Managing household finances can feel like juggling a dozen different things at once. From shared bills and groceries to saving for a family vacation or a new home, keeping everyone on the same page is a real challenge. Spreadsheets get messy, and single-user apps just don’t cut it. You need a centralized tool that adapts to your family’s unique dynamics. The goal isn’t just to track spending, but to build a shared financial future, together.

This guide dives deep into the 12 best budget app for families, breaking down the features that matter most, like multi-user access, shared goals, and data privacy, so you can find the perfect fit. We’ve done the heavy lifting to provide a comprehensive resource that moves beyond marketing hype. Here, you’ll find an honest assessment of each app’s strengths and weaknesses, ideal user profiles, and practical considerations for implementation.

As you explore these tools, remember that the foundation of a healthy financial household starts with education. Understanding the importance of financial literacy for kids can transform budgeting from a simple chore into a powerful teaching moment, setting your children up for future success.

We’ll cover everything from fully automated, bank-synced platforms to privacy-focused, manual-entry systems. Each review includes clear pros and cons, screenshots, and direct links to help you make an informed decision without the fluff. Let’s find the right financial command center for your family.

1. Econumo #

Econumo stands out as a powerful and flexible choice for families seeking deep control over their financial data. It is engineered with a privacy-first philosophy, making it the best budget app for families who are uncomfortable sharing sensitive banking information with third-party cloud services. Its design beautifully marries robust features with a clean, adaptive interface that works seamlessly across desktops, tablets, and mobile devices.

The platform’s architecture is uniquely suited for household collaboration. It supports multiple users and joint accounts, allowing partners to coordinate on shared expenses, track progress toward family goals like a vacation or down payment, and manage complex finances together.

Key Features and Use Cases #

Econumo’s feature set is built for real-world family scenarios. Here’s how it shines:

- Collaborative Budgeting: Create shared budgets for household expenses like groceries and utilities. Each partner can log transactions against the shared budget from their own device, providing a real-time, unified view of the family’s financial state.

- Multi-Currency for Travelers: If your family travels internationally or includes expats, the multi-currency support is a game-changer. You can manage accounts in different currencies without confusing conversions, perfect for tracking spending on a family trip abroad or managing income from another country.

- Mindful Manual Entry: While it lacks automatic bank syncing, Econumo turns this into a strength. By requiring manual transaction entry, it encourages a more conscious and accurate approach to spending, helping families build healthier financial habits.

- Data Sovereignty: For the tech-savvy, the free, self-hosted community edition offers complete ownership of your financial data. You control where it’s stored and who sees it, eliminating privacy concerns.

Pricing and Availability #

Econumo offers a unique dual-access model. You can self-host the community edition for free by deploying it on your own server. For those who prefer a simpler setup, a cloud-hosted version is in development with a planned one-time cost of around $20 to $30 per user. You can join the waiting list for early access and discounts.

Pros and Cons #

- Pros:

- Excellent multi-user support for family collaboration.

- Top-tier privacy with a self-hosted option.

- Built-in multi-currency handling.

- Clean, modern UI and an available API for customization.

- Cons:

- No automatic bank syncing relies on manual data entry.

- The managed cloud version is not yet publicly available.

Website: https://econumo.com

2. YNAB (You Need A Budget) #

YNAB, short for You Need A Budget, is more than just an app; it’s a complete financial methodology. It operates on a zero-based budgeting system, meaning every dollar is assigned a “job” before you spend it. This proactive approach makes it an exceptional tool for families who want to gain intentional control over their finances, plan for large expenses, and get out of debt together.

Its standout feature for families is its generous sharing model. A single subscription can be shared with up to six people, allowing spouses, partners, and even older children to collaborate on the same budget in real-time. This structure promotes financial transparency and helps teach valuable money management skills within the household. While the zero-based method has a learning curve, YNAB provides extensive educational resources, including workshops and video tutorials, to guide your family through the process.

Why It’s a Top Pick for Families #

YNAB earns its spot as one of the best budget apps for families by transforming how you think about money, not just how you track it. The “Age of Money” metric is a powerful visual motivator, showing how long your money stays with you before being spent, encouraging healthier saving habits across the family.

- Best For: Families committed to a structured, hands-on budgeting method and want to build lasting financial habits.

- Pricing: YNAB offers a 34-day free trial. After the trial, the cost is $14.99 per month or $99 per year.

- Availability: Web, iOS, and Android apps. Bank syncing is available in the US, Canada, the UK, and the EU.

- Website: https://www.ynab.com

3. Monarch Money #

Monarch Money is a modern, collaborative financial platform designed for partners and families seeking a holistic view of their finances. It goes beyond simple budgeting by integrating investments, goals, and net worth tracking into a single, clean dashboard. The platform allows for unlimited collaborators, making it easy for family members to manage their money together.

Its standout feature for families is the ability to create a shared household view while still allowing individual members to maintain private accounts. This granular control means you can collaborate on joint expenses like mortgages and groceries, but keep personal spending separate. Monarch also offers powerful integrations with services like Zillow and Coinbase, providing a complete picture of your family’s assets and liabilities in one place.

Why It’s a Top Pick for Families #

Monarch Money excels as one of the best budget apps for families due to its balance of powerful features and user-friendly design. It allows families to not only manage their day-to-day budget but also to plan for long-term goals like college savings or retirement. The platform’s flexible sharing options support financial transparency and teamwork without sacrificing individual privacy.

- Best For: Couples and families who want a comprehensive financial overview, including budgeting, investments, and net worth, with flexible sharing controls.

- Pricing: Monarch Money offers a 7-day free trial. After the trial, the cost is $14.99 per month or $99.99 per year for the whole family.

- Availability: Web, iOS, and Android apps.

- Website: https://www.monarchmoney.com

4. Quicken Simplifi #

Quicken Simplifi, from the well-known Quicken brand, offers a modern and streamlined approach to managing family finances. It focuses on providing a clear, real-time snapshot of your cash flow, helping you see what’s left after bills and savings. This makes it an excellent choice for families who want to manage day-to-day spending and project future balances without the rigid rules of a zero-based system.

Its strength lies in its simplicity and powerful automation. The app creates a customized spending plan based on your income and bills, while “watchlists” allow you to monitor specific spending categories closely, like groceries or kids’ activities. While it doesn’t offer multi-user access on a single subscription, partners can share a login to manage their household finances collaboratively. The optional LifeHub add-on also provides a secure space to organize important family documents, centralizing more than just your budget.

Why It’s a Top Pick for Families #

Simplifi stands out for its focus on forward-looking cash flow projections, which is invaluable for families juggling multiple bills and irregular expenses. This feature helps prevent financial surprises and ensures there’s enough money to cover everything on time. The combination of a user-friendly interface with robust tracking tools makes it one of the best budget apps for families who want comprehensive oversight without a steep learning curve.

- Best For: Families who want a clear, automated view of their cash flow and future financial projections.

- Pricing: Offers a 30-day free trial. Plans typically start around $3.99 per month (billed annually), with frequent discounts for the first year.

- Availability: Web, iOS, and Android apps. Bank syncing is available in the US only.

- Website: https://www.quicken.com/simplifi

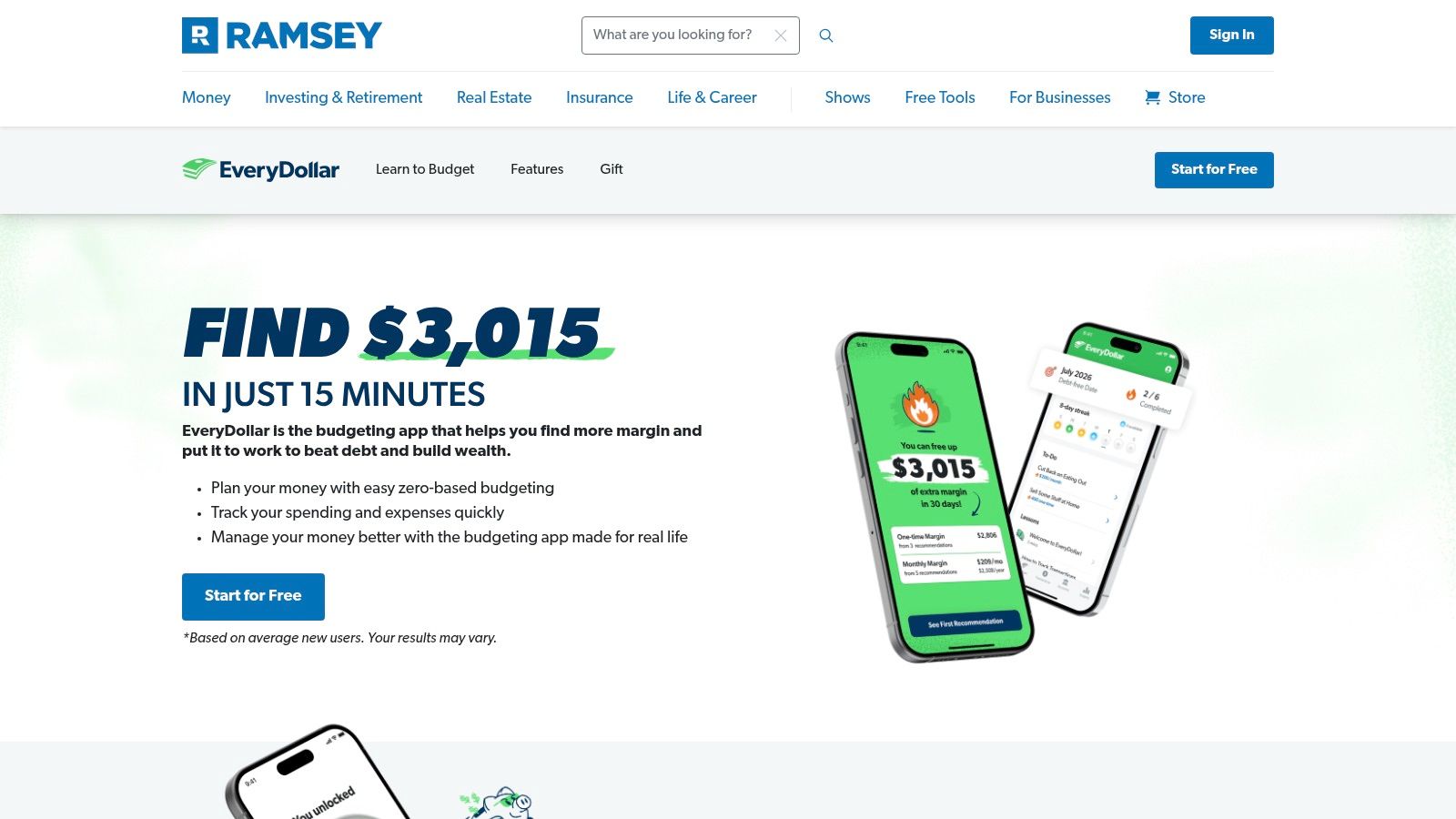

5. EveryDollar (Ramsey Solutions) #

EveryDollar is the official budgeting app from financial expert Dave Ramsey, designed around his popular zero-based budgeting principles. The app guides families to plan their income and expenses for the month ahead, assigning every dollar a specific purpose, from bills to debt payoff. Its primary strength lies in its simplicity and direct approach, making it an excellent entry point for families who feel overwhelmed by more complex financial tools and want a clear, guided path to financial control.

The platform is built to work seamlessly with Ramsey’s “Baby Steps” methodology for getting out of debt and building wealth. While the free version requires manual transaction entry, the paid version, Ramsey+, connects to your bank accounts for automatic syncing. This integration, combined with its straightforward user interface, makes EveryDollar one of the best budget apps for families who are new to budgeting and want a system that is easy to adopt and maintain together.

Why It’s a Top Pick for Families #

EveryDollar’s focus on simplicity and goal-oriented planning makes it a powerful tool for getting the entire family on the same financial page. The zero-based budget format encourages proactive conversations between partners about spending priorities and savings goals each month. For those following the Ramsey plan, the app serves as a practical, everyday tool to implement the financial lessons being learned.

- Best For: Families new to budgeting, especially those following Dave Ramsey’s financial principles who want a simple, no-fuss tool.

- Pricing: A free version is available with manual transaction entry. The premium version (Ramsey+) with bank syncing starts at $59.99 for a 3-month trial, then renews at $129.99 per year.

- Availability: Web, iOS, and Android apps.

- Website: https://www.everydollar.com

6. Honeydue #

Honeydue is designed specifically for couples, making it a fantastic starting point for partners building a financial life together. It focuses on transparency and communication, allowing you and your partner to link bank accounts, credit cards, and loans to a shared dashboard. The app facilitates joint tracking of bills and spending while maintaining a degree of individual privacy, as you can choose which accounts to share and which to keep private.

Its core strength lies in fostering financial collaboration without forcing fully merged finances. You can add comments to transactions, set up bill reminders, and even send emoji-based nudges to each other. This lighthearted approach encourages open dialogue about money and helps couples get on the same page with their financial goals, like setting a realistic monthly food budget for two and sticking to it.

Why It’s a Top Pick for Families #

Honeydue is the best budget app for families that are just starting out, specifically partners and couples. Its design is purpose-built to reduce financial friction and promote teamwork. By offering a shared view of spending, bills, and account balances, it removes guesswork and helps build a foundation of financial trust and accountability.

- Best For: Couples who want a simple, shared view of their finances without the complexity of a full-fledged family budgeting system.

- Pricing: Honeydue is free to use. They also offer a joint bank account called Joint Cash with no monthly fees or minimums.

- Availability: iOS and Android apps.

- Website: https://www.honeydue.com

7. Goodbudget #

Goodbudget is a digital take on the classic cash envelope budgeting system, making it an excellent choice for families who want to budget category by category. It encourages a hands-on approach where you assign income to virtual “Envelopes” for different spending areas like groceries, gas, or entertainment. This method makes it crystal clear how much you have left to spend in each category at any given moment.

The app’s core strength for family use is its cross-device syncing, which keeps everyone on the same page. You and your partner can share the same budget and see spending from shared Envelopes update in real-time, whether you’re using an iPhone, Android, or the web app. This shared visibility helps prevent overspending and ensures both partners are working toward common financial goals. It’s a straightforward system that’s easy to grasp, even for those new to budgeting. For more on this popular method, you can learn about the cash envelope system and how to apply it digitally.

Why It’s a Top Pick for Families #

Goodbudget stands out as one of the best budget apps for families because its envelope methodology is intuitive and effective for managing shared household expenses. The free plan is quite generous, making it accessible for families just starting their budgeting journey. The focus on proactive planning rather than reactive tracking helps families gain control over their spending habits together.

- Best For: Families who love the envelope budgeting method and want a simple, collaborative tool to manage category spending.

- Pricing: A free plan is available with 10 regular envelopes. The Plus plan is $8 per month or $70 per year for unlimited envelopes and optional bank syncing.

- Availability: Web, iOS, and Android apps. Bank syncing is limited to US and Canadian banks.

- Website: https://goodbudget.com

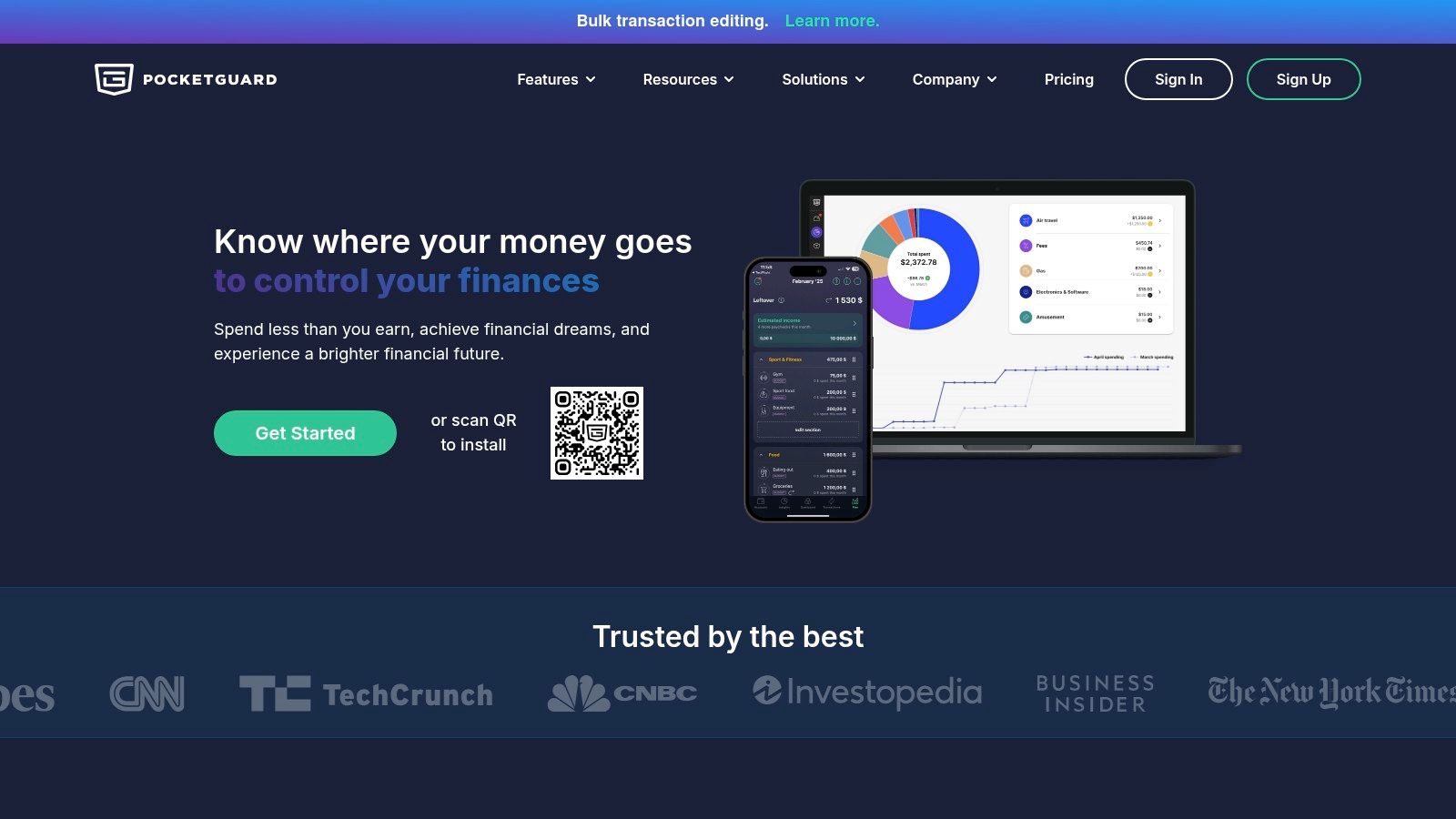

8. PocketGuard #

PocketGuard simplifies budgeting by focusing on one key question: “How much is in my pocket?” It analyzes your income, recurring bills, and spending habits to calculate a “safe-to-spend” amount, providing a clear daily, weekly, or monthly spending limit. This straightforward approach is perfect for busy families who need quick financial guardrails without getting bogged down in complex budgeting methods.

The app’s strength lies in its automation and overview capabilities. PocketGuard automatically categorizes your transactions, tracks your bills to prevent late fees, and even identifies unwanted subscriptions you can cancel to save money. Its debt payoff planner, “In My Pocket,” also helps families create a clear strategy for paying down loans or credit card balances, making it a comprehensive tool for both everyday spending and long-term financial health.

Why It’s a Top Pick for Families #

PocketGuard stands out as a top budget app for families who value simplicity and automation over granular control. The “safe-to-spend” feature is an intuitive tool that helps prevent overspending without requiring constant manual input. While the free version is quite limited, the competitively priced premium plan unlocks powerful features like unlimited accounts, custom categories, and goal tracking, offering significant value for a family managing a busy household.

- Best For: Busy families who want a quick, automated overview of their spending capacity and help with tracking bills and subscriptions.

- Pricing: A limited free version is available. PocketGuard Plus costs $12.99 per month, $74.99 per year, or a one-time lifetime payment of $99.99.

- Availability: Web, iOS, and Android. Bank syncing is available in the US and Canada.

- Website: https://pocketguard.com

9. Rocket Money #

Rocket Money (formerly Truebill) takes a unique approach to family budgeting by focusing on trimming the fat from your monthly expenses automatically. Its primary strength lies in identifying recurring subscriptions and negotiating bills on your behalf, which can free up significant cash flow for a busy family without requiring manual effort. The app analyzes your spending to find forgotten subscriptions, and with your permission, its concierge service will cancel them for you.

For family collaboration, the Premium version allows you to link and share all your financial accounts with a partner. This provides a complete picture of your collective net worth, spending habits, and progress toward savings goals. While its core budgeting tools are solid, the standout features are the automated savings services that work in the background to lower household costs, making it an excellent choice for families who want to save money with minimal hands-on time.

Why It’s a Top Pick for Families #

Rocket Money is one of the best budget apps for families who feel their monthly bills and subscriptions have gotten out of control. The bill negotiation and subscription cancellation features act as a financial assistant, finding savings opportunities you might miss. This automated cost-cutting is a powerful and practical way to improve a family’s financial health.

- Best For: Families looking for an automated way to reduce recurring bills and cancel unwanted subscriptions with minimal effort.

- Pricing: A free version is available with limited features. Premium tiers offer flexible pricing, ranging from $4 to $12 per month (billed annually) or a monthly option. Some services, like bill negotiation, take a percentage of the savings.

- Availability: Web, iOS, and Android apps.

- Website: https://www.rocketmoney.com

10. Copilot Money #

Copilot Money is a beautifully designed, AI-powered smart money app built exclusively for the Apple ecosystem. It excels at providing a visually intuitive overview of your finances by automatically categorizing transactions, tracking recurring bills, and monitoring investments. While it doesn’t offer a native joint account feature for family collaboration, it’s an excellent choice for households where one person manages the finances and shares insights with the rest of the family.

The app’s strength lies in its polished user experience, smart notifications, and powerful insights that help you understand your spending habits without manual effort. Its dashboard presents a clear picture of your cash flow, net worth, and budget progress at a glance. For families invested in Apple products, Copilot provides a seamless and aesthetically pleasing way to stay on top of financial goals.

Why It’s a Top Pick for Families #

Copilot secures its place as a top budget app for families who prioritize a high-quality user experience and powerful, automated insights within the Apple ecosystem. Its intelligent categorization and investment tracking capabilities make it easy for the designated family financial manager to get a comprehensive view and share progress reports. The app’s privacy-first approach, with no ads or data selling, also provides peace of mind.

- Best For: Apple-centric families where one partner takes the lead on financial tracking and wants a modern, automated experience.

- Pricing: Copilot offers a free trial. After the trial, the cost is $13 per month or $95 per year.

- Availability: Available exclusively on iOS (iPhone, iPad) and macOS. Bank syncing is primarily available for US and Canadian institutions.

- Website: https://copilot.money

11. Splitwise #

Splitwise is less of a comprehensive budget app and more of a powerful, specialized tool for tracking shared expenses and IOUs. For families, it excels at simplifying the process of splitting costs for everything from groceries and utility bills to vacation expenses and group gifts. Rather than trying to manage who paid for what in a spreadsheet or notebook, Splitwise provides a running, simplified balance among family members.

Its strength lies in its simplicity and low-friction approach. You can quickly add an expense, assign who owes what, and the app keeps a clear, real-time tally. This makes it perfect for managing day-to-day shared spending without the complexity of a full-fledged budgeting system. For families looking beyond basic bill splitting with tools like Splitwise and needing more comprehensive shared expense management, exploring the dedicated best shared expense tracker app options can offer more robust features.

![]()

Why It’s a Top Pick for Families #

Splitwise makes our list because it solves a common family finance problem with exceptional ease. It removes the awkwardness from “who owes what,” making it easy for partners, adult children, or extended family members to track shared costs transparently. While not a standalone budget app, it serves as an indispensable companion to one.

- Best For: Families, roommates, or couples needing a simple and effective way to track and settle shared expenses and IOUs.

- Pricing: The core features are free. Splitwise Pro, which adds receipt scanning and currency conversion, is available for $2.99 per month or $29.99 per year.

- Availability: Web, iOS, and Android.

- Website: https://www.splitwise.com

12. FamZoo #

FamZoo is less of a traditional budgeting app and more of a hands-on financial education system for the entire family. It revolves around a system of parent-managed prepaid cards for kids and teens, combined with a robust chore and allowance tracker. This unique approach allows parents to teach practical money management skills, like saving, spending, and giving, in a controlled and observable environment. The platform is designed to mimic a real banking experience, helping children understand financial concepts from an early age.

The system uses IOU accounts for younger kids and transitions to prepaid debit cards as they get older, all managed from a central family dashboard. Parents can set up automated allowances, create paid chore lists, and even apply “parent-paid interest” to encourage saving. While its core focus is on children’s financial literacy rather than comprehensive adult budget management, it’s an unparalleled tool for families who want to raise financially savvy kids. The platform’s extensive educational resources and transparent model make it a standout choice for this purpose.

Why It’s a Top Pick for Families #

FamZoo earns its place as a top pick by gamifying financial education and giving children practical, real-world experience with money. It empowers parents to guide their kids’ financial habits directly, a feature that distinguishes it from adult-focused budgeting apps. By integrating these lessons into your household’s routine, you can seamlessly create a family budget that includes everyone.

- Best For: Parents who want to teach their children financial responsibility through a hands-on, card-based system.

- Pricing: FamZoo offers a free trial, with subscriptions starting at $5.99 per month for the whole family. Discounts are available for longer-term plans.

- Availability: Web, iOS, and Android apps. Prepaid cards are available in the US.

- Website: https://famzoo.com

Top 12 Family Budget Apps Comparison #

| Product | Core features | Quality ★ | Price 💰 | Target & USP 👥 ✨ |

|---|---|---|---|---|

| Econumo 🏆 | Collaborative multi-user & joint accounts, multi-currency, manual entry, API, self‑host option | ★★★★☆ | 💰 Self‑host: Free; Cloud planned ~$20–$30 one‑time/user | 👥 Couples, families, travelers • ✨ Privacy‑first, self‑host & manual control |

| YNAB (You Need A Budget) | Zero‑based budgeting, goals, reports, bank connections, household sharing (up to 6) | ★★★★★ | 💰 Subscription (higher); 34‑day free trial | 👥 Families seeking structured budgeting • ✨ Strong budgeting methodology & education |

| Monarch Money | Unlimited account connections & collaborators, budgets, goals, investments, net‑worth | ★★★★☆ | 💰 Subscription; no permanent free tier | 👥 Couples/households wanting planning tools • ✨ Granular sharing & clean planning UI |

| Quicken Simplifi | Custom spending plans, projections, savings & investment tracking, US bank sync | ★★★★☆ | 💰 Paid (often first‑year discounts) | 👥 Families wanting established brand support • ✨ Cash‑flow projections & optional LifeHub |

| EveryDollar (Ramsey) | Zero‑based monthly budgets, paycheck planning, optional paid bank connections | ★★★☆☆ | 💰 Free basic; paid plan for bank links & best features | 👥 Beginners / Ramsey followers • ✨ Simple zero‑based workflow & educational tie‑ins |

| Honeydue | Shared budgets & bills, transaction comments, privacy controls, alerts | ★★★☆☆ | 💰 Free with optional features | 👥 Couples who want partial sharing • ✨ Flexible privacy and communication tools |

| Goodbudget | Envelope‑style budgeting, shared budgets across devices, Premium bank sync | ★★★☆☆ | 💰 Free limited; Premium for more envelopes & bank sync | 👥 Hands‑on families using envelope method • ✨ Simple category-based discipline |

| PocketGuard | Safe‑to‑spend view, rollover budgeting, goals, subscription tracking, automation | ★★★★☆ | 💰 Free basic; Premium subscription | 👥 Busy households wanting quick guardrails • ✨ Fast setup & strong automation |

| Rocket Money | Subscription tracking/cancellation, bill negotiation, budgets, splits | ★★★★☆ | 💰 Free + paid Premium/services (negotiation fees possible) | 👥 Families trimming recurring costs • ✨ Concierge bill negotiation & subscription savings |

| Copilot Money | Real‑time transaction classification, budgets, investment tracking (iOS/macOS) | ★★★★☆ | 💰 Free trial; paid tiers | 👥 Apple‑centric households • ✨ Polished iOS/macOS experience & privacy focus |

| Splitwise | Shared ledgers, IOUs, settle‑up reminders, Pro: receipts & currency conversion | ★★★★☆ | 💰 Free basic; Pro paid | 👥 Roommates, couples, groups • ✨ Low‑friction shared expense tracking |

| FamZoo | Parent‑managed prepaid cards, IOU accounts, family dashboard, chore/allowance tools | ★★★★☆ | 💰 Family pricing covers members; card logistics/fees possible | 👥 Parents teaching kids/teens • ✨ Prepaid cards + allowance & chore management |

Choosing and Implementing Your Family’s New Budgeting System #

Navigating the landscape of financial apps can feel overwhelming, but you’ve just reviewed twelve of the strongest contenders on the market. From the zero-based budgeting philosophy of YNAB to the kid-focused system of FamZoo, the perfect tool for your family is within reach. The journey to financial clarity doesn’t end with reading reviews; it begins with making a choice and taking that first, crucial step.

The key takeaway is that the best budget app for families isn’t a one-size-fits-all solution. It’s the one that aligns with your family’s unique communication style, financial goals, and comfort level with technology. Your ideal app is a tool that reduces financial stress, not one that adds another complicated task to your to-do list.

Distilling Your Decision: Three Core Questions #

Before you download a single app, sit down with your partner and discuss what you truly need. Boiling it down to a few key priorities will instantly narrow the field from a dozen options to just two or three.

- Automation vs. Mindfulness? Do you want an app that automatically syncs with your bank accounts for a hands-off, real-time overview (like Monarch Money or Copilot)? Or do you prefer the intentional, privacy-focused approach of manual entry, which forces you to be more mindful of every dollar spent (a core strength of Econumo and Goodbudget)?

- Simplicity vs. Power? Is your main goal to track shared bills and basic spending without fuss (Honeydue)? Or do you need a powerful, all-in-one platform that handles investments, net worth, and complex financial goals (Quicken Simplifi)?

- Whose Budget Is It? Are you solely managing household finances between adults? Or is teaching your children financial literacy a key objective? If it’s the latter, a dedicated tool like FamZoo might be a better fit than a general-purpose budgeting app.

Your Action Plan: From Selection to Success #

Once you have a front-runner in mind, it’s time to put your plan into action. A successful implementation is about process and collaboration, not just technology.

- Schedule a “Money Date”: Set aside a specific, low-stress time to tackle this together. Order takeout, pour a glass of wine, and make it a positive, collaborative meeting. Avoid trying to set up a new system when you’re tired or rushed.

- Start Small and Simple: Don’t try to create the perfect, multi-category budget for the next twelve months on day one. Your initial goal is simple: get the app set up and track your spending for one full month. This gives you a realistic baseline of your family’s actual financial habits.

- Assign Clear Roles (If Needed): In some families, one partner naturally takes the lead on finances. Decide who will be responsible for entering transactions, categorizing expenses, or initiating the weekly check-in. Clarity prevents confusion and ensures the system is actually used.

- Embrace the Trial Period: Almost every paid app offers a free trial. Use it to its full potential. Connect your accounts, create a test budget, and see how it feels in your daily life. If it feels clunky or unintuitive after a week, it’s not the right fit, and that’s okay.

Choosing the right tool is about empowering your family to work as a team toward shared financial goals. Whether you’re saving for a down payment, planning a family vacation, or simply trying to get a better handle on your monthly cash flow, the right app transforms budgeting from a chore into a shared project. It’s a powerful step toward building a more secure and intentional financial future together.

If your family values privacy, control, and a mindful approach to your finances, your search for the best budget app for families might end right here. Econumo is designed for those who want a secure, self-hosted system without sacrificing a beautiful and user-friendly experience. Take control of your financial data and build your budget on your own terms by visiting Econumo to learn more.