So, what’s a realistic grocery budget for one person? Most people can expect to spend somewhere between $300 and $400 a month. But let’s be honest, that’s just a ballpark figure. Your actual spending will really depend on what you eat, where you live, and how you shop.

Understanding the National Averages for Groceries #

It’s helpful to think of the national average as a starting point—a useful but imperfect yardstick for your own spending. It gives you a general feel for what others are spending, but it doesn’t really get into the nitty-gritty of individual lifestyles.

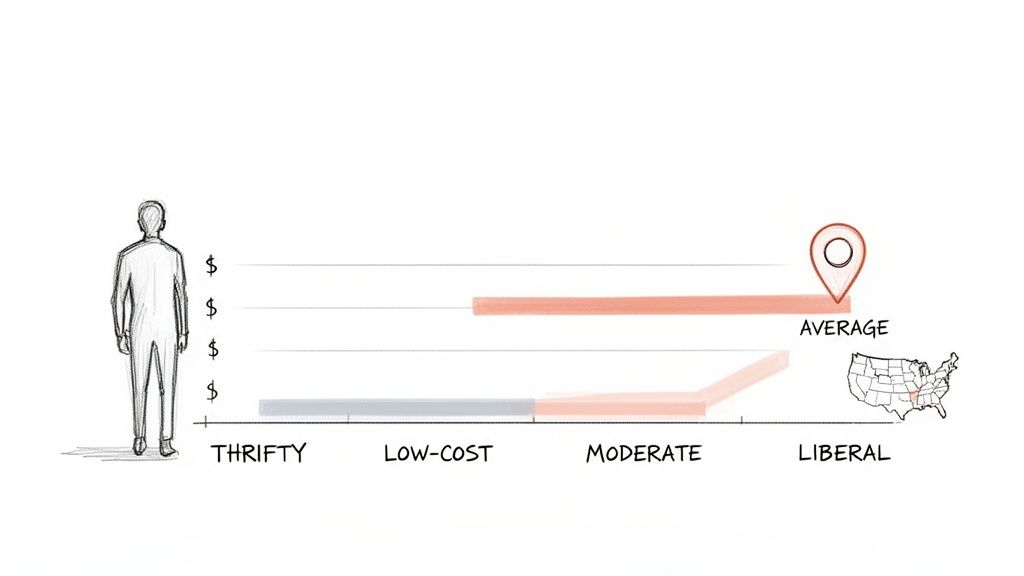

For a much clearer picture, we can look at the official numbers from the U.S. Department of Agriculture (USDA). They’ve done the hard work of breaking down costs into different spending styles, which makes it easier to see where you might fit in. These plans help turn abstract government data into something you can actually use.

USDA Monthly Grocery Estimates for One Person #

To give you a better benchmark, let’s look at how the USDA breaks down their official food plans. Each level reflects a totally different approach to grocery shopping, from being incredibly frugal to allowing for more splurges on high-end or prepared foods.

Here’s a quick look at the average monthly grocery costs for one person, based on those different spending levels.

Monthly Grocery Budget Estimates for One Person #

| Food Plan Level | Estimated Monthly Cost |

|---|---|

| Thrifty Plan | $297 - $372 |

| Low-Cost Plan | $318 - $371 |

| Moderate-Cost Plan | $392 - $465 |

| Liberal Plan | $499 - $566 |

As you can see, there’s no single “right” amount to spend on groceries. Your personal average will almost certainly land somewhere in this range, depending on your lifestyle and priorities.

Your grocery bill is one of the most flexible parts of your budget. Unlike fixed costs like rent, you have significant control over how much you spend on food each month.

It’s also impossible to ignore the elephant in the room: inflation. Since early 2020, we’ve seen grocery prices jump by a whopping 29%. Certain items like eggs and beef have seen even bigger price hikes.

As a general guideline, a single adult cooking most meals at home might aim to spend between $328 and $388 monthly. But knowing how much prices have fluctuated is key to setting a budget that actually works.

Of course, groceries are just one part of your overall financial life. To see how your food spending stacks up against other common costs, take a look at our complete list of household expenses.

Why Your Grocery Bill Is So Unique #

Trying to compare your grocery spending to a national average is a bit like comparing your daily commute to a cross-country road trip. Sure, both involve driving, but the details make them completely different worlds. The average grocery cost for one person is a helpful benchmark, but it flattens out all the personal factors that make your food budget yours and yours alone.

Think of it this way: your grocery bill is your own personal recipe. The core ingredients are where you live, what you eat, and how you shop. Change just one of those things, and the final cost can change dramatically.

Location: The Main Ingredient in Your Grocery Bill #

Where you live has a huge impact on what you pay for food. Prices aren’t the same everywhere—not by a long shot. They swing based on things like local taxes, how far food has to travel to get to you, and what’s available nearby. It’s no surprise that someone shopping in a major city like New York or San Francisco will have a much higher bill than someone in a small town in the Midwest.

For instance, groceries in Hawaii and Alaska are notoriously expensive because nearly everything has to be shipped in. On the flip side, a state like California with its massive agricultural industry might have cheaper produce. This geographical lottery can easily account for a 35% difference or more in your grocery costs.

Your zip code is one of the biggest predictors of your food spending. Two people with identical diets and shopping habits can have wildly different monthly bills simply because they live in different parts of the country.

Your Diet and Shopping Habits Stir the Pot #

After location, your personal choices are what really shape your spending. This is where the budget gets truly personal and explains why you and your next-door neighbor could have vastly different grocery bills.

What you choose to eat is a massive driver. If you follow a specific diet, you’re often paying a premium for it.

- Organic: Going all-organic on produce, meat, and dairy can easily inflate your bill by 20% to 100% on those items compared to their conventional counterparts.

- Vegan or Vegetarian: This can be a money-saver if you stick to staples like beans, lentils, and tofu. But if you’re loading up on specialty plant-based meats and cheeses, the cost can quickly climb.

- Keto or Gluten-Free: These diets often lean on expensive ingredients like almond flour, specialty oils, and specific cuts of meat, which adds up fast.

Finally, your shopping habits put the finishing touches on your bill. Where you shop and what brands you buy make a tangible difference. Shopping exclusively at a high-end health food store will naturally cost more than doing your weekly run at a discount grocer like Aldi. And consistently reaching for name-brand products instead of the store-brand version can add up to 25% to your total over time.

All these pieces—location, diet, and shopping style—come together to create a grocery budget that is as unique as you are. Getting a handle on these drivers is the first real step toward taking control and building a food budget that actually works for your life.

How Food Costs Change Around the World #

We’ve seen how much your neighborhood can affect your grocery bill, but let’s zoom out. A global view really puts things into perspective. The average grocery cost for one person doesn’t just shift from state to state; the differences between countries are often staggering. Understanding this can be a game-changer, whether you’re planning a move, an extended trip, or are just curious about how your spending stacks up globally.

So, how do you even compare the cost of a carton of milk in New York to one in Nigeria? Economists use what’s called a food cost index. It’s basically a scoring system that sets a benchmark—in this case, New York City gets a score of 100. Every other city is then measured against it.

A score under 100 means groceries are cheaper than in NYC, while a score over 100 means you’ll be paying more. It’s a simple way to make sense of a really complex global economy.

Global Highs and Lows in Grocery Spending #

When you start looking at the numbers, you see just how wild the differences are. According to recent global data, the average monthly food expense for one person worldwide is about $361, using New York City as the standard for comparison.

But that average hides the extremes. The data reveals some truly eye-opening highs and lows:

- Most Expensive: The priciest spots are often remote islands. Norfolk Island, for instance, has an index score of 220. That means groceries there are more than double the cost of NYC, with a single person’s monthly food bill hitting around $1,100.

- Most Affordable: In contrast, countries with a much lower cost of living have incredibly low food expenses. Nigeria has an index of just 14, which means a person might only spend $70 a month on groceries.

This global view teaches us a critical lesson: location isn’t just a minor detail in your budget. It’s one of the biggest drivers of your day-to-day expenses.

These figures aren’t just fun facts; they show why your financial plan needs to be flexible. Knowing how much geography impacts your wallet is crucial, whether you’re moving across the country or just trying to get a handle on your own spending. You can dive deeper and explore the complete World Food & Groceries Cost Index to see how different nations compare.

Ultimately, this worldwide context proves there’s no magic number for what you “should” spend on food. Your budget is deeply personal, and where you live plays a leading role. That’s why the most effective way to manage your money is to build a budget based on your own reality, not on a generic average.

Navigating the Reality of Food Inflation #

If you feel like your grocery bill is inching up every month, you’re not just imagining things. Food inflation is a real and constant pressure on our budgets. It quietly adds a few dollars here and there, and before you know it, your monthly total is a lot higher than you expected.

It’s kind of like a slow leak in a tire. It doesn’t happen all at once, but over time, it definitely makes a difference.

This steady climb in prices totally changes the math behind the average grocery cost for one person. A budget that felt perfectly comfortable six months ago might feel pretty tight today. This is exactly why a “set it and forget it” approach to your grocery budget just doesn’t cut it anymore. You have to stay aware of these shifts to keep your finances on track.

Understanding Price Trends and Forecasts #

It’s one thing to notice your go-to cereal costs fifty cents more, but it’s another to understand the bigger picture. Economic forecasts can sound dense and complicated, but they actually give us good clues about what’s coming at the checkout line. Experts look at everything from weather patterns hitting crops to global shipping problems to predict where food prices are headed.

For example, forecasts for 2026 suggest that grocery prices (what economists call “food-at-home”) will keep rising by about 2.3%. That might not sound like a huge number, but it’s a steady creep that adds up across every single item you buy. For a closer look at these predictions, you can dig into the complete food price outlook from the USDA.

Inflation isn’t just some abstract concept for economists to debate. It’s the simple reason that $100 buys you fewer groceries this year than it did last year. The best way to fight back is to actively manage your budget.

Which Food Categories Are Most Affected #

Inflation doesn’t spread evenly across the grocery store. Some aisles get hit much harder than others, and knowing which items are most likely to see price jumps can help you shop smarter.

Historically, some of the main culprits for price hikes include:

- Proteins: The cost of beef, chicken, and eggs can swing wildly. This is often tied to things like the price of animal feed or even disease outbreaks that affect supply.

- Fresh Produce: Fruits and veggies are super sensitive to seasonality, weather events like a drought or flood, and rising transportation costs.

- Dairy Products: The price tags on milk, cheese, and butter are directly linked to the costs of running a dairy farm and processing the products.

So, when you see those headlines about food costs soaring, it often comes back to these specific categories. Paying attention to these trends lets you adjust on the fly. Maybe you swap out ground beef for lentils or chicken this week because beef prices are through the roof. Being a flexible shopper is your best strategy for dealing with food inflation.

How to Build Your Own Food Budget #

Knowing the average grocery cost for one person is a good starting point, but the real magic happens when you get a handle on your own spending. The shift from knowing the numbers to owning them means creating a budget that actually fits your life. Don’t worry, this isn’t about complicated spreadsheets—it’s about building smarter, more mindful spending habits.

The best way to kick things off is to play detective with your own finances for a month. Seriously. Track every single dollar that goes toward food. This means the big weekly grocery trip, the quick run for milk, your morning coffee, and that takeout lunch you grabbed on Tuesday.

This isn’t about judging yourself; it’s just about collecting the facts. Think of it as a personal finance experiment to find your baseline. You might be surprised at what you discover—those little purchases have a funny way of adding up.

Establishing Your Spending Baseline #

You don’t need any fancy software to get started. A simple notebook, a note on your phone, or a basic spreadsheet will do the trick. The only rule is to be consistent. By the end of the month, you’ll have a crystal-clear picture of your true food spending, which is the rock-solid foundation for any realistic budget.

This process is especially important today. As prices climb, you can feel the strain on your wallet, making it crucial to plan ahead.

As this shows, rising costs directly squeeze your budget, highlighting why a proactive plan is your best defense.

Once you have your total, you can start building a simple budget. A great first step is to sort your expenses into categories to see where the money is really going. This is a core concept for managing your finances, and you can dive deeper in our complete guide to tracking income and expenses.

A budget isn’t a financial straitjacket; it’s a tool for empowerment. It gives you the information you need to make intentional choices about your spending instead of letting your spending happen to you.

Creating a Simple Budget Template #

After a month of tracking, you can organize that data into a real, working budget. This is where you start telling your money where to go, instead of wondering where it went.

Here’s a sample template to get you started. It helps you categorize your spending and see how your plan stacks up against reality.

Sample Monthly Grocery Budget for One Person #

| Expense Category | Budgeted Amount | Actual Spent | Difference |

|---|---|---|---|

| Groceries (Home Cooking) | $250.00 | $275.00 | -$25.00 |

| Coffee Shops/Cafes | $40.00 | $55.00 | -$15.00 |

| Lunches (Work/Takeout) | $60.00 | $45.00 | +$15.00 |

| Snacks/Convenience | $30.00 | $35.00 | -$5.00 |

| Total Food Spending | $380.00 | $410.00 | -$30.00 |

This simple table instantly reveals where you overspent and where you came in under budget. Armed with this insight, you can make smarter adjustments for next month and turn reactive spending into a proactive financial strategy.

Smart Strategies to Lower Your Grocery Bill #

Once you’ve tracked your spending for a few weeks, you get to be the boss of your budget. The great news is that cutting your grocery bill doesn’t mean a life of sad, boring meals. It’s all about making small, smart changes that add up over time, helping you bring down your personal average grocery cost.

And don’t worry, you can forget about spending hours clipping coupons. Modern saving is about working smarter, not harder. A great first step is to plan your meals around whatever’s on sale at your local store. This one switch flips your whole shopping mindset from “what do I want?” to “what’s a great deal this week?”

Master Your Kitchen and Pantry #

One of the single most effective ways to slash your spending is to stop throwing away food. It sounds simple, but it’s huge. A fantastic way to do this is the “cook once, eat twice” method. When you make dinner, just cook a double batch. Pack the leftovers for lunch the next day, and you’ve instantly saved yourself from buying a pricey meal out.

Your freezer and pantry are your best friends in this mission.

- Freeze Strategically: See a great sale on chicken, bread, or berries? Buy in bulk and freeze it. This locks in that low price and makes sure you always have ingredients ready to go.

- Shop Your Pantry First: Before you even think about writing a grocery list, take a look at what you already have. Building a meal around items that need to be used up keeps food from expiring and stops you from buying something you already own.

The goal isn’t just to spend less; it’s to get more value from every dollar you spend on food. Smart planning turns your kitchen into a hub of savings.

Become a Savvy Shopper #

Finally, a few simple habits at the grocery store itself can make a massive difference. Always look at the unit price—that little number on the shelf tag that shows the cost per ounce or per item. It tells you which product is truly the better deal, no matter the package size.

Choosing store brands over big-name brands is another easy win. You can often save up to 25% without noticing a difference in quality. It’s one of the simplest swaps you can make.

By combining these strategies, you’ll start to see your grocery spending drop. If you want to make saving even more engaging, check out our guide on the 100 envelope challenge printable to turn it into a fun game.

Got Questions About Your Grocery Budget? We’ve Got Answers. #

As you start to figure out your own grocery budget, you’re bound to have some questions. Everyone does. Let’s walk through a couple of the most common ones that come up when people are trying to get a handle on their food spending.

Is Going Organic Going to Break My Budget? #

Let’s be real: organic food costs more. You can expect to pay anywhere from 20% to 100% more for organic items compared to the regular versions, especially for things like meat, dairy, and certain fruits and veggies.

But it doesn’t have to be an all-or-nothing game. A smart way to approach it is by focusing on the “Dirty Dozen”—a list of produce known for having higher pesticide levels. Splurge on the organic versions of those, and then save your money by buying conventional for things with thick peels you don’t eat, like bananas or avocados. It’s a great middle ground.

How Often Do I Need to Mess With My Budget? #

It’s a great idea to give your spending a quick look-over each month to see where your money went. But you probably don’t need to do a major overhaul of your budget more than once every 6 to 12 months.

The big exceptions are major life changes. If you move to a new city, have to adopt a new diet for health reasons, or we hit a rough patch of high inflation, you’ll definitely want to revisit your numbers.

Think of your budget as a living document. It should adapt to your life, not the other way around. A periodic check-in ensures it always reflects your current reality.

This way, your budget stays useful and realistic without you having to stress over every single penny, every single day.

Ready to take full control of your finances? Econumo is a collaborative budgeting app designed for modern households. Plan shared goals, manage joint accounts, and build mindful spending habits with our flexible, privacy-focused platform. Try the live demo on Econumo.com and see how easy collaborative budgeting can be.