The right family budget software can be a game-changer. It pulls all your financial information into one place, transforming money management from a point of contention into a genuine team effort. These tools are built for the reality of family life—shared goals, joint accounts, and complex spending—providing a level of transparency that a simple spreadsheet or a single-user app just can’t offer.

Why You Need a Specialized Tool for Shared Finances #

Managing money as a family is more than just tracking what goes out. It’s a constant balancing act involving shared bills like the mortgage and groceries, individual spending habits, and big-picture goals like saving for a house or that dream vacation. Trying to manage all of this with generic spreadsheets or a personal finance app designed for one person often creates more headaches than it solves.

This old-school approach is a recipe for miscommunication, missed payments, and friction over money. Without a central dashboard, one partner might not realize a big expense is coming up, leading to accidental overspending. That lack of visibility is one of the most common sources of financial stress for couples.

From Financial Chaos to Clarity #

This is where collaborative budgeting software steps in. It’s designed from the ground up to solve these shared financial challenges.

- Total Transparency: Everyone with access sees the exact same financial picture in real-time. No more guesswork or unwelcome surprises.

- Aligned Goals: It gives you a dedicated space to track progress toward your shared goals, which helps keep everyone motivated and on the same page.

- Simple Joint Expenses: These tools make it easy to categorize and manage bills that come out of joint accounts, so nothing slips through the cracks.

The difference a dedicated tool makes is huge. Budgeting features are a major force in the finance software market, with the budget planner segment alone making up over 28% of the market’s revenue back in 2022. For families and couples, these multi-user platforms are proven to cut down on arguments by helping everyone align on their goals. They help you shift from being reactive spenders to proactive planners.

Here’s what a clear, collaborative dashboard looks like—giving you an instant overview of your family’s financial health.

This kind of visual summary lets you and your partner quickly check spending, see what bills are coming up, and monitor your savings goals without needing to schedule a formal sit-down. This shared access is the foundation for building a strong financial future, together. You can learn more about how to get this set up in our user guide: https://econumo.com/docs/user-guide/shared-access/

What to Look For in a Great Family Budgeting App #

Before we start comparing different apps, we need to agree on what makes a tool genuinely useful for a family. A simple expense tracker just won’t cut it when you’re juggling shared finances, different goals, and multiple people. Getting clear on these non-negotiables is the first step to finding the right fit for your household.

Think of these features as the bedrock of a collaborative financial system. They’re designed to tackle the common friction points that pop up when two or more people manage a budget, turning potential arguments into productive teamwork.

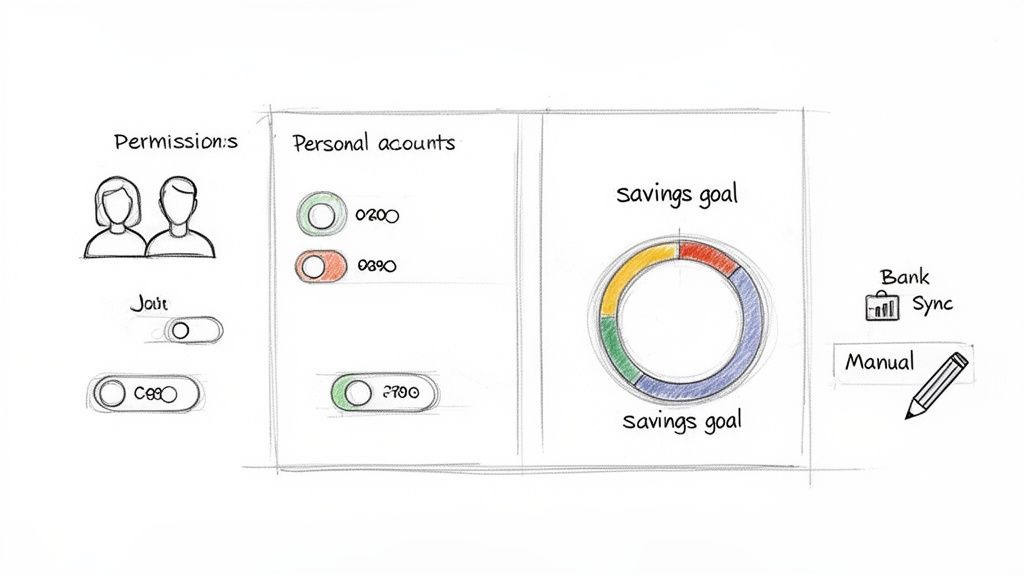

Multi-User Access with Smart Permissions #

The absolute must-have is the ability for more than one person to log in. But it’s not just about sharing a password. The best apps offer customizable permissions.

You and your partner might need full admin rights to connect bank accounts and create budget categories. But what about your teenager who just got their first part-time job? You can give them access to track their own spending without letting them accidentally mess up the household mortgage payment category. This kind of flexibility is key.

Key Insight: It’s all about building trust and teaching financial literacy at the right pace. Granular controls let the tool adapt as your family grows, from teaching a kid about their allowance to giving a young adult real financial responsibility.

A Single View of All Your Accounts—Joint and Personal #

Let’s be real: a family’s finances are a mix. You’ve got the joint checking for bills, but you also have your own personal credit cards, maybe a separate savings account, or even a small business account.

A top-tier budgeting app brings all of this together on one dashboard. This gives you an honest, complete picture of your household’s financial health without having to sign into three or four different banking websites. You can finally answer questions like, “Can we actually afford that trip?” with one quick look.

This holistic view is what prevents financial blind spots. It makes it easy to see how one person’s spending might affect a shared goal, which helps spark healthier money conversations.

Shared Savings Goals That Everyone Can See #

A budget isn’t just about policing your spending—it’s about pointing your money toward things you actually care about. A feature for tracking shared goals is absolutely essential for keeping everyone on the same page and excited about the future.

When you can see a progress bar inching closer to that family vacation or the down payment on a new home, the goal feels real. It turns “saving” from a chore into a team sport.

- Vacation Fund: “We’re 75% of the way to our beach trip!”

- Emergency Fund: Watch your safety net grow toward that 3-to-6-month target.

- Kid’s College Fund: Visualize the long-term compounding for their education.

This is more than just a feature; it’s a communication tool. It changes the conversation from a negative (“We have to stop spending”) to a positive (“Look how much progress we’re making!”). For more on setting up these kinds of goals, see our guide on how to create effective budgets.

Essential Features Checklist for Family Budgeting Tools #

To make it even easier, here’s a quick-reference table summarizing what truly matters when you’re evaluating your options.

| Feature | Why It Matters for Families | What to Look For |

|---|---|---|

| Multi-User Access | Allows partners and older kids to participate directly. It’s about teamwork, not one person shouldering the whole burden. | Separate logins for each family member. Avoid apps that only allow password sharing. |

| Customizable Permissions | Prevents accidental changes to the budget and allows for age-appropriate access (e.g., view-only for teens). | The ability to set roles like “Admin” and “User” or to restrict access to specific accounts or categories. |

| Joint & Personal Account Syncing | Provides a complete financial picture by showing how all accounts (shared and individual) contribute to the household’s net worth. | Support for connecting multiple bank accounts, credit cards, and investment accounts under one unified dashboard. |

| Shared Savings Goals | Aligns the family around common objectives and makes saving a motivating, shared activity rather than a restrictive one. | Visual goal trackers (like progress bars) that everyone can see. The ability to name and set deadlines for each goal. |

| Mobile & Desktop Access | Everyone can check the budget or log an expense on the go or sit down for a deeper review at home. Convenience is key to consistency. | A reliable mobile app (iOS and Android) that syncs instantly with a web or desktop version. |

This checklist covers the foundational elements. If a tool doesn’t tick these boxes, it’s likely going to create more problems than it solves for a busy family.

A Look at the Top Family Budgeting Software #

Choosing the right tool isn’t just about bells and whistles; it’s about finding a system that clicks with how your family talks about and handles money. It’s a big deal, which is why the personal finance software market, valued at USD 1.08 billion in 2022, is expected to hit USD 1.59 billion by 2030. Families are actively looking for better ways to manage their shared lives, and for good reason—households using these tools often see overspending drop by 20-30%. If you’re curious about the numbers, this detailed industry report breaks down the market’s growth.

To help you find the right fit, we’re going to dig into four of the best options out there. We’ll move past the marketing fluff and look at how each one handles real-life family money situations.

YNAB (You Need A Budget): The All-in-One Automator #

YNAB is built on a simple but game-changing idea: give every dollar a job. It’s a digital version of the old-school envelope system, designed to make you proactive with your money instead of just reacting to bills as they come in. For anyone trying to break the paycheck-to-paycheck cycle, this philosophy is a lifesaver.

For families, YNAB’s power lies in its seamless bank syncing. It pulls transactions from all your connected accounts—joint and personal—giving everyone a crystal-clear, unified view of the family finances. The goal-tracking features are visual and incredibly motivating, which is perfect when you’re saving for a family vacation or a down payment.

Scenario A: Splitting the Utility Bill

That $150 utility bill comes in. With YNAB, you’d already have a “Utilities” category funded with money from your joint account. When the payment syncs, you just assign it to that category. Instantly, the budget updates, and both you and your partner can see the remaining balance. No more guesswork.

Scenario B: Saving for Vacation

Your family is dreaming of a $3,000 trip in 12 months. In YNAB, you set up a “Vacation Fund” goal. The app will then calculate that you need to set aside $250 per month and prompt you to assign that money every time you get paid. It turns a big goal into small, manageable steps.

What sets it apart? YNAB’s magic is its four-rule methodology. It doesn’t just show you where your money went; it actively teaches you a new way to manage it. This can be incredibly powerful for a family trying to get on the same financial page.

The catch? This structured approach can feel a bit rigid for some. It requires consistent effort, and its reliance on bank syncing might not sit well with families who are hesitant to share their login details with a third-party app.

Monarch Money: The Hands-Off Visualizer #

Monarch Money is a sleek, modern platform for families who want a bird’s-eye view of their entire financial world, including investments and net worth. Think of it less as a strict budget and more as a comprehensive financial dashboard.

Its greatest strength is its ability to pull everything together. Monarch connects to a massive network of financial institutions—banks, credit cards, brokerage accounts, even crypto wallets. This gives you a high-level picture of your finances that’s tough to find anywhere else.

Scenario A: Splitting the Utility Bill

Just like YNAB, the $150 utility payment syncs into Monarch automatically. You can set up a rule so any future payments to that company are always labeled “Utilities.” It also has a neat feature for splitting transactions, which comes in handy if you and your partner pay for things from different accounts.

Scenario B: Saving for Vacation

Monarch’s goal tracking is clean and simple. You create a goal for the $3,000 trip and can link a specific savings account to it. The dashboard then gives you a nice visual of your progress, showing you exactly how far you have to go.

What sets it apart? Monarch’s holistic view is its real superpower. By tracking your investments and calculating your net worth right alongside your budget, it encourages families to think about long-term wealth building, not just day-to-day spending.

The trade-off is that Monarch is almost completely dependent on automated bank syncing. If your family prefers a more hands-on, deliberate approach to tracking money, the “set it and forget it” nature of Monarch might not foster the mindful spending habits you’re trying to build.

Goodbudget: The Simplicity-First Option #

Goodbudget is a fresh take on the classic cash envelope system, built for your phone and computer. The idea is simple: you proactively divide your income into digital “envelopes” for categories like groceries, gas, and fun money.

It’s a fantastic starting point for families who are new to budgeting or find other tools too complicated. Goodbudget doesn’t connect to your bank accounts, which means you have to log every transaction by hand. That might sound like a chore, but it’s the whole point—it forces you to be aware of every dollar you spend. If you are looking for other great options that don’t break the bank, you might be interested in our guide on the best free budgeting software.

Scenario A: Splitting the Utility Bill

When the $150 utility bill gets paid, you or your partner manually enter it into the app and assign it to the “Utilities” envelope. The balance in that envelope drops immediately, and the app syncs across all your devices so everyone knows exactly how much is left.

Scenario B: Saving for Vacation

To save for your trip, you’d create a “Vacation Fund” envelope. Every payday, you would transfer $250 of your income into that envelope. It’s a wonderfully simple and tangible way to watch your savings grow without the fuss of linking bank accounts.

What sets it apart? Goodbudget’s strength lies in its simplicity and its focus on intentional, manual tracking. By cutting out the noise of automation, it helps families build the core habit of mindful spending from the ground up.

Of course, the lack of automation is also its main drawback. For busy families who want the convenience of syncing and a complete picture that includes investments, Goodbudget’s manual-only approach might feel a bit too basic.

Econumo: The Privacy-Focused Powerhouse #

Econumo is for families who refuse to compromise, offering powerful collaboration features alongside total control over your financial data. It strikes a unique balance, combining the intentionality of manual entry with an option for complete privacy through self-hosting.

This platform is built from the ground up for families. It handles multiple users, shared budgets, and joint accounts with ease. It even has multi-currency support, making it a perfect fit for international families or frequent travelers.

Scenario A: Splitting the Utility Bill

In Econumo, paying that $150 utility bill is a deliberate act. One partner logs the expense, tags it as “Utilities,” and assigns it to the joint account. The dashboard instantly updates for everyone, showing the impact on the monthly budget. This manual step ensures no transaction gets missed and encourages open communication.

Scenario B: Saving for Vacation

For that $3,000 vacation, you set up a “Trip to Italy” savings goal. Each month, as you set aside your $250, you log it toward the goal. A visual progress tracker keeps the whole family excited and on the same page, turning a faraway dream into a concrete plan.

What sets it apart? Econumo’s defining feature is data sovereignty. The option to self-host your finances means your sensitive information never leaves your control. For families who value privacy, this offers a level of security and peace of mind that cloud-only services simply can’t provide.

While Econumo is centered on a philosophy of mindful manual entry, those who absolutely need full automation might find the lack of direct bank syncing to be a hurdle. But for families who view budgeting as an active, shared responsibility, Econumo delivers an ideal mix of control, privacy, and powerful, family-first features.

How to Choose the Right Software for Your Family #

Picking the right budgeting software isn’t about finding the one “best” tool on the market. It’s about finding the one that clicks with your family’s personality and financial goals. The best app should feel like a natural part of your life, not another chore you have to remember. If the tool doesn’t match your habits, you’ll stop using it—it’s the number one reason budgeting plans fall apart.

Before you even start comparing features, the first step is to have a real conversation with your partner. Sit down and get on the same page about your core priorities. What are you actually trying to do here? Is the main goal to finally crush your debt, save up for a down payment, or just figure out where all the money is going each month?

Getting this alignment first is everything. It gives your budget a purpose—a “why”—and turns it from a restrictive chore into a shared mission.

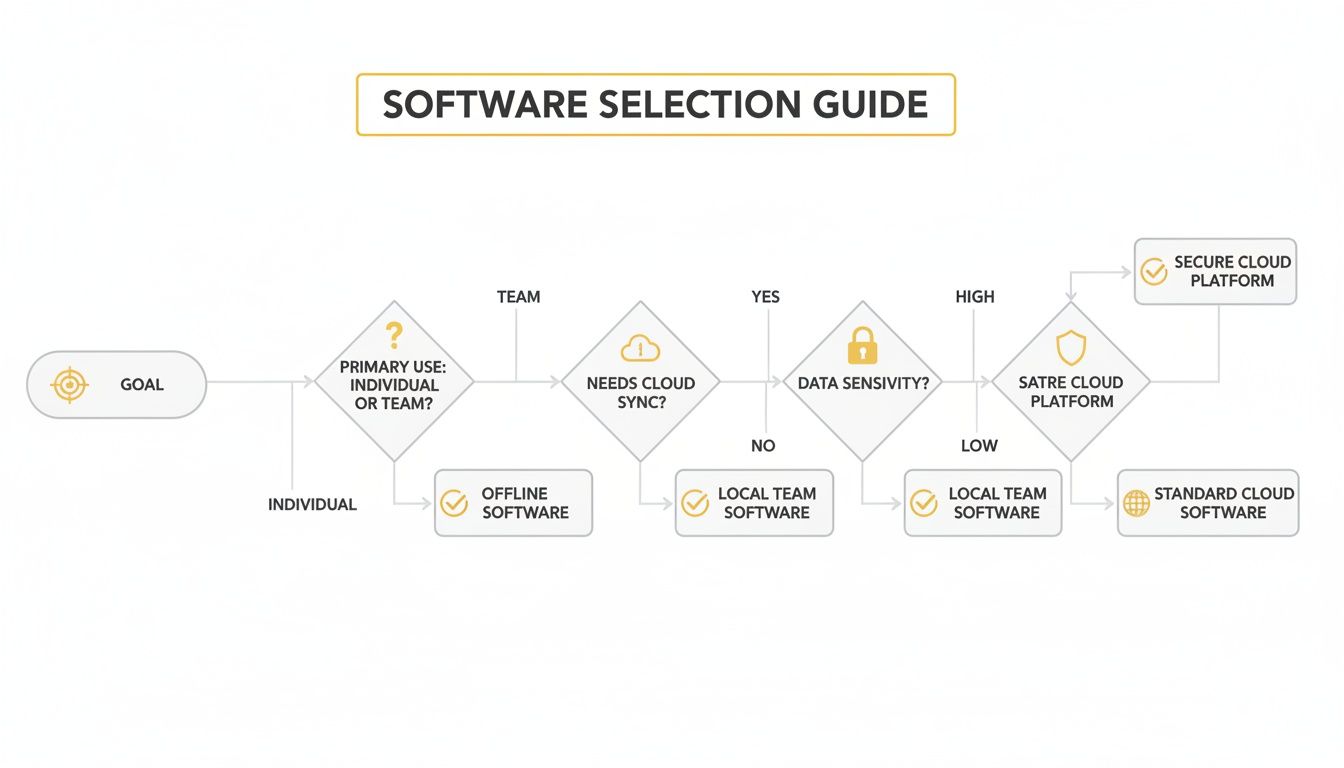

This decision tree can help you visualize how a few key questions can point you toward the right kind of software, based on your goals, how you want to sync data, and your feelings on privacy.

As the flowchart shows, your choice really comes down to a few critical decisions. It starts with your main objective and then branches out based on how comfortable you are with automation and sharing your financial data.

Identifying Your Family’s Financial Profile #

Every family handles money differently. Once you know which of these profiles sounds most like your household, you can quickly narrow down the options to a tool that will actually help you.

1. The “Set It and Forget It” Automators

- Who You Are: You’re a busy family that puts convenience first. You want technology to do the heavy lifting by automatically tracking and categorizing everything so you can get a quick, accurate picture without all the manual data entry.

- Primary Need: Seamless bank syncing and automated expense tracking.

- Best Software Fit: YNAB or Monarch Money. These two are fantastic at pulling data from all your accounts, giving you a real-time, hands-off look at your financial health.

2. The Mindful Manual Trackers

- Who You Are: You believe that physically typing in each transaction builds financial awareness. You want to feel every dollar you spend to build better habits and keep tight control over your budget.

- Primary Need: A clean, simple interface built for manual entry.

- Best Software Fit: Goodbudget or Econumo. Both are designed around the idea of intentional spending, making you pause and think before and after each purchase.

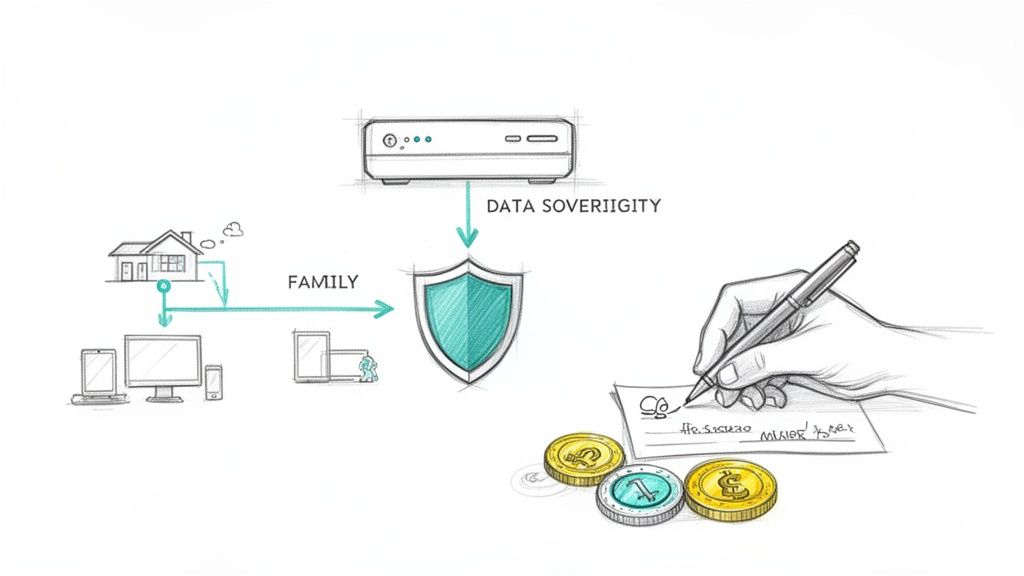

3. The Privacy-Conscious Data Guardians

- Who You Are: You’re not comfortable sharing sensitive financial information with third-party apps. The thought of linking your bank accounts to a cloud server is a deal-breaker, and you believe your financial data should stay completely private.

- Primary Need: Total data control and zero bank connections.

- Best Software Fit: Econumo’s self-hosted option. This is the ultimate choice for privacy because your financial data never leaves your own server. You get all the powerful budgeting features without ever compromising on security.

Your choice of software has to match the level of hands-on work your family is willing to do. Automation is convenient, but manual entry builds discipline. Neither is better than the other, but picking the wrong one for your style is a recipe for failure.

Matching Your Family Profile to the Right Software #

The market for financial planning software is growing fast—it’s projected to expand by USD 15.94 billion between 2025 and 2030, all thanks to families like yours looking for better financial control. While cloud-based mobile apps are popular for their convenience, a surprising 53% of users still prefer desktop applications, largely due to security concerns. This just goes to show how important it is to pick a tool that aligns with your family’s comfort level with technology and data privacy. You can find out more about these market trends and what’s driving them.

To make your decision a bit easier, take a look at the table below. It matches common family situations with the software that’s likely the best fit.

Matching Your Family Profile to the Right Software #

| Family Profile | Primary Need | Top Software Pick | Why It Fits |

|---|---|---|---|

| Newlyweds Merging Finances | Simplicity & Guided Setup | YNAB | Its rule-based system gives you a clear roadmap for creating your first joint budget and getting on the same page about spending. |

| Family with Irregular Income | Flexible, Forward-Looking Budget | YNAB | The “give every dollar a job” method is perfect for freelancers; you just allocate money as it comes in, no matter when that is. |

| Tech-Savvy Privacy Advocates | Data Control & Self-Hosting | Econumo | It offers a self-hosted option, which means your sensitive financial data stays 100% under your control on your own server. |

| International/Expat Family | Multi-Currency Support | Econumo | Seamlessly handles accounts and transactions in different currencies, which is a must-have for managing finances across borders. |

| Budgeting Beginners | Simplicity & Habit Building | Goodbudget | The digital envelope system is super intuitive and encourages mindful spending without a bunch of overwhelming features. |

| High-Net-Worth Households | Investment & Net Worth Tracking | Monarch Money | Excels at giving you a complete picture of all your assets, including investments, property, and retirement accounts. |

At the end of the day, the best family budget software is the one you’ll actually stick with. By being honest about your family’s habits, priorities, and privacy concerns, you can choose a tool that truly empowers your financial teamwork instead of just adding another layer of stress to your life.

How Econumo Tackles Real-Life Family Budgeting Problems #

Let’s be honest, most families don’t fail at budgeting due to a lack of effort. They fail because their tools just aren’t designed for the messy reality of family life. Things like impulse buys, growing concerns over data privacy, and juggling money across different countries are real challenges that need a real solution. This is exactly where Econumo steps in, offering a thoughtful mix of features built for control, security, and genuine flexibility.

Unlike apps that try to automate everything behind the scenes, Econumo is built around manual transaction entry. This isn’t a drawback; it’s the whole point. The simple act of typing in each expense creates a moment of awareness. Suddenly, budgeting isn’t just a report on where your money went—it’s an active, conscious decision you make every day. For any family trying to get a handle on impulse spending, this small change can be a game-changer.

You Own Your Financial Data—Period #

We live in an era where our personal data is bought and sold, so it’s no surprise families are hesitant to hand over their bank logins to yet another cloud service. Econumo offers a clear, powerful answer to this very modern problem.

With its self-hosting option, Econumo puts your family back in the driver’s seat. Your financial data lives on your own server, completely firewalled from big tech and safe from the risks of a giant, centralized database. This principle of data sovereignty delivers a level of security and peace of mind that cloud-only apps just can’t offer.

Choosing privacy doesn’t mean you have to give up functionality. You still get a powerful platform for budgeting together, but with the confidence that comes from knowing your family’s financial story is yours and yours alone.

Made for the Modern, Global Family #

Family isn’t always in one place. You might be expats, travel often, or have loved ones living overseas, which can turn managing money into a complicated puzzle.

Econumo was built for this exact scenario, with seamless multi-currency support baked right in.

- See all your accounts in one place: You can easily track a checking account in USD, a savings account in EUR, and a credit card in GBP, all on a single, clean dashboard.

- Log expenses from anywhere: When you’re traveling, just enter that dinner expense in the local currency. Econumo handles all the conversion and reporting, so you can ditch the confusing mental math.

- Plan your global goals: Whether you’re saving for a big trip or managing international investments, you can see how all the pieces of your financial life fit together, no matter what currency they’re in.

A Power Tool for Those Who Want More #

Econumo also gets that some people want to tinker under the hood. For the more tech-minded family, the platform provides a robust API (Application Programming Interface). This unlocks a huge range of possibilities for customizing and automating your workflow on your own terms.

You could, for instance, write a simple script to import transactions from an unusual bank statement or build a custom dashboard to visualize your savings goals in a unique way. This kind of flexibility ensures Econumo can adapt as your family’s financial needs grow, making it a versatile and future-proof contender for the best family budget software.

Your Top Questions About Family Budgeting Software, Answered #

Picking the right software for your family’s finances is a big step, and you probably have a few questions rolling around in your head. Let’s tackle some of the most common ones we hear from families just like yours. My goal here is to clear up any confusion so you can feel good about your choice.

We’ll cover everything from the initial time commitment to how to handle your data long-term, giving you a practical look at what it’s really like to bring a new financial tool into your home.

How Much Time Does It Take to Set Up a Family Budget? #

Getting started is usually quicker than most people expect, but how long it takes really depends on the path you choose.

If you go with a tool that automatically syncs with your bank, the setup is pretty fast. Your main job is to connect your accounts, which often takes less than an hour. The app does the heavy lifting by pulling in your transaction history. After that, you just need to go through and categorize your past spending to get a clear starting point.

On the other hand, with manual entry tools like Econumo, you’ll spend that initial time creating your budget categories and putting in your starting account balances. The real work is building the simple habit of logging expenses as they happen, which honestly only takes a couple of minutes each day.

My Take: The initial setup is a one-time thing. The real magic happens with the ongoing check-ins. Most families find that spending just 15-20 minutes a week is all it takes to stay on top of their finances and build some powerful momentum.

Is It Safe to Connect My Bank Accounts to an App? #

This is a huge, and very valid, concern. Most well-known budgeting apps use bank-level security and are granted “read-only” access to your accounts. They typically partner with trusted companies like Plaid to manage the connection, which means the app itself never even sees or stores your actual bank login details.

But let’s be realistic: no cloud-based system is 100% risk-free. If you’re someone who puts a premium on privacy, the best bet is a tool that doesn’t need to connect to your bank at all.

- Manual Entry: This approach completely sidesteps the risk because you never share your banking credentials with anyone.

- Self-Hosting: Some platforms, including Econumo, offer a self-hosted option. This means your financial data lives on your own private server, not on a company’s cloud. You have complete control and ownership.

Ultimately, you have to decide what you’re more comfortable with: the convenience of auto-syncing or the total control of manual entry.

What if My Partner Is Resistant to Budgeting? #

Ah, the classic standoff. Getting a reluctant partner on board is one of the most common hurdles, but it’s definitely not impossible. The trick is to frame budgeting as a tool for achieving your shared goals, not as a straitjacket.

Start with a positive, shared dream. Instead of saying, “We have to cut back,” try something like, “Hey, what if we worked together to save up for that family trip we keep talking about?”

Make it a team sport from the beginning. Sit down together to pick the software and decide on the budget categories. And make sure the tool you choose is genuinely easy for both of you to use. A clunky, complicated system will just create more tension. The best software for your family is one that feels like a shared project, not a chore one person is forcing on the other.

Can We Track Both Shared and Personal Spending? #

Absolutely. In fact, this is a non-negotiable feature for any modern family budgeting tool. Very few households pool 100% of their money these days, and your software needs to reflect that.

Most good apps will let you:

- Link Joint Accounts: Easily connect the shared checking or savings you use for household bills.

- Link Personal Accounts: Each partner can also connect their own individual credit cards or bank accounts.

- Use Smart Categories: You can set up categories like “Household Groceries” (paid from a joint account) and “Chris’s Coffee Fund” (paid from a personal one) to get a full, honest picture of where every dollar is going.

This kind of setup gives you a complete overview of your finances as a team while still respecting each person’s financial independence. It’s the perfect balance of teamwork and personal freedom.

Ready to take control of your family’s finances with a tool built for privacy and collaboration? Econumo provides the powerful features you need, including multi-user access and multi-currency support, with the security of manual entry and a self-hosting option. Explore the live demo or get started for free today.