Financial planning as a married couple is all about working together to set goals and drawing up a roadmap to get there. A good plan isn’t just about the numbers; it builds trust, gets you talking, and turns two individual financial lives into one powerful force. It’s the bedrock for building a secure and happy life together.

Why Financial Planning Is the Foundation of a Strong Marriage #

Starting a life together is an incredible adventure, full of big dreams and exciting plans. But let’s be honest—merging two separate financial worlds can feel complicated, even a little scary. It’s no wonder so many couples sidestep money talks, worried they’ll spark an argument.

That’s a classic mistake. Getting on the same page with your finances is one of the best things you can do for your relationship. Think of it like building a house: you wouldn’t just start throwing up walls without a blueprint. A joint financial plan is that blueprint, giving you the solid foundation needed to build everything else.

Turning Chores into Shared Goals #

The real purpose of financial planning for married couples isn’t to get bogged down in spreadsheets or create budgets that feel like a straitjacket. It’s about crafting a shared vision for your future and then teaming up to bring that vision to life. It’s your map to the life you both want to live.

This simple shift in perspective turns what feels like a chore into an exercise in teamwork. When you plan together, you’re actively building:

- Trust: Being open about your income, debts, and spending habits creates a culture of honesty and transparency. No secrets, no surprises.

- Alignment: You make sure you’re both pulling in the same direction, whether your goal is buying a home, saving for retirement, or traveling the world.

- Resilience: A solid plan helps you weather life’s storms—like an unexpected job loss or medical bill—without completely derailing your long-term goals.

The Power of a Proactive Plan #

Unfortunately, too many couples wait to have these conversations. Shockingly, research shows that only about 1 in 4 married Americans actually has a formal financial plan when they get married. This delay can take a toll.

Couples without a plan report lower marital satisfaction (89%) compared to the impressive 94% satisfaction rate among those who plan together. The connection is clear: financial teamwork leads to a stronger partnership. You can learn more about how couples manage money on WesternSouthern.com.

By reframing financial planning as an act of partnership, you shift the focus from individual accounts and habits to a collective journey. It’s not about “my money” or “your money”—it’s about “our future.”

Adopting this team-based mindset is the single most important step you can take. It empowers you and your partner to see money not as a source of stress, but as a tool for building the life you’ve always dreamed of—together.

How Should We Actually Manage Our Money Together? #

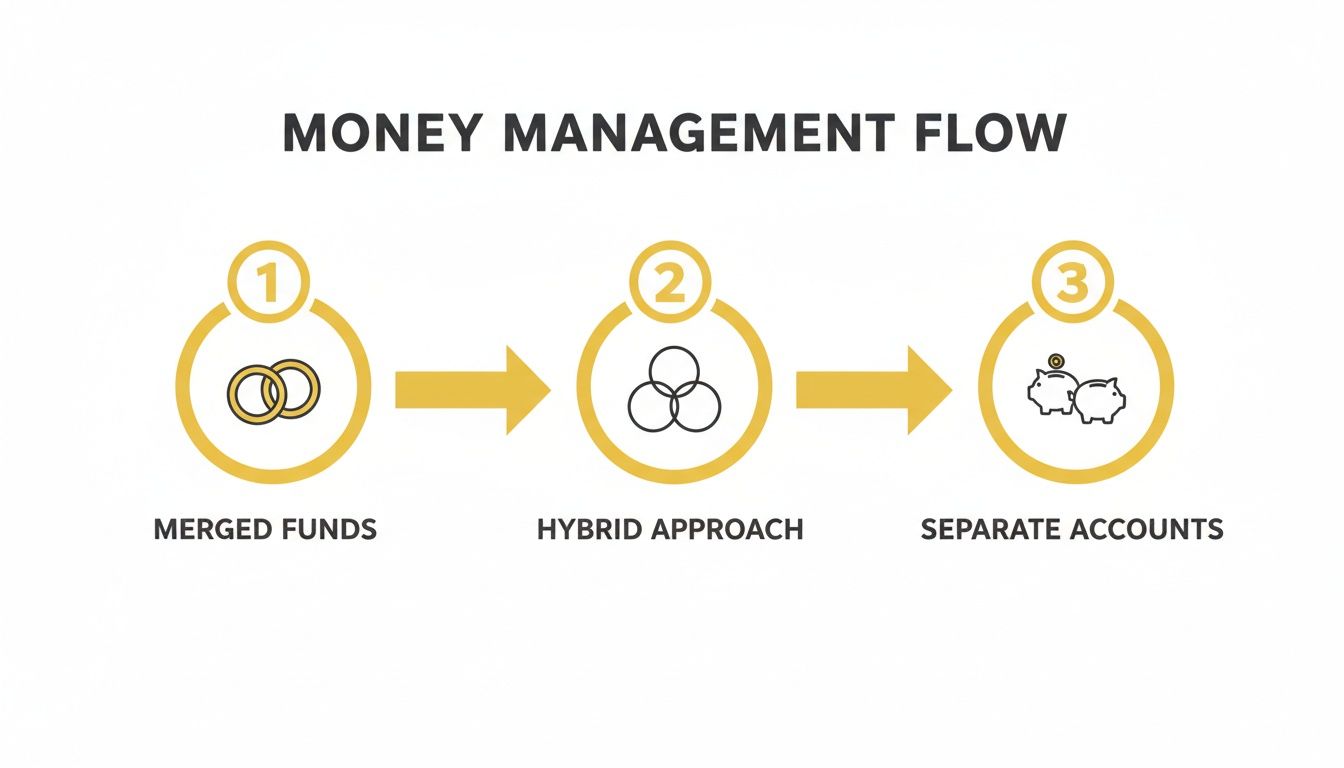

Once you’ve agreed to get on the same financial page, the next step is figuring out the “how.” How will you physically structure your bank accounts and manage the day-to-day flow of money? There’s no single right answer here. The best system is the one that fits your personalities, your individual money histories, and what feels right for your relationship.

The whole point is to find a setup that feels less like a chore and more like a natural part of your life together. Let’s walk through the three most common ways couples do this.

The “All-In” Approach: Fully Merged Finances #

This is the traditional “what’s mine is yours” model. Every dollar you both earn goes into a shared pot—a joint checking or savings account. From there, you pay all the bills, fund your savings goals, and cover personal spending.

This method is the ultimate in simplicity and transparency. You’re a single financial unit, which can build a powerful sense of teamwork. Every decision is made together, making it easier to stay aligned on big goals.

Of course, that total transparency can also feel a bit suffocating. If one of you is a super-saver and the other enjoys a little more freedom with their spending, this can create friction over small, personal purchases. It demands a massive amount of trust and constant communication to work without a hitch.

The “Yours & Mine” Approach: Completely Separate Finances #

At the other end of the spectrum, you have couples who keep everything separate. Each partner has their own accounts, and you figure out a system to split the shared costs like rent, utilities, and groceries.

This setup offers maximum personal freedom. You can buy that new gadget or pair of shoes without having to run it by your partner, which can definitely cut down on minor squabbles. It’s also a practical way to handle things if either of you came into the relationship with significant personal debt or other complex financial ties.

The downside? It can feel a little… transactional. Keeping a running tally of who paid for what can get old fast and might make it harder to see the big picture of your shared financial progress.

The “Best of Both Worlds” Approach: A Hybrid System #

This is an increasingly popular middle ground, and for good reason. You open a joint account specifically for shared household expenses—the mortgage, car insurance, groceries, you name it. Both of you contribute a set amount to this account each month.

Everything else stays separate. You each keep your own personal accounts for individual spending, personal savings goals, or paying down old debts. This gives you a clear framework for teamwork on the essentials while preserving your autonomy for everything else.

The hybrid system creates a clear distinction between “our money,” “my money,” and “your money.” This brings a ton of clarity, allowing for guilt-free personal spending while making sure all the joint responsibilities are covered together.

Recent trends show that more and more couples are moving toward these kinds of flexible setups. The idea of being ‘married but separate’ financially is on the rise. In fact, the percentage of married couples with no joint bank accounts has climbed from 15% in 1996 to 23% today. The hybrid model has seen a huge jump, with 17% of couples now mixing accounts, up from just 9% back in 1996. You can dig into more of this data directly from the U.S. Census Bureau.

This shift just underscores how important it is to find a system that honors both your shared goals and your individual independence.

Comparing Financial Management Models for Couples #

To make the decision a little easier, we’ve broken down the pros and cons of each approach. Think of this table as a conversation starter for you and your partner.

| Approach | Pros | Cons | Best For |

|---|---|---|---|

| Fully Merged | Ultimate simplicity and transparency. Fosters a strong sense of teamwork toward shared goals. | Can feel restrictive and lead to conflict over personal spending. Requires high levels of trust. | Couples who are completely aligned on financial habits and goals and who value simplicity above all. |

| Completely Separate | Maximum individual autonomy and financial freedom. Reduces conflict over minor purchases. | Can feel transactional and make tracking shared goals difficult. Requires constant coordination on bills. | Couples who value independence highly or those with complex individual finances (e.g., business owners, significant debt). |

| Hybrid System | Balances teamwork with personal freedom. Clear separation of shared vs. personal funds. | Requires a bit more setup than other models. You still need to agree on contribution amounts. | Most couples. It offers a flexible, modern approach that supports both shared responsibilities and individual autonomy. |

Ultimately, there’s no wrong answer—only what’s wrong for you. The best system is the one you can both genuinely commit to. Talking through these options is a huge first step in building a strong financial future together.

For a deeper dive into creating a shared financial plan, be sure to check out our guide on how to budget as a couple.

How to Build Your Joint Financial Action Plan #

You’ve talked about the big picture and decided how you’ll manage your money together. That’s a huge step! Now it’s time to get down to the nitty-gritty and build the actual plan. This is where you turn those conversations about your future into a concrete roadmap you can follow, day in and day out.

Think of this as your shared playbook. It’s what ensures you’re not just winging it, but actively working as a team to build the life you both really want. This whole process isn’t about pointing fingers or feeling judged; it’s about being open, honest, and creating something powerful together.

Step 1: Uncover Your Money Stories #

Before you can build a future, it really helps to understand your past. We all have a “money story”—a unique set of beliefs and habits shaped by how we grew up and what we’ve been through.

Maybe one of you grew up in a house where every penny was counted, which made you a natural saver. The other might have seen money as a way to have fun and create memories. Neither story is right or wrong, but they explain why you see money the way you do. Talking about them builds empathy and helps you avoid so many future misunderstandings.

To get started, try asking some open-ended questions:

- What’s your earliest memory of money?

- How did your parents handle finances? Did they talk about it openly, or was it a taboo subject?

- What’s one financial lesson—good or bad—that has really stuck with you?

This first conversation lays a foundation of understanding that makes every other step feel much easier.

Step 2: Get Full Financial Transparency #

Okay, deep breath. The next step requires total honesty. It’s time to lay all your financial cards on the table. This is a non-negotiable part of building trust and you simply can’t move forward without a complete, accurate picture of your combined financial health.

It’s time to gather everything:

- Assets: Bank statements for checking and savings accounts, investment portfolio summaries, retirement accounts like 401(k)s or IRAs, and any documents showing the value of big-ticket items like your home or cars.

- Debts: A list of all credit card balances, student loans, car loans, personal loans, and your mortgage.

- Income: Grab your most recent pay stubs to get a clear picture of your actual take-home pay each month.

I know this part can feel a little vulnerable, but it’s absolutely essential. This isn’t about judging past decisions. It’s about establishing a clear, honest starting point for the future you’re building together.

Step 3: Set Meaningful Goals Together #

Now for the fun part! With a full picture of where you stand, you can start dreaming about where you want to go. Setting goals gives your financial plan a purpose. It turns boring tasks like budgeting and saving into something exciting because you know exactly what you’re working toward.

It helps to break your goals into three buckets:

- Short-Term (1–3 years): Things like building an emergency fund, finally paying off that one credit card, or saving up for a fantastic vacation.

- Mid-Term (3–10 years): Bigger goals like saving for a down payment on a house, upgrading your car, or starting a family.

- Long-Term (10+ years): This is where you plan for retirement, paying off the mortgage for good, or funding a child’s education.

A great tip is to make your goals SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Don’t just say, “We want to save more.” Instead, try: “We will save $10,000 for a house down payment in the next two years.” That kind of clarity makes it so much easier to track your progress and stay fired up.

Step 4: Build a Unified Budget #

Your budget is the engine that drives your entire financial plan. It’s the practical tool that directs your money toward your goals, month after month. It doesn’t matter if you’ve decided to merge accounts, keep them separate, or go for a hybrid approach—you still need one unified budget that reflects your shared priorities.

This diagram lays out the three main ways couples structure their money, which will help you think about how to build your budget.

As the visual shows, whether you pool everything, keep it all separate, or land somewhere in the middle, the key is agreeing on a system that works for both of you. To get your budget started, you’ll need a solid grasp of your spending. You can dive deeper with our guide to understanding your income and expenses.

Step 5: Create a Debt Repayment Strategy #

Debt can feel like a heavy anchor holding you back from all your exciting goals. But tackling it together? That can be incredibly empowering. Once you have a complete list of all your debts, it’s time to decide on a game plan.

Two of the most popular methods are:

- The Debt Snowball: You focus on paying off the smallest debt first, no matter the interest rate. Getting that quick win of clearing a debt completely can give you the motivation to keep going.

- The Debt Avalanche: You attack the debt with the highest interest rate first. This approach will save you the most money on interest in the long run.

There’s no single “right” answer here. Pick the strategy that gets you both the most excited to start. The best plan is always the one you’ll actually stick with.

Step 6: Schedule Regular Money Dates #

A financial plan isn’t something you create once and then file away. Life happens, things change, and your plan needs to be flexible enough to change with you. This is why scheduling regular “money dates” is one of the most important things you can do.

Set aside 30 minutes every month just to check in. This isn’t a time for blame or stress—it’s a positive, forward-looking meeting. Use this time to go over your budget, see how you’re tracking toward your goals, and talk about any big expenses coming up.

Keeping the conversation going is a game-changer, especially for younger couples. Financial disagreements are a major source of stress, cited by 34% of Gen Z couples, who often deal with income gaps and different asset levels. But here’s the good news: couples who’ve been together longer report becoming more financially compatible over time. This shows just how powerful it is to build these collaborative habits early on.

By following these steps, you’re doing more than just building a financial plan. You’re building a true partnership grounded in trust, great communication, and a shared vision for an amazing future.

Navigating Financial Disagreements with Your Partner #

Let’s be realistic: even with the best-laid financial plans, you and your partner are going to disagree about money. It’s inevitable. Maybe one of you is a natural-born saver, while the other believes money is meant to be spent on amazing experiences. Or maybe an unexpected car repair blows your budget completely out of the water.

Life is messy, and our feelings about money are even messier. The goal isn’t to pretend you’ll never have another argument about finances—that’s a fantasy. The real win is learning how to navigate those disagreements as a team. It’s about turning a potential fight into a moment that actually strengthens your partnership.

The most important part is a simple mindset shift: stop thinking “me vs. you” and start thinking “us vs. the problem.” When you frame a disagreement as a shared puzzle you need to solve together, the blame game stops, and the search for solutions begins.

Setting the Stage for Productive Conversations #

Trying to have a serious money talk when you’re stressed, tired, or already in the middle of an argument is a recipe for disaster. The first step is to intentionally create a safe space where you both feel heard and respected. This is where the idea of a regular “money date” comes in.

A money date is exactly what it sounds like: a scheduled time you set aside just to talk about your finances. Put it on the calendar. Treat it like a dinner reservation you wouldn’t miss. This simple act takes the pressure off and ensures you’re both coming to the conversation focused and prepared, rather than trying to sort things out on the fly.

A scheduled money date transforms a potentially tense conversation into a proactive, collaborative check-in. It’s a calm, neutral ground to review goals, discuss upcoming expenses, and tackle challenges before they become full-blown conflicts.

To keep these chats on track, it helps to set some ground rules beforehand. Agreeing on a few simple principles can make all the difference.

- No Blame: Focus on the numbers and your goals, not on who did what wrong last month. This is about moving forward.

- Active Listening: Try to genuinely understand your partner’s point of view instead of just waiting for your turn to talk.

- Time Limits: Keep it focused. A productive 30-minute check-in is almost always better than a draining two-hour marathon.

- One Topic at a Time: Don’t try to solve your budget, retirement plan, and vacation savings all at once. Pick one thing and stick to it.

Communication Tools for Tough Topics #

When things get heated, it’s all too easy to start pointing fingers. Using a few simple communication tricks can help lower the tension and build real understanding. One of the most powerful tools in your toolkit is the “I feel” statement.

Instead of saying, “You spend way too much on takeout,” which immediately puts your partner on the defensive, frame it from your own perspective. For example: “I feel anxious when our food budget is overdrawn because I worry we won’t hit our savings goal this month.”

See the difference? This approach communicates your feelings without placing blame, opening the door for a real conversation. It helps your partner understand where you’re coming from and respond with empathy, not a counter-attack.

Another crucial strategy is learning to find the middle ground. Financial planning as a couple is rarely about one person “winning” an argument. It’s all about compromise. If one of you is laser-focused on paying down debt and the other is dreaming of a vacation, the solution isn’t to just pick one. It’s about finding a way to do both, even on a smaller scale.

For instance, you might agree to put an extra $200 a month toward your debt while also putting $100 a month into a dedicated vacation fund. This creates a win-win. Both of you feel like your priorities are being heard and valued. By working together to find these compromises, you’re not just building a budget—you’re building a stronger bond.

Planning for Your Long-Term Future Together #

Okay, so you’ve got a handle on your day-to-day budget and you’re tackling bills like a pro. Awesome. Now it’s time to zoom out and look at the bigger picture. This is where financial planning for married couples transitions from managing the now to actively building the life you want later.

It’s all about creating a solid foundation and a smart growth plan for the decades ahead. These long-term topics can feel a little heavy, but they’re just the next steps in your journey. When you take them on as a team, you’re making sure you’re both protected and ready for whatever comes next.

Coordinating Your Retirement Strategy #

Saving for retirement is definitely a marathon, not a sprint, and doing it together is a huge advantage. The real goal here is to combine your efforts to get the absolute most out of the retirement accounts available to you.

Most people have a 401(k) through work. If both of you have one, and especially if your employers offer a match, your first move is crystal clear: contribute enough to get that full match. It’s free money, and you never want to leave that on the table.

Once you’ve secured the match, you can look at other accounts, like an Individual Retirement Account (IRA). A smart, coordinated plan often looks something like this:

- Step 1: Both of you contribute just enough to your 401(k)s to grab the maximum employer match.

- Step 2: From there, you could focus on maxing out one or both of your IRAs.

- Step 3: If you still have money left to invest (way to go!), circle back to your 401(k)s and contribute more until you hit the annual limit.

This is just one approach, of course. For a deeper dive, check out our guide on having an IRA and a 401(k). The main takeaway is to stop thinking of them as “my account” and “your account” and start seeing them as one big, shared portfolio.

Building Your Financial Safety Net #

A huge part of planning for the long haul is protecting your family from life’s curveballs. That’s what insurance is for. I know, it’s not the most thrilling topic, but getting it right buys you incredible peace of mind.

Think of insurance as the guardrails on the highway of your financial journey. You hope you never need them, but they are absolutely critical for keeping you on track if something goes wrong.

For married couples, two types of insurance are non-negotiable:

- Life Insurance: If one of you were to pass away, life insurance pays out to the surviving spouse. It’s there to cover lost income, pay off the mortgage, or just keep the family financially stable during an impossible time.

- Disability Insurance: This one is so often overlooked, but it’s just as vital. Disability insurance replaces a chunk of your income if you get sick or hurt and can’t work. It protects your ability to earn a living—which is your single most valuable asset.

Setting Up Your Estate Plan #

“Estate planning” sounds like something for the ultra-wealthy, but it’s really just about making sure your wishes are clear. It answers two simple questions: who gets your stuff, and who makes decisions for you if you can’t?

For most couples, a basic estate plan has a few key parts:

- A Will: This is the legal document that spells out how you want your assets divided and, if you have kids, who you want to be their guardian.

- Beneficiary Designations: Go through all your retirement accounts, life insurance policies, and other financial accounts and name your spouse as the primary beneficiary. This one simple step can help those assets bypass the long, costly court process of probate.

- Powers of Attorney: These documents let you appoint someone (usually each other) to make financial and healthcare decisions for you if you become incapacitated and can’t make them yourself.

Getting these things in order now saves your loved ones from a world of stress and confusion down the road.

Your Top Questions About Money and Marriage, Answered #

Talking about money as a couple can feel like walking through a minefield. It’s totally normal to have a lot of questions. Let’s tackle some of the most common ones that come up when you’re blending your financial lives.

Should We Combine Bank Accounts Right After Getting Married? #

Honestly, there’s no one-size-fits-all answer here. For some couples, merging everything into one big pot works perfectly. But for many others, a hybrid approach feels much more comfortable.

A popular setup is having one joint account for all the shared stuff—rent, groceries, utilities—while you each keep your own personal account for individual spending. This gives you both teamwork and a healthy dose of independence.

The best system is the one that reduces friction and supports your shared goals. Don’t get stuck on what you should do; focus on what actually works for your relationship.

What if One of Us Is a Spender and the Other Is a Saver? #

Ah, the classic “spender vs. saver” dynamic. It’s incredibly common and doesn’t have to be a source of conflict. The secret is to build a budget that honors both of your natural tendencies.

Here’s how you can make it work:

- Set shared savings goals: This is huge for the saver. It gives them a sense of security and a feeling of making real progress.

- Give each other a personal spending allowance: Designate a certain amount of “no questions asked” money for each of you every month.

This creates a win-win. You’re hitting your shared goals, but you also have the freedom to be yourselves without feeling guilty or resentful about every little purchase.

How Do We Deal With Debt From Before We Got Married? #

First things first: lay all the cards on the table. You need 100% transparency here. Once everything is out in the open, you have to decide if you’re going to treat it as “our debt” and attack it together, or if each person will continue to be responsible for their own.

If you choose to tackle it as a team, a strategy like the debt snowball (paying off the smallest debts first for quick psychological wins) can work wonders. When you frame it as a shared mission you can track and celebrate together, you turn a major source of stress into an amazing opportunity for teamwork.

Ready to build a financial plan that works for both of you? Econumo provides the tools you need to manage joint accounts, create shared budgets, and track your progress toward your biggest goals. Take control of your financial future together.