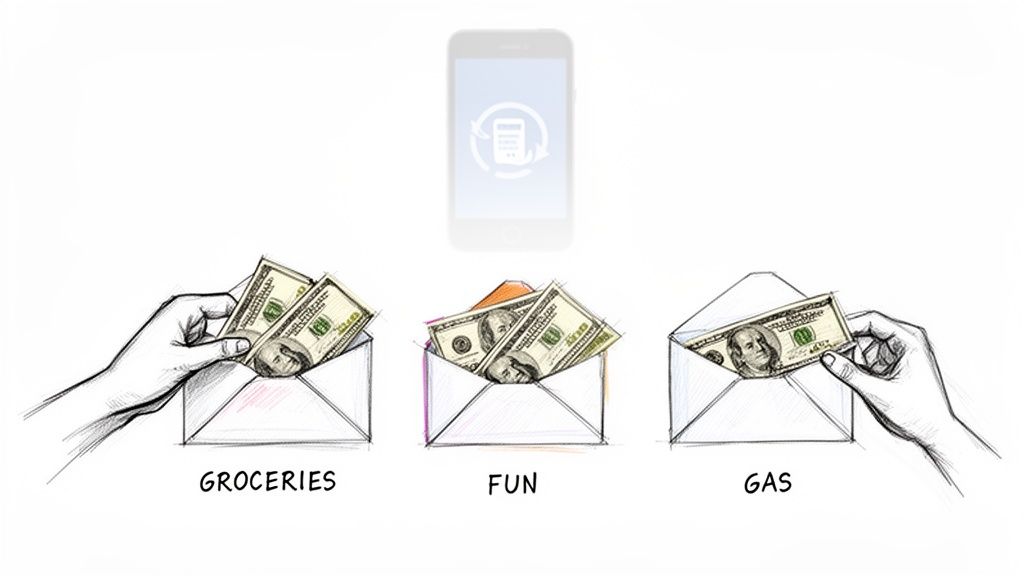

The cash envelope system is a simple, hands-on way to manage your money. You divide your cash for the month into different envelopes, each one labeled for a specific spending category like “Groceries” or “Gas.” Once the cash in an envelope is gone, you’re done spending in that category until next month.

It’s a beautifully simple system that creates a real, physical connection to your spending and makes it almost impossible to overspend. It’s all about giving every dollar a job.

Why Cash Envelopes Still Work in a Digital World #

In a world of one-tap payments and credit cards, using physical cash might seem a bit old-fashioned. But that’s exactly why the cash envelope budgeting system is so powerful. Sometimes, the best way to get a handle on your finances is to go back to basics.

The magic of this method is all in the psychology. Swiping a card is easy and abstract—the money doesn’t feel real. But when you have to physically hand over bills from an envelope, you feel it. You see the money leaving your hands, which forces a pause and makes you think about each purchase. This friction is a good thing; it breaks the habit of mindless, frictionless spending that digital payments make so easy.

A Timeless Strategy for Financial Clarity #

This isn’t some new fad. The cash envelope system has been helping families get their finances in order for decades. It really became popular over 70 years ago, back in the 1950s and 60s, when cash was king. For many households on a tight budget, carefully dividing up the weekly paycheck was essential just to make ends meet. This long history shows just how effective this method is at creating financial discipline. You can dig deeper into the history of cash stuffing and see why it’s making such a big comeback.

At its core, the system forces you to be intentional. You’re not just spending; you’re allocating your money with purpose. You decide what’s important—paying down debt, saving for a down payment, or just making sure you have enough for groceries—and you put your money where your priorities are.

By making your budget tangible, you transform abstract financial goals into a physical reality you can hold in your hands. This direct interaction is what helps so many people finally stick to a budget after digital tools have failed them.

Key Benefits of Going Analog #

For a lot of people, this old-school method gets results that fancy apps just can’t match. The advantages are pretty clear:

- It stops overspending cold. You simply can’t spend money you don’t physically have. When the “Eating Out” envelope is empty, you’re making dinner at home. End of story.

- It builds powerful financial awareness. When you handle cash every day, you become acutely aware of where it’s all going. That $5 daily coffee hits different when you see it draining your “Fun Money” envelope.

- It helps you crush debt. By cutting out impulse buys and sticking to your plan, you’ll find you have more money left over to throw at your debts.

- It improves communication for couples. When you and your partner sit down and fill the envelopes together, it brings transparency to your finances. No more secret Amazon purchases or surprise credit card bills.

Cash Envelopes vs Digital Budgeting Quick Comparison #

While the hands-on nature of cash is a huge plus, it’s worth seeing how it stacks up against modern digital budgeting apps. Each has its place, and many people find a hybrid approach works best.

| Feature | Cash Envelope System | Digital Budgeting Apps |

|---|---|---|

| Tangibility | High. Physically see and handle your money. | Low. Numbers on a screen, transactions are abstract. |

| Overspending Risk | Very low. Can’t spend what you don’t have. | Higher. Easy to overspend with linked cards and accounts. |

| Tracking | Manual. Requires discipline to track every expense. | Automatic. Syncs with banks to track spending instantly. |

| Convenience | Lower. Requires trips to the bank and carrying cash. | High. Accessible anywhere from your phone. |

| Awareness | Forces conscious spending decisions with every purchase. | Can lead to passive tracking without changing behavior. |

| Best For | Visual learners and those needing strict spending limits. | Tech-savvy users who want automation and detailed reports. |

Ultimately, there’s no single “best” method—only what works best for you. The cash envelope system excels at changing spending behavior through direct, physical interaction, while apps offer unparalleled convenience and data analysis.

Building Your Budget Before You Touch a Dollar #

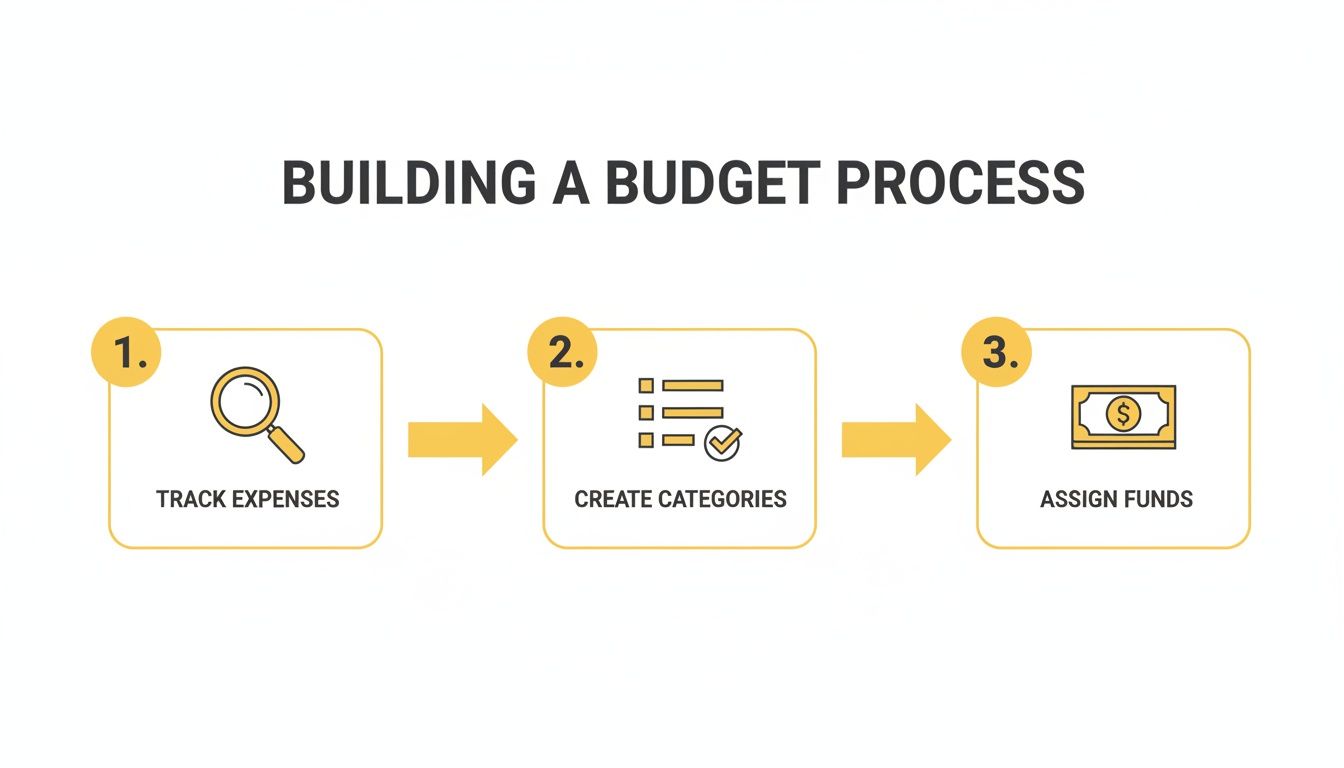

I see this all the time: people get excited about the cash envelope system, rush to the bank, and start stuffing envelopes without a real plan. It’s a classic mistake, and honestly, it’s why the system fails for so many. Before a single dollar goes into an envelope, you need to lay the groundwork with a solid budget.

Think of it this way: your budget is the blueprint. It’s not about restricting yourself; it’s about being intentional. To tell your money where to go, you first have to figure out where it’s been going. This means you’ll need to do a little financial detective work. This is the core of mastering cash flow planning.

Uncovering Your Spending Habits #

To build a budget that actually sticks, you can’t rely on guesses. You need cold, hard data. Your first assignment is to track every single dollar you earn and spend for one full month. Yes, it can feel a bit tedious, but it’s the only way to get an honest look at your financial reality.

Pull up your bank statements and credit card bills. Dig out those crumpled receipts from your glove box. The goal here isn’t to feel guilty about past purchases—it’s just to gather information. I guarantee you’ll find some surprises. Those daily coffee runs and “just a few things” from Amazon add up faster than you think.

If you need a hand with this, we have a detailed guide on how to effectively track your income and expenses. Getting this part right is what makes the whole system click and prevents those nasty budget-busting surprises later on.

Creating Categories That Reflect Your Life #

Once you have a month’s worth of spending data in front of you, it’s time to create your budget categories. Don’t just google a generic list and copy it. Your categories need to make sense for your life.

A few common ones to get you started might be:

- Groceries: Food you buy at the store to cook at home.

- Restaurants/Takeout: Be honest with yourself and give this its own category.

- Transportation: Gas, public transit passes, Uber—whatever gets you around.

- Household Supplies: Cleaning products, paper towels, toothpaste.

- Personal Spending: This is your fun money! Hobbies, treats, a little something for yourself.

The key is to group similar expenses but be specific enough for the category to be useful. If you drive to work every day, your transportation needs are totally different from someone who takes the bus. Make the budget work for you, not the other way around.

A budget isn’t a financial straitjacket; it’s a roadmap to your goals. Giving every dollar a specific job before the month begins is the single most effective way to gain control over your money.

Assigning Every Dollar a Job #

Alright, now for the fun part. Using your tracked expenses as a guide, you’re going to assign a spending limit to each category. We’re going for a zero-based budget here, which just means your income minus all your planned expenses (including savings!) should equal zero. Every dollar gets a job.

Let’s say your take-home pay is $3,000 a month. Your budget might look something like this:

| Category | Allocated Amount | Notes |

|---|---|---|

| Rent/Mortgage | $1,200 | Fixed expense, paid from bank |

| Groceries | $450 | Variable, perfect for a cash envelope |

| Transportation | $200 | For gas and car maintenance |

| Utilities | $150 | Fixed expense, paid from bank |

| Restaurants | $150 | Cash envelope for eating out |

| Personal | $100 | Guilt-free spending money |

| Debt Payment | $350 | Targeted extra payment |

| Savings | $400 | For emergency fund and goals |

| Total | $3,000 | Income - Expenses = $0 |

This process forces you to make conscious trade-offs. Want to throw an extra $50 at your credit card debt? Great! Maybe that means cutting your restaurant budget back a bit for the month. It’s all about aligning your spending with what you truly value. This planning phase is what elevates the cash envelope system from a neat trick into a seriously powerful financial tool.

Your Practical Guide To Using The Envelopes #

Alright, you’ve got your budget mapped out. Now for the fun part: making it real. This is where we move from numbers on a spreadsheet to a hands-on tool that will genuinely change how you handle your money day-to-day.

The magic of this system is its simplicity. You’re going to physically divide your cash into envelopes for all those spending categories that tend to fluctuate—think groceries, gas, entertainment, and the like.

This simple three-step process is the engine that drives the whole system. You track what you’re actually spending, create a realistic plan based on that, and then assign your cash accordingly.

As you can see, you can’t just jump to stuffing envelopes. First, you have to get a clear picture of your spending habits to build a budget that actually works for you.

Getting Your Envelopes Ready #

First off, don’t feel like you need to rush out and buy a fancy, expensive system. While you can find beautiful laminated envelopes and custom binders, you can start with plain old paper envelopes from the corner store. It’s not about the tool; it’s about the commitment.

Label each envelope with one of your variable spending categories. For instance, you might have:

- Groceries

- Gas

- Restaurants

- Personal Care

- Fun Money

My advice? Keep it simple at the beginning. You can always break it down further later, but starting with just your biggest spending trouble spots makes the whole thing feel much less overwhelming. Remember, your fixed expenses like rent or your car payment, which are typically paid online or via auto-draft, don’t need a cash envelope.

The Payday Ritual: Stuffing Your Envelopes #

This will quickly become a satisfying routine. After each payday, head to the bank and withdraw the total amount of cash you need for all your envelopes until the next paycheck. So, if you’re paid bi-weekly and your cash budget is $750 per check, that’s exactly what you’ll take out.

Back home, sit down with your budget and your fresh stack of cash. This is the “stuffing” process. Carefully count out the money for each category and place it into its labeled envelope.

For example, you might put $600 into the “Groceries” envelope for the month. Then, $200 goes into “Gas,” and $150 gets tucked into “Fun Money.” You just keep going until every dollar has a job to do. This little ritual is incredibly powerful for making your financial plan feel tangible.

The act of physically assigning cash to each category is a powerful psychological reset. It forces you to confront your spending limits head-on before you even make a single purchase.

Here’s a quick look at how a household with a $3,500 monthly take-home pay might set up their envelopes.

Sample Monthly Cash Envelope Allocation

| Budget Category | Monthly Allocation | Notes |

|---|---|---|

| Groceries | $600 | For all food and household items bought at the supermarket. |

| Transportation/Gas | $200 | Fuel for the cars, public transport passes. |

| Restaurants/Takeout | $150 | Eating out, coffee shops, and delivery services. |

| Fun/Entertainment | $150 | Movies, hobbies, events—whatever you do for fun. |

| Personal Care | $100 | Haircuts, toiletries, cosmetics. |

| Household Misc. | $100 | Small repairs, cleaning supplies not from the grocery store. |

| Total Cash | $1,300 | This is the total amount withdrawn each month to fund the envelopes. |

This is just an example, of course. Your own categories and amounts will look different, but it gives you a solid idea of how to break things down.

The Golden Rule Of Spending #

With your envelopes filled, you’re ready to go. Heading to the grocery store? Grab your “Groceries” envelope. When it’s time to pay, you use the cash from that specific envelope. It’s really that simple.

This brings us to the single most important rule of the cash envelope system: when the cash in an envelope is gone, you must stop spending in that category.

No exceptions. You can’t just swipe a credit card “this one time.” If your “Restaurants” envelope is empty two weeks into the month, that means you’re eating at home until the next payday. This is the tough love that makes the system so effective. It’s not a guideline; it’s a hard stop that makes overspending nearly impossible. The results are often staggering; people can cut unnecessary expenses by 25-40% because it imposes a discipline that swiping a card just can’t match.

Tracking Your Spending Within The System #

Just because you’re using cash doesn’t mean you stop tracking. You still want to know where the money in each envelope is going—that data is gold for tweaking your budget down the road.

Here are a few easy ways to do it:

- On the Envelope Itself: Many people just jot down purchases and the new balance right on the outside of the envelope. Quick and easy.

- A Small Notebook: Keep a little notepad with your envelopes and log expenses as they happen.

- The Receipt Method: Just tuck every receipt into the envelope it came from. At the end of the week, you can add them all up.

Tracking helps you spot patterns you’d otherwise miss. You might realize your grocery budget is always stretched thin, or that your “Fun Money” is really just a “Fancy Coffee” fund. This is exactly the kind of insight you need to make your budget more realistic over time. If you’re looking for other creative ways to save with cash, check out our guide on the 100 envelope challenge printable. Sticking with this hands-on process builds a deep-seated financial awareness that will pay dividends for years.

Making the System Work for Modern Spending #

Let’s be real—living a 100% cash-only life is a tall order these days. Between online shopping, automatic bill payments, and subscription services, a pure cash envelope system can feel pretty impractical.

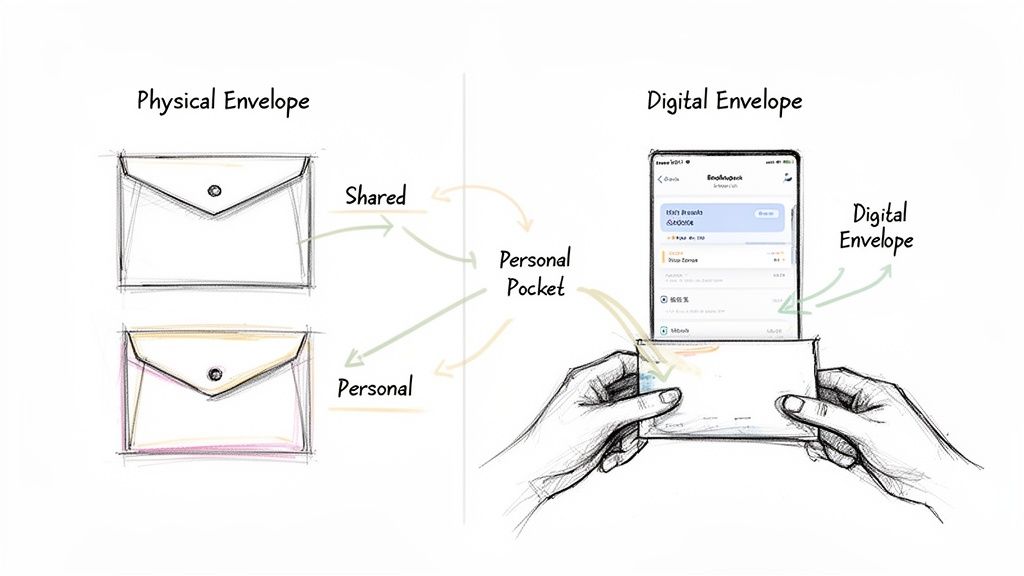

But that doesn’t mean you have to abandon it. The key is to create a hybrid system that blends the discipline of cash with the realities of how we spend money today. This approach lets you use cash where it has the most impact—on your variable, day-to-day spending—while still managing your digital financial life responsibly.

Creating Your Digital Envelopes #

The biggest hurdle for many is figuring out how to handle online purchases and recurring bills. How do you use a cash envelope for your Netflix subscription or that must-have item from Amazon? The answer is what I call the “digital envelope.”

A digital envelope isn’t a special product; it’s a mindset. It’s a specific amount of money in your checking account that you mentally fence off for these non-cash expenses. You have to treat this money with the same rule as physical cash: once it’s designated for a purpose, it cannot be used for anything else.

For example, after you withdraw cash for your physical envelopes, you might leave $500 in your account. Your budget might break this down as:

- $150 for Utilities (auto-pay)

- $75 for Internet & Streaming

- $275 for Online Shopping & Subscriptions

This money stays in your account, but you track it as if it were in separate envelopes. When you shop online, you simply deduct the amount from your “Online Shopping” digital envelope, making sure you don’t accidentally overspend what you’ve budgeted.

Managing Money as a Couple #

The cash envelope system can be a total game-changer for couples, bringing clarity and cutting down on money-related arguments. A shared financial reality often improves communication, with a reported 70% of couples using the method feeling more financial harmony. The trick is to combine teamwork with individual autonomy.

Start by sitting down together and agreeing on a budget for shared expenses. These become your household envelopes.

- Shared Envelopes: Groceries, household supplies, date nights, kids’ activities.

- Personal Envelopes: This is the secret sauce. Each partner gets their own personal spending envelope with an agreed-upon amount of “no questions asked” money.

This structure allows you to manage household finances as a team while giving each person the freedom to spend on their own hobbies or interests without guilt or judgment. It eliminates the need to check in on every little purchase, which fosters both trust and independence. For instance, creating a plan is essential when determining a realistic monthly food budget for two, which can then be funded through a shared grocery envelope.

The goal isn’t to control each other’s spending. It’s to create a shared plan that honors both your collective goals and your individual freedom.

Adapting for Travel and Multiple Currencies #

What if you’re a frequent traveler or an expat dealing with more than one currency? The cash envelope system is surprisingly adaptable. Before a trip, create a specific “Vacation” envelope and fill it with the local currency of your destination.

This acts as a powerful spending guardrail, helping you stick to your travel budget without constantly doing currency conversions in your head. For longer-term, multi-currency needs, a hybrid approach using digital tools is your best bet. Apps like Econumo allow you to track spending across different currencies, giving you a clear financial picture no matter where you are.

Using Digital Tools to Complement Your Cash #

You don’t have to choose between physical envelopes and a budgeting app. In fact, they work brilliantly together. Use your physical envelopes for the tactile, psychological benefits of managing daily spending.

At the same time, let a digital tool like Econumo be your central financial hub. You can log your cash withdrawals and track your “digital envelope” spending right alongside your fixed bills and savings goals. This gives you a complete, accurate overview of your entire financial life in one place, combining the best of both the analog and digital worlds.

Staying on Track When Things Go Wrong #

Let’s be real: no budget is perfect. Life happens. A tire goes flat, your kid gets invited to a last-minute birthday party, or you just plain misjudge how much food you need for the month.

These moments aren’t failures. They’re just part of life, and a key test of your new cash envelope budgeting system. The real goal isn’t to create a flawless plan but to build the financial muscle to handle these curveballs without blowing up your entire month. Staying on track is all about how you react when things inevitably go sideways.

Handling Unexpected Expenses and Overspending #

So, you’re standing at the grocery checkout, and the total is $20 more than the cash you have in your envelope. What do you do? The first rule is simple: don’t panic. And definitely don’t just whip out a credit card on instinct. This is where the magic happens.

Take a breath and assess the situation. Is this a genuine emergency, or just an oversight in your planning? An unexpected car repair is an emergency. Spotting a new pair of shoes on sale is not. Getting clear on that distinction is what keeps your budget intact.

If it’s not a true emergency, you’ve got a couple of choices:

- Put something back. I know, it stings a little. But this is the system doing its job perfectly, forcing you to make a tough call between needs and wants right there in the moment.

- Make a conscious trade-off. If you absolutely have to cover the difference, you must decide where that money will come from. This is “borrowing” from another envelope, and it has to be a deliberate, intentional decision.

The real power of cash envelopes isn’t that they stop financial problems from happening. It’s that they force you to face them head-on, turning a mindless swipe into a conscious, intentional choice.

The Art of Conscious Borrowing #

Let me be clear: if you’re constantly shuffling cash between envelopes, you’re missing the point. But strategic, occasional borrowing is what makes a budget flexible enough for the real world. Overspend on groceries? You might consciously decide to pull that $20 from your “Restaurants” envelope.

What you’ve just done is actively choose to eat out one less time this month to cover a more immediate need. By physically moving the cash, you feel the weight of that decision. You’re not creating new debt; you’re just reallocating the money you already have.

Of course, even the best budget can’t solve everything. If you find yourself dealing with existing balances, learning how to get out of credit card debt can give you the strategies you need to finally get ahead.

Staying Motivated for the Long Haul #

Let’s face it, sticking with any new habit is tough. The key to staying motivated with budgeting is seeing progress. A recent survey found that 52% of people using envelopes paid off debt faster—averaging $3,200 in debt reduction per year—simply because the hard limits stopped them from overspending. Watching that debt balance drop is an incredible feeling.

Here are a few tips to keep that momentum going strong:

- Celebrate the small wins. Did you end the month with a little extra cash in an envelope? That’s amazing! Acknowledge it.

- Schedule quick check-ins. Set aside just 10-15 minutes a week to glance through your envelopes. It helps you spot a potential issue early and fix it before it snowballs.

- Keep your “why” front and center. Write down your reason for doing this—getting out of debt, saving for a down payment—and stick it on your fridge or bathroom mirror.

And the best part? Deciding what to do with money left over at the end of the month. This is your reward! You can throw it at your debt, add it to a savings goal, or roll it into a “treat yourself” fund. It’s this positive feedback that makes the whole process feel less like a chore and more like a win.

Common Questions About Cash Envelope Budgeting #

Jumping into the cash envelope system is a big change, and even the best-laid plans can leave you with a few lingering questions. It’s totally normal. You’re fundamentally changing how you interact with your money day-to-day, so it’s smart to think through the “what-ifs.”

Let’s walk through some of the most common hurdles people face. Getting these sorted out will give you the confidence to not just start, but to actually stick with it and see the payoff.

What If I Have an Unexpected Expense? #

This is probably the number one concern, and for good reason—life happens. You’ve got your budget dialed in, but then the car gets a flat tire or the dog needs a surprise trip to the vet. Suddenly, your “Car Maintenance” or “Miscellaneous” envelope is empty. Now what?

This is precisely why a separate emergency fund is non-negotiable. This isn’t just another cash envelope. It’s a dedicated savings account, tucked away with three to six months of living expenses, for true, out-of-the-blue emergencies. A major car repair or a medical bill is what this fund is for—you’d pull from savings, not your daily spending cash.

But what about smaller, non-emergency surprises? This is where the system forces you to make a conscious choice. If you absolutely have to cover a small, unforeseen cost, the rule is to intentionally “borrow” from another, lower-priority envelope. You might pull $50 from “Entertainment” to cover last-minute school supplies for your kid. This makes the trade-off real: less fun money this month. That little bit of friction is what makes the system so effective.

Is It Safe to Carry That Much Cash Around? #

The thought of pulling out a few hundred dollars at the start of the month can definitely feel a little nerve-wracking. But here’s a common misconception: you don’t have to carry all your cash with you all the time. In fact, you absolutely shouldn’t.

The best practice is simple: take only the envelope you need for that specific trip.

- Headed to the grocery store? Grab your “Groceries” envelope.

- Meeting a friend for lunch? Just take your “Restaurants” or “Fun Money” envelope.

Leave the rest of your cash locked up somewhere safe at home. And remember, for big, fixed expenses like rent or a car payment, you should be using a hybrid approach anyway. That money should stay in your bank account, treated like a “digital envelope,” and paid electronically. This simple habit slashes the risk while still giving you the powerful, hands-on benefit of using cash for your variable spending.

How Can My Partner and I Use This Together? #

Bringing a cash envelope system into a relationship can be one of the best things you do for your financial teamwork. Or, if you don’t set it up right, it can be a new source of tension. The whole thing hinges on communication and working as a team.

First, you have to build the budget together. Both of you need to agree on the amounts going into shared envelopes like “Groceries,” “Household,” or “Date Night.” This creates a sense of shared ownership and gets you both rowing in the same direction.

The secret to making it work as a couple isn’t just about managing the shared bills. It’s about protecting each person’s financial independence, even on a small scale.

This is where personal spending envelopes are a game-changer. Set up separate “no questions asked” envelopes for each of you with an equal, agreed-upon amount of cash. This is your guilt-free money to spend however you want. It completely eliminates arguments over small, personal purchases and gives both partners a sense of autonomy, which is crucial for making the budget last.

Is This System Actually Good for Paying Off Debt? #

Absolutely. In fact, it’s one of the most powerful methods for getting out of debt faster. The magic is in how it forces you to clamp down on that leaky, everyday spending, which automatically frees up more of your income to throw at your debt.

Here’s how to put it into action:

- Create a “Debt Payoff” envelope. Give it a name and a job.

- When you stuff your envelopes on payday, put your planned extra debt payment into this envelope first.

- Seeing that stack of cash earmarked for your debt is an incredible motivator.

Once that money is in the envelope, it’s mentally gone. You’re way less likely to raid it for an impulse buy when you can physically see its purpose is to crush your debt. At the end of the month, you just take that cash, deposit it back into your bank, and make the extra payment.

Ready to combine the hands-on benefits of cash envelopes with the convenience of a modern app? Econumo is designed for couples and families who want to manage their money collaboratively. Track your digital envelopes, coordinate shared goals, and stay on the same financial page. Try the live demo or join the waiting list at Econumo.