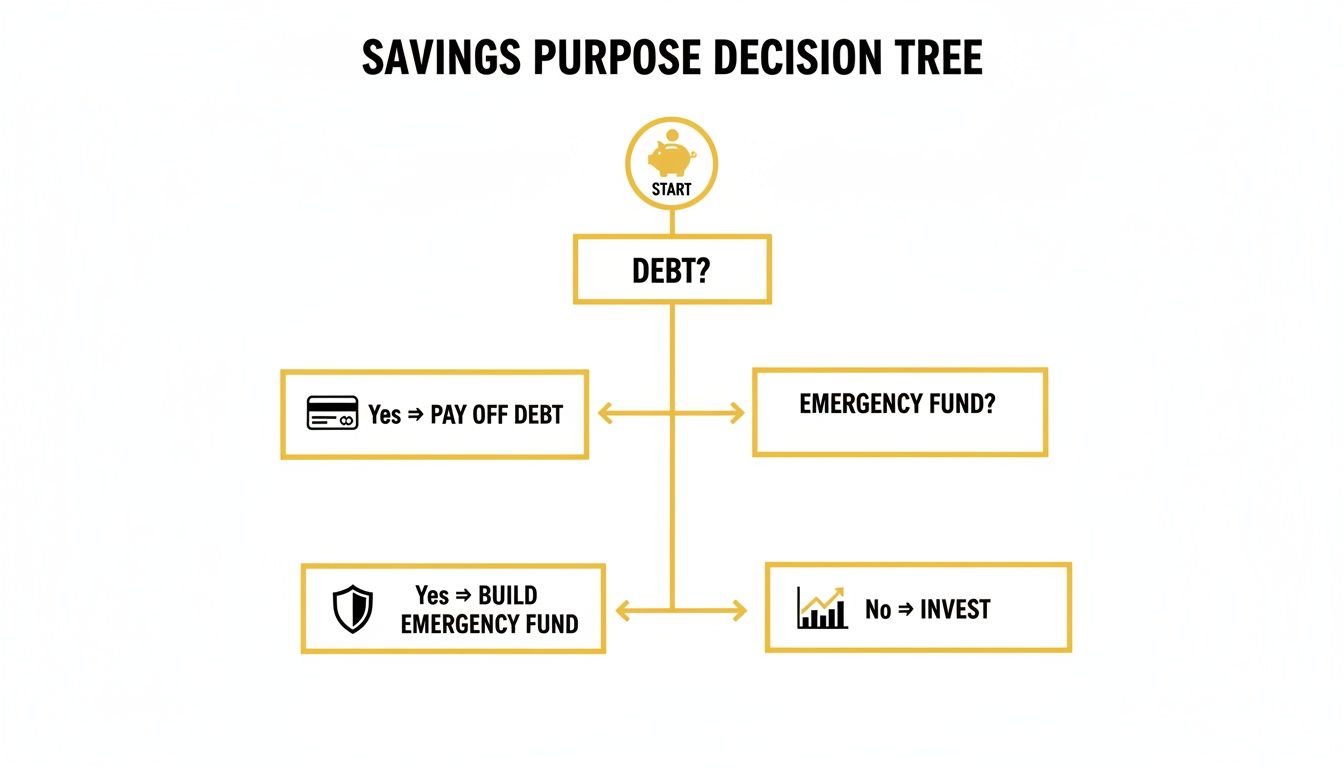

The Waterfall Method for Focused Goals #

The waterfall method is all about creating momentum. You channel every spare dollar you can save toward one single goal at a time with intense focus. Once that goal is hit, you take all the money you were putting toward it and “waterfall” it down to the next priority on your list.

This decision tree gives you a simple visual for how to prioritize where your money should go first.

As the flowchart shows, building a financial safety net is the critical first step. That means tackling high-interest debt and building an emergency fund before you start getting aggressive with long-term investments. This focused approach is incredibly motivating because you see progress quickly. Instead of trickling small amounts into five different goals, you fill one bucket at a time.

Putting It All Together: How Real People Save From Their Paychecks #

General rules like the 50/30/20 budget are a fantastic starting point, but let’s be honest—life is rarely that neat. The real world is messy. We all have different incomes, competing goals, and unique challenges that a simple formula can’t always solve.

Sometimes, the best way to figure out how much to save per paycheck is to see how others in similar boats are navigating their own finances. So, let’s move past the theory and dive into four distinct, real-world scenarios. We’ll break down the thought process, the numbers, and the strategies that make consistent saving a reality for them.

The Single Professional Juggling Debt And Retirement #

Meet Maya. She’s a marketing manager earning a $70,000 salary, which gives her a take-home pay of about $2,100 every two weeks. Maya’s two biggest financial priorities are paying down her student loans aggressively while also getting a handle on retirement savings.

She feels that classic pressure to do everything at once, but she knows a focused plan is the only way forward.

Maya’s Paycheck Savings Breakdown:

- Emergency Fund: She’s already built a $5,000 cushion in a high-yield savings account. This covers about two months of her core expenses, so she’s paused contributions for now to focus elsewhere. It’s her “sleep-at-night” fund.

- Retirement: Her employer offers a 4% 401(k) match. This is a no-brainer. She contributes 4% of her pre-tax income to get every penny of that free money. It happens automatically before she ever sees it.

- Student Loans: The big one. On top of her minimum payment, she automates an extra $300 payment from each paycheck, targeting her highest-interest loan first.

- Short-Term Savings: Maya loves to travel, so she doesn’t want to feel deprived. She automatically sends $100 from every paycheck to a separate “Travel Fund.”

All told, Maya is actively sending $400 of her take-home pay toward her goals each paycheck. That’s just over 19% of her income. By prioritizing the 401(k) match and attacking her debt, she’s making smart, powerful moves for her future.

The Dual-Income Couple Saving For A House #

Next up are Ben and Sarah, a couple with a combined income of $120,000 a year. They have one massive goal on their radar: saving $50,000 for a house down payment within the next three years.

They funnel all their income into a joint account for bills and savings, which keeps them on the same page and simplifies tracking.

Combining forces can be a huge accelerator for big savings goals. The secret sauce is open communication and a shared system. When both partners are aligned on the “why” and the “how,” progress happens much faster.

Ben and Sarah’s strategy is all about maximizing their savings rate for this one specific goal.

Ben and Sarah’s Paycheck Savings Breakdown:

- Shared System: All paychecks land in their joint checking account. From there, they tackle the mortgage, utilities, groceries, and other shared bills.

- Retirement First: Just like Maya, their first move is non-negotiable. They each contribute enough to their own 401(k)s to secure their full employer match.

- The “House Fund” Sweep: After all the bills are paid and they’ve set aside a small amount for personal spending, they have a standing rule. Whatever is left over—which is usually around $1,500 a month—gets immediately swept into their high-yield “Down Payment” savings account. This “save what’s left” method works perfectly for them because their income and expenses are very stable and predictable.

This aggressive approach means they’re stashing away a huge chunk of their income. They’ve consciously decided to make the down payment their primary focus, putting other big goals on the back burner for a while.

The Freelancer With A Fluctuating Income #

Now let’s look at Chris, a freelance graphic designer whose income is a rollercoaster. Some months he might bring in $7,000; other months could be a lean $3,000. Saving a fixed dollar amount is simply not an option. Instead, he lives and dies by a flexible percentage model.

Managing an irregular income requires a totally different mindset. For a deeper look at this strategy, check out our guide on budgeting for irregular income.

Chris’s Paycheck Savings Breakdown:

Chris’s system is all about percentages and separate bank accounts. As soon as a client payment hits his business account, he splits it up.

| Allocation | Percentage of Income | Purpose |

|---|---|---|

| Tax Savings | 25% | Immediately moved to a separate account for quarterly tax payments. |

| Business Expenses | 15% | Set aside for software, marketing, and other operational costs. |

| Personal Savings | 20% | Automatically transferred to a high-yield savings account for his goals. |

| Take-Home Pay | 40% | The rest is moved to his personal checking account for living on. |

This method guarantees he’s always setting money aside for taxes and his own future, regardless of how big or small the check is. On a $5,000 month, he saves $1,000 for himself. On a $3,000 month, he still manages to put away $600.

The Expat Family Saving Across Currencies #

Finally, let’s meet the Rodriguez family. They live in Spain but earn income in both Euros (EUR) and US Dollars (USD). Their unique challenge is managing savings goals across two different currencies, banking systems, and continents.

Their top priorities are saving for their children’s education back in the States (in USD) and building up a local emergency fund (in EUR).

The Rodriguez Family’s Paycheck Savings Breakdown:

- Local Emergency Fund (EUR): From their Euro-based income, they have an automatic transfer set up for €400 each month. This goes straight into a local Spanish savings account to cover any immediate, in-country emergencies.

- Education Fund (USD): From their US-based income, they automatically transfer $500 each month into a 529 college savings plan in the US.

- Retirement (USD): They also contribute $300 a month from their US income to a US-based IRA.

To keep it all straight, they use a financial app that supports multiple currencies. This gives them a clear, consolidated view of their total net worth and lets them track progress without constantly doing mental currency conversions. Their system is a perfect example that even the most complex financial situations can be tamed with the right tools and a clear plan.

Turn Your Savings Plan Into A Habit #

A great savings plan is just an idea on paper. The real magic happens when you build a system that makes saving feel effortless—turning a chore into a background habit that works for you 24/7. This is how you make your savings plan stick for good.

If there’s one trick I’ve seen work time and time again, it’s automation. When you set up automatic transfers, you take willpower and decision fatigue completely out of the picture. You’re no longer trying to save; saving just happens.

Automate Everything On Payday #

The moment your paycheck lands in your checking account is your point of maximum financial power. This is your chance to act before a single bill gets paid or a coffee gets bought. It’s the core of the whole “Pay Yourself First” philosophy, and it works.

Here’s how to put it into practice:

- Set up recurring transfers: Jump into your online banking and schedule an automatic transfer from your checking to your savings account. Make sure the date is set for your payday or the day right after.

- Split your direct deposit: Check with your HR department. Many employers let you split your direct deposit across multiple bank accounts. You can send a fixed amount or a percentage of each paycheck straight to savings. You’ll never even see that money in your primary account, which is a huge psychological win.

This is a small, one-time setup that completely changes the game. You stop hoping there’s something “left over” at the end of the month and start guaranteeing you make progress on your goals.

Conduct A Quick Spending Audit #

Sometimes, the extra cash you need to boost your savings is hiding in plain sight. A quick spending audit isn’t about building a painful, restrictive budget. It’s about finding money you’re spending on autopilot that could be redirected toward things you actually care about.

Grab your latest bank and credit card statements and give yourself 30 minutes. Look for those forgotten subscriptions, the daily coffee runs that sneak up on you, or the takeout orders that have become a little too frequent. You might be shocked to find an extra $50 or $100 a month that you can easily free up.

Finding “hidden money” in your spending isn’t about deprivation. It’s about aligning your spending with your values. Every dollar you redirect from an unused subscription to your house down payment fund is a vote for your future self.

Managing Savings As A Couple #

For couples, getting on the same page financially is everything. An open conversation and a unified system can prevent a ton of stress and seriously accelerate your progress toward big goals, like buying a home or retiring early.

Here are a few practical tips that actually work:

- Schedule regular money dates: Once a month, set aside 20-30 minutes to check in on your shared goals. This isn’t an audit of each other’s spending—it’s a time to celebrate wins and make sure you’re both still pulling in the same direction.

- Use a shared system: Whether it’s a joint account for bills or a shared budgeting app like Econumo to track progress, having one central place to see your financial picture keeps you working as a team.

- Define “yours, mine, and ours”: Figure out how you’ll handle personal spending money. Giving each partner a guilt-free amount to spend however they want can reduce friction and make sticking to the big shared goals much, much easier.

Review And Adjust Your Savings Plan #

Your financial life isn’t static, so your savings plan shouldn’t be either. A plan you create today might be outdated in a year. Life happens—a new job, a raise, a baby, or paying off a big debt are all perfect moments to revisit your numbers.

Set a calendar reminder to review your savings strategy every 3-6 months. It doesn’t have to be complicated. Just ask a few simple questions:

- Are my goals still the same?

- Can I bump up my savings rate, even by just 1%?

- Are my automatic transfers still working for me?

This regular check-in ensures your plan grows with you, keeping your momentum strong and your goals within reach. You’re building a system that runs on autopilot but is still flexible enough to adapt when your life changes.

Getting Past the Most Common Savings Roadblocks #

Figuring out a savings plan on paper is one thing. Making it work in the real world, with all its messy variables, is another thing entirely. Life happens, and practical questions always pop up.

Let’s dig into the most common questions I hear. These are the hurdles that can stop a good savings plan in its tracks if you don’t have a clear way to handle them.

“What If I Can’t Save 20% Right Now?” #

First things first: the 20% savings rule is a guideline, not a commandment. If that number feels completely out of reach, don’t sweat it. The real goal is to build a consistent savings habit, and you can’t do that if you never start.

Saving anything is always better than saving nothing.

If 20% is a non-starter, try for 5%. If even that feels tight, start with just 1%. On a $2,000 bi-weekly paycheck, that’s only $20. It might not feel like you’re moving mountains, but you’re laying the foundation for a powerful financial habit.

The most important number isn’t the percentage you save. It’s the number of paychecks in a row you’ve managed to put something away. Consistency is what builds momentum and, eventually, real wealth.

Once you’ve automated that 1%, you’ll probably forget it’s even happening. A few months down the line, try bumping it to 2%. This gradual approach is key—it keeps you from feeling deprived and makes your savings plan something you can actually stick with for the long haul.

“Should I Save or Pay Off Debt First?” #

Ah, the classic financial tug-of-war. The answer is almost always to do both. I know that sounds counterintuitive, especially when you’re staring down a high-interest credit card bill, but focusing 100% on debt can leave you dangerously exposed.

Here’s a balanced strategy that actually works:

- Build a small emergency fund first. Aim to get $500 to $1,000 into a separate savings account. Think of this as your financial fire extinguisher. It’s there to handle small emergencies that would otherwise send you right back into debt.

- Keep making minimum payments on everything. This is non-negotiable to keep your accounts in good standing.

- Throw every extra dollar at high-interest debt. Once your mini-emergency fund is locked in, you can attack high-interest debt—like credit cards that charge 20% or more—with everything you’ve got. Paying that off is like getting a guaranteed return on your money.

People make the mistake of skipping that first step all the time. But without that small cash cushion, a single flat tire can completely derail your debt-payoff momentum.

“How Should I Handle Raises and Bonuses?” #

When extra cash lands in your account, it’s so tempting to just let your lifestyle expand to absorb it. A raise or a bonus is a golden opportunity to turbocharge your financial goals without having to cut back on your current budget.

A simple but incredibly effective rule is the 50/50 split.

Commit right now to sending 50% of any raise, bonus, or other windfall straight to your financial goals. The other 50%? It’s yours to enjoy. This creates the perfect balance between rewarding yourself now and securing your future.

Let’s say you get a raise that adds $200 to each paycheck. Here’s how you’d play it:

- Immediately increase your automatic savings transfer by $100.

- Enjoy the other $100 as a guilt-free boost to your everyday spending money.

This simple trick is your best defense against “lifestyle creep,” where your expenses mysteriously rise to meet your income, leaving you wondering where all that extra money went.

“Where’s the Best Place to Keep My Savings?” #

Where you park your savings matters almost as much as how much you save. Your money needs to be safe, easy to get to in an emergency, and hopefully, earning a little something for you in the background.

For most short-term goals (your emergency fund, a down payment, a vacation fund), a high-yield savings account (HYSA) is the best tool for the job. These accounts are FDIC-insured, so your money is safe, and they offer interest rates that blow the accounts at traditional big banks out of the water. It’s a simple way to make your money work a little harder and fight back against inflation while it’s waiting to be used.

Ready to get a clear view of your savings goals and put these strategies into action? Econumo is a simple yet powerful app designed for individuals, couples, and families to manage their finances together. Track your savings, create shared budgets, and handle multiple currencies with ease. Take control of your money by visiting https://econumo.com to try the live demo or join the waiting list.