Let’s be honest, few things cause more friction in a household than money. That sinking feeling when an unexpected bill arrives, the “did you pay the electric bill?” text, the scramble to figure out who paid what—it’s a recipe for stress and arguments. A shared home finance and bill organizer is your way out of that cycle.

Think of it as a central command center for your household’s finances. It’s a single, shared space that gives everyone a crystal-clear, real-time view of your money, turning financial management from a solo burden into a true team effort.

How a Shared Organizer Can End Money Fights for Good #

We’ve all been there: a stack of mail on the counter, trying to piece together due dates and amounts. It’s this exact kind of financial chaos that often leads to tension. The solution isn’t just another complicated spreadsheet; it’s a system designed specifically for collaboration.

When you bring all your financial information into one place, there’s no more room for confusion. Everyone can see what’s coming in, what’s going out, and what’s left. That shared understanding is the bedrock of building financial trust and actually working together toward your goals.

The Magic of Financial Transparency #

With a single source of truth, conversations about money shift from emotional and reactive to strategic and productive. Instead of bickering about a forgotten credit card payment, you can start having real discussions about saving for that family vacation or figuring out how to crush your debt ahead of schedule.

A good system helps you:

- Kill the Guesswork: See every single upcoming bill, its due date, and how much is owed, all in one spot.

- Create Clear Accountability: Assign who’s responsible for what payment without any nagging or crossed wires.

- Get Ahead of Problems: Easily spot spending patterns and adjust your budget as a team before small issues become big ones.

This level of organization is no longer a “nice-to-have”—it’s essential. In the third quarter of 2025, total U.S. household debt surged to $18.59 trillion, with credit card balances hitting $1.23 trillion. Those numbers from the New York Fed’s quarterly report paint a stark picture of how many financial plates families are spinning. A centralized organizer is your best defense against letting one of them drop.

A shared home finance and bill organizer does more than just track payments. It builds a foundation of communication and shared responsibility, turning financial stress into financial strength.

Building Your Collaborative Financial System #

Before you even think about downloading an app or opening a spreadsheet, the most important step is to talk. Seriously. The tech is just a tool; the real system is the understanding you build with your partner. This starts with a real, honest chat about money—your habits, your fears, and your dreams for the future.

It’s all about getting on the same page. What does “financially secure” mean to each of you? Are you laser-focused on a house deposit, or is a big trip abroad the priority right now? There are no wrong answers here, but if your expectations don’t line up, your budget is doomed from the start.

Defining Your Shared Financial Lanes #

A huge point of friction for many couples is figuring out what’s “ours” and what’s “mine.” In my experience, a hybrid approach works wonders. It fosters teamwork for shared goals while giving each person the freedom they need. It’s a setup that says, “We’re in this together, but we’re also individuals.”

Here’s a practical way to structure your accounts that I’ve seen work time and again:

- A “Joint Bills” Checking Account: Think of this as the main hub for your household. Both of you contribute a set amount from each paycheck to cover all the shared stuff—mortgage or rent, utilities, groceries, car payments, you name it.

- Individual Personal Accounts: This is a game-changer. Each of you keeps your own separate account for your own spending. Hobbies, lunches out with friends, that new gadget you’ve been eyeing—it comes from here, no questions asked. This single step grants you autonomy and cuts down on so many potential arguments over small purchases.

- Shared Savings Accounts: Get specific! Instead of one big savings pot, create buckets for your goals. You might have an “Emergency Fund,” a “Vacation to Italy” fund, and another for “New Car Down Payment.” Giving your goals a name makes them feel real and keeps you motivated.

If you’re feeling the pressure of managing it all, you’re not alone. The whole point of a shared system is to reduce that stress.

As you can see, when stress enters the picture, a shared organizer is the clearest path back to feeling in control.

Putting the Pieces Together #

Once you’ve settled on a structure, it’s time to act. Go to the bank (or online) and open that joint account. The next move is to set up automatic transfers from your personal accounts to the joint one right after payday. This “pay yourself first” method ensures the bills are always covered.

Choosing the right approach for your family depends on your comfort levels with sharing and autonomy. There are a few common ways couples tackle this.

Approaches to Shared Household Finances #

| Approach | How It Works | Best For | Potential Pitfall |

|---|---|---|---|

| All-In Joint | All income goes into one shared account. All spending, personal and household, comes out of it. | Couples who are completely aligned on financial goals and spending habits. Maximum simplicity. | Can lead to a loss of individual autonomy and arguments over personal spending. |

| Hybrid “Yours, Mine, Ours” | Each partner keeps a personal account. A third joint account is funded by both for shared bills. | Most couples. It offers a great balance of teamwork for shared responsibilities and freedom for personal spending. | Requires a bit more setup and agreeing on how much each person contributes to the joint account. |

| Proportional Contributions | Similar to the hybrid model, but contributions to the joint account are based on income percentage. | Couples with a significant income disparity. It feels fairer as each contributes relative to their earnings. | Can feel complex to calculate and may need readjusting if incomes change. |

| Separate But Equal | Partners keep completely separate finances and split shared bills one by one. | Couples who value financial independence above all else. | Can be administratively heavy, tracking who paid for what. May hinder progress on shared long-term goals. |

No single method is perfect for everyone. The key is to pick the one that feels right for your relationship and makes money a source of collaboration, not conflict.

Finally, you’ll want to connect all these accounts—your new joint account and your personal ones—to your chosen organizer app. This creates that all-important single source of truth, giving you a complete, real-time dashboard of your entire household’s financial health.

The goal is to create a unified dashboard of your household’s cash flow. This single view eliminates financial guesswork and empowers you to make informed decisions together, quickly and without conflict.

If you’re looking to expand this organizational hub beyond just money, the Ultimate Digital Family Command Center Guide has fantastic ideas for integrating calendars and to-do lists. And as you set things up, make sure you know how to give your partner access. You can find detailed instructions on managing permissions in our guide to shared access controls.

Creating Your Master Bill and Payment Calendar #

Now that your accounts are set up for teamwork, it’s time to build the engine of your home finance and bill organizer: the master payment calendar. This isn’t just a list of due dates. Think of it as a complete roadmap of your financial obligations, giving you a clear, honest look at your cash flow for the month ahead.

First things first, you need to go on a little financial treasure hunt. Your mission is to track down every single recurring expense your household pays. The best way to do this is to pull up your bank and credit card statements from the last three months and go through them line by line. Don’t just look for the big stuff; it’s often the small, forgotten subscriptions that quietly eat away at a budget.

![]()

This process can be a real eye-opener. The average American consumer is juggling more debt than ever, which makes a solid bill tracking system non-negotiable. As of June 2025, the total debt burden averaged a staggering $104,755 per person, with mortgages making up the biggest chunk. This complex financial reality, packed with different loans and payment schedules, is exactly why a disorganized approach just doesn’t cut it anymore. You can learn more about these consumer debt trends from Experian.

Categorizing Your Household Expenses #

To get a handle on all this information, you need to group your bills into logical categories. This simple step helps you see exactly where your money is going at a glance and makes building out your budget later on much easier.

A great place to start is by splitting them into two main buckets:

- Fixed Expenses: These are the predictable costs that stay the same month after month. We’re talking about things like your mortgage or rent, car payments, insurance premiums, and any personal loan repayments. They form the bedrock of your financial plan.

- Variable Expenses: These are the costs that can fluctuate. This bucket includes utilities like electricity and water, groceries, transportation costs like gas, and all those entertainment subscriptions.

For your variable expenses, where the exact amount isn’t set in stone, just look at the average from the past few months to get a realistic baseline. Don’t guess—use your actual spending data. I’ve found it’s always better to slightly overestimate these costs to build a little buffer into your plan.

Your goal is to eliminate surprises. By logging every single bill—from the $1,200 mortgage to the $15 streaming service—you build a calendar that reflects your true financial reality, not just the big-ticket items.

Populating Your Bill Organizer and Setting Reminders #

With your list in hand, it’s time to plug everything into your chosen organizer. For each bill, you’ll want to log a few key details to make the system truly work for you. This is what turns a simple list into a powerful management tool.

Here’s the essential info I recommend including for every single entry:

- Bill Name: Get specific (e.g., “City Water Bill,” not just “Utilities”).

- Due Date: The exact day of the month it’s due.

- Payment Amount: Use the precise figure for fixed bills and your calculated average for variable ones.

- Assigned Payer: Note who’s responsible for hitting the “pay” button (e.g., “Partner A,” “Partner B,” or “Auto-Pay from Joint”).

- Confirmation Method: How will you know it’s paid? (e.g., “Email Receipt,” “Bank Alert”).

Once all your bills are logged, the final—and most crucial—step is to set up automated reminders. Most financial apps let you schedule alerts 3-5 days before a bill is due. This is your safety net, ensuring a due date never sneaks up on you or your partner again. This proactive habit is the heart of a stress-free home finance and bill organizer.

Designing a Budget That Actually Works for Your Life #

Alright, with your bills all mapped out, it’s time to tackle the budget itself. A lot of people hear the word “budget” and think it means restriction and sacrifice, but that’s not it at all. A good budget is about giving your money a job—it’s the tool that helps you spend intentionally on the things that truly matter to you.

The best budgets start with a dose of reality. First, figure out your total combined monthly take-home pay. Then, pull in all those fixed costs from your master bill calendar—the mortgage, utilities, car payments, and so on.

This simple step gives you an immediate, clear picture of your financial baseline. You’ll know exactly what’s left over for everything else, from groceries and gas to savings and getting out of debt. It’s no longer a guessing game.

From Essentials to Wish Lists #

Once you’ve got your core expenses down, you can start categorizing everything else. The goal here isn’t to scrutinize every past purchase but to build a realistic plan moving forward. This is where a shared home finance and bill organizer really shines, as you and your partner can see these patterns emerge together.

Try sorting your spending into buckets that fit your life.

- Needs (The Essentials): These are the have-to-pays. Think mortgage or rent, groceries, insurance premiums, and minimum debt payments. They’re the non-negotiables.

- Wants (The Fun Stuff): Here’s where your discretionary spending lives—dining out, hobbies, streaming services, and that weekend getaway. Be honest about what you typically spend here.

- Goals (The Future): This is all about paying your future self. It covers everything from building an emergency fund and saving for a down payment to making extra payments on high-interest debt.

With these categories clearly defined, you can have much more productive conversations about money. Maybe you’ll notice that your takeout habit is costing more than you realized, and you’d both rather put that cash toward your vacation fund. For a deeper look at this process, we’ve got a full guide on how to create a household budget.

A great budget isn’t about cutting out everything you love. It’s about making conscious choices to spend less on things you don’t care about so you can spend more on the things you do.

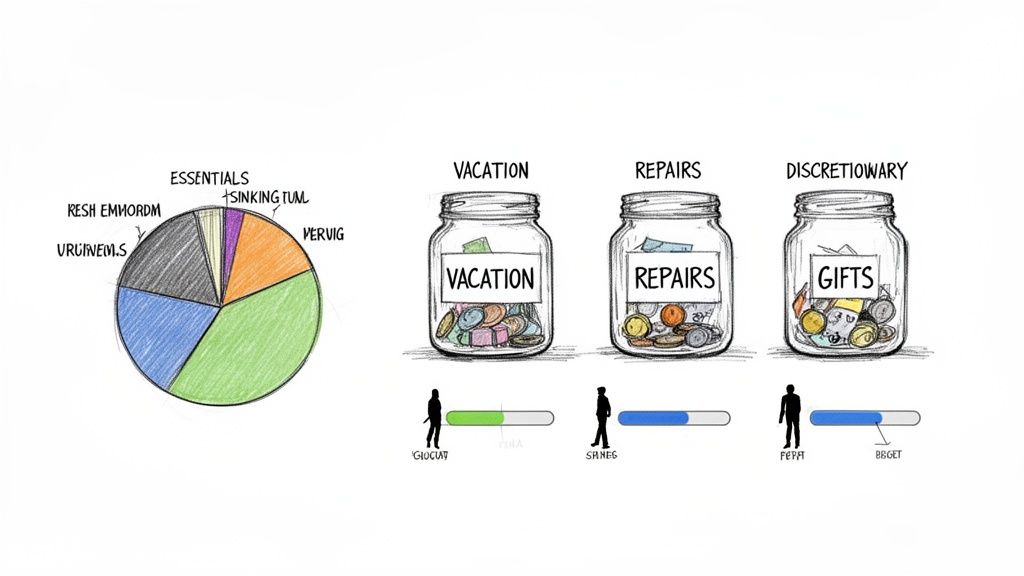

The Power of Sinking Funds #

Want to know one of the best ways to eliminate financial stress? Meet sinking funds. These are simply small, dedicated savings pots for specific, predictable expenses that don’t happen every month. Instead of getting hit with a huge bill out of nowhere, you prepare for it over time.

Think about it—you know your car insurance is due every six months, and the holidays roll around every single December. A sinking fund turns these budget-busting moments into predictable, planned events.

Let’s say you aim to spend $1,200 on holiday gifts. Just create a “Holiday” sinking fund and start tucking away $100 a month. When December comes, the money is already sitting there, ready to go. No stress, no debt.

Some popular sinking funds people set up include:

- Car Maintenance & Repairs

- Vacations & Travel

- Annual Subscriptions (like Amazon Prime)

- Holiday & Birthday Gifts

- Home Repairs & Improvements

By breaking down large, intimidating costs into small, monthly contributions, you create a much smoother, more predictable financial life. It’s a proactive strategy that truly puts you in the driver’s seat.

Unlocking Advanced Financial Control Features #

Once you’ve got the basics of budgeting and bill scheduling down, you can start exploring some seriously powerful features that give you a much deeper level of financial insight and security. This is where you move beyond just tracking what comes in and what goes out. You start turning your simple organizer into a true command center for your family’s finances.

A lot of modern tools are built around linking your bank accounts, which is great for pulling in data automatically. The downside? It can create a “set it and forget it” mentality where you’re not really engaged with your money. An alternative that I’ve found builds incredible financial awareness is good old-fashioned manual transaction tracking.

The Unexpected Power of Manual Tracking #

When you purposefully log every single expense—that morning coffee, the weekly grocery trip, that late-night online purchase—it forces you to be mindful. Spending becomes an active choice, not just a passive habit.

This simple act of accountability has a way of uncovering surprising spending patterns that automated systems sometimes miss. It keeps you connected to your financial reality in a way that just scanning a bank statement can’t.

To make this easier, you can use digital tools like expense tracking apps to log everything on the go. While many are marketed for business use, their core features are perfect for anyone serious about household tracking.

Managing Finances Across Borders #

Life isn’t always lived in one currency. For expats, digital nomads, or families with financial ties in other countries, managing money can get complicated fast. A top-tier home finance and bill organizer has to handle these complexities without breaking a sweat.

Here’s what you should look for:

- The ability to track accounts in their native currency, whether it’s euros, pounds, or yen. You don’t want forced conversions messing up your real financial picture.

- A feature to view your total net worth in a single, primary currency, using real-time exchange rates to give you an accurate snapshot.

- The option to set budgets in different currencies. This is a lifesaver if you’re managing daily expenses abroad while still paying bills back home.

This kind of functionality eliminates the headache—and potential financial loss—that comes from constantly doing mental currency math with ever-changing exchange rates.

As our financial lives become more global, the tools we use have to keep up. Real control means having a clear, accurate view of all your assets, no matter where they are or what currency they’re in.

Taking Control of Your Financial Privacy #

In a world filled with data breaches, thinking about who has your financial data is more important than ever. Most cloud-based apps store your sensitive information on their servers, which can be a weak link. For anyone who puts a premium on privacy, self-hosting is the ultimate answer.

Self-hosting simply means you run the financial software on your own private server. You have complete ownership and control over your data—no third party can ever see it. It takes a bit more technical know-how to set up, but the peace of mind it offers is priceless for the security-conscious.

Platforms like Econumo are built with this flexibility in mind, offering both cloud and self-hosted options. You can explore different approaches in our guide to the best family budget software.

The need for this level of control isn’t just a preference; it’s becoming a necessity. With household debt payments now eating up 11.25% of disposable income and delinquencies on mortgages and credit cards on the rise, these advanced features are no longer a luxury.

A recent report highlighted that households are juggling over $1.23 trillion in credit card debt and $1.66 trillion in auto loans. Managing that kind of debt requires precise tools, where things like privacy and multi-currency support are fundamental for modern financial security.

Frequently Asked Questions #

Even with the best financial plan, life happens. As you start building your shared home finance and bill organizer, you’re bound to run into a few common questions. Tackling these challenges early on is what makes the difference between a system that works and one that gets abandoned after a month.

Let’s walk through some of the most frequent hurdles couples and households hit, and how to clear them.

How Do We Handle Unexpected Expenses With a Shared Budget? #

The best way to deal with unexpected costs is to… well, expect them. The trick is building a buffer right into your budget from day one. Your first priority should be an emergency fund with 3-6 months of essential living expenses tucked away in a separate, easy-to-reach savings account. This is for the big stuff—a job loss, a sudden medical bill—not a last-minute concert.

For the smaller, less catastrophic surprises like a car repair or an emergency vet visit, a sinking fund is your best friend.

By having dedicated funds for specific “surprises,” you turn a potential panic-inducing argument into a calm discussion about which account to pull from. It stops a minor setback from blowing up your entire month.

What’s the Best Way to Track Shared Cash Spending? #

Ah, cash. The budget’s biggest blind spot. It’s so easy for cash to just disappear, but if you want your budget to be accurate, you have to track it. The only real way to do this is through manual tracking.

This requires a little discipline. Both you and your partner need to take a minute or two each day to log any cash you spent in your organizer app. Don’t put it off until the weekend—by then, the receipts are gone and you’ve forgotten what you even bought. Making this a daily habit not only keeps your numbers right but also makes you much more aware of where those little bits of cash are actually going. Snapping a quick photo of your receipts can be a great backup, too.

How Can We Make a Shared Organizer Work With Different Spending Habits? #

This is probably the single biggest point of friction for most couples. But here’s the secret: a great shared system doesn’t mean you have to agree on every single purchase. The key is to build personal spending allowances into the budget itself.

Here’s how it works: After you’ve set aside money for all your joint bills, savings goals, and sinking funds, you each get a set amount of discretionary money for the month. This is your money to spend however you want, no questions asked. It’s a simple but powerful way to maintain your individual autonomy while still working together as a team on the big picture.

Ready to build a financial system that finally ends the money stress? Econumo gives you all the tools for collaborative budgeting, multi-currency tracking, and total privacy. Try the live demo today and see how it feels to be in control of your shared finances.