Yes, you absolutely can have both an IRA and a 401(k) at the same time. This is one of the most common questions people ask when they start getting serious about retirement. The good news is, not only is it allowed, but for many people, it’s a fantastic strategy to really accelerate their savings.

Think of it as having two different but powerful tools in your financial workshop. Each one has its own job to do, and using them together can help you build a much stronger financial future.

Why Having Both an IRA and a 401k Is a Smart Move #

It’s a myth that if you have a 401(k) at work, you’re locked out of an IRA. The IRS has no rules that stop you from owning and funding both accounts in the same year. For a deeper dive into the specifics of contribution limits, you can get more details at sharebuilder401k.com.

Running with this dual-account approach is a core principle for savvy retirement planners. It simply allows you to build wealth more effectively than you could with just one account.

The Power of Two Retirement Accounts #

Let’s use an analogy. Your 401(k) is like your trusty family sedan. It’s solid, reliable, and gets you where you need to go. Contributions come right out of your paycheck automatically, and best of all, it often comes with an employer match—which is literally free money. You never want to leave that on the table.

Now, think of your IRA as a zippy sports car. It’s an account you open and control yourself, which gives you the freedom to choose from a nearly unlimited universe of investments. While your 401(k) might offer a dozen or so mutual funds, an IRA lets you pick from individual stocks, bonds, ETFs, and all sorts of other options.

This combination provides a balanced approach: the steady, automated growth from your 401(k), complemented by the flexibility and expanded investment choice of your IRA.

By using both, you get the best of both worlds and can build a much more robust and diversified retirement plan. The main perks of this strategy really boil down to a few key things:

- Increased Savings Potential: You can contribute to both accounts each year, allowing you to save far more than the limit on just one account would allow.

- Greater Investment Control: An IRA puts you in the driver’s seat. You can build a portfolio that perfectly matches your personal goals and comfort level with risk.

- Tax Diversification: You can mix and match Traditional (pre-tax) and Roth (after-tax) options across both accounts. This gives you incredible flexibility for managing your tax bill, both today and down the road in retirement.

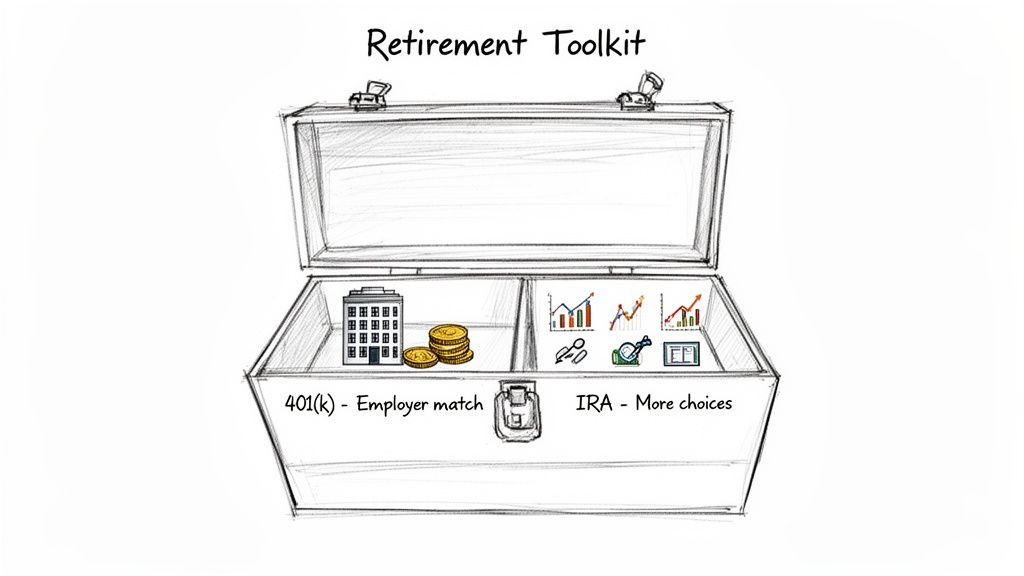

Understanding Your Retirement Toolkit #

Think of your 401(k) and IRA as two essential tools in your retirement-building workshop. They aren’t in competition; they’re designed to work together, each with a unique job to do. Knowing how to use both is the key to building a strong financial future.

Your 401(k) is the trusty power tool of the bunch. It’s your employer-sponsored plan, and its biggest advantage is how easy it is to use. The money comes right out of your paycheck before you even see it, putting your savings on autopilot.

But the absolute best feature of a 401(k) is the employer match. If your company offers one, it’s the closest thing you’ll get to a guaranteed high return. It’s free money. Not contributing enough to get the full match is like telling your boss you don’t want a pay raise.

The 401(k): Your Foundational Tool #

Picture your 401(k) as the concrete foundation of your retirement house. It’s solid, dependable, and your employer helps you pour it. Sure, your investment options might be a bit limited—like choosing from a set menu—but the consistent, automated contributions ensure you’re always building.

Key Takeaway: Before you do anything else, contribute enough to your 401(k) to get the full employer match. This is the non-negotiable first step.

Once you’ve locked in that free money, it’s time to reach for the next tool.

The IRA: Your Personal Savings Powerhouse #

This is where the Individual Retirement Arrangement (IRA) shines. An IRA is an account you open on your own, putting you in the driver’s seat with far more control and investment freedom.

While your 401(k) might offer a dozen mutual funds, an IRA throws the doors wide open. You get access to a massive world of investment choices.

- Individual Stocks: Want to own a piece of your favorite companies? You can.

- Bonds: Lend money to corporations or governments.

- Exchange-Traded Funds (ETFs): Easily invest in entire market sectors or indexes, often with very low fees.

- Mutual Funds: Choose from thousands of options, far beyond what your 401(k) plan offers.

This incredible flexibility lets you craft a portfolio that perfectly fits your personal goals and comfort level with risk. But the choices don’t end there. You also have to pick between the two main flavors of IRAs, which come with different tax perks.

A Traditional IRA can give you a tax break now. Your contributions may be tax-deductible, which lowers your taxable income for the year. The trade-off is that you’ll pay income tax on your withdrawals when you retire.

A Roth IRA, on the other hand, works the opposite way. You contribute with money you’ve already paid taxes on, so there’s no deduction today. But here’s the magic: all your qualified withdrawals in retirement are 100% tax-free.

Getting a handle on this “pay taxes now or pay taxes later” decision is a cornerstone of smart retirement planning. It helps you play the long game with your tax strategy.

How Contribution Limits Work Together #

So, you have a 401(k) and an IRA. The big question is, “How much can I actually save?” People get tangled up in this all the time, but the answer is surprisingly simple—and powerful.

Think of your 401(k) and your IRA as two completely separate buckets. Pouring money into one doesn’t shrink the size of the other. Their annual contribution limits are totally independent, which is fantastic news for anyone serious about building a nest egg. You can max out your 401(k) contributions and it won’t affect your ability to also max out your IRA in the same year.

This separation is the secret sauce that makes holding both accounts such a smart wealth-building strategy.

Understanding the Annual Limits #

Let’s put some real numbers to this. The IRS sets the contribution limits each year, and while the exact dollar amounts might change, the principle of them being separate stays the same.

The amount you can personally contribute to a 401(k) is already quite high. But when you factor in employer matches or profit-sharing, the total that can go into the account gets even bigger. On top of all that, your IRA stands on its own, letting you sock away thousands more in either a Traditional or Roth IRA. You can get a more detailed look at the 401(k) side of things over at sharebuilder401k.com.

Here’s a quick breakdown of what you can contribute:

- Standard Contributions: This is the base amount you can contribute to each account if you’re under the age of 50.

- Catch-Up Contributions: Savers age 50 and over get a nice perk. They can contribute an additional amount to both their 401(k) and their IRA each year, helping them ramp up savings as retirement gets closer.

This means a saver over 50 can contribute the maximum to their 401(k), add the 401(k) catch-up, contribute the maximum to their IRA, and add the IRA catch-up—all in the same year. That’s a massive boost.

A Real-World Savings Scenario #

Let’s see how this works in practice. Meet Sarah, a 42-year-old professional who’s determined to maximize her retirement savings this year. She has a 401(k) at work and just opened a personal Roth IRA.

Here’s Sarah’s game plan for using both accounts effectively:

- Prioritize the 401(k) Match: Sarah’s employer matches 50% of her contributions up to 6% of her salary. Her first move is to contribute at least that 6% to her 401(k). Not doing so is literally leaving free money on the table.

- Max Out the IRA: With the match secured, she shifts her focus to her Roth IRA, contributing the full annual maximum. This locks in a pool of money that will be completely tax-free in retirement.

- Return to the 401(k): Once her IRA is fully funded for the year, Sarah goes back and bumps up her 401(k) payroll deductions, aiming to get as close to the annual IRS limit as her budget allows.

By following this simple order of operations, Sarah isn’t choosing between her accounts; she’s making them work together. She gets her full employer match, then builds on that foundation by maxing out her personal account.

Of course, juggling these moving parts requires knowing where your money is going. Getting a clear handle on your budget is the first step, and our guide on managing your income and expenses is a great place to start. This coordinated approach allows Sarah to save tens of thousands of dollars in a single year—way more than she ever could with just one account.

Navigating Income Limits and Tax Deductions #

While anyone with earned income can technically contribute to both a 401(k) and an IRA, your income is the secret ingredient that determines just how sweet the tax benefits are. This is where things get a bit more nuanced, but the rules are pretty straightforward once you see them laid out.

The IRS sets income thresholds, officially called phase-out ranges. If your income climbs into these ranges, your ability to get a tax deduction on Traditional IRA contributions or put money directly into a Roth IRA starts to shrink—or even disappear completely. This is especially true when you already have a 401(k) at work.

How Income Affects Your IRA Tax Perks #

Think of these income limits like a dimmer switch, not an on/off button. For a Traditional IRA, having access to a 401(k) means the IRS puts your income under a microscope. If you earn too much, that fantastic upfront tax deduction fades away. You can still contribute, but the money goes in after-tax (this is called a non-deductible contribution).

With a Roth IRA, the rule is more of a hard stop. If your income is over the limit, the door to direct contributions is closed for the year. The government designed the biggest perks for low-to-middle income earners.

Your Modified Adjusted Gross Income (MAGI) is the specific number the IRS looks at to figure out your eligibility. It’s vital to know this figure when you’re mapping out your retirement plan for the year.

Here’s a look at the specific income numbers you’ll need to know.

IRA Contribution and Deduction Income Limits #

This table shows the Modified Adjusted Gross Income (MAGI) phase-out ranges that determine your ability to contribute to a Roth IRA or deduct contributions to a Traditional IRA if you have a 401(k) at work.

| Filing Status | Roth IRA Contribution Phase-Out Range | Traditional IRA Deduction Phase-Out Range (with 401k) |

|---|---|---|

| Single, Head of Household | $146,000 – $161,000 | $77,000 – $87,000 |

| Married Filing Jointly, Qualifying Widow(er) | $230,000 – $240,000 | $123,000 – $143,000 |

| Married Filing Separately | $0 – $10,000 | $0 – $10,000 |

As you can see, the income ranges vary significantly. For more details on these limits and how they work, you can find a good breakdown at sharebuilder401k.com.

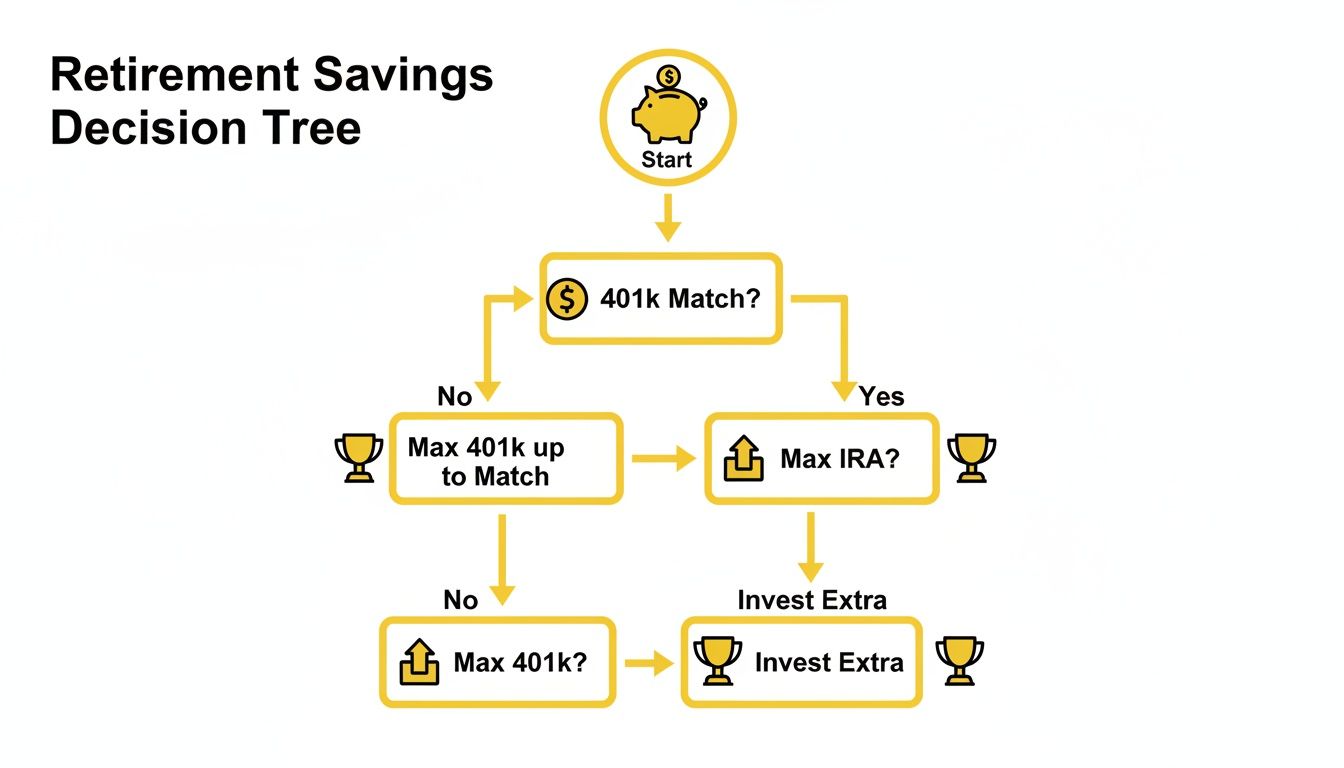

This decision tree shows a smart way to prioritize your savings, starting with grabbing that free money from your employer match before filling up your other retirement buckets.

The flowchart makes it clear: after you’ve contributed enough to your 401(k) to get the full match, funding an IRA is often the next best move before you go back to maxing out the 401(k).

A Strategy For High Earners: The Backdoor Roth IRA #

So, what if your income is too high to contribute to a Roth IRA? Don’t sweat it. There’s a popular—and perfectly legal—strategy called the Backdoor Roth IRA. It sounds sneaky, but it’s a well-established financial planning tool.

Here’s the simple, two-step process:

- Contribute to a Traditional IRA: First, you put money into a Traditional IRA. Since you’re over the income limit to get a tax break, this is a non-deductible contribution made with after-tax dollars.

- Convert to a Roth IRA: Almost immediately, you convert that Traditional IRA into a Roth IRA.

Because you already paid taxes on the money you put in, the conversion itself is usually tax-free. You’d only owe taxes on any tiny amount of interest the money earned while it sat in the Traditional IRA for a few days.

This workaround effectively lets high earners get money into a Roth IRA, completely bypassing the income restrictions. It’s a powerful way to make sure you can build a source of tax-free income for retirement, no matter how much you make.

When you’re part of a team, especially in marriage, the strategy of having both a 401(k) and an IRA gets even more powerful. Retirement planning for couples isn’t about two separate paths; it’s about weaving a single, strong financial future together. Suddenly, you might be looking at managing not just one or two accounts, but maybe four—a 401(k) and an IRA for each of you.

This opens up a whole new world of strategic planning. Think of it like a financial tag team.

A Coordinated Household Attack Plan #

One partner’s job might offer a fantastic 401(k) match. If that’s the case, their first mission is crystal clear: contribute enough to squeeze every last penny of that free money out of their employer. It’s the best return on investment you’ll find anywhere.

At the same time, the other partner could focus on maxing out a Roth IRA. This builds up a pot of money that will be completely tax-free in retirement. Creating this kind of tax diversification gives your family incredible flexibility decades down the road when you start drawing on your savings.

Maximizing Your Family’s Contributions #

When a family works together, the numbers get big, fast. Picture a couple in their 40s. One person maxes out their 401(k) to get a great company match. The other contributes to their own 401(k), and they both fully fund their IRAs. This aggressive, multi-account strategy can seriously accelerate their savings. You can dive deeper into how the numbers stack up by learning about 401k limits on sharebuilder401k.com.

This is where getting on the same page about your finances is non-negotiable. Having a solid plan for how to budget as a couple makes a huge difference in staying aligned on your goals and making sure the contributions actually happen.

Don’t Forget the Spousal IRA #

What if one of you stays home, is between jobs, or doesn’t earn much? The tax code has a brilliant solution for this: the spousal IRA. This rule allows the working spouse to contribute to an IRA for their non-working or low-earning partner.

There are just a couple of requirements:

- You must file your taxes jointly.

- The spouse with the job needs to have enough earned income to cover both their own IRA contribution and their partner’s.

The spousal IRA is a game-changer. It makes sure both partners are building a nest egg, so no one gets left behind. It really reinforces the idea that retirement planning is a team sport.

This is where a tool like Econumo can help you see the whole picture at once.

Having a central dashboard lets you see all the moving parts—the 401(k)s, the IRAs, everything. That kind of clarity helps you make sure all your accounts are working together, not in isolation, to build the future you both want.

Your Action Plan for Managing Both Accounts #

Knowing you can have both a 401(k) and an IRA is great, but putting that knowledge into practice is what actually builds wealth. Let’s break down all this information into a simple, step-by-step priority list you can start using today.

This isn’t some niche strategy, either. It’s actually pretty common. Industry data suggests around 60% of workers with a 401(k) also have an IRA. Why? It’s all about control. While your 401(k) usually has a limited menu of investment options, an IRA opens the door to a much bigger universe of stocks, bonds, and funds. You can discover insights about contribution limits on sharebuilder401k.com to see how the numbers compare.

Following this game plan helps make sure every dollar you save is working as hard as possible for you.

Your Three-Step Savings Waterfall #

The best way to think about this is like a waterfall. You want to fill one bucket completely before letting your savings spill over into the next. This simple order of operations maximizes your returns and builds serious momentum over time.

Step 1: Capture Your Full 401(k) Match This is non-negotiable. Before you do anything else, contribute enough to your 401(k) to get every last penny of your employer’s match. It’s an instant, guaranteed return on your money. Passing it up is literally like turning down a raise.

Step 2: Fully Fund Your IRA Once you’ve locked in that free money, switch your focus to your IRA. Try to contribute the annual maximum. Whether you choose a Roth or a Traditional IRA will depend on your income today and where you think your tax rate will be when you retire.

Step 3: Return to Your 401(k) If you’ve maxed out your IRA and still have room in your budget to save more, it’s time to circle back to your 401(k). Keep bumping up your contributions there until you hit the annual IRS limit for that account, too. This one-two punch is an incredibly powerful way to accelerate your retirement savings.

Key Takeaway: Think of it as the “Match-IRA-Max” sequence. This method ensures you never leave free money on the table while still taking advantage of the unique perks and flexibility each account offers.

Lastly, make it a habit to review your investments across both accounts at least once a year. This is just a quick check-in to ensure your overall portfolio still lines up with your financial goals and risk tolerance. Getting a handle on all these moving parts starts with knowing your numbers, so check out our guide on how much to save per paycheck to get your budget in order.

Got Questions? We’ve Got Answers #

Even with the best plan, you’re bound to have questions pop up as you juggle a 401(k) and an IRA. Let’s tackle some of the most common ones that come across my desk.

I Can’t Max Out Both Accounts. Where Should My Money Go First? #

This is a classic dilemma, but the strategy is surprisingly simple. Think of it as a three-step priority list.

First, always contribute enough to your 401(k) to get the full employer match. No exceptions. This is an instant, guaranteed return on your money, and you don’t want to leave it on the table.

Once you’ve secured the match, turn your attention to your IRA (either Roth or Traditional). After that’s funded for the year, any extra savings you have can go back into your 401(k) until you hit the annual limit.

I Just Changed Jobs. What Should I Do with My Old 401(k)? #

Leaving a job opens up a few doors for that old 401(k). You’ve got four main paths to choose from:

- Leave it behind: If your balance is over a certain amount (usually $5,000), you can often just leave it in your old employer’s plan.

- Move it to your new 401(k): Your new job might let you roll your old account into their plan, consolidating your funds.

- Roll it into an IRA: This is a popular choice because it usually unlocks a much wider world of investment options and gives you more control.

- Cash it out: This is almost always a mistake. You’ll get hit with a hefty tax bill and early withdrawal penalties, which can take a huge bite out of your savings. Avoid this unless it’s a true emergency.

What’s a Spousal IRA and How Does It Work? #

A spousal IRA is a fantastic tool for couples where one partner earns little or no income. It lets the working spouse contribute to a separate IRA for their non-working or low-earning partner.

To make it happen, you just need to file your taxes jointly. The contributing spouse must also have enough earned income to cover the contributions for both their own IRA and their partner’s. It’s a great way to make sure both partners are building a nest egg, regardless of who brings home the bigger paycheck.

Keeping all these accounts straight, especially when you’re coordinating with a partner, can feel like a lot. That’s where a tool like Econumo comes in. It gives you a clear, shared dashboard of your entire financial picture, so you and your partner can track your progress and stay on the same page with your savings goals. See how Econumo simplifies family finances.