Budgeting is about understanding where your money has gone. Forecasting is about deciding where it will go. For couples and families, getting these two things to work together is the key to creating a real financial roadmap, one that turns vague dreams into a concrete plan and swaps money stress for a feeling of control.

Why Budgeting and Forecasting Are Your Financial Superpowers #

Let’s be honest, most people hear “budgeting” and think of a restrictive chore—a financial diet focused on everything you can’t have. But that view misses half the story, and it’s the most important half. Real financial power comes when you pair budgeting with forecasting. It completely changes the game, moving you from a reactive, stressful cycle to a proactive, forward-looking strategy.

Think of it like this: a budget is your rearview mirror. It gives you a crystal-clear picture of where you’ve been and how you got here. Forecasting, on the other hand, is your GPS. It takes all that historical data and maps out the best route to where you want to go, whether that’s a down payment on a house, finally becoming debt-free, or saving for that big family trip.

Budgeting shows you the “what.” Forecasting answers the “what if?” Together, they give you a complete picture of your financial health—past, present, and future—allowing you to make intentional choices instead of just reacting to whatever life throws at you.

From Reactive Stress to Proactive Strategy #

Managing money without a plan often feels like playing defense. An unexpected car repair sends the month into a tailspin. You get to the end of the month and wonder where all the money for groceries went. This reactive firefighting is a huge source of anxiety and a common point of conflict for couples and families.

A proactive approach using budgeting and forecasting flips that script entirely. It puts you in the driver’s seat. Instead of wondering where your money went, you’re telling it exactly where to go.

This shift feels deeply personal, but it also reflects a larger economic reality. When you see governments struggling with massive deficits, it’s a powerful reminder of what happens when spending consistently outpaces income. U.S. federal deficits, for example, are projected to hit $22.7 trillion over the next decade. You can read more about these national fiscal challenges on CRFB.org, but the core lesson hits close to home: a sustainable financial future demands a plan.

The table below breaks down the emotional and practical difference between these two mindsets.

Reactive vs Proactive Financial Management #

| Aspect | Reactive Approach (No Plan) | Proactive Approach (Budgeting & Forecasting) |

|---|---|---|

| Feeling | Stressed, anxious, and out of control. | Confident, calm, and empowered. |

| Decision Making | Based on immediate needs and panic. | Based on long-term goals and values. |

| Financial Surprises | A crisis that derails everything. | A manageable bump in the road. |

| Conversations | Often turn into arguments about spending. | Collaborative discussions about shared goals. |

| Outcome | Stagnation, debt, and constant worry. | Progress, financial security, and peace of mind. |

Looking at it this way, it’s clear which approach leads to a better quality of life. Shifting to a proactive stance is about more than just numbers; it’s about reducing daily stress.

Building a Foundation for Shared Dreams #

For couples, this proactive approach is a relationship-builder. Money is one of the top reasons for arguments, but it absolutely doesn’t have to be. When you sit down to build a budget and forecast together, you’re doing so much more than crunching numbers.

You are:

- Creating a Shared Vision: This is your chance to align on what’s truly important to both of you, turning individual wants into unified family goals.

- Improving Communication: Financial talks stop being about blame and start being about teamwork. They become collaborative planning sessions.

- Building Trust: Being open and honest about income, debts, and spending habits creates a powerful sense of partnership and mutual respect.

Ultimately, mastering budgeting and forecasting turns money from a source of stress into a tool for building the life you actually want. It’s about gaining the freedom to make choices that reflect your values, secure your future, and achieve your biggest goals—together.

Setting Meaningful Financial Goals Together #

Before you ever touch a spreadsheet or download an app, the most important part of budgeting and forecasting happens. It starts with a simple conversation. A financial plan that actually works isn’t built on formulas; it’s built on a shared vision for your life.

For a lot of couples and families, this is where things get tricky. Talking about money can feel heavy, loaded with anxieties and assumptions we don’t even realize we have. The trick is to create a safe space where you can dream together about what you really want your money to do for you.

Starting the Conversation #

Instead of jumping straight to “What’s our budget?”, try asking questions that get to the core of what you both value. This simple shift can turn a dreaded chore into an exciting planning session for your future.

Here are a few ways to get the ball rolling:

- “If an extra $500 landed in our account this month, what’s the one thing we could do with it that would make us happiest?”

- “What’s one money worry that’s been on your mind? How can we tackle it together?”

- “Picture us five years from now. What would we have accomplished with our money that would make us feel incredibly proud?”

The point isn’t to solve everything at once. It’s about listening and understanding what truly matters to each other, so your financial plan is a reflection of both of you.

Defining Your Goal Timelines #

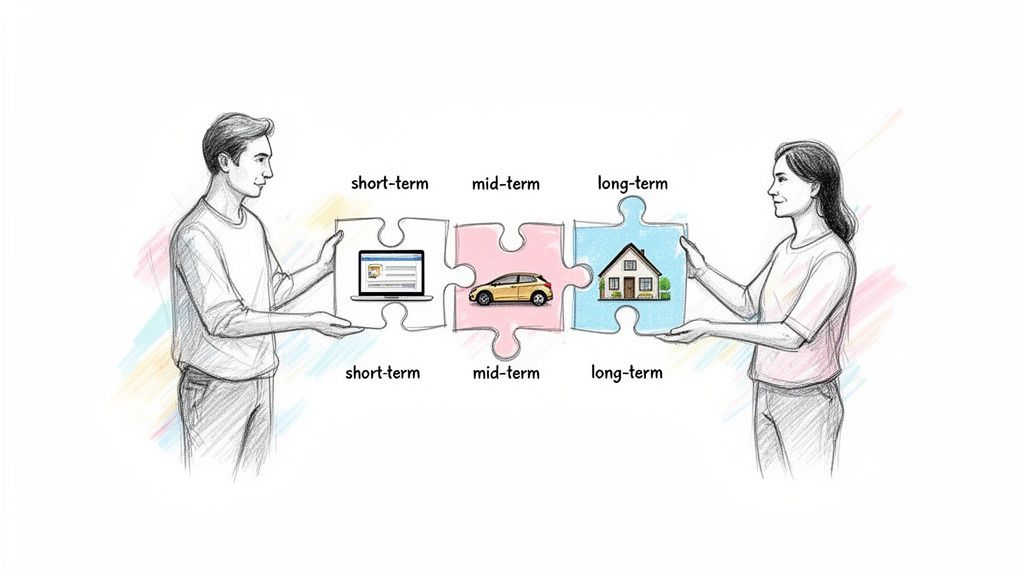

As you talk, you’ll notice your goals start to fall into a few different buckets. Sorting them by timeframe is a great way to make everything feel less overwhelming and much more concrete. It takes a fuzzy idea like “save more” and turns it into an actionable plan.

- Short-Term Wins (The Next 12 Months): These are your quick victories that build momentum. Think about things like finally buying that new laptop, wiping out a pesky credit card balance, or hitting a $1,000 emergency fund target.

- Medium-Term Targets (1-5 Years): These goals need a bit more patience and consistent effort. We’re talking about saving for a down payment on a car, planning that big family trip to Italy, or knocking out a student loan for good.

- Long-Term Dreams (5+ Years): This is the big picture—the “why” behind all your daily efforts. It could be building a retirement nest egg you can actually count on, paying off the mortgage ahead of schedule, or setting up a college fund for your kids.

A healthy mix of goals is the secret sauce. Short-term wins keep you motivated, while the big, long-term dreams give every dollar you save a powerful, shared purpose.

This is where a tool like Econumo really shines. It helps you take those conversations and turn them into tangible targets with real numbers and timelines. You can create a “Vacation Fund” or a “New Car” goal and physically see the progress bar fill up. That visual feedback is powerful—it transforms an abstract idea into a project you’re actively building together, one transaction at a time.

Choosing the Right Forecasting Method for Your Life #

Once you have your goals mapped out, it’s time to pick a forecasting method that actually fits your life. Let’s be honest, a generic template won’t cut it. Real budgeting and forecasting isn’t about wrestling your finances into a rigid box; it’s about finding a rhythm that works with your income, your lifestyle, and your big-picture plans.

There’s no magic “best” way to do this, but getting to know a few key approaches can make a world of difference. The right method feels less like a chore and more like giving yourself a financial superpower—the ability to see around corners, handle a fluctuating income, and make smart moves when life inevitably gets complicated.

Let’s break down three of the most effective strategies for modern households.

Rolling Forecasts for Continuous Clarity #

Imagine driving at night, but your headlights only show you the ten feet of road right in front of your bumper. That’s what a static annual budget feels like by the time summer rolls around—outdated and not very useful.

A rolling forecast completely changes the game. Instead of setting a budget once a year and hoping for the best, you always look a consistent distance into the future, usually 12 months.

Every time a month ends, you simply tack a new month onto the end of your forecast. This simple action creates a continuous, living picture of your finances. It’s a fantastic fit for couples or families who have relatively stable incomes and predictable big expenses. If you prefer making small, regular tweaks over a massive annual overhaul, this method brings a steady sense of calm and control.

Zero-Based Budgeting for Variable Incomes #

If you’re a freelancer, a small business owner, or part of the gig economy, the idea of a traditional budget can feel like a bad joke. How can you plan for next month when you don’t know exactly what you’ll bring in?

This is where zero-based budgeting shines. The idea is simple but incredibly powerful: every single dollar you earn is given a specific job. Whether it’s for rent, groceries, savings, or paying down debt, everything is accounted for. At the end of the month, your income minus your expenses should equal zero.

Zero-based budgeting is all about being intentional. Instead of vaguely wondering how much you can spend on eating out, you start with your actual income and decide, “This is exactly how much we will spend on eating out this month.”

Think about a couple where one partner is a freelance designer. At the beginning of the month, they’ll tally up their paid invoices and start assigning that cash to different categories. They’ll cover the essentials first—mortgage, utilities, insurance—then move on to their savings goals and variable spending. If it was a great month, maybe they’ll put extra toward their vacation fund. If things were a bit slower, they know exactly which “wants” to trim back without touching their financial foundation.

Scenario Planning for Life’s Big Moments #

Sometimes you’re not just forecasting for your normal, day-to-day life. You’re planning for a whole new chapter. Scenario planning is your tool for tackling those big “what if” moments by creating different forecasts for different potential futures.

It’s an absolute must when you’re preparing for major life changes.

- What if we have a baby? You can build a forecast that includes childcare costs, all those diapers, and a temporary dip in income during parental leave.

- What if one of us changes careers? Model how a salary increase—or even a decrease for a passion project—will impact your savings rate and debt-payoff timeline.

- What if we move across the country? Map out the one-time hits like movers and security deposits, plus the new ongoing expenses like higher rent or different utility bills.

Scenario planning lets you stress-test your finances against these big questions. You get to see the long-term impact of your choices before you’re locked in, allowing you to move forward with confidence instead of just hope. In an economy with more than its fair share of uncertainty, this kind of forward-thinking is priceless. As global economic forecasts, like UNCTAD’s 2025 foresights, suggest potential slowdowns, having a plan A, B, and C provides a vital financial cushion.

Which Forecasting Method Is Right for You? #

Choosing the right method can feel overwhelming, but it really comes down to your income style and what you need to feel in control. Here’s a quick comparison to help you decide.

| Method | Best For | Key Benefit | Potential Challenge |

|---|---|---|---|

| Rolling Forecast | Stable, predictable incomes (salaried employees, couples). | Provides a constant, year-long view of your financial health. | Can feel repetitive if your finances rarely change. |

| Zero-Based Budgeting | Variable or irregular incomes (freelancers, gig workers, sales). | Forces intentionality and ensures every dollar has a purpose. | Requires diligent tracking each time you get paid. |

| Scenario Planning | Anyone facing major life changes (new job, baby, moving). | Helps you prepare for the financial impact of big decisions. | Can be time-consuming to build out multiple futures. |

Ultimately, the best method is the one you’ll stick with. Pick the approach that feels most natural for you and gets you closer to the future you’re building.

And remember, forecasting is only half the battle. Understanding how your plans stack up against reality is where the real learning happens. To master this, check out our guide on comparing your budget vs actual results.

How to Build Your First Shared Budget #

Alright, you’ve talked about your goals and have a forecasting method in mind. Now it’s time to get your hands dirty and actually build the budget. This is where those big-picture ideas turn into a real, workable plan for your money.

Don’t stress about making it perfect right away. The goal here is to create a solid foundation that actually reflects your life, not some generic template you found online.

First thing’s first: you need to do a little financial detective work. Gather up all the documents that tell the story of your money.

- Pay stubs or income records from all sources for the last three months.

- Bank statements for every account, both joint and individual.

- Credit card statements to get an honest look at where the money has been going.

- Loan statements for the mortgage, car payments, student debt—all of it.

- Recent utility bills like electricity, water, and internet.

This isn’t just about plugging in numbers. It’s about seeing your financial habits laid out in black and white, which is the bedrock of any good forecast.

Calculating Your True Total Income #

If you and your partner both have steady, predictable paychecks, this part is pretty simple. Just add your net (after-tax) incomes together, and you’ve got your total monthly household income.

But what if one or both of you freelance, work on commission, or have a side hustle? In that case, your income probably looks different every month. The best way to handle this is to look at your income from the past three to six months and calculate an average. This smooths out the peaks and valleys, giving you a more realistic (and safer) number to build your budget around.

Always budget based on your most conservative income estimate. If you have a great month, that extra cash is a bonus you can put toward goals. Budgeting with an overly optimistic number is a recipe for stress and falling behind.

The Power of Manual Entry #

Before we start sorting through expenses, I want to make a case for manual entry. I know, I know—automated tools are fast. But the simple act of typing in each transaction forces you to be mindful. It makes you pause and actually acknowledge every dollar you spend.

This process alone can be a game-changer for spending habits. You start to notice patterns you were completely blind to before, like how those small daily coffee purchases add up or how much you’re really spending on subscriptions. In Econumo, we’ve made this deliberate approach a core feature because it builds financial awareness, not just a spreadsheet of data.

Categorizing Your Spending #

Now for the fun part: sorting your expenses. Go through your bank and credit card statements and give every transaction a home. The easiest way to start is to split them into two main buckets: fixed and variable.

- Fixed Expenses: These are the predictable bills that rarely change. Think rent or mortgage, car payments, insurance premiums, and loan repayments.

- Variable Expenses: This is everything else—the costs that fluctuate. Groceries, dining out, gas, entertainment, and utilities all fall in here.

Don’t get lost trying to create dozens of super-specific categories right now. Start broad. You can always refine it later. To see one of the best methods for this in action, you can explore how zero-based budgeting examples help you give every single dollar a job.

To keep your budget sharp, you have to track expenses diligently. If you ever lose a physical record, knowing the ins and outs of getting copies of receipts is a surprisingly useful skill for maintaining accurate financial records and a reliable paper trail.

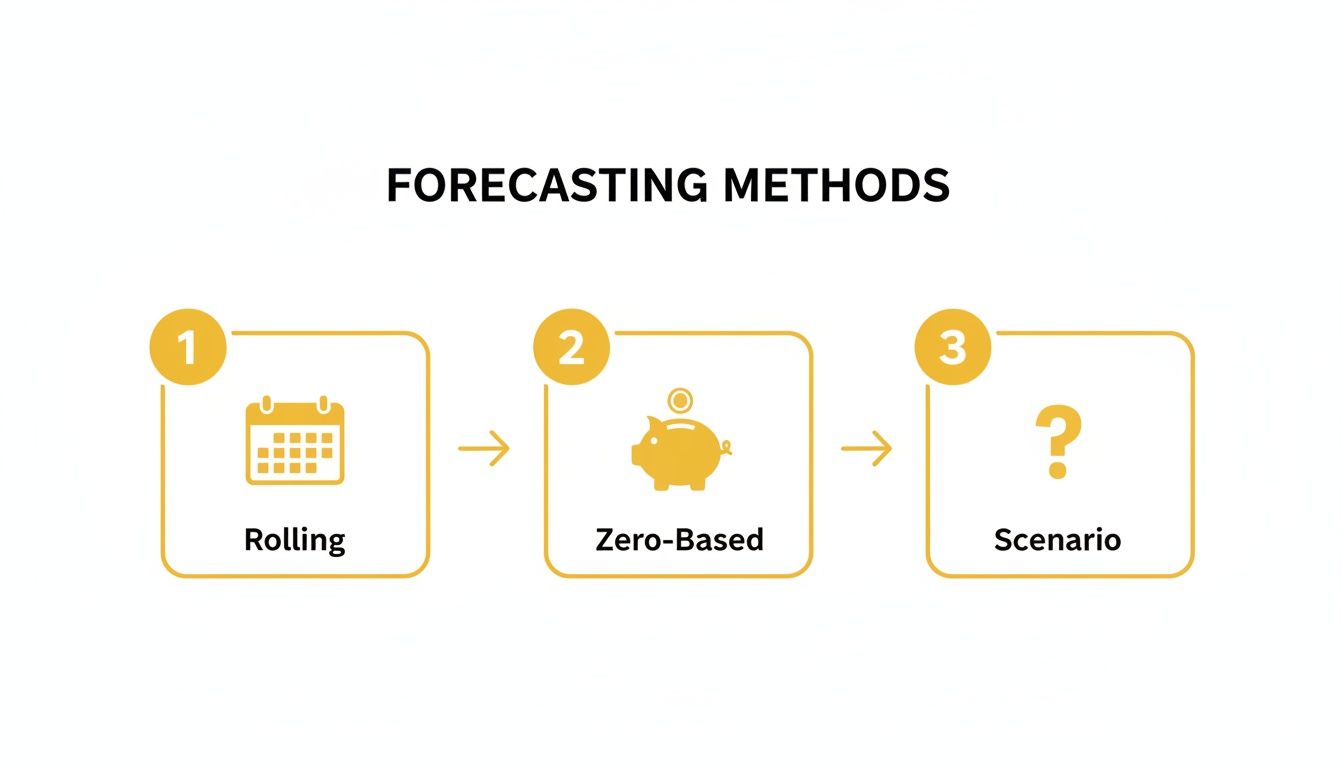

This infographic breaks down a few forecasting methods you can apply once your budget is built.

As you can see, different life situations call for different strategies, from the steady rhythm of a rolling forecast to the proactive nature of zero-based budgeting.

Handling Joint and Separate Accounts #

Many couples I know use a hybrid system: a joint account for shared bills and separate accounts for personal spending. Your budget needs to reflect this setup.

- Calculate Total Shared Expenses: First, add up all your fixed costs (like housing) and the variable costs you’ve agreed to share (like groceries). This is the amount you need in your joint account each month.

- Determine Contributions: Next, decide how you’ll fund that joint account. Some couples split it 50/50. Others contribute a percentage based on their income. There’s no single right way—just what’s fair for you.

- Allocate Personal Spending: Whatever is left in your separate accounts is yours to manage for personal expenses, like hobbies, lunches, or individual savings goals, all within the lines you’ve drawn in your budget.

This approach gives you both shared responsibility and personal freedom, a balance that keeps a lot of financial partnerships healthy.

Navigating Multiple Currencies #

If you’re an expat or a couple dealing with income from one country and expenses in another, you’ve got an extra layer to consider. When building your budget, pick one primary currency to be your “home base.”

Convert all other income and expenses into that single currency using current exchange rates. This gives you a true, consolidated snapshot of your financial position and makes the budgeting and forecasting process much, much clearer. It’s a simple step that prevents some very costly mix-ups.

Taking Control of Your Financial Privacy #

When you start budgeting and forecasting, you’re dealing with some of your most sensitive personal data. Every purchase, every savings goal, and every loan payment paints a detailed picture of your life, your habits, and your dreams.

Who gets to see that picture is a choice you should be making for yourself.

In a world where data is big business, many free or cheap budgeting apps treat your financial information as their product. They analyze your spending to serve you targeted ads or sell aggregated data to other companies. It might be legal, but it can feel like a pretty uncomfortable trade-off just for a bit of convenience.

This is where the idea of taking back control becomes so important. It’s not just about managing money—it’s about managing your information on your own terms.

The Self-Hosting Difference #

The real choice here boils down to a simple question: where does your financial data live? On a company’s cloud server, or on a server that you control?

Cloud-Based Services: With a typical cloud app, your data is stored on the company’s servers. This is convenient, for sure, and lets you log in from anywhere. But it also means you’re placing a lot of trust in their security and their privacy policies.

Self-Hosted Solutions: With a self-hosted tool like Econumo, you run the software on your own private server. This could be a small computer in your home or a private server you rent. The crucial difference is that you are the sole owner and controller of the data.

Choosing to self-host is a deliberate act of digital independence. It ensures that no one—not the software developer, not advertisers, not data brokers—can access your financial information without your explicit permission.

This approach gives you complete autonomy. You aren’t just a user of a service; you are the owner of your entire financial ecosystem. That peace of mind is priceless, especially for families who want to keep their household finances completely confidential. You can learn more about the practical steps in our guide to self-hosted budget software.

Why Owning Your Data Matters #

There’s a reason we’re seeing an explosion in financial software. The global market is expected to grow from $1.55 billion in 2024 to $1.65 billion in 2025, which lines up with what we’re seeing in tech spending across the board. As more of our lives move online, making intentional choices about data privacy becomes even more critical.

Owning your data has real-world benefits beyond just a feeling of security. It means your financial situation is never used to build a marketing profile of you. You won’t suddenly see ads for personal loans just because you created a “Debt Payoff” goal, and your grocery bill won’t influence the credit card offers you get in the mail.

It also adds a significant layer of security. While major cloud companies have strong security teams, data breaches are an unfortunate reality. When you self-host, your data simply isn’t part of a massive, high-value target for hackers.

Creating a Private Financial Sanctuary #

Think of a self-hosted budget tool as your family’s private financial headquarters. It’s a secure space where you and your partner can plan, forecast, and manage your money without any outside influence or prying eyes.

This is especially valuable for modern families with complex financial lives. Whether you’re juggling multiple currencies as expats or meticulously tracking every penny by hand to build better habits, a private system ensures your focus stays on what matters: your goals.

And of course, when you’re managing your finances online, especially on public Wi-Fi, it’s smart to think about the security of your connection. Protecting your data while it’s in transit is just as important as protecting where it’s stored, which is why using a VPN for banking safely is a good habit to get into.

By choosing a path that puts privacy first, you’re doing more than just organizing your finances. You’re making a powerful statement that your personal information is yours alone, turning your budgeting and forecasting into a truly empowering and confidential practice.

Answering Your Top Budgeting and Forecasting Questions #

Taking this step to manage your finances together is a huge deal, and it’s totally normal to have questions. Think of this as your go-to guide for those common bumps in the road that can make even the best financial plans feel a little shaky.

Our goal here isn’t just to build a budget. It’s to build your confidence in managing it as a team, through all of life’s ups and downs.

How Do We Handle Unexpected Expenses? #

Life happens, and it rarely checks your budget spreadsheet first. The car breaks down, the dishwasher decides to flood the kitchen, or a surprise medical bill shows up. These unplanned events are one of the biggest tests for any couple’s financial plan.

The trick is to stop thinking of them as failures and start treating them as inevitabilities. This is exactly why an emergency fund should be one of your very first shared goals. You’ll want to aim for at least three to six months of essential living expenses tucked away in a separate savings account that you can get to quickly.

When that unexpected cost hits:

- Assess the situation. Is this a “we need to fix this right now” problem, or can it wait a bit?

- Use the emergency fund. That’s what it’s there for! Using this dedicated cash means you don’t have to blow up your monthly budget or turn to a high-interest credit card.

- Refill the fund. Once the dust settles, make rebuilding that emergency savings a top priority in your budget for the next few months.

This simple process turns a potential crisis into a manageable event, keeping your bigger, long-term goals right on track.

What If We Go Over Budget in a Category? #

It’s going to happen. You’ll get a little carried away at the grocery store one week or say “yes” to a few too many social invitations. The absolute most important thing is not to panic or start pointing fingers.

Instead, see it for what it is: a learning opportunity. When you overspend in one area, you’ve got two main choices:

- Move money around. Take a look at your other flexible spending categories. Can you cut back on entertainment or takeout for the rest of the month to make up the difference?

- Analyze and adjust. Was this just a one-off thing, or is your budget for that category just not realistic? If you find you’re consistently overspending on groceries, for instance, it might be a sign you need to permanently increase that budget line and trim a little from somewhere else.

A budget isn’t meant to be a rigid rulebook; it’s a living, breathing guide. The most successful budgets are the ones that are flexible enough to change as you learn more about your real-life spending habits.

How Can We Stay Motivated Month After Month? #

That initial burst of excitement from starting a new budget can wear off, leaving you with what feels like just another chore. The real secret to making budgeting and forecasting stick for the long haul is to keep your “why” front and center.

Motivation isn’t about raw willpower; it’s about staying connected to your goals.

- Schedule regular money dates. Put 20-30 minutes on the calendar every week or two to review things together. This isn’t an audit. It’s a chance to celebrate your wins (“We hit our savings goal!”) and tackle any issues as a team.

- Make your goals visible. Saving for a big vacation? Put a picture of your destination on the fridge. Trying to crush some debt? Create a visual chart you can color in as you pay it down.

- Build in some “fun money.” A budget that’s all about restriction is doomed from the start. Make sure you each have a specific, guilt-free amount to spend however you want, no questions asked. This little bit of freedom goes a long way in making the whole process feel sustainable.

What If One of Us Earns a Lot More? #

Income differences are incredibly common, but they can create an awkward power dynamic if you don’t talk about them openly. The best approach I’ve seen is to shift your mindset and view all money coming in as “household income,” no matter whose paycheck it came from.

From there, you can figure out a contribution plan that feels fair to both of you. A lot of couples have success with a proportional system. For example, if one partner earns 65% of the total household income, they contribute 65% toward the shared bills and goals.

This way, both of you are contributing equitably based on what you earn, which builds a real sense of teamwork instead of making it feel like a transaction.

Should Our Budget Break Even Every Month? #

This is a really common myth, especially for people who have heard of zero-based budgeting. While the idea is to give every dollar a job, it absolutely does not mean your income has to perfectly match your outgoings.

In fact, a truly healthy financial plan should have a built-in surplus. When your planned income is higher than your planned expenses, you’re creating a buffer. You can use this extra cash to:

- Speed up your goals by throwing more at debt or savings.

- Absorb small overspends without having to raid your emergency fund.

- Build long-term wealth through investing or other savings.

Aiming for a surplus isn’t just about good bookkeeping; it’s a proactive strategy that builds financial strength and helps you get ahead so much faster. It’s a core principle of effective budgeting and forecasting that shifts you from just managing your money to actively growing it.

Ready to build a financial plan that gives you clarity, control, and complete privacy? Econumo is designed for couples and families who want to manage their money together, on their own terms. Take control of your financial future by visiting https://econumo.com to try the live demo or self-host the free community edition today.