With Mint’s shutdown official, many of us are looking for a new place to manage our money. The top alternatives to Mint finance are apps like Monarch Money, YNAB, and Tiller. These aren’t just simple replacements; they offer features that modern users actually need, like collaborative household budgeting, better privacy controls, and multi-currency support.

Navigating Your Finances After Mint #

The end of Mint has left millions searching for a new financial home. For years, Mint was the go-to for free, automated budget tracking. But let’s be honest, its one-size-fits-all approach often felt lacking for anyone with slightly more complex needs.

Luckily, the world of personal finance apps has grown up. Today, you can find specialized tools that fill the exact gaps Mint left behind. This guide is here to help you find the right one by focusing on what really matters in a modern budgeting app.

We’re going to skip the generic feature lists and give you a clear framework for making your decision. The goal isn’t just to replace Mint; it’s to find a genuinely better tool that fits your financial life.

Key Evaluation Criteria for Mint Alternatives #

When you’re looking for a replacement, it’s easy to get bogged down in basic expense tracking. But the best apps out there do so much more, catering to very specific priorities and life situations.

Here are the core features we’ll use to compare the top contenders:

- Collaborative Budgeting: Absolutely crucial for couples and families. You need to be able to manage shared accounts, split bills easily, and work on financial goals together.

- Privacy and Data Control: This is a huge concern for a lot of people now. We’ll look at apps that offer self-hosting or at least have crystal-clear data privacy policies.

- Manual Transaction Workflows: Some of us prefer a hands-on approach. Manually entering transactions can build much healthier spending habits than relying on a bank sync you ignore.

- Multi-Currency Support: If you travel often, live abroad, or deal with money in different countries, this is a deal-breaker.

The search for a Mint replacement is a great opportunity to upgrade your financial toolkit. Instead of just finding a clone, think about what was missing from Mint and choose an app that solves those specific problems for you.

High-Level Comparison of Popular Choices #

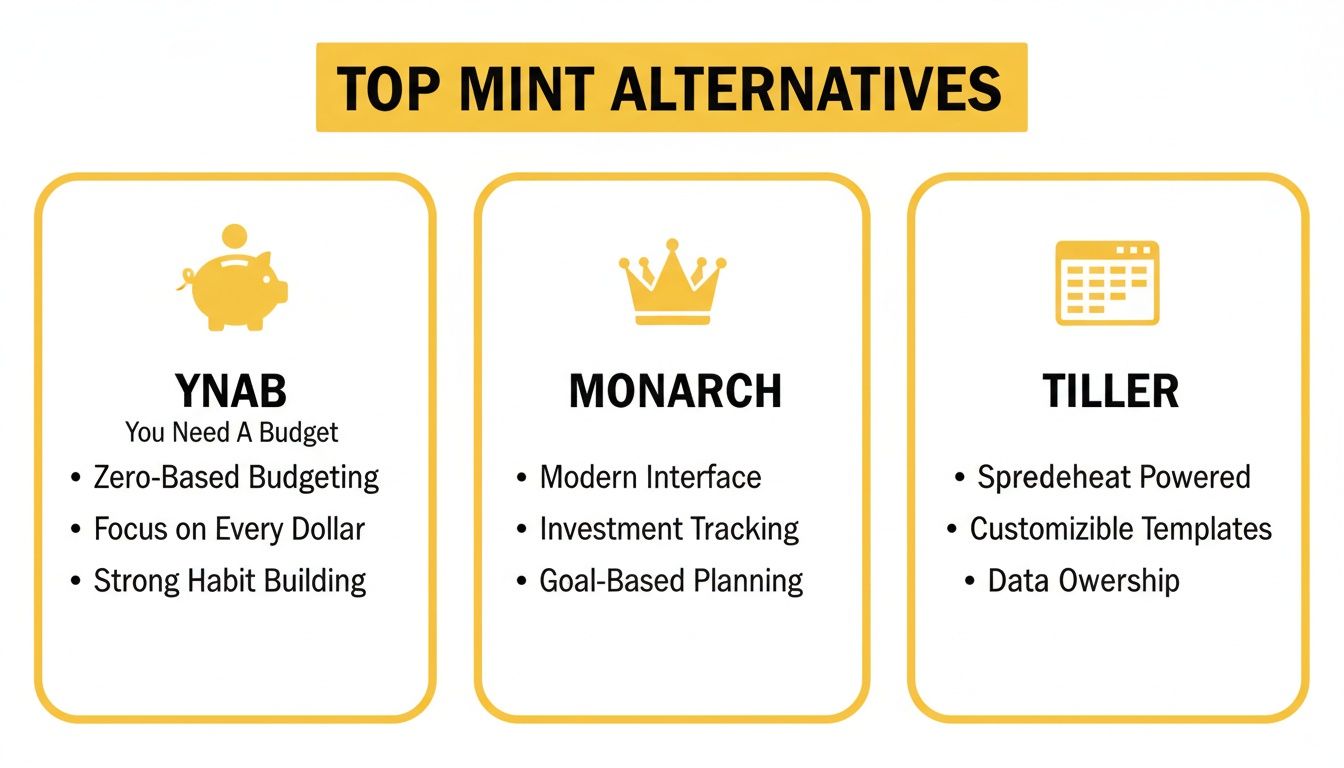

To get a quick lay of the land, let’s see how a few of the most popular alternatives stack up against these modern needs. Each tool has its own philosophy—from YNAB’s strict, envelope-style methodology to Tiller’s complete flexibility in a spreadsheet. Understanding these core differences is the first step to finding the perfect fit.

| Feature | Monarch Money | YNAB | Tiller | Econumo |

|---|---|---|---|---|

| Household Collaboration | Strong | Good | Moderate | Excellent |

| Privacy (Self-Hosting) | No | No | No | Yes |

| Manual Entry Focus | Hybrid | Hybrid | Hybrid | Strong |

| Multi-Currency | Limited | No | Limited | Yes |

Why People Were Already Moving On From Mint #

Even before the news broke about its shutdown, a lot of us were already on the hunt for alternatives to Mint finance. Mint was a game-changer back in the day, offering free, automated budgeting to the masses. But as our financial lives got more complicated, its cookie-cutter approach started to feel restrictive.

It just wasn’t keeping up. People needed more control and flexibility than Mint’s rigid system could offer, which opened the door for a new wave of budgeting tools designed for real life.

The Need for a True Household Budget #

One of the biggest frustrations with Mint was its complete lack of features for joint finances. If you were a couple trying to manage a household budget, track shared expenses, or save for a family vacation, you were out of luck. It forced you and your partner to manage everything in separate, disconnected accounts.

This pain point alone sent countless users searching for apps built for collaboration. Families and partners needed a shared dashboard to see the full picture—who paid for what, how much was left in the grocery budget, and whether they were on track for their goals.

Taking Back Control of Financial Data #

With data privacy becoming a major topic of conversation, the idea of giving a third-party app your bank login credentials started to feel pretty uncomfortable. People began asking tough questions about who really owned their financial data and what was being done with it.

This shift sparked a huge interest in tools that put security and control back in the user’s hands. Self-hosted platforms became a popular solution, allowing you to keep all your sensitive financial information on your own private server. We cover this topic in more detail in our guide to open-source personal finance software.

The core issue was control. Users wanted to move from being passive observers of their finances to active participants, and Mint’s rigid, automated system often stood in the way.

The Return to Mindful, Manual Budgeting #

Mint’s big selling point was its automated bank syncing. While convenient, it also encouraged a hands-off, passive approach to money management. Transactions would just show up, and it was easy to lose touch with your actual spending habits.

A counter-movement started to form around a more intentional, manual approach. The simple act of logging each expense makes you stop and think about your purchases, which is incredibly powerful for building better financial habits. People began looking for tools that not only supported manual entry but embraced it as a key feature.

It’s also worth noting that while Mint felt like a consumer app, its user base was surprisingly corporate. Market analysis from Enlyft reveals that 37% of Mint’s customers were large enterprises with over $1 billion in revenue, while small businesses made up just 36%. This data suggests its core design may have been fundamentally misaligned with the specific needs of everyday individuals and households.

Comparing the Top Mint Alternatives #

Choosing a new personal finance tool feels a lot like picking a financial advisor. The best one isn’t just about flashy features; it’s about finding a philosophy that clicks with your goals and how you live. The world of alternatives to Mint finance is packed with options, and each one is built for a different kind of person.

Instead of just running down a checklist, we’re going to dig into what makes each of the top contenders truly shine. We’ll frame this comparison around real-world needs to help you find the tool that will actually make a difference in your financial life.

Best for Collaborative Households: YNAB vs. Monarch Money #

For anyone managing money with a partner or family, this is a big one. Mint’s single-user setup was a constant headache for households trying to budget together. Two platforms, YNAB and Monarch Money, have really nailed this, but they do it in very different ways.

YNAB (You Need A Budget) is all about its strict, proactive method. It makes you and your partner “give every dollar a job” before you spend it. This forces you to talk constantly and get on the same page about your financial priorities.

- Shared Methodology: You’re both playing by the same rules, which creates a truly unified financial plan.

- Joint Decision-Making: The YNAB system basically requires you to discuss and agree on where your money is going.

- Goal Alignment: It’s fantastic for tackling shared goals, like saving for a house or crushing debt as a team.

Monarch Money, on the other hand, gives you a flexible, dashboard-first experience. You can invite your partner and connect everything—joint accounts, individual accounts, you name it—into one clean, comprehensive view. This is perfect for couples who want total transparency without having to completely merge how they manage their day-to-day money.

YNAB is like a structured financial workshop for your household, enforcing discipline and communication. Monarch Money is like a shared financial command center, offering transparency and flexibility. Choose YNAB for its system; choose Monarch for its dashboard.

The real difference is philosophical. YNAB is prescriptive; it teaches you a specific way to handle money. Monarch is descriptive; it shows you the full picture of your combined finances and trusts you to decide what to do next. If your household needs a system to follow, go with YNAB. If you’ve already got a system and just need a better tool to see it all, Monarch is the clear winner.

Top Choice for Privacy and Control: Self-Hosted vs. Cloud Apps #

With data breaches becoming a regular headline, the idea of truly owning and controlling your financial data is more appealing than ever. This is where self-hosted apps like Econumo have a serious edge over cloud-based tools. A self-hosted app runs on your own server, which means your sensitive financial history never leaves your sight.

This is a world away from cloud services like Simplifi or Monarch, where your data sits on their servers. Sure, these companies invest a fortune in security, but at the end of the day, you’re trusting them. For many, the peace of mind that comes with total data ownership is well worth the little bit of initial setup. You can see more options in our guide covering the best free budgeting software, which includes several self-hosted choices.

Ideal for Manual Budgeting: Tiller vs. Others #

The grab-and-go convenience of automatic bank syncing—Mint’s biggest draw—can sometimes make you a passive observer of your own finances. For people who believe in the power of mindful spending, manual transaction entry is an absolute must-have. This hands-on approach forces you to acknowledge every single purchase, building a much deeper awareness of your spending habits.

Tiller has brilliantly carved out a space for itself by mixing automation with the manual control of Google Sheets and Microsoft Excel. It automatically pulls in all your transactions, but from there, you have total freedom to categorize, analyze, and build whatever custom reports you can dream up. This makes it a huge favorite among data nerds who want the raw numbers without being stuck inside a restrictive app.

- Ultimate Flexibility: If you can imagine it in a spreadsheet, you can build it with Tiller.

- Data Ownership: Your transaction history lives in your personal Google or Microsoft account, not on a third-party server.

- Automation with Control: It handles the boring part (importing data) but leaves you in the driver’s seat for the analysis.

While apps like YNAB and Monarch also let you add transactions by hand, their main workflow is built around bank syncing. Tiller is designed from the ground up for people who love to get their hands dirty with the data.

Built for Global Lifestyles: Analyzing Multi-Currency Support #

If you’re a digital nomad, an expat, or just anyone who deals with money in different countries, most budgeting apps are flat-out useless. They often lock you into one currency, making it impossible to get an accurate picture of your net worth or create a sensible budget.

This is a massive gap in the market, as many popular alternatives to Mint finance have weak or nonexistent multi-currency features. YNAB, for instance, is famously single-currency only. And while some apps let you connect international accounts, they often just convert everything to your home currency at whatever the daily rate is, which can really distort your financial picture.

This is where a purpose-built tool makes all the difference. A platform with real multi-currency support lets you:

- Hold accounts in their native currencies: A EUR account is tracked in EUR, and a USD account is tracked in USD. Simple.

- Set budgets in local currencies: Your grocery budget in Germany is in Euros, not some fluctuating dollar amount.

- View a consolidated net worth: The app should give you an accurate, real-time total of your net worth, cleanly converted to the currency of your choice.

Without these basics, you’re stuck juggling spreadsheets or just guessing about your financial health. For a global citizen, true multi-currency support isn’t a nice-to-have; it’s essential for sound financial planning. The competition to win over former Mint users is fierce, and we’re seeing apps zero in on specific strengths. For example, Tiller connects to over 21,000 US financial institutions, while Simplifi supports over 14,000, highlighting a deep focus on the domestic market. You can read more about this competitive landscape in this detailed market analysis.

Feature Comparison of Top Mint Alternatives #

To help you see how these leading contenders stack up, here’s a side-by-side look at the features we’ve discussed. This isn’t just about checkmarks; it’s about understanding the core design choices each platform has made.

| Feature | YNAB | Monarch Money | Tiller | Econumo |

|---|---|---|---|---|

| Best For | Strict, proactive budgeting; couples needing a shared system | Household dashboards; flexible budgeting; investment tracking | Spreadsheet lovers; DIY budgeters; data control | Privacy-focused users; manual budgeters; multi-currency needs |

| Joint/Household | Yes, designed for it via “Together” feature | Yes, best-in-class with roles and a single dashboard view | Yes, via spreadsheet sharing (Google/Microsoft) | Yes, by sharing access to the self-hosted instance |

| Privacy/Self-Hosted | No, cloud-based | No, cloud-based | Partial (data is in your spreadsheet, but Tiller’s service is cloud) | Yes, fully self-hosted |

| Manual Workflow | Yes, but heavily favors bank syncing | Yes, but primarily designed for automated syncing | Yes, core to its spreadsheet-based workflow | Yes, designed for a manual-first approach |

| Multi-Currency | No, single-currency only | Limited (connects accounts, but converts to a base currency) | No, requires manual workarounds in the spreadsheet | Yes, full native support for multiple currencies |

| Price | $99/year | $99.99/year | $79/year | Free (self-hosted) |

This table makes it clear that there’s no single “best” tool—the right choice depends entirely on what you prioritize. If you need a strict system to follow with a partner, YNAB is built for that. If you value a beautiful, all-in-one dashboard with investment tracking, Monarch excels. For ultimate control and flexibility, Tiller is unmatched. And for those who put privacy, manual control, and multi-currency support above all else, Econumo offers a unique and powerful solution.

Putting It All Together: Which App Fits Your Life? #

Theory is one thing, but the real test is how these alternatives to Mint finance actually work in the wild. To help you cut through the marketing noise, let’s walk through a few common scenarios and see which app really shines for each. It’s a lot easier to make a decision when you can picture yourself using the tool.

This quick overview gives you a visual snapshot of the big players—YNAB, Monarch, and Tiller—and what they bring to the table.

As you can see, there’s a clear trade-off. You’re either choosing the disciplined structure of YNAB, the slick and flexible dashboards of Monarch, or the deep data control of Tiller.

The Family Juggling Shared and Personal Finances #

Let’s imagine Alex and Jamie, a couple with two kids. They use a joint checking account for all the household bills but also have their own separate accounts for personal spending. Their biggest challenge is finding a tool that gives them a complete picture of their shared financial life while still allowing for some individual autonomy.

Monarch Money feels like it was designed specifically for this. Its collaborative dashboard is its killer feature, letting Alex and Jamie do a few key things:

- Link everything: They can connect their joint account, personal accounts, investment portfolios, and even the kids’ savings accounts all in one spot.

- Set shared goals: Planning for a big family vacation or a kitchen remodel is easy because they can create and track progress together.

- Keep things private: Each partner can see the big picture without having to get into the weeds of the other’s personal day-to-day spending.

While a tool like YNAB can work for couples, its strict “give every dollar a job” method can feel a bit rigid for a family that already has a system that mostly works. Monarch delivers the transparency they need with the flexibility they want.

The Digital Nomad Couple Managing Multiple Currencies #

Now, let’s think about Ben and Sofia. They’re freelance developers who split their time between Portugal and Thailand. They get paid in USD, handle daily expenses in EUR and THB, and keep some savings in a CAD account. For them, most standard budgeting apps are completely useless.

This is where a tool with genuine multi-currency support, like Econumo, becomes a game-changer. It’s not just a nice-to-have; it’s essential. With it, they can:

- Track accounts in their native currency: Their Portuguese bank account shows up in EUR, and their Thai account is in THB. No more messy mental conversions.

- Budget like a local: They can set a realistic grocery budget in Thai Baht without constantly trying to figure out what that means in dollars.

- See a consolidated net worth: With just a click, they get an accurate, up-to-date picture of their total net worth, automatically converted into their currency of choice.

For anyone living a global lifestyle, multi-currency support isn’t a feature—it’s the entire foundation of a functional budget. Without it, you’re just guessing.

The Privacy-Focused User Who Wants Full Data Control #

Finally, meet Maya. She’s a software engineer who has grown deeply uncomfortable with the idea of handing her bank login credentials over to third-party cloud services. After years on Mint, she’s decided her next tool must give her total ownership of her financial data.

For Maya, a self-hosted app is the only real answer. Econumo’s self-hosting option delivers the ultimate control and privacy. By running the software on her own server, she can be 100% certain that her sensitive financial information never leaves her direct control. This simple move completely eliminates the risk of her data being exposed in a company-wide breach.

Of course, this level of control means she’s responsible for her own setup and security. But for someone who values data sovereignty above all else, that trade-off brings invaluable peace of mind. As the personal finance market attracts more investment, we’re seeing more innovation in these specialized areas. You can explore more about the financial trends shaping these tools to see where the industry is headed.

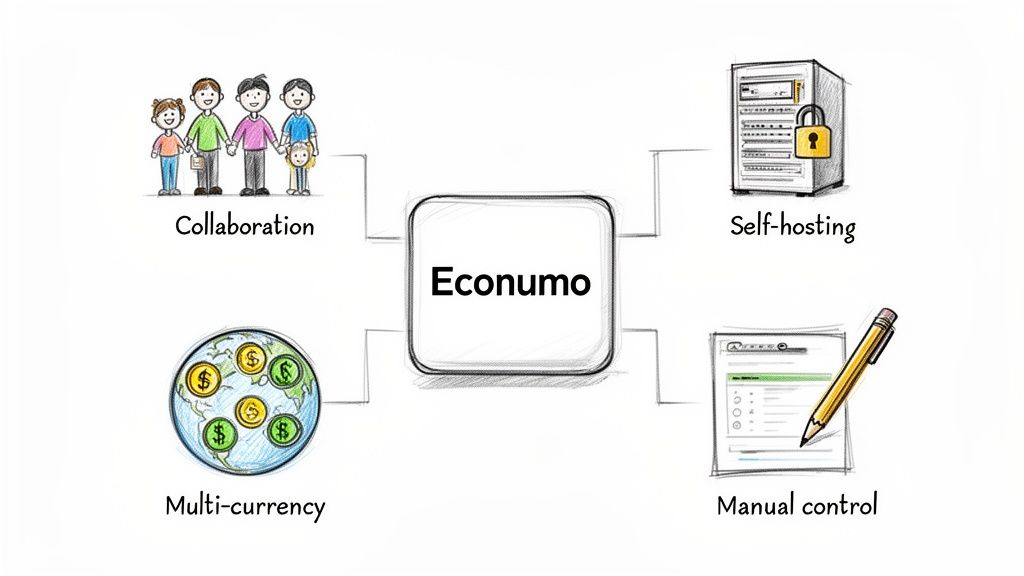

How Econumo Addresses Modern Budgeting Needs #

While a lot of Mint alternatives are good at one or two things, we built Econumo from the ground up to solve the real problems modern households actually face. It’s not just another Mint clone. Instead, it’s a focused, powerful solution for people who care about working together on their finances, keeping their data private, and managing money across the globe.

Econumo is a direct answer for anyone who felt stuck with the limits of older apps. The whole design is centered on the things that have become non-negotiable for so many of us, creating a tool that feels both deliberate and genuinely practical.

Designed for Collaborative Households #

Let’s be honest, one of the biggest headaches with Mint was trying to manage money with a partner. Econumo fixes this with a multi-user design that makes household budgeting seamless and totally transparent.

Partners can share access to the same account, letting both of you track spending, check on joint accounts, and work towards shared goals together. This shared dashboard gets rid of the guesswork and the constant “did you pay this?” conversations. Whether you’re saving for a vacation or just trying to rein in the grocery bill, everyone is finally on the same page.

Unmatched Privacy Through Self-Hosting #

With data breaches happening all the time, handing over your financial data to a third-party company feels riskier than ever. Econumo puts you back in the driver’s seat with a solid self-hosting option.

By running Econumo on your own server, you own your financial history, period. Your data never leaves your control, which means there’s zero risk of it getting caught up in a massive corporate data leak. This gives you a level of security and peace of mind that cloud-based services just can’t offer. For anyone who values privacy, this is a game-changer.

Self-hosting is the ultimate expression of data ownership. It transforms you from a user of a service into the owner of your platform, ensuring your most sensitive information remains truly private.

A Focus on Mindful Manual Budgeting #

Automated bank syncing is convenient, but it can also make you a passive observer of your own finances. Econumo encourages a more intentional approach by emphasizing manual transaction entry.

This hands-on method makes you more mindful about your spending. The simple act of logging each purchase forces you to acknowledge exactly where your money is going, helping you build a much stronger awareness of your habits. If you’re trying to break a cycle of overspending or just want a tighter grip on your budget, this manual-first workflow is an incredibly effective way to change your behavior. Our user guide gives you more detail on how to set up your budgets effectively.

True Multi-Currency Support for Global Citizens #

For expats, digital nomads, or anyone juggling finances in different countries, most budgeting apps are fundamentally broken. Econumo was built with a global mindset from day one, offering true, native multi-currency support.

This means you can:

- Manage accounts in their original currencies: Your EUR bank account stays in EUR, and your USD investments stay in USD. No more wonky, inaccurate conversions.

- Set budgets in local currencies: Create a grocery budget in Japanese Yen or a rent budget in British Pounds for planning that reflects the real world.

- Get a clear net worth overview: See a consolidated view of your total net worth, accurately converted to whatever base currency you choose.

This is absolutely essential for anyone whose financial life crosses borders. It brings a level of clarity that single-currency apps will never have. With the global market for stablecoins projected to hit $2 trillion by 2028, the need for tools that can handle a multi-currency world is only going to grow.

Flexible and Future-Ready #

Econumo is designed to adapt to your life. For developers and power users, an API is available to build custom integrations and automations, letting you connect your finances to other parts of your digital world.

This flexibility also applies to how you get started. You can begin today by self-hosting the free community edition, which gives you all the core features you need. For those who’d rather not manage the technical side, an upcoming cloud version will offer the same great tools with the convenience of a managed service. This mix of options ensures Econumo can work for a wide range of people, from the dedicated DIY budgeter to the busy family who just needs something that works.

Got Questions About Mint Alternatives? We’ve Got Answers. #

Moving on from a tool you’ve used for years can feel a little daunting. To help you feel more confident about making the switch, we’ve put together answers to some of the most common questions we hear about choosing a new budgeting app.

Finding the right replacement for Mint really comes down to what you need most. Is it collaborative family budgeting? Tighter control over your privacy? Or maybe better multi-currency support? Let’s dive in.

What’s the Best Free Alternative to Mint? #

Plenty of the top Mint alternatives are paid, but there are some excellent free options out there, especially if you have a specific goal in mind. The “best” one really depends on what you’re trying to accomplish.

If owning your data and protecting your privacy is your number one priority, a self-hosted tool is the clear winner.

- For Total Privacy and Control: A self-hosted app like Econumo’s community edition is a powerful and genuinely free solution. You run it on your own server, so your financial data never leaves your control. This completely sidesteps the privacy issues that come with cloud-based services.

- For Basic Tracking: You can find some cloud-based apps with free tiers, but they usually have strings attached. Expect limitations like a cap on connected bank accounts, very basic reports, or a screen full of ads.

It’s worth remembering that “free” isn’t always free. You might not pay a subscription, but you could be paying with your personal data or by putting up with a watered-down experience. A self-hosted option is truly free without those trade-offs.

Ultimately, you have to ask yourself if a free tool will really work for you in the long run. Paid apps often deliver a much smoother user experience, actual customer support when you need it, and more powerful features for things like managing a household budget together.

How Do I Move My Data From Mint to a New App? #

Making sure your financial history comes with you is a huge part of switching apps. The good news is that Mint lets you export your data, and most decent alternatives are built to import it. The whole process is usually pretty straightforward.

First, log into your Mint account and head over to the “Transactions” page. You should find an option to “Export All Transactions.” Clicking this will download a single CSV file with every transaction you’ve ever logged. We highly recommend you do this now, just to be safe.

Once you have that CSV file, how you import it will differ a bit from app to app. Most tools, Econumo included, have a dedicated import function. You might just need to tweak the column headers in your spreadsheet so they match what your new app is expecting. That little bit of prep work ensures a clean transfer.

Are Self-Hosted Budgeting Apps Secure? #

Yes, they absolutely can be—in fact, they can offer a level of security that cloud services just can’t match. But the key thing to remember is that the responsibility for that security is now in your hands.

With a self-hosted platform, all your sensitive financial info stays on your personal server or computer, not on some company’s servers out in the cloud.

This setup gives you two massive security advantages:

- No More Third-Party Breach Worries: Your data is completely off the grid when it comes to the massive data breaches that hit big companies.

- You Have Total Control: You, and only you, decide who gets access to your information.

Of course, that control comes with responsibility. You’ll need to handle your own security basics, like using strong passwords, keeping your software up to date, and making sure your network is configured correctly. For anyone comfortable with a little bit of tech management, self-hosting is hands-down the best way to guarantee your financial data stays private and secure.

Ready to take control of your household finances with a tool built for collaboration, privacy, and modern needs? Explore Econumo and see how our focused approach can simplify your financial life. Try the live demo or self-host the free community edition today at https://econumo.com.