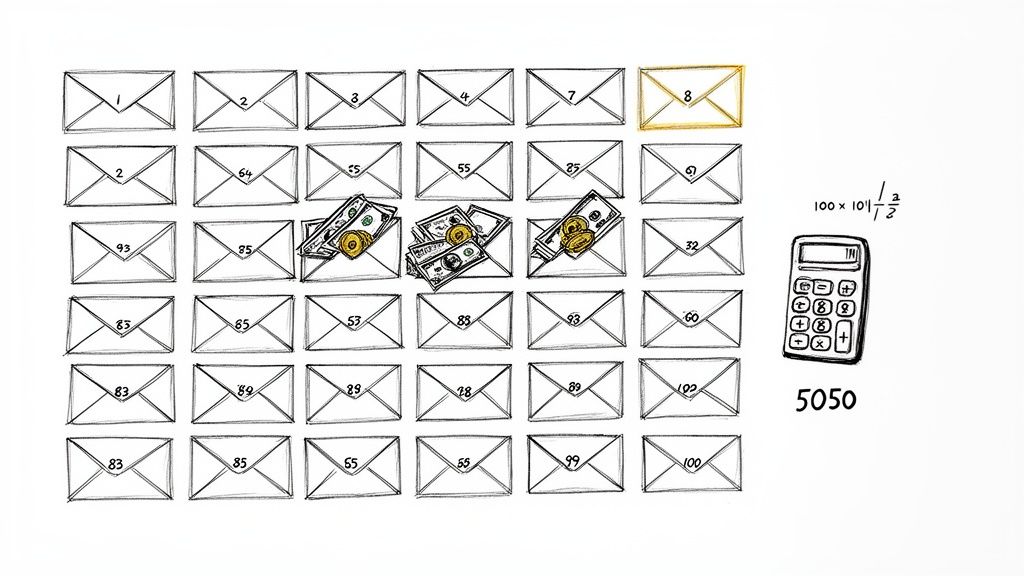

If you’ve ever wanted a simple, hands-on way to save a serious chunk of cash, a 100 envelope challenge printable is your ticket to stashing away exactly $5,050. The whole idea is to turn saving money into a kind of game by using a tracker or labels numbered 1 to 100. You match the dollar amount to the number on the envelope and stuff it inside.

What Is the 100 Envelope Challenge #

The 100 Envelope Challenge is a savings method that went viral for good reason—it transforms the vague idea of “saving more” into a physical, hands-on activity. The concept is refreshingly simple: grab 100 envelopes and number them from 1 to 100.

Then, on a schedule that works for you (daily, weekly, whenever you get paid), you pick an envelope and put the matching amount of cash inside. That means $1 goes into envelope #1, $25 into envelope #25, and eventually, $100 finds its home in envelope #100. Once you’ve filled all 100, you’ll have a cool $5,050 saved up.

This challenge really took off because it directly addresses a common financial pain point. A Federal Reserve survey found that a shocking 43% of U.S. adults would struggle to cover an unexpected $400 expense. The 100 Envelope Challenge offers a structured path to building that exact kind of emergency fund. That $5,050 total isn’t just a random number; it’s the sum of adding all the numbers from 1 to 100 together. You can read more about this viral savings trend and why it’s resonating with so many people.

For a quick overview, here are the core details of the challenge.

100 Envelope Challenge At a Glance #

| Metric | Details |

|---|---|

| Total Savings | $5,050 |

| Number of Envelopes | 100 |

| Envelope Values | $1, $2, $3… up to $100 |

| Completion Time | Typically 100 days, but can be adapted to weekly or bi-weekly schedules |

This table shows just how straightforward the system is, but its real power lies in how it makes saving feel.

Why This Visual Approach Works So Well #

The real magic here is psychological. Instead of just seeing a number go up in your banking app, you’re physically handling your money and watching your stack of filled envelopes grow. This turns saving from an abstract chore into a tangible, rewarding process.

The power of the 100 Envelope Challenge is that it makes your savings goal real. Every filled envelope is a small, satisfying win that builds momentum and makes the larger goal feel achievable.

This method is brilliant because it breaks a massive goal—saving over five thousand dollars—into small, manageable chunks. The game-like structure provides a steady stream of positive reinforcement, which is key to building good financial habits that actually stick.

Here’s why people find it so effective:

- Gamification: It feels less like a chore and more like a game with clear rules and a definite finish line.

- Visual Progress: Seeing a growing stack of envelopes or checking off numbers on a printable tracker gives you a powerful visual of how far you’ve come.

- Flexibility: You don’t have to do it daily. You can easily adapt it to your own cash flow, whether that’s weekly or bi-weekly.

- Accessibility: You don’t need fancy tools. All it takes is some envelopes, a pen, and our free 100 envelope challenge printable.

At the end of the day, this challenge is much more than a savings gimmick. It’s a tool that empowers you to build discipline, see real results, and take control of your financial future.

Download Your Free Printable Savings Kit #

Alright, let’s get you set up for success. I’ve put together a complete, free savings kit to get you started on your journey to saving $5,050. No fuss, just everything you need to download and begin today.

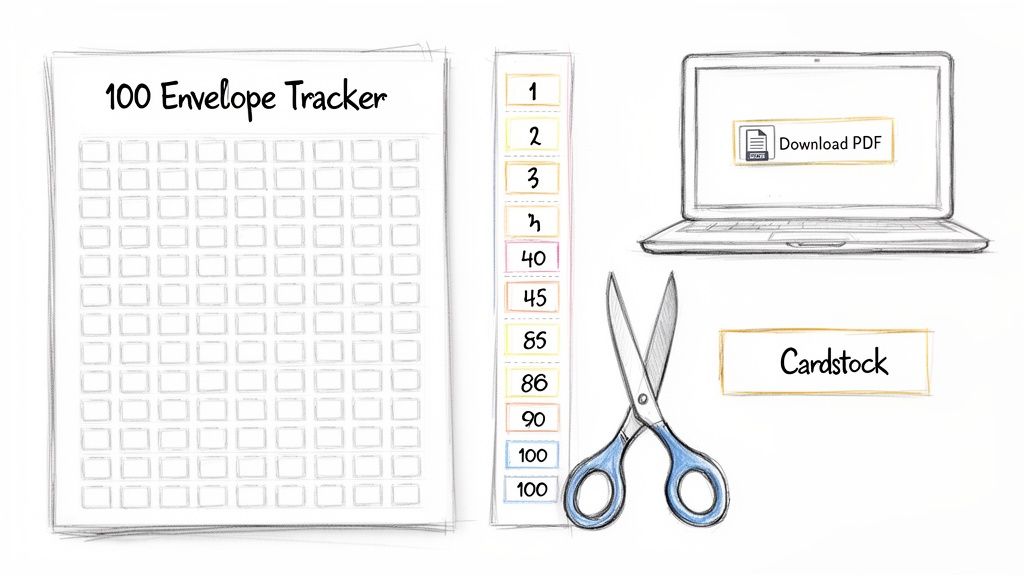

The main piece is the classic 100 Envelope Challenge Printable tracker. It’s a simple grid with 100 boxes you can color in, check off, or slap a sticker on every time you fill an envelope. Trust me, seeing that grid fill up is one of the best motivators you’ll have.

To make things even easier, the kit also includes printable number slips from 1 to 100. Just cut them out and tape them to your envelopes. This saves you the hassle of writing out every single number by hand.

Find the Perfect Printable for Your Goals #

Personal finance is, well, personal. There’s no one-size-fits-all solution, which is why I’ve included a few different versions in the kit to match where you are right now.

Here’s exactly what you’ll find in your free download bundle:

- Classic 100 Envelope Tracker: This is the standard version, designed to help you save $5,050.

- Printable Number Slips (1-100): Ready-to-go numbers for all your envelopes.

- 50-Envelope Challenge Tracker: A fantastic starting point if the full challenge feels like too much. It helps you save $1,275.

- Blank Customizable Tracker: Want to invent your own challenge? This blank grid lets you set custom amounts and timelines.

Each printable is designed to be clean and simple. The idea is to get rid of any barriers so you can focus on the one thing that matters: building your savings.

So, which tracker should you choose? It really depends on your income and your goal. The classic challenge is perfect for something big, like building a solid emergency fund. The 50-envelope version is a bit less intense and great for getting your feet wet.

If you’re also trying to get a clearer picture of where your money goes each month, our monthly expense tracker printable works really well alongside this challenge.

No matter which one you pick, the next step is the same: download the PDF, print it out, and you’re ready to start breaking a big financial goal into small, totally manageable steps.

Getting Your Challenge Set Up for Success #

Alright, you’ve got your 100 envelope challenge printable downloaded. Now for the fun part: bringing it to life.

First up, printing. Regular paper will do the job, but from my experience, using a slightly heavier paper like cardstock for the main tracker makes a huge difference. It’s going to be handled a lot over the next 100 days, so you want it to last.

Once everything is printed, take some time to cut out the number slips from 1 to 100. I usually do this while listening to a podcast or some music—it’s surprisingly therapeutic. Then, just attach each number to a plain envelope with a glue stick or a small piece of tape. And just like that, you have a tangible, ready-to-go savings kit.

Create Your Savings Station #

Now that your envelopes are prepped, where are you going to keep them? This might seem like a small detail, but it’s actually a key part of staying motivated. You want to create a dedicated, visible space for your savings goal. A shoebox, a decorative bin, or a binder all work great.

The trick is to pick a spot that’s safe but also somewhere you’ll see it often. This visual cue is a powerful, daily reminder of the goal you’re working toward.

Having a designated “savings station” makes the whole process feel more official. It’s not just a random pile of envelopes anymore; it’s a command center for your savings mission, which really helps reinforce the habit.

Find Your Rhythm #

The last piece of the puzzle is figuring out when you’ll actually stuff the envelopes. There’s no single right answer here—what matters most is consistency. Your best bet is to build a schedule that fits your personal cash flow and lifestyle.

Here are a few popular ways people tackle it:

- The Payday Method: This is my favorite. Every time you get paid, you stuff one or two envelopes. It ties your saving directly to when money comes in.

- A Weekly Ritual: You could set aside a specific time each week, maybe Sunday evening, to pick and fill an envelope for the week.

- The Daily Dash: If you’re really motivated and want to finish fast, filling one envelope a day will get you done in just over three months.

Honestly, the best plan is the one you’ll actually stick with. If you’re not quite sure what your budget can handle, our guide on how much to save per paycheck can help you figure it out. By picking a rhythm that feels natural, you’re turning this challenge into a rewarding routine instead of a chore.

Find a Challenge Strategy That Works for You #

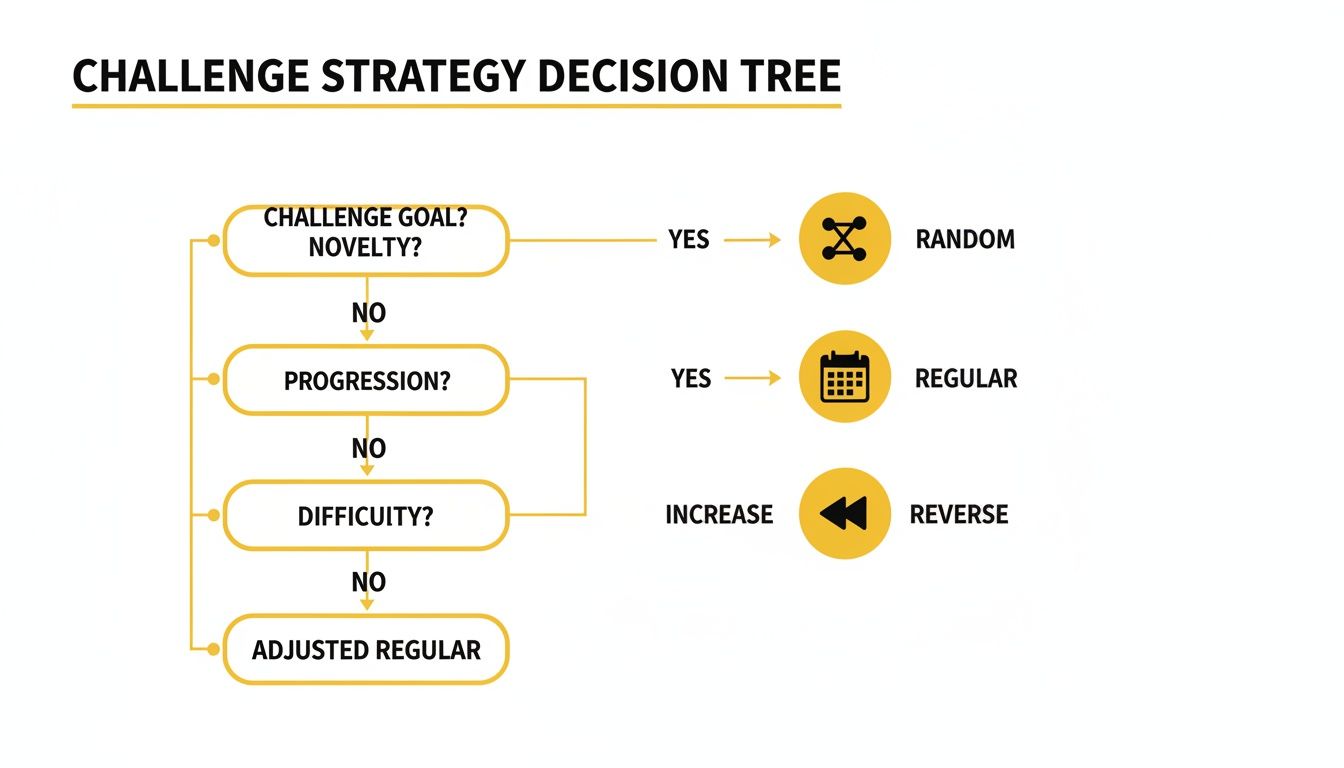

The best savings plan isn’t about the loftiest goal; it’s about finding a system you can actually stick with. The 100 envelope challenge is brilliant in its simplicity, but its real magic is how easily you can adapt it. Let’s walk through a few different ways you can tackle this to make it work for your money and your personality.

The Classic: The Standard Method #

The most common way to do this is just to go in order. You start with envelope #1, putting in $1. The next day, you put $2 in envelope #2, and so on. It’s simple, predictable, and starts off incredibly easy, which is fantastic for building that initial habit.

The only catch? The last few weeks get pretty intense. You’ll be trying to find close to $100 on back-to-back days, which can be a tough ask, especially when rent or other big bills are due. This approach works best if your income is very stable and you like a clear, straightforward path.

For the Thrill-Seekers: The Randomized Method #

If a straight line sounds boring, try shuffling things up. With the Randomized Method, you’ll mix up all your numbered envelopes (or slips of paper with numbers on them) in a box. Each day, you just pull one out at random. One day you might get a $5 envelope, the next could be $82.

This turns saving into a fun little game, which can be a huge motivator. The downside is the unpredictability. You have to be ready for a high-number day to pop up at any time. This is a great fit for people who have a little wiggle room in their budget and can handle a surprise $95 savings day without breaking a sweat.

Get the Hard Part Over With: The Reverse Method #

Another really clever twist is the Reverse Method. Here, you flip the whole thing on its head and start with the highest numbers. On day one, you tackle envelope #100 with $100, then #99 with $99, and work your way down.

The psychological boost here is huge. You knock out the most intimidating amounts right at the beginning when your motivation is at its peak. Every day after that feels a little bit easier.

This is a fantastic way to build confidence and make sure you actually finish. As the challenge goes on, the amount you need to save shrinks to just a few dollars. It’s perfect if you want to front-load your savings, maybe right after getting a work bonus or a tax refund.

Make the Timeline Work for You #

And remember, this doesn’t have to be a 100-day sprint. The challenge is incredibly flexible. A daily pace gets it done in about 3.3 months, but stretching it out over 100 weeks means you’d only need to save an average of $50.50 a week—much more manageable for most people. The “gamified” feel is a big reason people stick with it, and why printable trackers have become so popular, racking up millions of downloads. You can read more about how different timelines make the challenge more accessible.

Think about a pace that fits your paycheck schedule:

- The Bi-Weekly Plan: Stuff two envelopes every time you get paid.

- The Weekly Goal: Fill just one envelope each week.

The most important step is picking a strategy that feels right for you. Whether you want a steady climb, a bit of an adventure, or to conquer the biggest challenge first, there’s a version of this that will get you to your goal.

Turn Your Savings Into a Team Goal #

Why save alone when you can save together? The 100-envelope challenge isn’t just for individuals; it’s an amazing way to turn a financial goal into a fun, collaborative project for couples and families. Tackling it as a team makes the whole process more engaging and helps build solid financial habits you can all share.

Instead of one person carrying the full weight of the challenge, you get to share the wins. For families, this is a golden opportunity to teach kids about the real value of money in a hands-on way. Imagine having a “Savings Night” each week where everyone gathers around, and a different person gets to pick and stuff that week’s envelope. It builds excitement and shared purpose.

Making It Work for Your Family #

The secret is to set it up so it feels fair and motivating for everyone. The last thing you want is for saving to feel like a chore or a burden. The idea is to get the whole crew fired up about working toward a shared dream, whether that’s a trip to Disney World, a new swing set for the backyard, or finally knocking out that credit card debt.

So, how do you split the contributions fairly? Here are a few ways I’ve seen work well:

- Take Turns: This is the easiest approach. You fill an envelope this week, your partner takes the next one. Simple.

- Split the Big Ones: When you pull a high-number envelope, you can go 50/50. If the $80 envelope comes up, you each chip in $40.

- Income-Based Contributions: For couples with different incomes, it might make more sense to contribute proportionally. This keeps things equitable and pressure-free.

This challenge is so much more than a savings method; it’s a fantastic conversation starter. It gets everyone talking about money and goals in a positive, proactive way. For more on this, our guide on how to budget as a couple has some great strategies that dovetail perfectly with this challenge.

The flowchart below breaks down a few popular ways to tackle the challenge. You can look it over and decide as a team which path feels right for you.

This decision tree can help you visualize whether going in order, picking randomly, or even working backward from 100 is the best fit for your family’s style.

Tackling a financial goal together strengthens your relationship by building trust and shared purpose. Every envelope stuffed is a collective win, reinforcing that you’re a team working towards a better future.

In the end, by using a 100 envelope challenge printable as a family project, you’re doing more than just saving $5,050. You’re building a foundation of financial literacy for your kids and strengthening your partnership through shared goals and celebration. Honestly, the memories you make while saving together can be just as valuable as the money in those envelopes.

Got Questions About the 100 Envelope Challenge? #

It’s only natural to have a few questions pop up before you dive into a new savings goal. Let’s walk through some of the common ones so you can get started feeling confident and prepared.

Lots of people understandably get a little nervous about the daily commitment. After all, life has a funny way of getting in the way of even the best-laid plans.

What if I Miss a Day? #

First off, don’t sweat it. A missed day (or even a few) isn’t going to sink your progress. The whole point is to build a consistent habit, not to be perfect.

The beauty of the 100 envelope challenge printable is its flexibility. If you can’t contribute one day, just pick it back up when you can. Pulled a high number like $98 but the budget is tight this week? No problem. Set it aside and grab a smaller, more manageable number instead. The goal is to keep the momentum going, no matter how slow you have to go.

The people who succeed at this aren’t the ones who never stumble; they’re the ones who give themselves a little grace and keep going. Think of it as a marathon, not a sprint.

Is It Safe to Keep All That Cash at Home? #

This is a fantastic question, and probably the most important one. Having thousands of dollars in cash lying around your house is definitely a risk we want to avoid. While physically stuffing the envelopes is a huge motivator, your security is the top priority.

Here’s what I always recommend: let the cash build up a little, then deposit it. Once you’ve saved a few hundred dollars, take a trip to the bank and move that money into a dedicated high-yield savings account. You can simply mark those numbers on your tracker as “deposited.” That way, your money is safe, secure, and even starts earning a little interest for you.

Can I Do This Challenge Digitally? #

Of course! You absolutely don’t need to use physical cash to make this challenge work for you. The printable tracker is just as powerful when you go digital.

Instead of stuffing an envelope, just transfer the amount for the day from your checking account into a separate savings account. You still get that same satisfying feeling of accomplishment as you color in each square on your tracker, but without having a single bill in sight.

Ready to see your savings grow in a way that’s simple, visual, and effective? Econumo helps you track your progress and stay focused on your biggest financial goals. Get started at https://econumo.com.