Tackling debt can feel overwhelming, but the right tool can turn a complex challenge into a clear, manageable plan. A dedicated debt payoff app helps you organize your loans, strategize your payments, and visualize your progress, providing the motivation needed to stay on track. These apps move you beyond simple spreadsheets by automating calculations for popular methods like the debt snowball or avalanche, showing you exactly how much time and money you can save.

This guide is designed to help you find the best debt payoff apps for your specific financial situation. Whether you’re a couple managing joint finances, a family trying to get ahead, an expat handling multiple currencies, or someone who simply values privacy and manual control, there’s an option here for you. We cut through the marketing noise to give you a straightforward comparison of the top tools available.

Inside, you’ll find a comprehensive review of 12 leading platforms, from powerful all-in-one budget managers like YNAB and Monarch Money to specialized calculators like Unbury.me and PowerPay. For each app, we provide:

- A detailed profile of its key features.

- Clear pricing and platform availability.

- An honest look at its pros and cons.

- Specific “best for” use cases to match the app to your needs.

We’ve included direct links and screenshots to give you a clear look at each tool’s interface and functionality. Our goal is simple: to provide a practical resource that helps you choose an app, build a solid repayment strategy, and accelerate your journey to becoming debt-free. Let’s find the perfect app to support your financial goals.

1. Econumo #

Econumo stands out as a powerful and flexible choice among the best debt payoff apps, particularly for users who prioritize privacy, collaboration, and manual control over their finances. It’s designed as a privacy-first web application that helps individuals, couples, and families work together on shared financial goals, including aggressive debt repayment, without compromising data ownership.

Its core philosophy revolves around mindful spending and deliberate financial management. By emphasizing manual transaction entry, Econumo encourages users to actively engage with their budget, a practice that builds stronger awareness of spending habits. This hands-on approach is invaluable when trying to identify extra funds to allocate toward debts.

Key Strengths and Use Cases #

Econumo’s feature set is uniquely suited for specific needs, making it a top contender for users who find other apps too restrictive or invasive.

- Privacy and Data Ownership: For those wary of linking bank accounts, Econumo offers a self-hosted community edition. This free option gives you full control over your financial data by running the software on your own server.

- Collaborative Finances: Its multi-user support is a game-changer for couples and families. You can create joint accounts to track shared bills, savings goals, and a unified debt payoff plan, ensuring everyone is aligned and accountable.

- Multi-Currency Support: Expats, digital nomads, and frequent travelers will appreciate the robust multi-currency functionality, which simplifies managing income, expenses, and debts across different countries.

- Flexibility for Power Users: An available API allows technically-inclined users to build custom automations or integrate Econumo with other tools, offering a level of customization rarely seen in personal finance apps.

The platform is accessible via any modern web browser, with a responsive design that adapts seamlessly to desktop, tablet, and mobile devices. While a hosted cloud edition is still in development, you can explore a live demo and join a waiting list for an early-bird discount on the planned one-time payment of around $20–$30. This model avoids recurring subscription fees, adding to its long-term value. For practical strategies on accelerating your repayment journey, Econumo provides excellent resources on how to pay off debt faster.

| Feature | Details |

|---|---|

| Best For | Privacy-conscious individuals, couples, families, and expats. |

| Platform | Web (Responsive for Desktop, Tablet, Mobile) |

| Pricing | Community Edition: Free (self-hosted). Cloud Edition: In development, planned one-time payment (~$20–$30). |

| Key Differentiator | Self-hosting option for complete data privacy and robust multi-user features for collaborative budgeting. |

| Data Sync | Primarily manual entry to encourage mindful tracking. |

Pros:

- Privacy-first: Keep your financial data entirely private with the self-hosted edition.

- Designed for households: Multi-user and joint account features streamline shared finances.

- No subscriptions: The planned cloud version uses a one-time payment model.

- Power-user friendly: An API provides ultimate flexibility for custom integrations.

Cons:

- Cloud version is not yet released: The hosted service is still under development, and final pricing could change.

- Requires manual effort: The lack of automatic bank syncing may not suit users who prefer a fully automated system.

2. Debt Payoff Planner #

Debt Payoff Planner is a streamlined tool that does one thing exceptionally well: it helps you create, track, and visualize your debt elimination plan. If you find comprehensive budgeting apps overwhelming, this app’s focused approach is its greatest strength. It’s one of the best debt payoff apps for users who want a dedicated space just for tackling their balances without extra distractions.

The app’s core function revolves around building a strategy using popular methods like the debt snowball or avalanche. After entering your debts, it generates a clear payoff schedule, complete with a projected “debt-free date” that updates as you make extra payments. This visual feedback is incredibly motivating. While its primary goal is payoff planning, paying down debt on time is a key factor in your financial health. If you’re looking for other ways to build your financial profile, you can learn how to improve your credit score with a few simple steps.

Key Features & Cost #

| Feature | Details |

|---|---|

| Payoff Strategies | Supports debt snowball, avalanche, debt snowflake, and custom ordering. You can easily switch between them to see which saves more money or provides quicker wins. |

| Progress Tracking | Clear charts and timelines show your progress, comparing your accelerated plan against making only minimum payments. |

| Platform & Syncing | Available on iOS, Android, and the web. The Pro plan ($12/year or $29 lifetime) enables multi-device syncing and removes ads. |

| User Experience | The interface is simple and intuitive. Adding new debts and logging payments takes only a few seconds, making it easy to stay current. |

| Primary Limitation | This is not a budgeting app. It lacks features for expense tracking, income management, or savings goals. Bank syncing can be inconsistent, so manual entry is often best. |

Website: https://www.debtpayoffplanner.com/

3. Apple App Store – Debt Payoff Planner & Tracker #

For iPhone and iPad users, the dedicated App Store listing for Debt Payoff Planner & Tracker is the most direct and secure way to access the app. While the core product is the same as the web version, using the App Store simplifies installation, updates, and managing subscriptions. It’s the ideal starting point for anyone embedded in the Apple ecosystem who wants a powerful, focused tool to eliminate debt.

This platform provides transparent pricing for in-app purchases, clear version history, and user ratings to help you make an informed decision. The app itself excels at creating debt snowball or avalanche strategies, offering clear visual charts to track your journey toward becoming debt-free. By centralizing management through your Apple ID, it streamlines the experience of using one of the best debt payoff apps available on iOS.

Key Features & Cost #

| Feature | Details |

|---|---|

| Native iOS Experience | A clean, intuitive interface designed specifically for iPhone and iPad, ensuring smooth performance and integration with the Apple ecosystem. |

| Payoff Calculators | Includes snowball and avalanche calculators that generate a clear payoff schedule and a projected debt-free date based on your inputs. |

| Progress Tracking | Visual charts and timelines illustrate your progress, motivating you by showing how much interest you’re saving and how quickly you’re reducing balances. |

| Subscription & Pricing | The App Store listing clearly outlines the cost for the Pro version, which removes ads and enables features like multi-device syncing. Purchases are managed via your Apple ID. |

| Primary Limitation | This listing is platform-specific. Android users must download the app from the Google Play Store, and it doesn’t offer budgeting or expense-tracking features. |

Website: https://apps.apple.com/us/app/debt-payoff-planner-tracker/id1009323715

4. Google Play Store – Debt Payoff Planner & Tracker #

For Android users, the official Google Play Store listing for Debt Payoff Planner & Tracker offers a secure and straightforward way to access this powerful tool. It’s the same dedicated app as its web counterpart, focused entirely on helping you build and stick to a debt elimination plan. This makes it one of the best debt payoff apps for those who prefer the simplicity of managing their finances directly from their Android device without extra budgeting features.

The platform provides a clear overview of the app’s features, ratings, and user reviews before you install. It’s ideal for users who prioritize a native mobile experience and the security of downloading from an official app store. The app itself allows you to model both debt snowball and avalanche strategies, providing a clear visual timeline and a projected debt-free date to keep you motivated on your journey. Its focused approach ensures you can quickly log payments and track progress without getting sidetracked by other financial management tasks.

Key Features & Cost #

| Feature | Details |

|---|---|

| Payoff Strategies | Supports debt snowball and avalanche methods, allowing you to create a detailed amortization schedule and see your debt-free date. |

| Progress Tracking | Offers clear charts, a percentage-complete bar, and notifications to help you visualize your progress and stay on track. |

| Platform & Syncing | Available exclusively for Android through the Google Play Store. A Pro subscription is required to sync across multiple devices, including the web version. |

| User Experience | The store listing clearly outlines privacy policies, subscription costs, and developer contact information, making for a transparent installation process. |

| Primary Limitation | Like the web version, this is not a full budgeting app. Advanced features like multi-device syncing require an in-app purchase, and availability can vary by region. |

Website: https://play.google.com/store/apps/details?id=com.oxbowsoft.debtplanner

5. YNAB (You Need A Budget) #

YNAB, or You Need A Budget, is a comprehensive budgeting platform that treats debt payoff as an integral part of your overall financial plan. Its philosophy is built on zero-based budgeting, where every dollar has a job. This makes it one of the best debt payoff apps for users who want to see exactly how their spending habits impact their ability to accelerate debt repayment, rather than just tracking debt in isolation.

The platform’s Loan Planner tool allows you to simulate different payment scenarios to see how much interest you can save and how quickly you can become debt-free. By actively managing your budget, you can find extra money to allocate toward your loans. This hands-on approach is powerful for changing financial behaviors and is a great way to learn how to reduce your monthly expenses effectively. YNAB is particularly well-suited for couples and families looking to align their financial goals and tackle debt together.

Key Features & Cost #

| Feature | Details |

|---|---|

| Budgeting Method | Built around the zero-based budgeting philosophy, requiring users to assign every dollar a purpose, including extra debt payments. |

| Debt Payoff Tools | The Loan Planner tool visualizes the impact of extra payments on interest saved and your debt-free date. It integrates directly with your budget categories. |

| Platform & Syncing | Available on web, iOS, and Android with seamless syncing. Offers secure bank connections for automatic transaction imports. |

| Collaborative Features | Excellent for shared finances. Multiple users can manage a single household budget, making it ideal for partners or families. |

| Primary Limitation | The price ($99/year) is higher than dedicated debt apps, and there is a learning curve associated with its specific budgeting methodology. |

Website: https://www.ynab.com/pricing

6. EveryDollar (Ramsey Solutions) #

EveryDollar is a comprehensive budgeting app from Ramsey Solutions that integrates a dedicated debt-elimination feature. It’s built around the zero-based budgeting philosophy, where every dollar has a job. This app is an excellent choice for users who want their debt payoff plan tightly connected to their monthly budget, all guided by the well-known Ramsey snowball methodology.

The app’s core strength lies in its simplicity and directness. You set up your budget, and the built-in “Baby Steps” tracker guides you to allocate any extra money toward your debts using the snowball method. This makes EveryDollar one of the best debt payoff apps for those who follow Dave Ramsey’s financial principles and want a tool that aligns perfectly with that system. The community support and wealth of resources from Ramsey Solutions also provide extra motivation.

Key Features & Cost #

| Feature | Details |

|---|---|

| Payoff Strategies | Exclusively uses the debt snowball method, ordering debts from smallest to largest balance. It’s designed to build momentum and psychological wins. |

| Progress Tracking | The app visually tracks your progress through Ramsey’s “7 Baby Steps,” with debt payoff being Step 2. It shows how extra payments accelerate your debt-free date. |

| Platform & Syncing | Available on iOS, Android, and the web. The free version requires manual entry. The Premium plan ($79.99/year) adds bank syncing, reporting, and priority support. |

| User Experience | The interface is clean and user-friendly, with a strong focus on creating and sticking to a monthly budget. Setting up your snowball is a straightforward process. |

| Primary Limitation | Heavily favors the snowball method, with no option for the debt avalanche. Most automation and convenience features, like bank syncing, are locked behind a paid plan. |

Website: https://www.ramseysolutions.com/ramseyplus/everydollar

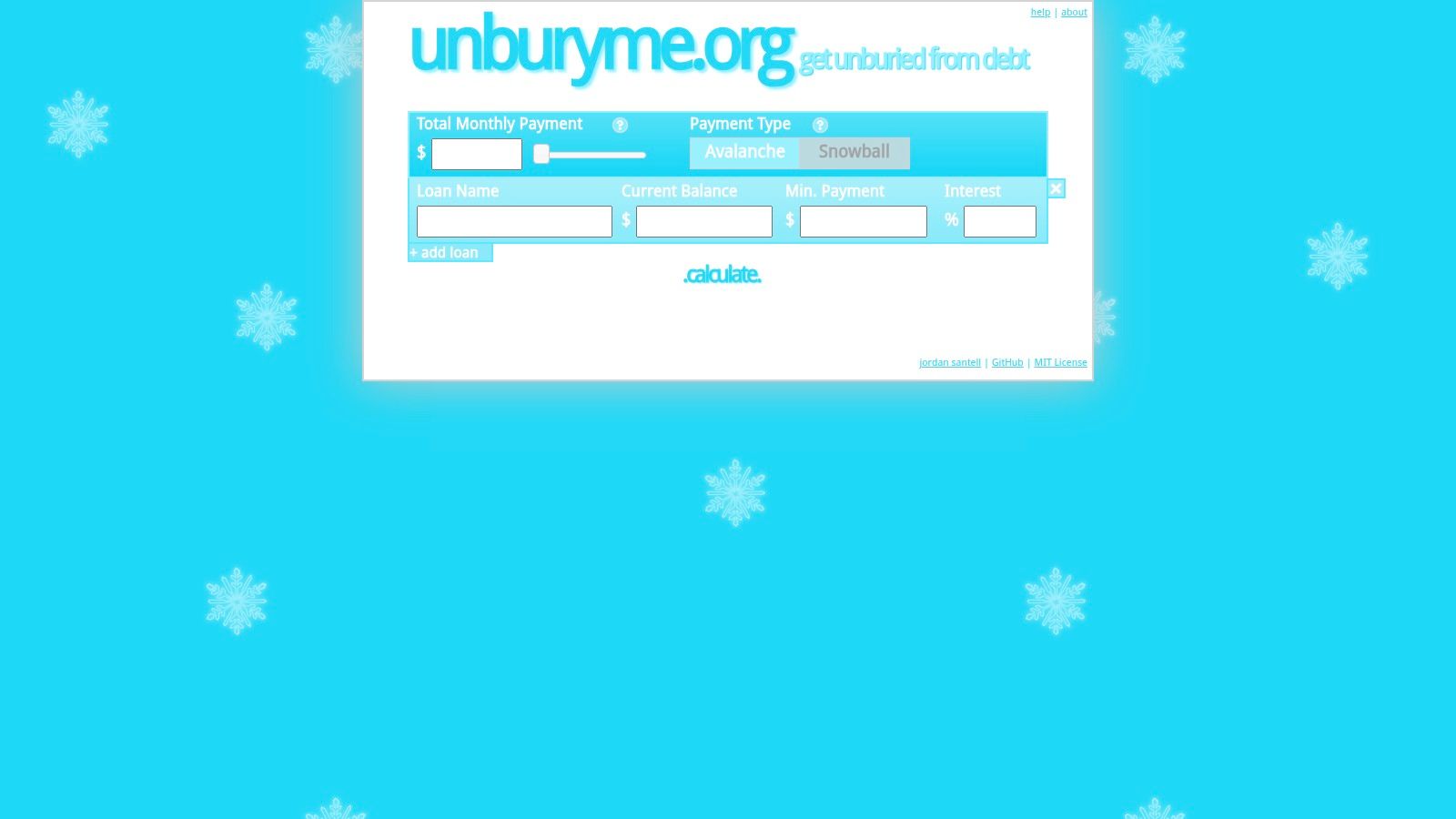

7. Unbury.me #

Unbury.me is less of a full-featured app and more of a powerful, free, and anonymous debt payoff calculator. Its genius lies in its simplicity. Without needing an account or any personal information, you can input your debts, interest rates, and minimum payments to instantly visualize your payoff timeline. This makes it one of the best debt payoff apps for quick, commitment-free scenario planning before you settle on a long-term tool.

The web-based tool allows you to toggle between the debt avalanche and debt snowball methods with a single click, immediately showing you the difference in total interest paid and your projected debt-free date. You can also experiment with adding extra monthly payments to see how much faster you can eliminate your balances. The detailed amortization schedule it generates is a fantastic learning resource for understanding how your payments are applied over time. Its focused, calculator-style approach is perfect for getting a clear financial picture without any fuss.

Key Features & Cost #

| Feature | Details |

|---|---|

| Payoff Strategies | Instantly compare the debt avalanche (highest interest first) and debt snowball (lowest balance first) methods to see the impact on your timeline and total interest. |

| Progress Tracking | This is a one-time calculator, not an ongoing tracker. It provides a static plan based on your inputs but does not save progress or send reminders. |

| Platform & Syncing | Web-based only. There is no native mobile app, account system, or syncing capability. It is 100% free to use. |

| User Experience | The interface is extremely straightforward and fast. Entering debt information and comparing strategies takes only a minute, making it ideal for quick analysis. |

| Primary Limitation | It offers no long-term tracking, account saving, or automated features. You must manually re-enter your data each time you want to update or review your plan. |

Website: https://unburyme.org/

8. PowerPay (Utah State University Extension) #

PowerPay is a unique, university-backed platform that offers a credible and educational approach to debt elimination. Developed by the Utah State University Extension, it functions as a robust financial calculator and planner rather than a sleek consumer app. It’s an excellent choice for users who value a research-driven, no-cost tool and prefer a detailed, analytical approach to creating their debt-free plan without the distractions of a typical app.

The platform’s strength lies in its “power payment” logic, which automatically rolls over paid-off debt payments to the next target account, accelerating your progress. Users can create highly personalized payoff calendars and run “what-if” scenarios, such as the impact of a tax refund or a 0% balance transfer. While it lacks the polish of modern apps, its educational modules and detailed reports make it one of the best debt payoff apps for those who want to learn the mechanics behind their financial strategy.

Key Features & Cost #

| Feature | Details |

|---|---|

| Payoff Strategies | Focuses on a structured rollover method (similar to snowball/avalanche) and allows for extensive “what-if” scenario planning with extra payments or balance transfers. |

| Planning & Reports | Generates detailed payoff calendars, amortization schedules, and spending plan worksheets. Users can save their plans by creating a free account. |

| Platform & Syncing | Web-only platform with no native mobile apps. All data entry is manual, which enhances privacy but requires user diligence. |

| User Experience | The interface is functional and data-driven but feels dated compared to commercial apps. It’s designed for planning and analysis rather than daily tracking. |

| Primary Limitation | Its academic, utilitarian design may not appeal to users seeking a modern, visually engaging mobile experience. There is no bank syncing or automated transaction tracking. |

Website: https://extension.usu.edu/powerpay/

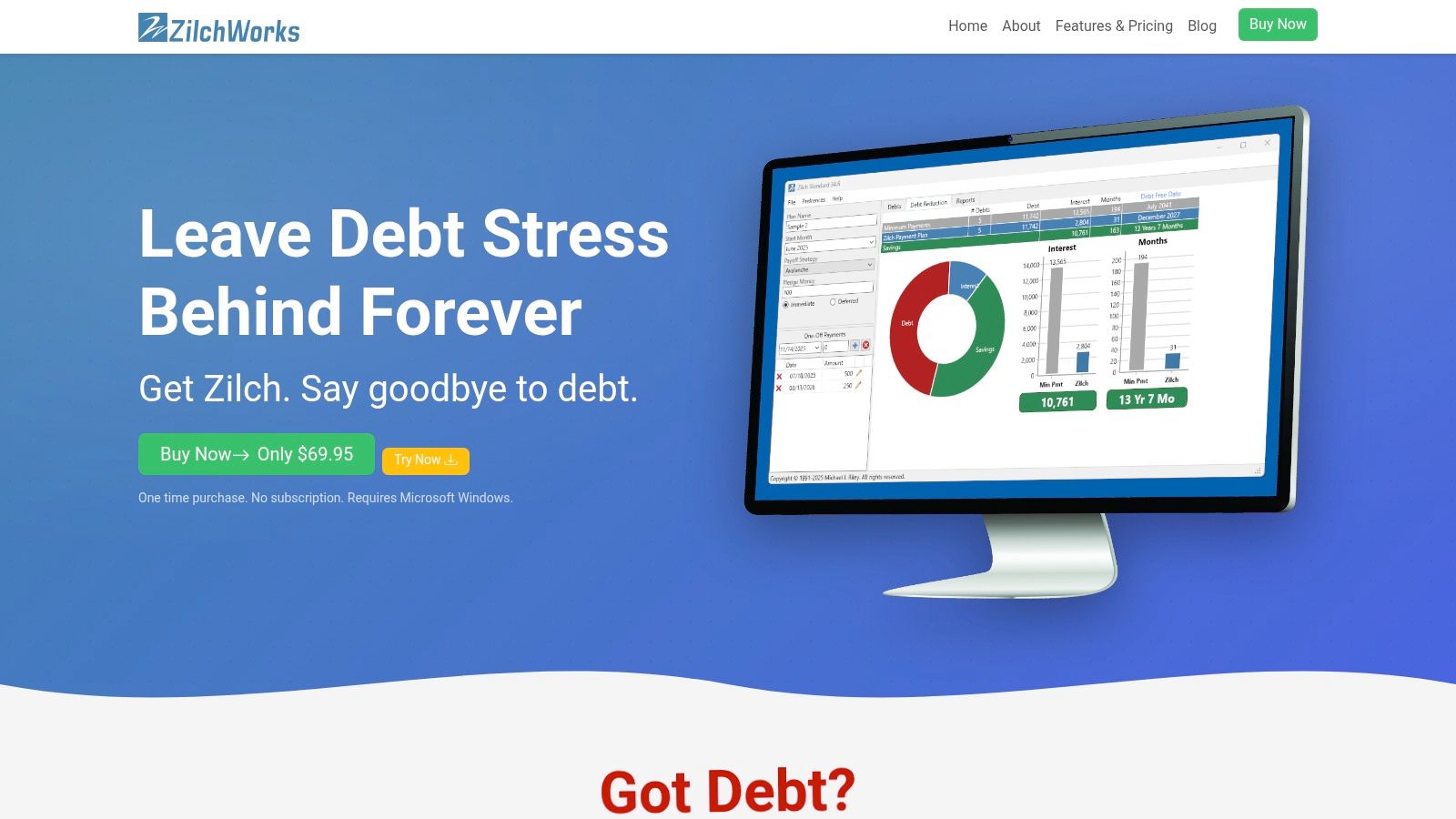

9. ZilchWorks (Debt Payoff Software) #

ZilchWorks takes a classic, offline approach to debt management, offering downloadable Windows software for users who prioritize privacy and control. Unlike cloud-based apps, your financial data stays on your computer. It’s one of the best debt payoff apps for individuals who prefer a one-time purchase over a recurring subscription and value the ability to generate detailed, printable reports for their records.

The software’s main purpose is to create a powerful, customized debt elimination plan. You can use standard strategies like the debt snowball and avalanche or create a completely custom payoff order. A unique “Dial-a-Date” feature lets you set a target debt-free date, and the software calculates the extra payment needed to achieve it. For those wanting a quick analysis without installing software, ZilchWorks also offers a free, capable online calculator on their website.

Key Features & Cost #

| Feature | Details |

|---|---|

| Payoff Strategies | Supports debt snowball, avalanche, highest interest first, and fully custom payoff ordering. The software generates clear amortization schedules for each scenario. |

| Progress Tracking | Generates detailed, printable reports and charts showing your payoff progress, total interest paid, and projected debt-free date. |

| Platform & Syncing | A Windows-only desktop application. The Standard version is a one-time fee of $39.95. There is no multi-device syncing as it is an offline tool. |

| User Experience | The interface is functional and data-driven, resembling classic desktop software rather than a modern mobile app. It’s built for detailed analysis, not sleek design. |

| Primary Limitation | This is not a budgeting or expense-tracking tool. Its focus is solely on debt repayment planning, and the full software is only available for Windows users. |

Website: https://www.zilchworks.com/

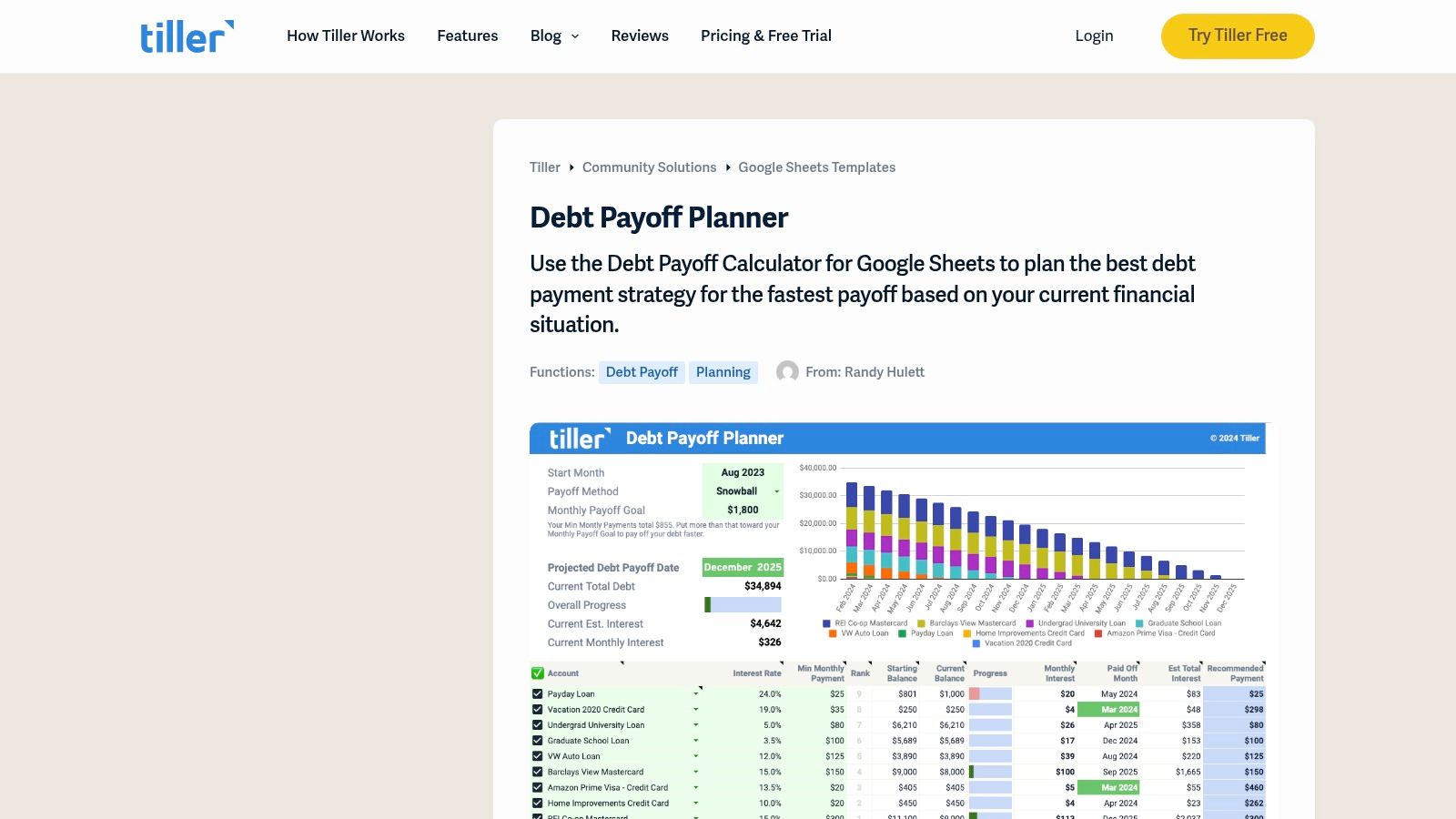

10. Tiller Money – Debt Payoff Planner (Template) #

Tiller Money offers a unique approach for spreadsheet enthusiasts who want automated bank data combined with total control over their financial plan. Instead of a standalone app, Tiller provides a powerful Debt Payoff Planner template for Google Sheets and Excel. It automatically imports your latest account balances and transactions, giving you a real-time foundation for building a sophisticated payoff strategy without manual data entry.

This setup is one of the best debt payoff app solutions for those who feel constrained by traditional apps. You can customize the spreadsheet to your exact needs, integrating your debt plan with other Tiller templates for budgeting, net worth tracking, and more. The template supports both the debt snowball and avalanche methods and dynamically projects your debt-free date based on your actual balances, making it a powerful tool for data-driven users.

Key Features & Cost #

| Feature | Details |

|---|---|

| Payoff Strategies | The template fully supports debt snowball, avalanche, and custom payoff ordering. As a spreadsheet, it allows for infinite customization of the payoff logic. |

| Progress Tracking | It offers detailed amortization schedules and charts within the spreadsheet, showing your projected progress and how extra payments accelerate your debt-free date. |

| Platform & Cost | Operates in Google Sheets or Microsoft Excel. Requires a Tiller subscription, which costs $79 per year after a 30-day free trial. |

| User Experience | Ideal for intermediate to advanced spreadsheet users. Setup requires more effort than a typical mobile app but offers unparalleled flexibility once configured. |

| Primary Limitation | The learning curve is steep if you are not comfortable with spreadsheets. It is not a turnkey mobile app and requires a paid subscription to Tiller for automation. |

Website: https://tiller.com/community-templates/debt-payoff-calculator/

11. Monarch Money #

Monarch Money is a premium, all-in-one personal finance platform designed for individuals, couples, and families who want to manage their entire financial picture, including debt. It excels at collaborative budgeting and goal-setting, making it one of the best debt payoff apps for households that need to tackle debt as a team. Its strength lies in integrating debt pay-down goals directly into a comprehensive financial dashboard.

Unlike single-purpose apps, Monarch allows you to see how accelerating debt payments impacts your other financial goals, such as saving for a down payment or retirement. You can connect unlimited accounts, invite a partner to manage finances with you, and customize dashboards to keep your debt-free goal front and center. The user experience is polished and ad-free, reflecting its privacy-forward, subscription-based model.

Key Features & Cost #

| Feature | Details |

|---|---|

| Payoff Strategies | Allows users to set and track financial goals, including debt pay-down plans. Progress is visualized within the main dashboard, connecting it to your overall net worth. |

| Progress Tracking | Tracks balances, payments, and progress toward your debt-free date. The collaborative dashboard allows partners to monitor shared progress together. |

| Platform & Syncing | Available on web, iOS, and Android with seamless syncing. A subscription is required after a 7-day free trial, with plans starting at $14.99/month or $99.99/year. |

| User Experience | Features a clean, modern, and highly intuitive interface. Unlimited account connections and an ad-free experience provide a premium feel. |

| Primary Limitation | It is not a dedicated debt-only app; its features are part of a broader personal finance tool. There is no permanent free tier, so a paid subscription is necessary. |

Website: https://www.monarchmoney.com/pricing

12. Rocket Money #

Rocket Money (formerly Truebill) is a comprehensive financial app that tackles debt payoff from a different angle: freeing up cash flow. While it offers tools to track your debts as part of your overall net worth, its core strength lies in identifying areas where you can save money, such as by canceling forgotten subscriptions and negotiating lower bills. This makes it one of the best debt payoff apps for users who want to find extra funds in their existing budget to accelerate their repayment journey.

The app’s automated tools are its main draw. By connecting your bank accounts, Rocket Money spots recurring charges and helps you cancel unwanted services with a single tap. Its bill negotiation feature can potentially lower costs for things like cable or internet, with the savings then redirected toward your debt snowball or avalanche. While not a dedicated payoff calculator, it provides the fuel needed to make those extra payments.

Key Features & Cost #

| Feature | Details |

|---|---|

| Debt & Net Worth Tracking | Displays all your liabilities, including credit cards, loans, and mortgages, in one dashboard to give you a clear picture of your total debt. |

| Subscription Management | Identifies and helps you cancel recurring subscriptions you no longer need, freeing up cash for debt payments. |

| Bill Negotiation | The service negotiates with providers on your behalf to lower monthly bills. This is a Premium feature that charges a percentage of the annual savings it finds. |

| Platform & Cost | Available on iOS, Android, and web. A Premium subscription (ranging from $4 to $12 per month) is required for most advanced features, including bill negotiation. |

| Primary Limitation | Its debt tools are for tracking, not strategic planning. It lacks specialized payoff calculators like the debt snowball or avalanche planners found in more focused apps. |

Website: https://www.rocketmoney.com/

Top 12 Debt Payoff Apps: Features & Pricing #

| Product | Core features | UX / Quality ★ | Pricing / Value 💰 | Best for 👥 | Unique selling points ✨ |

|---|---|---|---|---|---|

| 🏆 Econumo | Collaborative budgets, joint accounts, manual txn entry, multi-currency, API | ★★★★☆ polished adaptive web UI | 💰 Self-host FREE; cloud one‑time ~$20–$30/user (early) | 👥 Couples/families, privacy‑focused, expats, power users | ✨ Self‑hostable + API + privacy‑first + mindful manual tracking |

| Debt Payoff Planner | Snowball/avalanche/snowflake, payoff timelines, charts, sync | ★★★★☆ simple & focused workflow | 💰 Low cost; Pro adds web sync | 👥 Users focused solely on debt elimination | ✨ Clear payoff visuals & strategy options |

| Apple App Store – Debt Payoff Planner | Native iOS app, calculators, payment logging, family sharing | ★★★★★ visible strong user ratings | 💰 In‑app purchases / subscriptions | 👥 iPhone/iPad users wanting App Store convenience | ✨ App Store transparency & auto updates |

| Google Play Store – Debt Payoff Planner | Android app, payoff timelines, notifications, dev support | ★★★★☆ large install base | 💰 In‑app purchases / subscriptions | 👥 Android users seeking same payoff tool | ✨ Store listing privacy & install metrics |

| YNAB (You Need A Budget) | Zero‑based budgeting, collaborative accounts, loan tools | ★★★★★ robust education & community | 💰 Subscription (higher than niche apps) | 👥 Couples/families wanting active budgets + payoff | ✨ Deep budgeting pedagogy + goal tracking |

| EveryDollar (Ramsey) | Envelope budgeting, Debt Snowball, premium automations | ★★★★☆ easy on‑ramp, Ramsey community | 💰 Free tier; Premium adds bank sync | 👥 Users preferring Ramsey snowball method | ✨ Snowball‑centric workflow & community support |

| Unbury.me | Avalanche vs snowball comparisons, amortization exports | ★★★☆☆ fast, no‑login web tool | 💰 100% FREE | 👥 Users testing scenarios / learning payoff math | ✨ Instant, free scenario testing (no account) |

| PowerPay (USU Extension) | Payoff calendars, what‑if testing, education center | ★★★★☆ credible, education‑driven | 💰 FREE (university backed) | 👥 Budget learners wanting research‑backed tools | ✨ University‑sponsored education + robust what‑ifs |

| ZilchWorks | Windows desktop apps, printable schedules, one‑time license | ★★★☆☆ offline, report‑focused | 💰 One‑time license (Standard/Pro) + free web calculator | 👥 Offline users wanting detailed printable reports | ✨ Offline privacy + printable, exportable schedules |

| Tiller Money – Debt Planner (Template) | Spreadsheet template with live bank feeds & projections | ★★★★☆ highly customizable (spreadsheet power) | 💰 Requires Tiller subscription | 👥 Spreadsheet‑savvy users wanting live sync | ✨ Live account feeds into customizable spreadsheets |

| Monarch Money | Debt goals, unlimited account connections, household focus | ★★★★☆ polished UX & flat pricing | 💰 Subscription (no permanent free tier) | 👥 Households wanting unified finance dashboards | ✨ Polished shared‑finance UX + privacy‑forward stance |

| Rocket Money | Debt view, subscription cleanup, bill negotiation services | ★★★★☆ practical for freeing cash | 💰 Freemium; Premium features paid | 👥 Users seeking extra cash to accelerate payoff | ✨ Subscription cleanup + bill negotiation services |

Final Thoughts #

Choosing the right tool is the first major step on your journey to becoming debt-free. Throughout this guide, we’ve explored a wide range of the best debt payoff apps, each with unique strengths tailored to different financial situations and personal preferences. From the automated, all-in-one power of YNAB and Monarch Money to the focused, single-purpose calculators like Unbury.me, the perfect digital partner for your goals is out there.

The most important takeaway is that there is no single “best” app for everyone. Your ideal tool depends entirely on what you value most. A tool that works wonders for a single person focused on one credit card might not be the right fit for a couple juggling a mortgage, car loans, and student debt across multiple currencies.

Key Takeaways: How to Choose Your App #

To make your final decision, reflect on the core needs we’ve discussed. Your answers to these questions will point you directly to the right category of application.

- Automation vs. Manual Control: Do you want an app that automatically syncs with your banks and categorizes transactions, like Rocket Money or Monarch Money? Or do you prefer the intentionality of manual entry, a core feature of tools like EveryDollar and Econumo? Automation saves time, but manual tracking builds powerful financial awareness.

- Privacy and Data Security: How comfortable are you with sharing your financial data with third-party services? If data privacy is your top priority, a self-hosted or manual-entry tool is the safest path. This is a key area where privacy-first apps stand out from the crowd.

- Solo vs. Shared Finances: Are you managing debt on your own, or are you collaborating with a partner? Apps designed for couples and families offer features for joint accounts and shared visibility, which is essential for staying aligned on a shared payoff plan.

- Simplicity vs. All-in-One Features: Do you just need a powerful calculator to run snowball vs. avalanche scenarios, like PowerPay or the Debt Payoff Planner? Or do you need a comprehensive budgeting system that integrates debt repayment into your entire financial picture, like YNAB?

Putting Your Plan into Action #

Once you’ve selected an app, your work has just begun. The best debt payoff apps are only effective when paired with a consistent strategy and a firm commitment. Remember these crucial implementation steps:

- Gather Everything: Before you even open the app, collect all your debt information. You will need the current balance, minimum monthly payment, and interest rate (APR) for every single loan, credit card, and line of credit.

- Choose Your Strategy: Decide between the debt snowball (paying off smallest balances first for psychological wins) and the debt avalanche (paying off highest-interest debts first to save the most money). Most apps we reviewed will let you model both scenarios, so you can see the financial impact of each choice.

- Make it a Habit: Schedule a consistent time each week to update your progress, review your budget, and make your payments. Consistency is the engine that drives debt reduction. Your chosen app is your dashboard, not your driver.

Ultimately, the goal is to transform your relationship with debt from one of stress and uncertainty to one of control and empowerment. The right digital tool acts as your guide, keeping you motivated, holding you accountable, and clearly illuminating the path to zero. It visualizes your progress, celebrates your milestones, and shows you exactly how much interest you’re saving and how much sooner you’ll be free.

Don’t let analysis paralysis hold you back. Pick the app that feels like the best fit for now and get started. You can always switch later if your needs change. The most critical step you can take today is the first one.

If you’re a couple or family looking for a privacy-focused tool that supports manual tracking and multi-currency accounts, Econumo was built for you. Take control of your debt payoff strategy without compromising your data. Get started with Econumo today.